The Big Picture |

- Chart of the Day: Fed Ownership of the Yield Curve

- Inflation: Really That Bad?

- Michael Burry: Notes from Vanderbilt Speech

- The End of QE2: Major Policy Shift Ahead

- The Time Is Now

- Super Boom: Why the Dow Jones Will Hit 38,820 and How You Can Profit From It

- National Association of Attorneys General Keynote Address

- Follow the Money: How Systemic Bank Fraud Contributed to the Financial Crisis

- Fade the Inflation Hysteria

- California Dings MERS

| Chart of the Day: Fed Ownership of the Yield Curve Posted: 12 Apr 2011 09:00 AM PDT We've updated our chart illustrating the Fed ownership of the U.S. yield curve. We've also included the percentage of total maturities the Fed owns in each year from the April 2011 data and December 2010 data. Most of POMO buying since December has taken place in the 7-9 year maturities. In December, for example, the Fed owned 13.4 percent of the bonds maturing in 2019 compared to 31.6 percent today. We're with the conventional wisdom of no QE3, no massive flight to quality, or a miracle long-term budget agreement. We therefore expect continued upward pressure on interest rates. We recently posted our Flow of Funds analysis showing that the Federal Reserve and foreign flows effectively funded 100 percent of the U.S. budget deficit in Q4 2010. Interest rates need an upward adjustment to attract new non-official buyers, which could also put a short-term lid on commodities, in our opinion. We're on the same side as the Bond King. > |

| Posted: 12 Apr 2011 08:00 AM PDT Bill Fleckenstein of Fleckenstein Capital argues there is no such thing as good inflation and the Fed and government are out of control. Apr 8, 2011- 6:03 – |

| Michael Burry: Notes from Vanderbilt Speech Posted: 12 Apr 2011 07:30 AM PDT Hunter is the author of the Distressed Debt Investing blog. His commentary has been seen in online versions of WSJ, FT, and BusinessWeek. Hunter currently works as an investing professional at a large money manager, focused on the credit markets. Previously, he worked at two large hedge funds, as an analyst working on distressed debt and event-driven investing situations. ~~~ One of our favorite investors of all time, Michael Burry, who I personally have been following for quite some time, gave a speech tonight at Vanderbilt University entitled: “Missteps to Mayhem: Inside the Doomsday Machine with the Outsider who Predicted and Profited from America's Financial Armageddon”. Distressed Debt Investing was there (we have our tentacles everywhere) and are pleased to bring you notes from the speech. Enjoy! As indicated by the lecture's title most of Dr. Burry's material was a blow-by-blow account of how and why the housing bubble occurred and how he profited from the resultant crash. To put his presentation in context, it is worth noting that the audience was comprised of people from many different academic and professional backgrounds. As such, much of the content was already familiar to those who've read Michael Lewis's The Big Short and/or his Vanity Fair article. I assume the Distressed Debt Investing community is familiar with these works so my notes are focused on things I thought were not discussed in those works and interesting anecdotes that provide insight into his thought process.

