The Big Picture |

- Market Interlude

- 10 Tuesday PM Reads

- Mauboussin: The Success Equation

- The Buffetts (3 Generations) Discuss Charity & Succession

- Does No QE = Recession ?

- 10 Tuesday AM Reads

- NFP & the QE Counter-Factual

- Greenspan on Cap Requirements, Self Regulation

- Why Small Business Lending Isn’t What It Used to Be

| Posted: 23 Oct 2013 02:00 AM PDT Interlude

We have entered an interlude between the last incarnation of the budget, debt, debt-limit, and sequester confrontation and the next incarnation of the budget, debt, debt-limit, and sequester confrontation. Let’s think of this commentary as potpourri following "Done Deal." Item 1. Katie Darden, editor of SNL Financial, corrected an error that we made. The event we had discussed surrounding Congressman Dan Rostenkowski took place in 1989, not 1979. Here is the link to a Chicago Tribune report of that event: http://articles.chicagotribune.com/1989-08-20/news/8901050991_1_rep-dan-rostenkowski-chicago-mercantile-exchange-means-committee. Thank you, Katie, for the correction and for the link so that we may read precisely what citizens can do if they get sufficiently enraged to act. Item 2. A handful of readers corrected my statement that the Senate had not passed a budget in five years. It has actually been four years. Technically, a budget is passed every time there is a continuing resolution to authorize some spending. I do not know about other readers, but I do not consider that a budget process. I consider that to be an emergency, stop-gap adjustment that is put together because the politicians that we elect have no choice but to do so in order to fund the continuation of government. In fact, you could argue this last budget was not really a fully developed budget. Item 3. We can witness the disgrace in this process by examining the inclusion of an additional $2.1 billion for the Olmsted Lock and Dam Authority. The developer is URS Corp. This Ohio River project is approaching a cost overrun of four times the original cost estimate. Defenders of the project say it is necessary. Detractors wonder how such earmarking of spending will ever stop. Readers may note that Senator Mitch McConnell says the White House requested the money and argues it was not a “Kentucky kickback” as the conservatives have labeled it. Note that 81 Senators and 285 House Members voted “aye” on the deal. Most of them say they didn't know the dam-funding extension was in the legislation. Item 4. Let’s get to the Fed. The debate has swung back to tapering. When, how much, what criteria? We shall know something soon, since the next Fed meeting is at the end of this month. Today's release of the September employment report is abysmal. It further extends the Fed's tapering time horizon. The report shows how weak things were before the shutdown. Private sector job growth is declining by many measures; we assume that the shutdown only worsened this trend. Item 5. Uli Kortsch put together some interviews and is developing a full book sequence from a conference held at the Federal Reserve Bank of Philadelphia. The speakers included Bill Poole, former President of the St. Louis Fed; Lord Adair Turner, former Chair of the British equivalent of the Securities & Exchange Commission; Michael Kumhof of the IMF; Larry Kotlikoff, top economist on intergenerational issues; and economist Jeff Sachs, Director of the Earth Institute at Columbia. I was fortunate to be one of the presenters at that conference. Here is a link to Uli’s video: http://www.youtube.com/watch?v=ZaC1VxQPqtc . The video has excerpts from six presentations, slides, and commentaries. If you have the time to look at it in detail, you might find it worthwhile. For those who would rather have an abbreviated version, here is a link to a conference summary video from the organization that Uli is involved in developing: http://www.realmoneyecon.org/lev2/resources_2video.html. Item 6. As we anticipate the next iteration of the debt-limit fight, we can draw some clear conclusions from the last crisis. The US is not going to default. Politicians of both parties have come together and agreed on that. The structure and duration of the government shutdown hurt both political parties. It hurt the Republicans more, but it hurt both of them. The question facing them now is whether the citizens have memories long enough to reach to the next election. That will come in a year. Then we’ll find out who is re-electable. During this interlude, the ball is back in the Federal Reserve’s court. Congress is going to spend the next couple of months dealing with the crazy crisis-resolution process they worked out. It is timed with precision and is set up to lead to another fierce division of viewpoints. In the meantime, the Fed has to meet. It has to deal once more with the question of tapering or no tapering, in the midst of a change of leadership. It has to evolve some policy that is articulated with clarity. Right now, markets are confused about the Fed. They do not know the direction, depth, or timing of policy. The Fed officials know this and have to fix it. One thing seems clear. The zero-interest-rate limitation in the short-term end of the yield curve is going to persist for at least another couple of years. It may continue a lot longer. The shock of the US government shutdown and the antics of our politicians have only exacerbated the slowing of the US economy. What does it mean when the short-term interest rate is zero for a long period of time? It means that asset classes have a long and volatile, but favorable, upward bias. On this subject, here is a three-minute interview by Rhonda Shaffler of Reuters. In it, Rhonda asked me a question about the US stock market and why I think it is going to go higher. Here is the link: http://youtu.be/uVAdEsC0bGI . At this juncture, Cumberland equity accounts are fully and strategically invested around the globe using exchange-traded funds. We think that very-low-interest-rate policies will remain in effect worldwide for some extended period of years. We want to take advantage of them. Our bond accounts are configured to reflect the duration changes from all of these policy shifts. We are sensitive to credit risk. If we think there is trouble, we want to run fast. The idea is that pressured governments cannot rely on other governments to bail them out. The bailout era, with tons of money thrown precipitously at problems, seems to be drawing to a close. The difference between "bailout" and "bail-in" is a shift of responsibility. Lehman-AIG triggered a bailout. In the next round of trouble, bail-in will mean that risks have risen for the investor. The investor has to perform the risk management now, because the government will not save him or her from the errors that our system is prone to repeat. We want to thank readers for emails received in response to our commentary entitled "Done Deal!" About 300 responded. To put that into perspective, our primary email list includes approximately 10,000 clients, consultants, referring professionals, and others who request to be on the list. There is no charge to be on the primary list, and people can get on the list by going to our website: http://www.cumber.com/signup.aspx . Secondary distribution of our commentaries has been estimated at about 2 million. A final note is about something which we find disturbing. Fox Business' Neil Cavuto interviewed John McAfee about data security, hackers and the Obamacare website rollout. McAfee's expertise is in internet-related security issues and software security. His suggestions are eye-opening and he doesn't mince words. Here is the YouTube link: http://www.youtube.com/watch?v=5TCtLtzSe6I. ~~~ David R. Kotok, Chairman and Chief Investment Officer |

