The Big Picture |

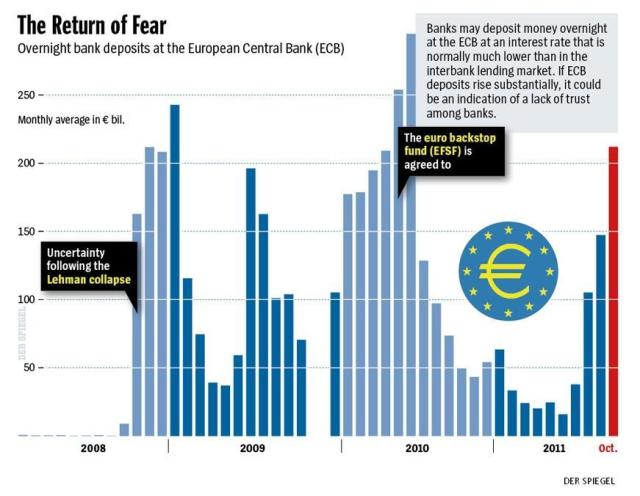

- Europe’s Stressed Out Banks

- Bratislava

- TBP Conference Twitter Feed

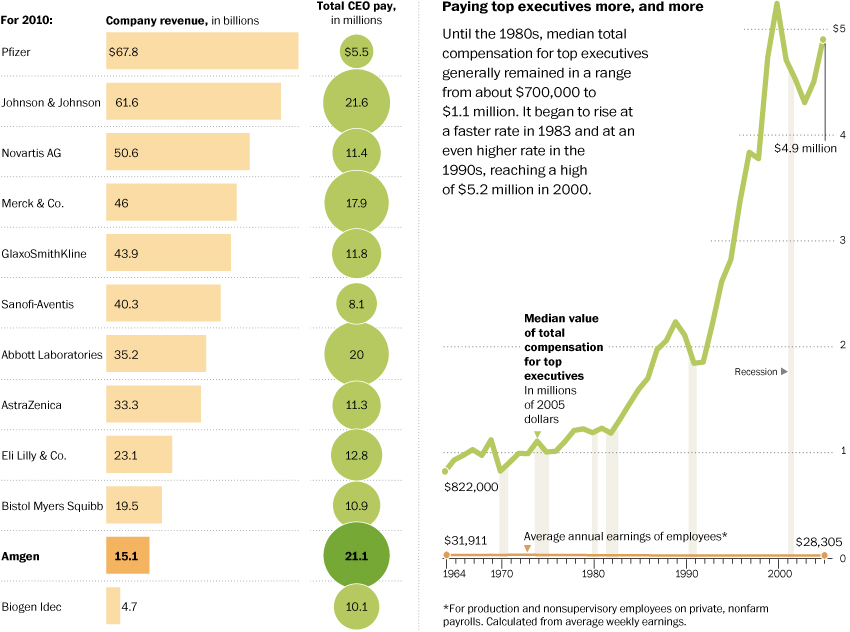

- Ratcheting Up CEO Pay With Peer Comparison

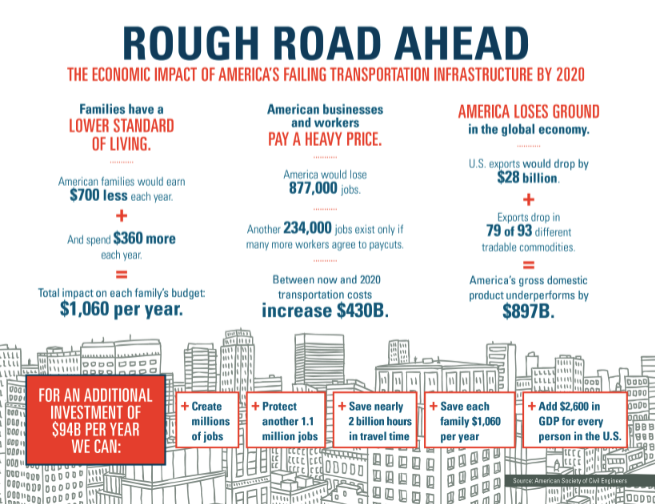

- Rough Road Ahead

- QOTD: Two Novels That Can Change Your Life

- American Hedge Fund Assets = $1.4 Trillion

- Let’s go Slovakia

- Has The Stock Market “Thrusted” Off A Bottom?

