The Big Picture |

- Quantitative Easing in Japan: Past and Present

- How I Ended Up On The Daily Show

- 10 Tuesday PM Reads

- Your New 2014 FOMC !

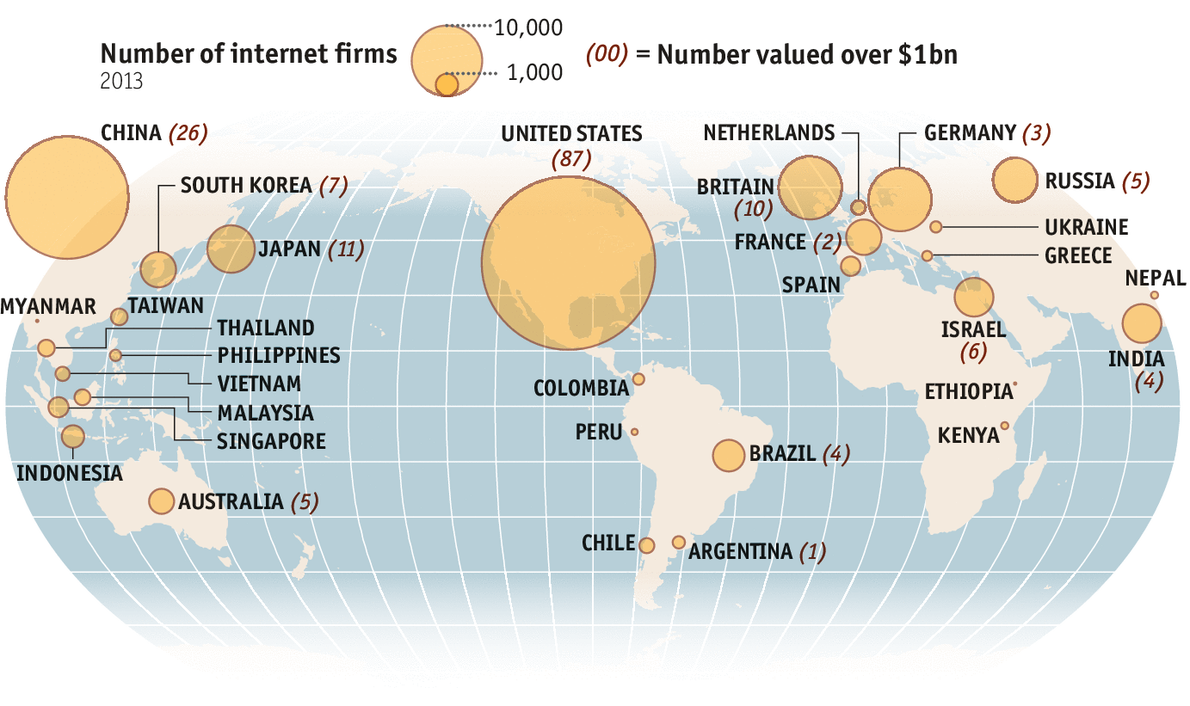

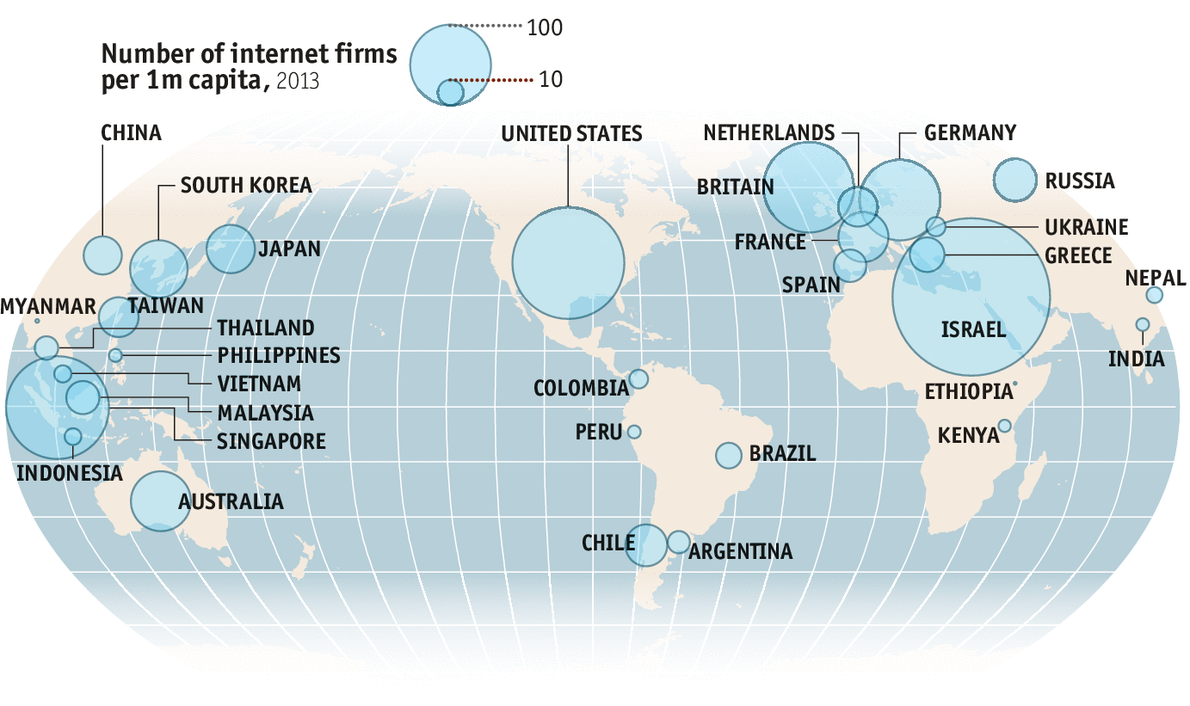

- Technoglobe

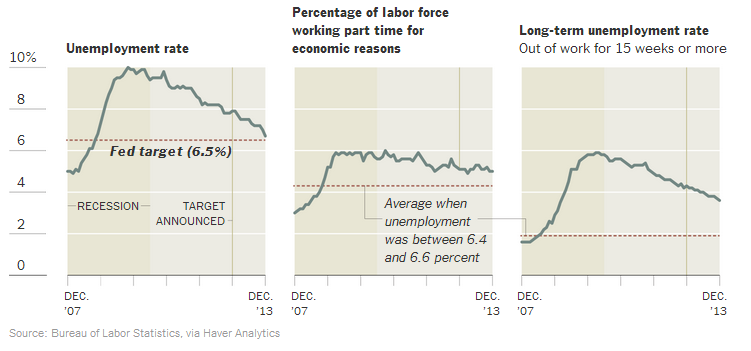

- Don’t Expect Job Data Alone to Persuade Fed on Rates

- 10 AM Tuesday Reads

- Friday Was a 90/90 Day. What That Means

- Uber vs Regulations, Taxi & Livery Services

| Quantitative Easing in Japan: Past and Present Posted: 29 Jan 2014 02:00 AM PST |

| How I Ended Up On The Daily Show Posted: 28 Jan 2014 04:30 PM PST Tonight, after the opening segment but before Louis CK comes on, I am deeply involved in the middle segment of The Daily Show. How this came about is an interesting story — one that is strange enough to be worth sharing. I am either brave or foolish publishing this before the show airs, but I don’t think I made too big an arse of myself. Regardless, it would not be the first time I did so on Television in my professional career. This episode came about thanks to a post I did for Bloomberg View on the minimum wage. I was at a hotel in Hartford, waiting to give pension fund investors my Romancing Alpha schtick. I had 90 minutes to kill, so I banged out this commentary titled How McDonald’s and Wal-Mart Became Welfare Queens. The story of the McResource hotline had already broken, and I wanted to address it from a perspective of a corporate subsidy from taxpayers. (The follow up are here and here) [Update: This interview was on December 18th, long before tonight's SOTU address, which hit on many of the same issues] I don’t use a publicist, so you can imagine my pleasant surprise when an email came in from the Daily Show producers asking me questions about the minimum wage and corporate subsidy column. We chatted a few times, the idea got kicked around by the writers and producers . . . and then the call came. “Hey, can we shoot you next week?” My response: Sure. (Why didn’t I get a haircut?) This wasn’t the first time I had been tagged by them — When Alan Greenspan retired from the Fed, they reached out (I put them in touch with Kudlow & Cramer instead). And it looked as