| Posted: 22 Oct 2013 01:00 PM PDT My afternoon train reading:

What are you reading?

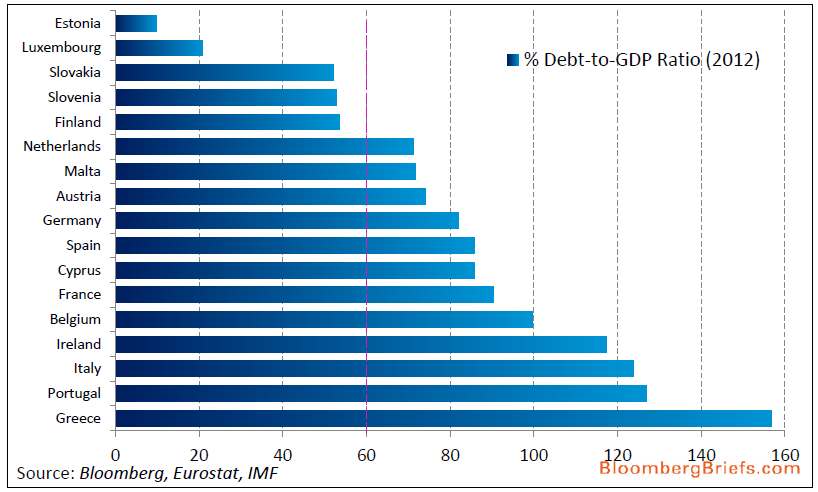

Euro-Area Sovereign Debt Rises to 8.6 Trillion Euros |

| Mauboussin: The Success Equation Posted: 22 Oct 2013 11:30 AM PDT Michael J. Mauboussin was of the speakers at our TBP conference earlier this month. You can see his presentation below video Michael Mauboussin: Why We Don’t Understand Luck from The Big Picture on FORA.tv

|

| The Buffetts (3 Generations) Discuss Charity & Succession Posted: 22 Oct 2013 11:09 AM PDT Oct. 22 (Bloomberg) — Berkshire Hathaway chairman/CEO Warren Buffett, board member Howard G. Buffett and Howard W. Buffett, executive director at Howard G. Buffett Foundation, talk with Betty Liu about their book "40 Chances," their philanthropic endeavors, succession at Berkshire Hathaway and Warren Buffett's love of the TV show "Breaking Bad." They speak on Bloomberg Television's "In The Loop." |

