The Big Picture |

- Sovereign Debt Markets in Turbulent Times: Discrimination and Crowding-Out Effects

- Cover Your Webcam With a Post-It Note

- 10 Tuesday PM Reads

- Have We Passed “Ex-Bubble Employment” (adjusted) Peak of 2007?

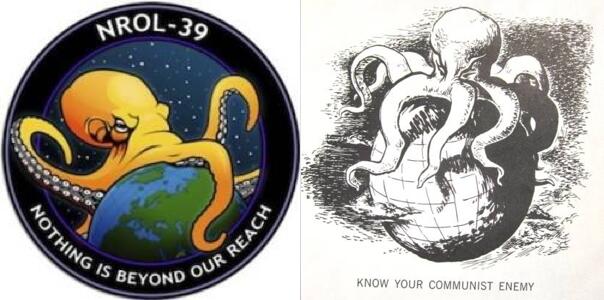

- Logo For US Spy Satellite Similar To American Depiction of Communism

- Comparing Private Job Creation Now & Then . . .

- 10 Tuesday AM Reads

- What Does It Mean When Investors Sit in Lots of Cash?

- Jim Bianco on Taper, Potential for Early Yellen Elevation

- All Habitable Zone Planets w/i 60 Light Years of Earth

- When Might the Federal Funds Rate Lift Off?

| Sovereign Debt Markets in Turbulent Times: Discrimination and Crowding-Out Effects Posted: 11 Dec 2013 02:00 AM PST |

| Cover Your Webcam With a Post-It Note Posted: 10 Dec 2013 10:30 PM PST Protect Yourself from Big BrotherWe noted in June that the single most important thing you can do to protect yourself from government spying is to realize that the NSA can turn on your cellphone or laptop's videocamera and microphone without you knowing. And see this. Now that even the Washington Post reported that your webcam can be remotely activated and you won't even know it's on, awareness of this vulnerability has gone viral. To give you an idea of how mainstream this concern is going, Mashable's Lance Ulanoff made a short video to show you how to use a post-it to block your webcam (duct tape works, but leaves a sticky mess on your laptop if you ever want to take it off to start using your webcam): |

| Posted: 10 Dec 2013 03:30 PM PST My afternoon train reading:

What are you reading?

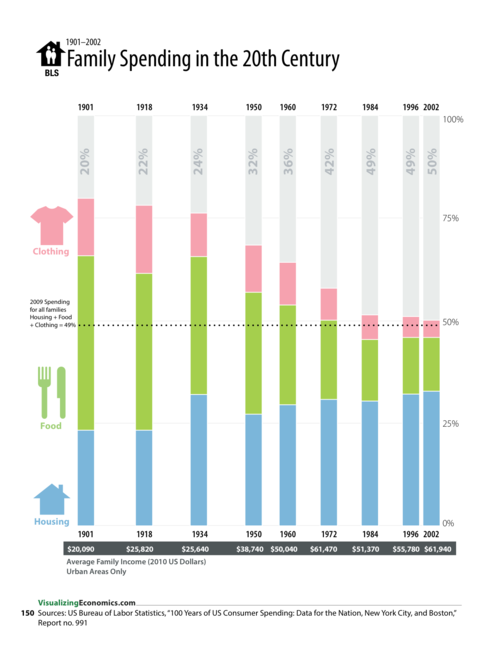

100 Years of Family Spending in the US |

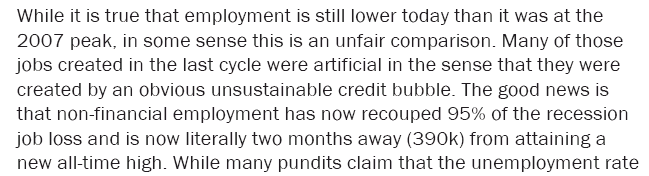

| Have We Passed “Ex-Bubble Employment” (adjusted) Peak of 2007? Posted: 10 Dec 2013 12:30 PM PST

Here is an interesting question: How does the present employment rate compare with the prior peak? According to Bureau of Labor Statistics data, if we compare the prior recent peak of 139,143,000 of November 2007 with last month’s figure of 137,942,000 (I used non-seasonally-adjusted because it’s November to November), we are still 1.2 million or so below the earlier highs. This suggest that by May or June 2014, the recovery will pass previous top levels. (Perhaps it’s noteworthy that women have already passed their prior peak employment). But let's look at this differently. What if we back out all of the artificially driven employment that has disappeared? If that is the case, we have probably already passed the prior "reality adjustment peak employment" — months ago. That is, remove the real estate agents, mortgage brokers, subprime securitizers, construction workers, etc., of the bubble and you end up with much more modest numbers.