- TBP Conference Has Arrived!

| Posted: 11 Oct 2011 10:30 PM PDT The Wall Street Journal reports Euro-zone banks' overnight deposits at the ECB increased again last week "reflecting deepening distrust in interbank lending markets." The Journal writes,

|

| Posted: 11 Oct 2011 08:30 PM PDT Bratislava

> I have been to Bratislava. You drive east from Vienna, across farmland and past windmills of the modern type, generating electricity for Austria. Instead of armed guards, searches, and moneychangers, you cross the open-border bridge spanning the Danube and enter Bratislava, the capitol of Slovakia. The city has been rebuilt since the war. It is colorful now that the years of gray communist pallor have been replaced by the open border and a growing economy. It has a generation of young people who do not remember the era of Moscow's domination. It has an older generation that does not want to return to that era. It has a stock exchange. It has a free press. It has international visitors and easy transit. In addition, it has a central bank. I visited that bank. As part of the GIC central banking series programming, www.interdependence.org, the governor of that central bank visited our group in Philadelphia. Slovakia is an indicator of the development of the European Union and the euro zone. Now it is in the limelight. It is a newer member of the 17-nation euro zone. To join the euro zone, it met the requirements on budget-deficit limits, inflation, and debt/GDP ratio. Now it is asked to assist Greece, the 12th member of the euro zone and the one that restated its numbers, after the fact, and was thereby caught in an economic prevarication. The other 16 member countries of the euro zone range in size from Germany, the largest, to Malta, the smallest. Those 16 have agreed to the EFSF, the fund to be used to bridge the financing requirements while Greece sorts through the inevitable restructuring of its debt. The attempt in Europe is to do it in an orderly way, without sinking the European banks that hold that Greek debt. This political showdown in Bratislava is about banks. Moreover, the banks are the bigger ones in the larger countries of the euro zone. In addition, this political fight in Bratislava is about the role and power of a member state vs. the evolution of a more central governing system that spans the European Union. Throw open the history of the United States and examine the debates about states' rights vs. the federal government's role, and you can see the forerunner to the present tension in Europe. We had our fights here. We still have them. In Europe, they are having their versions. Slovakia will not sink the euro zone. It loses if it does. In the end, we believe that Barclays' assessment of this momentary high-risk political gambit by one political faction in Bratislava is the accurate outlook. However, we admit that it is a high-stakes game. If Slovakia becomes an obstacle to the EFSF and then Germany, France, and others have to do a small-country carve-out in order to prevail, then Germany and France will have opened a Pandora's Box that cannot be closed. This is how the game of moral hazard is played. It is now years ago that the European Central Bank allowed a downgraded, previously investment-grade Greek bond to remain acceptable collateral for pledging to the ECB. That was the first chink in the armor against moral hazard. The cost of that erroneous decision is mounting. In the US, we did it by allowing Countrywide to merge with Bank of America when the Fed suspended a rule. Countrywide was the first primary dealer to fail, and the Fed took moral hazard up to prevent it from defaulting. The price tag was revealed when Lehman failed. The price tag is also revealed in the present charges taken by BofA. In Europe, the price tag will be revealed in the eventual size of the EFSF and other rescue funds. Moral hazard is costly. Systemic banking failure is costly, too. Here is Barclays' assessment today. We shall watch this evolution closely. Barclays analyst Francois Cabau wrote: “All in all, it seems that a solution exists for the EFSF 2.0 bill to be approved by the Slovakian Parliament but it could be very costly for the ruling SDKU-DS (15% of seats) and, thus, for the handling of domestic issues, as conditioned by a potential fall of the government. Furthermore, according to Slovakian law, the EFSF bill could be resubmitted to Parliament in an unchanged form if the composition of the current government were to change. Although this could imply significant amount of time lost for the EFSF, we remain of the view that Slovakia will eventually join the other 16 countries that have approved the bill. To sum up, the question is not 'what if it does not approve' but rather 'when it approves.' ” David R. Kotok, Chairman and Chief Investment Officer |

| Posted: 11 Oct 2011 07:52 PM PDT Just got back home after a long and terrific day. Here are the Tweets about the conference:~~~ ~~~ vinnystocktips Vinny @ @ritholtz Trey Annastasio RULES! Lived in NOLA for years and music is in my blood! Never thought I would see his name on a Stocktweet! :) ~~~ SlimCharles45 SlimCharles45 @ @nicoleslavitt @phish @howardlindzon @reformedbroker @ritholtz Whoa! What was Trey doing there? What’s his take on the Protest? ~~~ nicoleslavitt Nicole Slavitt meeting Trey from @phish with @howardlindzon @ReformedBroker @ritholtz was very entertaining tonight ~~~ ~~~