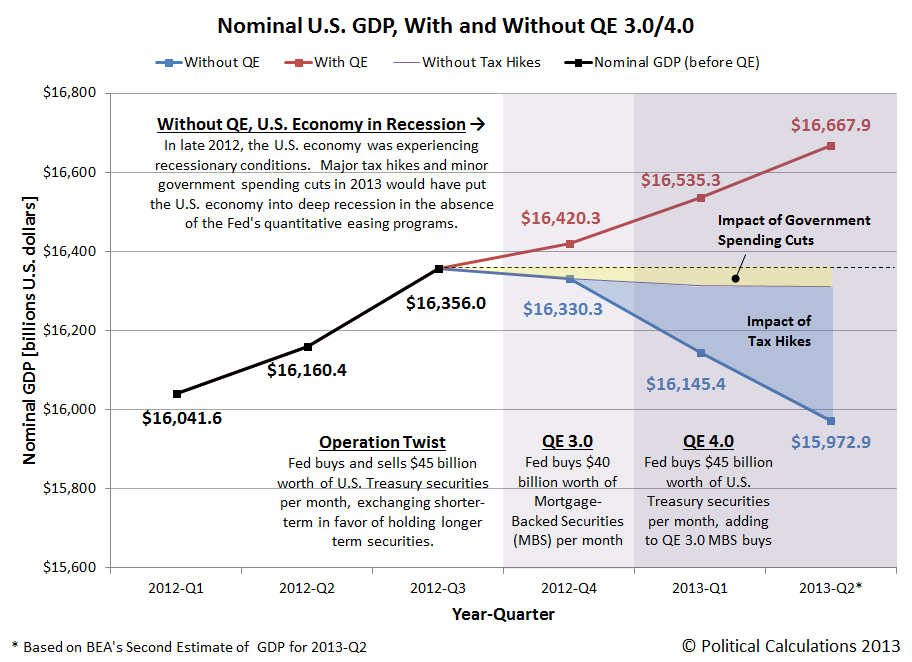

| Posted: 22 Oct 2013 09:00 AM PDT click for larger graphic

Earlier this morning, I suggested that when we consider the results of QE on NFP, we also consider what the world might look like in its absence. (Long term readers might recall I suggested we do the same thing with the bailouts as well, with the results being deeper selloff, more early pain, but a stronger and healthier recovery). As it turns out, Political Calculations already did imagine what that might look like last month — the results being the chart above:

If QE never came into existence, the world might look different in a variety of ways:

My assumptions that follow this is that without QE:

The last assumption is that as things got appreciably worse, Congress would be forced to act with a major stimulus. I fthey failed to do so, there might be a signifciant change November 2014. There is some irony in that the people who hate the Fed the most are potentially the biggest beneficiaries of their policies . . . |

| Posted: 22 Oct 2013 06:30 AM PDT My morning reading material:

What are you reading?

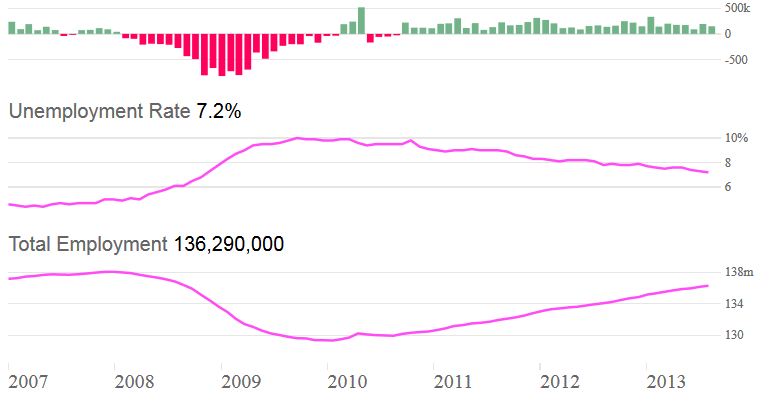

September Non Farm Payrolls |

| Posted: 22 Oct 2013 04:26 AM PDT One of the analytical errors I seem to constantly come across is what I call the non-result result. It goes something like this: If you do X, and there is no measurable change, X is therefore ineffective. The problem with this analysis is the lack of a control group, If you are testing a new medication to reduce tumors, you want to see what happened to the group that did not get the tested therapy. Perhaps their tumors grew and metastasized. Hence, no increase in tumor mass or spreading is considered a very positive outcome. This seems to get loss in the debate over QE. The debate — either ignorantly or disingenuously — makes claims such as “Look how few jobs have been created, and look how high unemployment is.” Understanding this logic, and lacking a control group, we must employ a counter-factual. The question one should be asking is “How many less jobs would have been created?; How much higher would unemployment be?” As someone who was strongly against the bailouts, this puts me in the odd position of defending the Fed against silly criticisms. But if we are not intellectually honest about our policies, how can we ever understand, critique and improve them? Hence, a weak or strong NFP should raise the question “What would it have been without QE? Based on that, can we determine when might this policy be unwound? ~~~ September Employment Situation out in one hour at 8:30 am