Continues here

|

| Logo For US Spy Satellite Similar To American Depiction of Communism Posted: 10 Dec 2013 11:30 AM PST The New Logo For the US Spy Satellite From the National Reconnaissance Office Is Eerily Similar To American Depiction of Communism In the 1950s Jon Schwartz notes:

The National Reconnaissance Office is one of the "big five" U.S. Intelligence agencies, which designs, builds, and operates the spy satellites of the United States government, and provides satellite intelligence to several government agencies, including the NSA. |

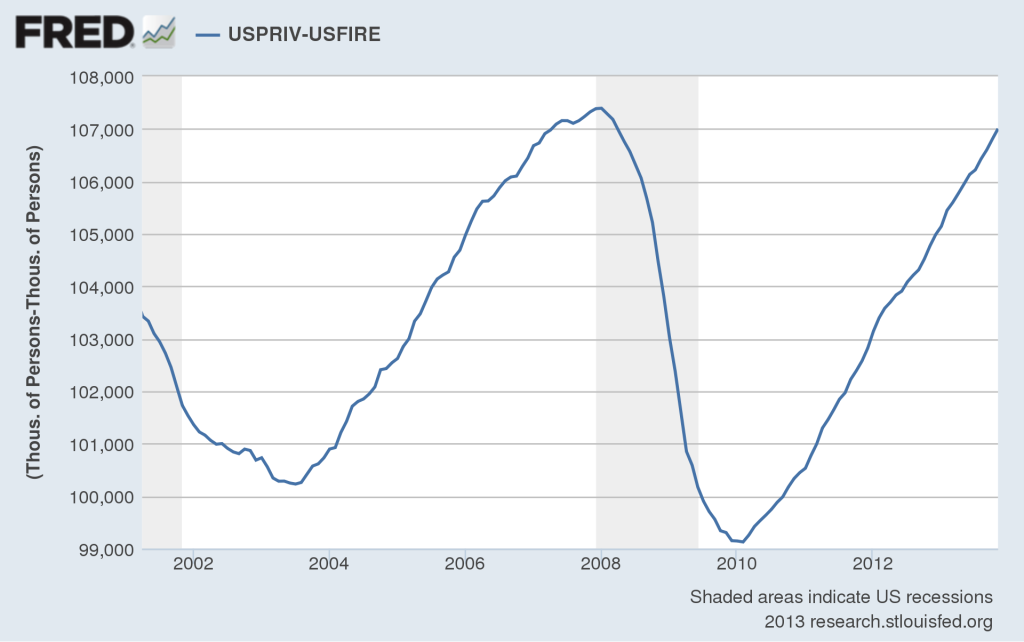

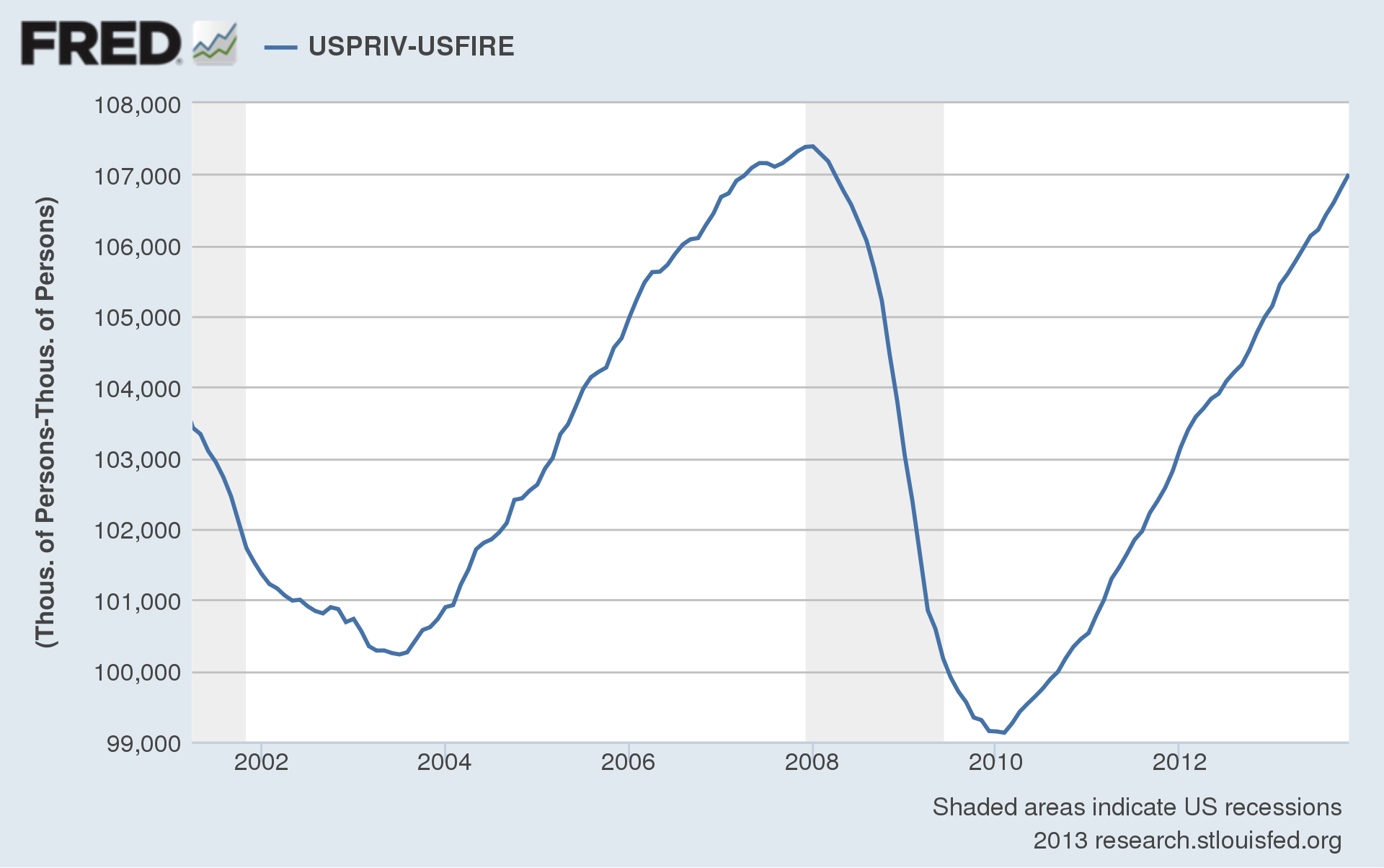

| Comparing Private Job Creation Now & Then . . . Posted: 10 Dec 2013 08:15 AM PST @TBPInvictus here: David Rosenberg made a point in his note Monday that I don’t think went quite far enough, or at least needs a bit more color:

Rosie then showed the chart below (the Haver Analytics version of it, anyway), which he dubbed “Employment Less Financials in Private Sector.” In St. Louis Fred-speak, that would be USPRIV – USFIRE:

We can probably agree with Dave that many jobs of the last cycle, particularly in finance, were indeed due to “obvious unsustainable credit bubble.” Now, all that said, here are some numbers out of the above chart:

Point here being that we are currently running at a 2.02% more naturally, if you will, than the 1.52% rate which itself was inflated by artificial, credit-bubble-induced hiring, mostly in the finance sector. And we are indeed within striking distance of eclipsing the January 2008 high within the next couple of months.

|

| Posted: 10 Dec 2013 06:26 AM PST My Tuesday morning roundup:

Continues here

|

| What Does It Mean When Investors Sit in Lots of Cash? Posted: 10 Dec 2013 05:30 AM PST Consider this interesting divergence: Despite a plethora of bubble talk, chatter about high CAPE valuations, and market tops, investors have been carrying an awful lot of cash. This is not a new phenomenon, but rather, has been a persistent condition since this most hated rally in Wall St history began. Before we proceed with the details, let me forewarn you what this column is not: It is not a "Cash on the Sidelines" argument. As we have discussed previously, there is ALWAYS cash on the sidelines. It is a lagging, not leading, indicator. When an investor buys an asset, it means the other side of the trade sells that asset. The cash merely transfers from one account to another. I don't pay garner much insight from sideline cash until it reaches extreme deviations from historical means in individual investor allocations. Regardless, it has not escaped my notice that a variety of surveys from major firms has revealed a lot of investment dollars is sitting in cash. Us Trust, Black Rock, UBS and American Express have all made similar discoveries, especially amongst high net worth/high income investors. What makes this so significant is the psychological component to this.