|

| The End of QE2: Major Policy Shift Ahead Posted: 12 Apr 2011 07:00 AM PDT The End of QE2: Major Policy Shift Ahead > This week's Outside the Box is from my friend David Galland, an interview he did for The Casey Report, and it represents a philosophical train of thought more in line with Austrian economics and libertarianism than my own. But if we only read what we already think, then how do we learn? It is only when your ideas are challenged and you must determine why the other guys are wrong and you are right, that you can either become more firm in your beliefs, or change. And much of what David says in this interview resonates. (I wrote about the end of QE2 a few weeks ago.) The guys at Casey are natural resources, commodities, and precious metals investors. Yet David argues that cash might be the wise thing now, after pounding the table for years on gold. He believes that the end of QE2 will be more important and dramatic than most think. That it is coming to an end I have no doubt, so it is important to think about what the effects, if any, will be. There are those who argue that we can live without it now. I argued (and still do) that we should have never had it. The unintended consequences are the ones I worry about. We just don't know. It was a crazy experiment, with no understanding of what would really happen. But hoping for the best is not a strategy, so let's think about it. David provides us with some different ways to look at the process. You can subscribe to The Casey Report at a 20% discount for my readers, right here. And for those who want to read more, you can get a free subscription to Conversations with Casey, which is a weekly e-letter delivered directly to your inbox every Wednesday. Contrarian investor and financial bestselling author Doug Casey talks about the economy, the markets, politics, society, and anything else that matters in life… a fireworks of informative, controversial, and entertaining viewpoints from one of the most original free-market thinkers of our time. Occasionally CWC will also feature interviews with Casey editors or "outside experts" on current market moves or important economic or political events. If you don't like libertarian thought, be warned. You can subscribe here. Last, a housekeeping item. I "fat-fingered" my inbox and lost about a hundred emails from the last three months or so, which I planned to get around to, but now they are buried in about 25,000 deleted files. (It's what happens when you don't touch-type and have to look at the keyboard. Yes, I know…) One way to clean out your inbox I guess, but if I owe you something, you might want to drop me a note again. Your already buried with 75 new emails in a few hours analyst, John Mauldin, Editor The Casey Report's David Galland: The End of QE2: Major Policy Shift Ahead(Interviewed by Louis James, Editor, International Speculator) Editor's Note: David Galland, Casey Research partner and managing editor of The Casey Report, sees a major shift in Federal Reserve policy ahead and has advice on how to invest accordingly. Time is short, so we've asked David to share his thoughts with us. L: David, in recent editorials you've warned of what could be an important shift in Fed policy – can you fill us in? David: Sure. The purpose of The Casey Report is to keep subscribers well positioned in powerful, long-term trends – the kind of trend that will keep giving and giving. The trend in precious metals – gold and silver – which we've been heavily recommending for ten years is a good example. The overarching goal of The Casey Report is first and foremost to identify those critical larger trends and then closely monitor them until they play out – which is another way of saying that we aren't big about market timing or jumping in and out of trades. I mention this to set the context for the coming shift in Fed policy. L: And that context is? David: That the shift, and it is imminent, will not change the larger trend, but it has the potential to be quite disruptive over the short term. L: Explain. David: In terms of the larger trends, the fundamentals that have caused so much pain and economic woe over the last ten years or so remain intact. If anything, they've gotten worse. We've gotten currency debasement, not just in the U.S., but especially in the U.S. dollar, which is not just any currency, but the world's reserve currency. We've got a truly mind-boggling expansion of the reach of government into all aspects of society and the economy, with all that that implies in terms of regulation, taxation, controls over investments and finance, impact on personal liberty, and so forth. By recognizing this destructive trend for what it is, investors can position themselves to avoid the worst, and to profit by betting on things like the continuing debasement of the dollar. So that's the big picture. There is growing evidence that in the next month or two, we will head into a very dangerous period. The Fed has been extremely supportive of the U.S. government's insane spending, polluting its own balance sheet by buying up toxic loans by the hundreds of billions and by pumping enormous quantities of cash into the money supply. You don't have to look very hard to understand why we have seen some small recovery in the economy, much of which has been driven by the financial sector that has been the recipient of so much largess – it was bought and paid for by the government, working hand in glove with the Fed. But there is about to be a fundamental change in this arrangement. It appears that the Fed has decided that it's time to take a step back from its monetization – or quantitative easing (QE), as they now term it – in the hopes that the market will step in to fill the large gap it will leave. They can't know how that's going to work out, but if they don't stop pumping money into the economy, they never will know if the quantitative easing has worked. Based on a lot of statements from a number of the voting members of the Federal Open Market Committee, the change just ahead is that they are serious about stopping QE in June. As they won't wait until the last minute to confirm the end of their Treasury buying, I would expect their intentions to be made clear following their end-of-April meeting, the full minutes of which should be released in early May.