CathleenRitt Cathleen Rittereiser Hey @Bsimi I just came from the Dream midtown roof. Great party to end the great @ritholtz #TBPconference ~~~ Wolfmansblog Eric Wilkinson @ #OWSers will be knockin on your doors too! @TheStalwart RT @ReformedBroker: @Ritholtz and @Dougkass on stage $$ instagr.am/p/P2J0k/ ~~~ AlmanacTrader StockTrader’sAlmanac Bummed I had to leave @ritholtz big picture conf early. @JoeSaluzzi @ThemisSal #HFT 80/2 rule: 80% of vol done by 2% of exchange clients. ~~~ robsimons Rob Simons Happy hour with #TBPconference attendees. Hopefully nobody will jump after the presentations. Nice job @Ritholtz 4sq.com/nEXZ7S ~~~ treehcapital Rob Majteles Hardest part of chairing/serving comp cmtee=getting peers right RT @ritholtz Ratcheting Up CEO Pay/Peer Comparison dlvr.it/qH4kf $$ ~~~ Top_Investors Cathleen Rittereiser Agree! RT @TheRudinGroup : Interesting “fireside chat” great end to great day! @ritholtz @dougkass #TBPconference yfrog.com/j2v9xnnj #in ~~~ TheRudinGroup April Rudin Interesting “fireside chat” great end to a great day! @ritholtz @dougkass #TBPconference yfrog.com/j2v9xnnj ~~~ markgimein Mark Gimein Stopped by @ritholtz conference but was turned away from the NY Athletic Club for wearing jeans. Weird. ~~~ hblodget Henry Blodget .@jaltucher electrifies @Ritholtz conference by confessing that he got an erection on the way to the conference (from seeing a car) ~~~ MattNesto Matt Nesto “Technical analysis is voodoo” Doug Kass at the Big Picture Conf w/ @ritholtz & @ReformedBroker ~~~ nicoleslavitt Nicole Slavitt I think @ritholtz and Doug Kass are putting out a fresh doom and gloom report @ReformedBroker conf. today ~~~ robsimons Rob Simons Final presentation of the day at #TBPconference is @DougKass and @Ritholtz. Should be a good finish to an informative day. ~~~ wallstwes wall street wes Whatever this was, looks like a great MISS RT @ritholtz: WSJ’s Kelly Evans leads new media impact on markets panel twitpic.com/6yu2c2 ~~~ phildefelice Phil DeFelice @ritholtz Like the blog, the content at this Big Picture Conference is robust, timely & thought provoking. So glad I attended!! ~~~ robsimons Rob Simons Great start to panel discussion at #TBPconference with @hblodget, @jaltucher and @howardlindzon. @ritholtz has recruited good speakers. ~~~ TheStalwart Joseph Weisenthal RT @Kelly_Evans: Had a blast! Great group RT @ritholtz: WSJ’s Kelly Evans leads new media impact on markets panel twitpic.com/6yu2c2 ~~~ Kelly_Evans Kelly Evans Had a blast! Great group. RT @ritholtz: WSJ’s Kelly Evans leads new media impact on markets panel $$ twitpic.com/6yu2c2 ~~~ JayBWood Jason Wood Running into lots of good folks @ritholtz Big Pic. Haven’t had chance to say hello @howardlindzon or @atask yet tho ~~~ ssstrom Stephanie Strom Missed opportunity for economic stimulus? RT @ritholtz: Rough Road Ahead dlvr.it/qGCqD $$ ~~~ ScottVanEpps Scott A Van Epps @ReformedBroker @ritholtz Josh you laughed at me looking at airbnb, maybe tonight I’ll sleep with he #occupywallstreet crowd tonight.. ~~~ cnbcfastmoney cnbcfastmoney Great conf today by @ritholtz, @ReformedBroker. A must nxt year if you want to hear the things your broker is afraid to tell you. -melloy ~~~ ampleambi Rufus G’morning & smile/laugh; 2 books that can change your life dlvr.it/qFZY8. Thanx @ritholtz #OccupyWallStreet #Liberta #citizensunited ~~~ vsaxena Vivek Saxena Love this hilarious #QuoteOfTheDay from @ritholtz 2 Novels that can change your life bit.ly/rd3B11 #quote HedgeyeDJ Daryl Jones I might stop by the Big Picture conference, even though @ritholtz “forgot” to invite @Hedgeye to speak. #timestamped Top_Investors Cathleen