|

| Greenspan on Cap Requirements, Self Regulation Posted: 22 Oct 2013 03:00 AM PDT Greenspan discusses many of the ideas he had reversed himself on regarding the financial requirement. Note he has adopted my Partner’s Joint & Thesis Liability explanation (from BN) that states the move to Corporate structure from a Partnership radically reduced the focus on risk management.

In this exclusive, unedited interview, former Fed Chairman Alan Greenspan explains why bankers are so terrible at self-regulation. Alan Greenspan Extended Interview Pt. 1 The Daily Show (06:51) ~~~ In this exclusive, unedited interview, former Fed Chairman Alan Greenspan discusses the need for increased capitalization in the global financial system. Alan Greenspan Extended Interview Pt. 2 The Daily Show (07:08)

|

| Why Small Business Lending Isn’t What It Used to Be Posted: 22 Oct 2013 02:00 AM PDT Why Small Business Lending Isn't What It Used to Be

Since the Great Recession, bank lending to small businesses has fallen significantly, and policymakers have become concerned that these businesses are not getting the credit they need. Many reasons have been suggested for the decline. Our analysis shows that it has multiple sources, which means that trying to address any single factor may be ineffective or make matters worse. Any intervention should take all of the many causes of the decline in small business lending into consideration. Small business lending has dropped substantially since the Great Recession. While some measures of small business lending are now above their lowest levels since the economic downturn began, they remain far below their levels before it. For example, in the fourth quarter of 2012, the value of commercial and industrial loans of less than $1 million—a common proxy for small business loans—was 78.4 percent of its second-quarter 2007 level, when measured in inflation-adjusted terms. And despite an increase of nearly 100,000 small businesses over the period, the number of these loans dropped by 344,000 over the 2007 to 2012 period (many such loans arguably go to small businesses).1 Policymakers have become concerned that the decline in small business lending may be hampering the economic recovery. Small businesses employ roughly half of the private sector labor force and provide more than 40 percent of the private sector's contribution to gross domestic product. If small businesses have been unable to access the credit they need, they may be underperforming, slowing economic growth and employment. Different views have emerged about the cause of the slowdown. Bankers say the problem rests with small business owners and regulators—business owners for cutting back on loan applications amid soft demand for their products and services, and regulators for compelling the banks to tighten lending standards (which cuts the number of creditworthy small business owners). Small business owners, in turn, say the problem rests with bankers and regulators—bankers for increasing collateral requirements and reducing their focus on small business credit markets, and regulators for making loans more difficult to get. In our analysis, we find support for all of these views. Fewer small businesses are interested in borrowing than in years past, and at the same time, small business financials have remained weak, depressing small business loan approval rates. In addition, collateral values have stayed low, as real estate prices have declined, limiting the amount that small business owners can borrow. Furthermore, increased regulatory scrutiny has caused banks to boost lending standards, lowering the fraction of creditworthy borrowers. Finally, shifts in the banking industry have had an impact. Bank consolidation has reduced the number of banks focused on the small business sector, and small business lending has become relatively less profitable than other types of lending, reducing bankers' interest in the small business credit market. Because none of these factors is the sole cause of the decline in small business credit, any proposed intervention needs to take into account the multiple factors affecting small business credit. The Demand-Side ProblemBankers say that the main reason small business lending is lower now than before the Great Recession is that demand has fallen. Small business owners, they argue, aren't expanding, depressing the amount that the small business sector needs to borrow. This is no doubt part of the story. Small businesses were hit hard by the economic downturn. Analysis of data from the Federal Reserve Survey of Consumer Finances reveals that the income of the typical household headed by a self-employed person declined 19 percent in real terms between 2007 and 2010. Similarly, Census Bureau figures indicate that the typical self-employed household saw a 17 percent drop in real earnings over a similar period. Weak earnings and sales mean that fewer small businesses are seeking to grow. Data from the Wells Fargo/Gallup Small Business Index—a measure drawn from a quarterly survey of a representative sample of 600 small business owners whose businesses have up to $20 million a year in sales—show that the net percentage of small business owners intending to increase capital investment over the next 12 months fell between 2007 and 2013. In the second quarter of 2007, it was 16 (the fraction intending to increase capital investment was 16 percentage points higher than the fraction intending to decrease capital investment), while in the second quarter of 2013, it was –6 (the fraction intending to decrease capital investment was 6 percentage points higher than the fraction intending to increase it). Similarly, the net percentage of small business owners planning to hire additional workers over the next 12 months was 24 in the second quarter of 2007, but only 6 in the second quarter of 2013. Reduced small business growth translates into subdued loan demand. Thus, it is not surprising that the percentage of small business members of the National Federation of Independent Businesses (NFIB) who said they borrowed once every three months fell from 35 percent to 29 percent between June 2007 and June 2013. Some of the subdued demand for loans may stem from business owners' perceptions that credit is not readily available. According to the Wells Fargo/Gallup Small Business Index survey, in the second quarter of 2007, 13 percent of small business owners reported that they expected that credit would be difficult to get in the next 12 months. By the second quarter of 2013 that figure had increased to 36 percent. By contrast, 58 percent of small business owners said credit would be easy to get during the next 12 months when asked in 2007, compared to 24 percent six years later. Small Businesses Are Less Creditworthy Than They Used to BeLenders see small businesses as less attractive and more risky borrowers than they used to be. Fewer small business owners have the cash flow, credit scores, or collateral that lenders are looking for. According to the latest Wells Fargo/Gallup Small Business Index, 65 percent of small business owners said their cash flow was "good" in the second quarter of 2007, compared to only 48 percent in the second quarter of 2013. Small business credit scores are lower now than before the Great Recession. The Federal Reserve's 2003 Survey of Small Business Finances indicated that the average PAYDEX