L: To be clear, do you mean no QE3, or that they cancel the portion of QE2 they haven't spent yet? David: They may leave themselves a bit of wiggle room by holding back some of the funds slated to be spent as part of QE2, in the hopes of demonstrating a high level of confidence in their decision to stop the monetization. That would also give them a bit of powder to use should the need suddenly arise, without exceeding the mandate of QE2. The important point is that I am increasingly sure they won't just roll out QE3, and that will have consequences. L: Are you saying, no QE3 at all? David: No. I think there will be a QE3, but it won't materialize until after a relatively lengthy period during which the Fed stands aside in order to give the market the opportunity to adapt and adjust to their exit from the Treasury auctions. In other words, once they stop, I wouldn't anticipate them jumping right back in at the first sign of trouble – say, if the stock market crashes. In time, however, as the ponderous problems weighing on the economy come back to the fore and return the economy to its knees, the Fed will be forced to reinstitute the monetization, though they will likely try to come up with a moniker other than quantitative easing to describe it. L: You're as cheerful as Doug. Why are you so sure there will be a QE3? David: Because the problems that made the economy stumble in 2008 have not been solved. As I said before, most have gotten worse. Have the impossible levels of sovereign debt and trillions in unresolved bad mortgages embedded in the balance sheets of Fannie, Freddie, the Zombie Banks and even the Fed been resolved? Hardly. Is there any real sign coming out of Washington that the deficits will be substantively tackled? You don't have to be as active a skeptic as I to understand that the deepest spending cuts being discussed don't even scratch the surface of the $1.5 to $2 trillion deficit. As for the $60 trillion or so in debt and unfunded obligations, forget about it. The U.S. government and the governments of most large nation-states are fundamentally bankrupt. In time, they will have to default on their obligations. While there will be some overt defaults, I expect most of them to follow the path of least resistance, which is to try to inflate the problem away. And that means QE3. For now, however, the Fed will claim victory over the economic crisis and follow suit with many other central banks – switching to a less accommodative monetary policy. L: They've done their job and now it's time for back-slapping and cigars. David: Yes. L: Consequences? David: If you look at a chart of the dollar, you'll see that it has been bumping along the bottom recently. Logically, if the Fed stops monetizing the Treasury's spending, we should see a rebound in the dollar. The big traders – the big institutional money out there – are going to use the change in Fed policy as a clear signal that it's safe to get back in the U.S. dollar. It would be wrong to underestimate the amount of money that needs to find a home, and the liquidity advantages offered by the U.S. Treasury market. If the river of money redirects into Treasuries, it could – at least for a time – offset the Fed's exit and push the dollar up, maybe significantly so. And if the dollar comes roaring back, commodities, including gold and silver, would likely take a fairly hard hit. Again, this is a short-term view. The longer-term trend for the precious metals is absolutely intact, because the fundamentals are entrenched – namely that the sovereign debt and spending is out of control, and politically uncontrollable. L: Let's talk about that for a moment. These people – the big money – are financial types. Bankers. They know about all the bad debt they have, even if the ever-so-convenient new reporting rules allow them to keep some of their problems off the books. They must know that a so-called jobless recovery is not a recovery. They are well aware of all sorts of dirt they don't discuss in public – how could they be stupid enough to let the Fed convince them the economy is healthy when their own information tells them it isn't? David: First off, "they" are not one guy. They are a lot of people with a lot of different perspectives and a lot of different objectives. Right now, for example, people look at the lack of yields in bonds and the potential for inflation in bonds, so they've been easing back on bonds and getting into equities more, in the hope of generating some kind of return. If you're a fund manager or a large institutional trader, you're not paid to sit on your hands. You've got to "do something," even though there are times – and I think this is one of those times – when doing nothing is exactly the right thing to do. So, I wouldn't say they are being stupid– L: Doug would: "An unwitting tendency toward self-destruction." David: Yes, he would – but these guys are not stupid; it’s rather that they've made their own calculations and concluded that U.S. equities are still safe – a position that is supported by the very low levels of volatility. Even the troubled financials have seen strong gains of late, even though nothing has been fixed. Of course, if you look under the hood, you find they've benefited substantially from the cheap money and rigged deals the government has orchestrated to bail them out. While no one can say when the