Rittereiser ampleambi Rufus G’morning & smile/laugh; 2 books that can change your life dlvr.it/qFZY8. Thanx @ritholtz #OccypyWallStreet #Liberta #citizensunited pkedrosky Paul Kedrosky Clever boy RT @ritholtz: QOTD: Two Novels That Can Change Your Life dlvr.it/qFZY8 $$ CathleenRitt Cathleen Rittereiser I really should live tweet the @ritholtz #TBPconference but there’s so much good content, and I can’t type that fast. bclund bclund Occupy Wall Street protestors now demanding subsidized Big Picture tickets @ReformedBroker @TheStalwart @ritholtz @howardlindzon $$ dinosaurtrader dinosaur trader Retweet if you couldn’t afford the Big Picture conference! @ReformedBroker, @TheStalwart, @ritholtz, but seriously, have fun, 1%ers. $$ nickbotto Nicholas Botto Who is Frodo Baggins? Awesome QOTD from @ritholtz ritholtz.com/blog/2011/10/t… fearlicious kevin ferry @ @ritholtz that is really good even tho you know where its going! TheRudinGroup April Rudin @ritholtz #TBPconference listening to amazing info on #behavioralfinance #crowsourcing effect on mkt yfrog.com/h8l9xayj scs1977 Scott Sinclair @ @reformedbroker @Ritholtz What ever happened to the Global Analyst Research Settlements?!? ow.ly/6TKV0 #howsoonweforget iheartWallSt scott bell Expert forecasters do about as well as the average members of public. — book “hedgehog vs. The fox” @ritholtz tommyhump Tommy Humphreys Representing @CambridgeConf and Canada @Ritholtz‘s Big Picture Conf. Sir @HowardLindzon sitting beside me. Only guy in jeans. YOCCSS YOCCSS RT @ritholtz: Let's go Slovakia dlvr.it/qFDxB $$ // como dijera el #PincheComunista de @MiguelPoblanno : #parendemamar howardlindzon howardlindzon Working the floor RT @tommyhump: Picking up @howardlindzon on the way to @ritholtz‘s Big Picture Conference NYC. $$ CathleenRitt Cathleen Rittereiser Full house for @ritholtz Big Picture conference. Celebrities spotted (so far) include @ppearlman @ReformedBroker. Great to be here todd_harrison Todd Harrison On way to The Big Picture Conference w @ritholtz bit.ly/p2lqXk fitzanalytics Fitzgerald Analytics @ Pawelmorski P M And falling by the hour RT @ritholtz: American Hedge Fund Assets = $1.4 Trillion dlvr.it/qDykB $$ chicagosean Sean McLaughlin That’s a lot of bread… RT @ritholtz American Hedge Fund Assets = $1.4 Trillion stks.co/ZUh $$ TheRudinGroup April Rudin WoW! Cool opening presentation TheBigPicture #TBPconference @cmulbrandon #visualizingeconomics #infographics @fitzanalytics @ritholtz tommyhump Tommy Humphreys Picking up @howardlindzon on the way to @ritholtz‘s Big Picture Conference NYC. TheRudinGroup April Rudin WoW! Cool opening presentation @TBPconference @cmulbrandon #visualizingeconomics #infographics @fitzanalytics @ritholtz @JamesHMcL ScottVanEpps Scott A Van Epps @ReformedBroker @ritholtz thanks for having pins on the nametags so I could cover the NYCAC logo in the house jacket, now I feel at home… robsimons Rob Simons At The Big Picture Conference with @Ritholtz. Expecting to learn about current and future economic opportunities. 4sq.com/qmJqGL ~~~ thebasispoint Julian Hebron Moneyball Housing Analogy & more links from @jonathanmiller @inmannews @ReformedBroker @ritholtz @tradingfloorcom ow.ly/6TzVY ~~~ Kelly_Evans Kelly Evans 4 words: mac ‘n’ cheese brulee RT @ThemisSal Great evening @ritholtz @ReformedBroker @DougKass @Kelly_Evans @TheStalwart ThemisSal Sal Arnuk :) Thank you Barry. Great evening and conversation. RT @ritholtz: @ReformedBroker @DougKass @Kelly_Evans Bone Marrow ~~~ ThemisSal Sal Arnuk Last night we dined with @ritholtz @ReformedBroker @DougKass , and a who’s who on the Planet Twitter. Great time. But bone marrow? WTF $$ |