Continues here |

| Jim Bianco on Taper, Potential for Early Yellen Elevation Posted: 10 Dec 2013 04:00 AM PST |

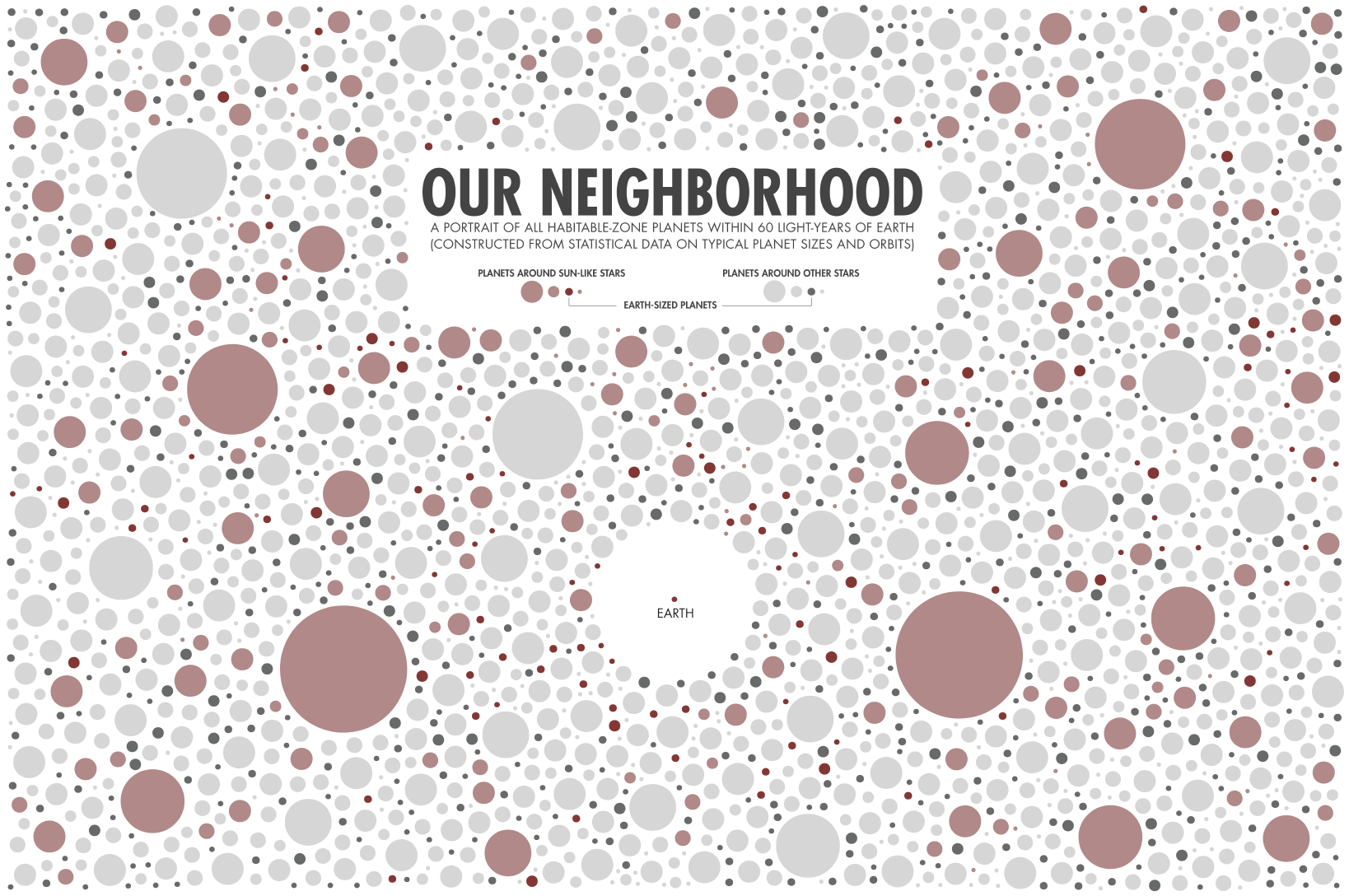

| All Habitable Zone Planets w/i 60 Light Years of Earth Posted: 10 Dec 2013 03:00 AM PST click for ginormous version |

| When Might the Federal Funds Rate Lift Off? Posted: 10 Dec 2013 02:00 AM PST |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 comments:

Post a Comment