shift out of equities and back into Treasuries and lower-risk assets will begin, in my view the Fed's exit from quantitative easing sets the stage for that to happen. After that, it will just be a matter of time before traders are going to wake up and decide equities are not safe, and they'll start leaving in droves. Remember, however, that the stock market and the economy are by nature very complex systems. There are so many variables, you just can't know which variable is going to rule the day at any given time. But given the importance of the Fed's intervention and the government spending that has helped engender, its policy shift is certainly a variable to keep an eye on. L: I find the capacity of bankrupt financial companies to defy gravity truly amazing. Disbelief sustained for such lengths of time makes me dizzy. David: You're not alone. The vast ocean of bad debt out there is just as big as ever. Everything I hear from people in the financial industry is that the banks' debt profiles are not getting any better. People are not getting on top of their debts. They are not paying down their mortgages. Default rates are still astronomical… L: How could it be otherwise? Unemployment is still high. David: Unemployment is still stubbornly very high, though if you buy into the government's figures, it is moving steadily in the right direction. Of course, the government has no reservations about jiggering the data to suit itself. That makes it important – if you want to get a more realistic picture – to look at the topic from different angles. One telling statistic is unemployment as a percentage of the employable population, which screens out many of the government's self-serving adjustments to its official figures. Looked at that way, you can see that unemployment is continuing to rise, even though the government is reporting that it's falling markedly. L: No! You can't be suggesting good old Uncle Sam would lie to us… David: You could say we have another deficit, one in government accountability. Clearly, it's very politically important that unemployment be perceived as declining, therefore, voilà, it is. L: "Alas, Bartleby." Okay, let's back up a bit to the debasement of the dollar. You mentioned that as a given, almost in passing, but there are a lot of people who don't see it. Inflation is low, Uncle Sam assures us, so the dollar has not been debased. Q.E.D. David: Well, anyone who can see beyond the tip of their nose can see that inflation is going up. Just pull up a chart of the CRB Index for commodities – the real stuff required for life – and one can see it has been on a steep upwards trajectory. Inflation is very much here and alive. L: John Williams' Shadow Stats chart shows inflation at nearly 10%, while the Bureau of Labor Statistics is reporting 2.1%. But even Williams' statistics don't report real inflation; they just report what it would be if the government reported inflation the way it used to, before it started "improving" its reporting in the 1980s. It's still an incomplete view, because the government's original reporting was flawed to begin with. David: Right. And one of those flaws is the way they weigh housing. It plays a big, big role in CPI, and in 2008 housing was dealt, if not a death blow, at least a blow that put it in the hospital. And it will be there for a very long time, because government policies encouraged bad decisions on the part of both lenders and borrowers. This has left trillions of dollars of bad debt hanging out there. The retracement of housing prices, as a component of official CPI, pulls the official inflation figures down, even though those figures don't sync up with the actual cost of living. Of course, a low CPI gives the government cover for continuing to monetize its debt. Inflation problem? What inflation problem? L: The net of this for inflation is that the crushing of the housing sector makes the CPI drop, making it look like life is getting cheaper, whereas the reality is that people's hard-earned wealth put into real property has taken a beating at the same time as the things they consume on a daily basis cost more. Life has gotten a lot more expensive even as savings have been wiped out. Not good. David: Right. And the government is trying to get people to ignore the signs of inflation, saying everything is all right. But recently, several Fed governors have been saying outright that there is a problem and that they need to cool off the money creation and start dealing with inflation. This is why I think there isn't going to be an immediate QE3. L: So, what happens next? David: Consider Japan as an example of an advanced economy that has been struggling to deal with the aftereffects of a collapsed bubble in real estate and stocks for many years – well before the recent earthquake. If you look at what happened when they did their equivalent of QE after the initial stock market crash, the spending stimulated a fairly significant recovery in Japanese equities, taking the market back up about halfway to the bubble's top; but the rally didn't last. Once the Japanese government put an end to its quantitative easing, the Nikkei plummeted. The government resisted reinstating quantitative easing for two years before throwing in the towel and once again cranking up the money engines in an attempt to break the economy out of the doldrums. The long-term result