| Ratcheting Up CEO Pay With Peer Comparison Posted: 11 Oct 2011 11:30 AM PDT Cozy relationships and 'peer benchmarking' send CEOs' pay soaring (Washington Post) Outsize Severance Continues for Executives, Even After Failed Tenures (NYT) |

| Posted: 11 Oct 2011 09:00 AM PDT |

| QOTD: Two Novels That Can Change Your Life Posted: 11 Oct 2011 07:30 AM PDT A fantastic quote bubbled up in comments the other day:

I find this hilarious, because it it true. |

| American Hedge Fund Assets = $1.4 Trillion Posted: 11 Oct 2011 06:00 AM PDT > Very interesting data points via Absolute Return:

> Source: |

| Posted: 11 Oct 2011 05:31 AM PDT Markets await the vote of the Slovakian Parliament to approve the expanded EFSF, the last country of the 17 euro members to do so. After the head of the opposition party said he would vote yes on a 2nd vote if the 1st vote failed, it eased concern of a failure of passage. Assuming no surprises, attention has shifted to what comes next and DJ is quoting an EU senior official saying finally, “The discussion is on a haircut, how big it needs to be and whether sovereign creditors may be involved.” Last night Juncker, who heads the euro finance ministers, said a 60% cut may be necessary but his spokesman said he didn’t mean to give an exact figure and only meant to say it would be above 21%. Either a debt swap or outright haircut will be the two options. The ECB will certainly be pushing for the former since their balance sheet is polluted with junk sovereign debt. Once a decision is made amongst the parties involved, the focus will then be on containing the collateral damage both to other sovereigns and to the banks that hold sovereign debt. Also today, the troika today will release their decision on whether Greece behaved enough to get their next allowance check and release of it is expected. In the first monetary step of an Asian central bank to reverse the economic concerns, Indonesia unexpectedly cut interest rates by 25 bps to 6.5%, reversing its Feb hike. China’s sovereign wealth fund bought Chinese bank stocks in the secondary market, news of which was announced after the Shanghai index close but before the Hang Seng closed |

| Has The Stock Market “Thrusted” Off A Bottom? Posted: 11 Oct 2011 05:30 AM PDT The Wall Street Journal – Chart Watchers See Upbeat Turn Several Technical Analysts Say Stock Moves Last Week May Signal a Market Bottom; 'Upside Breakout' Ahead? Comment We decided to take a further look at the highlighted statement above to see if we have hit a 'significant bottom' in the stock market after 3 consecutive daily rallies of 1.75% or more last week. Our analysis shows this is not the fourth time since WWII that the market had three consecutive daily rallies of at least 1.75%, but the eleventh. Additionally, this has occurred 34 times since the 1929 stock market crash. However, this has only occurred 4 times since 1974. We look at these periods in detail below. October 1974 Let's begin with the 3-day period in 1974. The chart below shows the S&P 500 from June 20 to December 31 1974. Between October 7 and October 14, 1974 the S&P 500 rose about 16%. Although the market continued to move sideways for the next couple of months, this was, in fact, a significant bottom in the stock market. Technicians would argue that this large three-day "thrust" did not trigger a technical breakout, but this move did occur near the low. August 1984 In the beginning of August 1984 the market saw another 3-day period of consecutive daily rallies of 1.75% or more. As the chart below highlights, the market rallied 8% between August 1 and August 3, 1984. The market continued to rally until the 1987 crash over three years later. Technicians would argue that "thrust" produced a breakout and the market responded by not looking back for over three years. August 2002 The chart below shows the next 3-day period in which stocks advanced by 1.75% or more each day. Between August 6 and August 8, 2002 the market rallied 8%. As the chart below shows, this was not a significant bottom. The market continued to fall another 11% by October of that year (three months later). October 2011 The chart below shows last week's 3-day advance from October 4 to October 6, 2011. Much like the 2002 incident, it is hard to make the case this "thrust" resulted in a breakout. Conclusion A lot of people have been talking about this pattern. The implication is this represents a thrust off a low and the start of a significant move higher. History shows this has only been the case when this pattern results in a breakout of the previous range (see 1984). When this thrust results in a move back into a defined range (see 2002), it has little meaning. When the market only barely broke out (see 1974), the market churned sideways for months before moving higher. Has the market's trend changed? For now, the answer appears to be "no." Until a breakout is established, we would not get that excited about the three consecutive daily rallies of 1.75% or more. Source: |

| Posted: 11 Oct 2011 04:30 AM PDT OK, today is the big day. Lots of you asked if there would be an audio or video recording — and we have retained FORA TV to shoot the entire event. They will edit, digitize and host the entire event, for what I am told is a moderate amount (as in under $100). I’ll post updates as they occur. Here is what I am doing all day: |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 comments:

Post a Comment