score of those surveyed was 53.4. By contrast, the 2011 NFIB Annual Small Business Finance Survey indicated that the average small company surveyed had a PAYDEX score of 44.7. In addition, payment delinquency trends point to a decline in business credit scores. Dun and Bradstreet's Economic Outlook Reports chart the sharp rise in the percent of delinquent dollars (those 91 or more days past due) from a level of just over 2 percent in mid-2007 to a peak above 6 percent in late-2008. While delinquencies have subsided somewhat since then, the level as of late 2012 remained at nearly 5 percent, notably higher than the pre-recession period. More lending is secured by collateral now than before the Great Recession. The Federal Reserve Survey of Terms of Business Lending shows that in 2007, 84 percent of the value of loans under $100,000 was secured by collateral. That figure increased to 90 percent in 2013. Similarly, 76 percent of the value of loans between $100,000 and $1 million was secured by collateral in 2007, versus 80 percent in 2013. The decline in value of both commercial and residential properties since the end of the housing boom has made it difficult for businesses to meet bank collateral requirements. A significant portion of small business collateral consists of real estate assets. For example, the Federal Reserve's 2003 Survey of Small Business Finances showed that 45 percent of small business loans were collateralized by real estate. On the residential side, Barlow Research, a survey and analysis firm focused on the banking industry, reports that approximately one-quarter of small company owners tapped their home equity to obtain capital for their companies, both at the height of the housing boom and in 2012. The value of home equity has dropped substantially since 2006. According to the Case-Shiller Home Price Index, the seasonally-adjusted composite 20 market home price index for April 2013 was only 73.8 percent of its July 2006 peak. On the commercial side, the Moody's/Real commercial property price index (CPPI) shows that between December 2007 and January 2010, commercial real estate prices dropped 40 percent. While prices have recovered somewhat since then, the index (as of February 2013) is still 24 percent lower than in 2007. Lending Standards Have TightenedAt the same time that fewer small businesses are able to meet lenders' standards for cash flow, credit scores, and collateral, bankers have increased their credit standards, making even fewer small businesses appropriate candidates for bank loans than before the economic downturn. According to the Office of the Comptroller of the Currency's Survey of Credit Underwriting Practices, banks tightened small business lending standards in 2008, 2009, 2010, and 2011. Loan standards are now stricter than before the Great Recession. In June 2012, the Federal Reserve Board of Governors asked loan officers to describe their current loan standards "using the range between the tightest and easiest that lending standards at your bank have been between 2005 and the present." For nonsyndicated loans to small firms (annual sales of less than $50 million), 39.3 percent said that standards are currently "tighter than the midpoint of the range," while only 23 percent said they are "easier than the midpoint of the range." Moreover, while banks have loosened lending standards for big businesses during the recent economic recovery, they have maintained tight standards for small companies. Figure 1 shows the net tightening of lending standards (the percentage of banks tightening lending standards minus the percentage loosening them) for small and large customers from 2003 to 2012. As the figure indicates, net tightening was slightly greater for small businesses than large businesses in 2009 and 2010. However, in 2011 and 2012, there was a net tightening of lending standards for small businesses, despite a net loosening for big businesses. While banks adjust lending standards for a number of reasons, there is some evidence that heightened scrutiny by regulators had an impact on them during and after the Great Recession. Recent research quantifies the impact of tighter supervisory standards on total bank lending. A study by Bassett, Lee, and Spiller finds an elevated level of supervisory stringency during the most recent recession, based on an analysis of bank supervisory ratings. This research concludes that an increase in the level of stringency can have a statistically significant impact on total loans and loan capacity for several years—approximately 20 quarters—after the onset of the tighter supervisory standards. It's Not All about the Financial Crisis and the Great RecessionRecent declines in small business lending also reflect longer-term trends in financial markets. Banks have been exiting the small business loan market for over a decade. This realignment has led to a decline in the share of small business loans in banks' portfolios. As figure 2 shows, the fraction of nonfarm, nonresidential loans of less than $1 million—a common proxy for small business lending—has declined steadily since 1998, dropping from 51 percent to 29 percent. The 15-year-long consolidation of the banking industry has reduced the number of small banks, which are more likely to lend to small businesses. Moreover, increased competition in the banking sector has led bankers to move toward bigger, more profitable, loans. That has meant a decline in small business loans, which are less profitable (because they are banker-time intensive, are more difficult to automate, have higher costs to underwrite and service, and are more difficult to securitize). ConclusionNo one disputes the decline in the amount of small business credit since the financial crisis and Great Recession. The most recently available data put the inflation-adjusted value of small commercial and industrial loans at less than 80 percent of their 2007 levels. While bankers, small business owners, and regulators all point to different sources for the drop in small business credit, a careful analysis of the data suggests that a multitude of factors explain this decline in credit. The factors unleashed by the financial crisis and Great Recession added to a longer-term trend. Banks have been shifting activity away from the small business credit market since the late 1990s, as they have consolidated and sought out more profitable sectors of the credit market. Small business demand for lending has shrunk, as fewer small businesses have sought to expand. Credit has also become harder for small businesses to obtain. A combination of reduced creditworthiness, the declining value of homes (a major source of small business loan collateral), and tightened lending standards has reduced the number of small companies able to tap credit markets. This confluence of events makes it unlikely that small business credit will spontaneously increase anytime in the near future. Given the contribution that small businesses make to employment and economic activity, policymakers may want to intervene to ensure that small business owners can access the credit they need to operate effectively. When considering means of intervention, however, it is important for policymakers to understand and take into account the multiple factors affecting small business credit. Any proposed solution needs to consider the combined effect of these factors. Footnote