is a Nikkei still well below the crash level (even before the earthquake), and all the spending has caused Japanese government debt to rise to 200% of GDP. While no two situations are identical, I think the U.S. is following a very similar script. L: If the Fed decided to hold off on QE3, do you think it could take as long as two years for them to feel forced back to it, forced to do something? David: It could. It would depend on how sharp the downtick is. There are so many factors at work here that it's really unknowable at this point. Nearer-term, all the signals are that the Fed will hold off on QE3 at their next meeting. And, as I have tried to make clear, that will have consequences – for equities, for the dollar, for the commodities sector. L: Can you give those readers not familiar with The Casey Report some reason to believe your crystal-ball gazing? What's your track record with these sorts of predictions? David: Well before the current financial storm hit, we were forecasting that the Fed would begin monetizing the government's debt, and we were writing about a credit crisis leading to a currency crisis, which is exactly what's happened. We absolutely nailed it, and our subscribers made a lot of money on some of our recommendations – and safeguarded a lot of their wealth with others. L: That's true, though back then, before The Casey Report separated out the big-picture writing from the International Speculator our portfolio did take a temporary beating – along with everything else at the end of 2008. David: Yes, but everything we said about the debasement of the dollar and its consequences for gold was borne out. Further, we made a bold move, counseling people to go a third in gold and gold-related assets, a third in cash, and a third in other assets that could do well in an economic crisis. Subscribers who actually followed this allocation suffered very little in 2008. L: Isn't it a bit contradictory to recommend that people keep 33% of their wealth in cash, if you think the dollar is being destroyed? David: The dollar is being destroyed, as one can see by how much gold, oil, wheat, cotton or any other number of things one can buy with it. However, while it's not dropping day to day and the markets remain extremely volatile, cash is not a bad thing to hold – especially in relatively safer currencies, like the Canadian dollar and the Norwegian krone. So, again, the big trends remain intact. Our question now is what's going to happen next, in the short term. And in that context, the Fed's switch in policy is a big deal. When you go from the Fed showing up every week and buying Treasuries, to the Fed stepping back and saying "No more," it can send major shock waves through the economy. L: So, if the Fed does what you think it will, by June, how do readers invest accordingly? David: [Laughs] This may not be a popular answer, but I think the correct answer is that the best thing you can do in the near term is to increase your cash position. I would be very cautious about moving into any other asset class at this point, including gold. L: You wound me. David: I know. Listen, if you own high-quality gold stocks, such as those you recommend in the International Speculator – companies that have the goods and can weather the coming storm – you can certainly just ride right through what's coming. But if you're not quite confident enough to avoid panic selling in a correction, or if you have some mutts in your portfolio that haven't performed and you're not sure why you own them, I'd get rid of them fairly quickly. Remember: the time line on the Fed's decision is quite near-term. That doesn't necessarily mean there would be an immediate stock market crash, but it certainly would have an effect on the commodities sector. On the other hand, as I've said, markets are complex. Saudi Arabia could go up in flames, sending oil and gold both way up. So I'm not telling anyone to get out of the markets. There's no way to predict such events – but what we do feel confident about predicting is that the Fed will not roll right into QE3. L: Agreed. And if you're wrong, having cash to deploy into new opportunities won't be a bad thing. Anything else? David: If you're of a mind to play in the currency markets, you could take a leverage bet on the dollar rising against competitive currencies. But right now, personally, I'm inclined to do nothing, except maybe to lighten up on some investments and go to cash. That sets you up for the real play. If I'm right, and commodities – including precious metals – sell off, and mining stocks sell off even more, there will be some fantastic opportunities to take advantage of. The people who are paying attention will be able to clean up. L: Now you're singing my song: short-term cash, and get your shopping list ready. David: That's the way I see it. L: Okay then, thanks for your predictions – I look forward to seeing how they bear out. David: It was fun. We should do this again sometime. L: I'm sure Doug won't mind, especially when you get a strong sense of where the markets are going, like this one. David: Until next time, then. —– (Whether the quantitative easing ends or not, one thing is for sure: inflation is baked in the cake. To learn how destructive this insidious force can be to your portfolio and bank account… and what you can do to outrun it, read our free report.) |