References"Income, Poverty, and Health Insurance Coverage in the United States: 2010," Carmen DeNavas-Walt, Bernadette D. Proctor, and Jessica C. Smith, 2011. Current Population Reports: Consumer Incomes, U.S. Bureau of the Census. "Estimating Changes in Supervisory Standards and Their Economic Effects," William F. Bassett, Seung Jung Lee, and Thomas W. Spiller. Federal Reserve Board, Divisions of Research and Statistics and Monetary Affairs, Finance and Economics Discussion Series, no. 2012-55. Ann Marie Wiersch |Policy Analyst  Ann Marie Wiersch is a policy analyst at the Federal Reserve Bank of Cleveland. She has worked on several Federal Reserve System initiatives, including projects focused on small business issues and state and local government finance. Scott Shane |Professor Scott Shane is a visiting scholar at the Federal Reserve Bank of Cleveland and the A. Malachi Mixon, III, Professor of Entrepreneurial Studies at the Weatherhead School of Management at Case Western Reserve University.

|

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

2 comments:

Great stuff from you, man. Ive read your stuff before and youre just too awesome. I love what youve got here, love what youre saying and the way you say it. You make it entertaining and you still manage to keep it smart. I cant wait to read more from you. This is really a great blog.

Great stuff from you, man. Ive read your stuff before and youre just too awesome. I love what youve got here, love what youre saying and the way you say it. You make it entertaining and you still manage to keep it smart. I cant wait to read more from you. This is really a great blog.

Post a Comment