| Posted: 12 Apr 2011 06:30 AM PDT |

| Super Boom: Why the Dow Jones Will Hit 38,820 and How You Can Profit From It Posted: 12 Apr 2011 06:00 AM PDT

The first post was titled “Hirsch's WTF Forecast: Dow 38,820” and filed under the category "Really, really bad calls." (I'll mea culpa if we come anywhere near 30,000 by 2025). I thought my old pal Jeff had lost his mind. But then I spoke with Jeff. He explained his reasoning. He sent me his fathers infamous 1977 500% call. I ended up doing a new post “War & Peace + Inflation + Secular Bull = Dow 38K ?“ The more I looked into it, the more it seemed like an ingenious piece of history repeating. I became impressed enough the methodology that I agreed to write the forward! I have no idea if we will see Dow 38820 in 2025, but the thesis is both intriguing and defendable . . . Some notable reviews follow:

|

| National Association of Attorneys General Keynote Address Posted: 12 Apr 2011 05:15 AM PDT This morning, I am one of the featured speakers at The National Association of Attorneys General annual conference. My presentation is titled “Follow the Money: How Systemic Bank Fraud Although I don’t really follow the powerpoint I use — its more of a take home for further research — but if you are interested, you can see it here. |

| Follow the Money: How Systemic Bank Fraud Contributed to the Financial Crisis Posted: 12 Apr 2011 05:00 AM PDT |

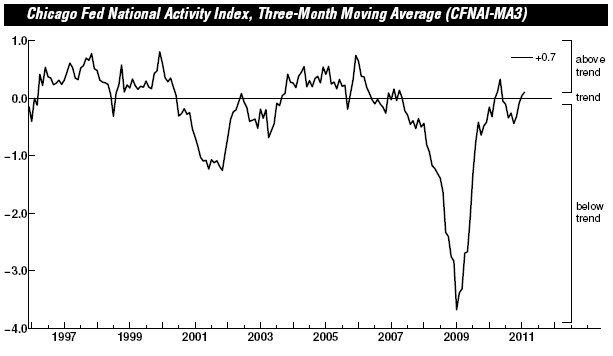

| Posted: 12 Apr 2011 04:15 AM PDT Tons of talk and pixels being spilled over the imminent inflation threat. It bears an eerie resemblance to what we heard from the likes of Jerry Bowyer and Art Laffer two years ago. I’d fade it now, exactly as I suggested back then (here and here, the latter piece co-authored with Bonddad): Exhibit A — The Chicago Fed National Activity Index (PDF)

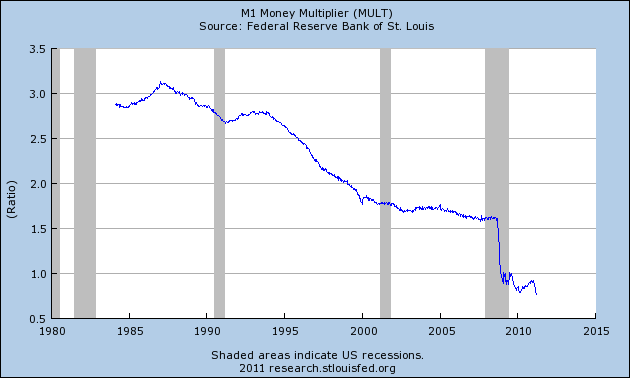

> Current read of CFNAI-MA3: +0.11, and that with three of the four subcomponents doing the heavy lifting while one — Consumption & Housing — remains mired near multi-year lows and shows no signs of recovering any time soon. We might actually get a good call out of Bowyer or Laffer before we get to +0.70 on CFNAI-3MA — it’s gonna be a while. Exhibit B — The Money Multiplier — all that heavy breathing about the flood of liquidity that was going to pour into the system. Hyper-inflation! Except not so much, apparently. As David Rosenberg (who was spot-on in his assessment of the last bogus inflation scare) put it in his Monday note:

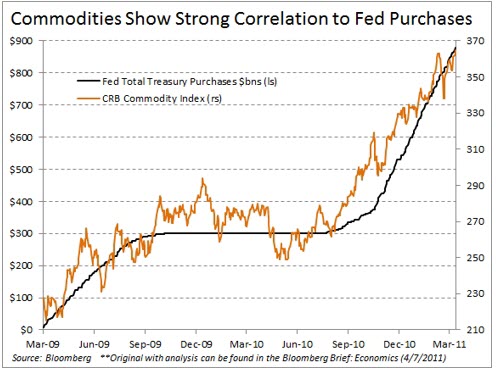

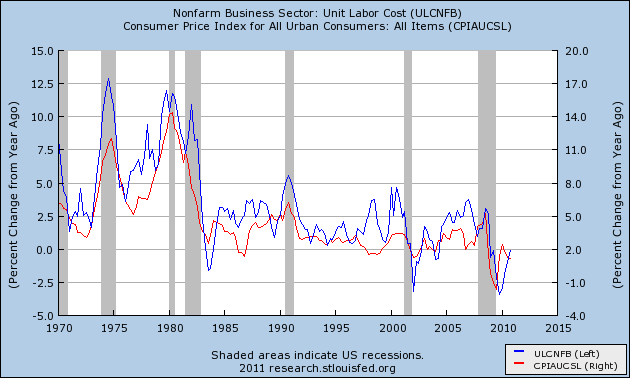

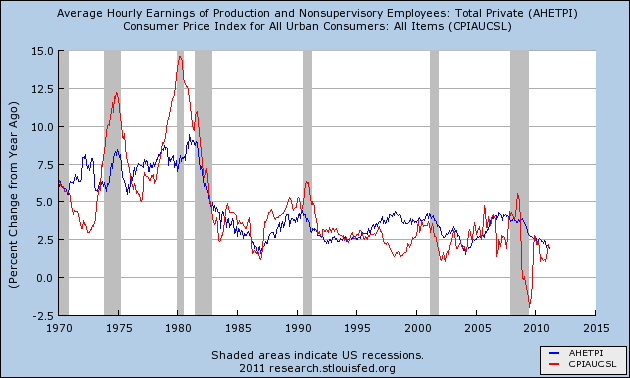

Those who still think the credit spigots are going to open any moment now, consider this: We know that consumer credit, ex-student loans, is still contracting. And we know from National Federation of Independent Business that “the vast majority of small businesses (93 percent) reported that all their credit needs were met or that they were not interested in borrowing.” Exhibit C — This remarkable chart that I’ve cribbed from Minyanville, though the original source is Bloomberg. What happens if there’s no QE3? (The chart above was really a stunner.) Exhibits D and E Two more reasons with a couple of homemade charts: Inflation has a very high correlation to the labor market. Indeed, the roots of inflation are generally found in higher labor costs. We are just not seeing upward pressure on labor costs — there is simply still too much slack in the system and the Unemployment Rate is too high. Unit Labor Costs and CPI sport a high +0.88 correlation: > Average Hourly Earnings and CPI have a +0.79 correlation: The Fed is on the record with their assessment that any bout of inflation will be “transitory.” I concur, as does this new Chicago Fed paper, and our old friend David Rosenberg (last week):

And the last word to Rosie (from Monday’s note):

Finally, on a semi-related matter, the NY Times ran an interesting piece that follows up nicely on my recent post highlighting the growth in student loans. |

| Posted: 12 Apr 2011 03:39 AM PDT California bankruptcy court Denies US Bank as trustee relief from stay; Court says recording is required BEFORE foreclosure, not after. Order Br Cally So Dist Salazar vs Us Bank Denying Mfrs Mers 4 11 2011 |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

The Big Picture (ritholtz)

The Big Picture (ritholtz)

0 comments:

Post a Comment