if Bailout Nation might have landed me in the guest chair, but that never quite materialized. So this was quote a lot of fun, and felt like a long time coming. As the photos below show, they arrived in our midtown office with tons of equipment. It took over 90 minutes for them to set up. Shortly afterwards, Samantha Bee showed up. She is a combination of hilarious and delightful. We settle into the chairs, and she begins to fire questions at me. For this 4 minute segment, we shot for two hours. The hardest part was not cracking up. Her facial expressions and cacophony of shrieks, whines and laughs are infectious. I ruined a few takes breaking up laughing. A few interesting things I learned about The Daily Show over the course of our shooting — first, they don’t want to tell you who is on the other side of the argument. I had suggested to them that Peter Schiff was a perfect guy for this, as he had been haranguing Wal-Mart shoppers in the parking lot (See this and this). The next night at dinner with a group of media folks and strategists I confirmed that it was indeed Schiff on the other side of the debate. Fun! Second, it appears that TDS has some smart lawyers who’ve thought this thing through. All of the answers were recorded following each question in one continuous segment. When I screwed up or ruined a shot, they had to go back to ask the question again, with the response immediately following in the same shot. In other words, they don’t cut up your answers or pull them out of context. Question, Answer, Question, Answer. I assume this keeps litigation from angry remote guests to a minimum. Over the course of two hours, its pretty easy to say something stupid — especially when one of the funniest people on earth is two feet away making faces and saying very funny things. I hope I didn’t embarass myself. We”ll find out at 11:06pm or so. Anyway, here are some of the snaps I grabbed with the phone. The last one is a spoiler so its after the jump . . .

They brought a ton of equipment, which raised eyebrows on our floor ~~~ ~~~ Setting up in my office, Camera 2 ~~~ ~~~ ~~~ ~~~

|

| Posted: 28 Jan 2014 01:30 PM PST Stuff you should read:

I’m cold. Is anybody else cold?

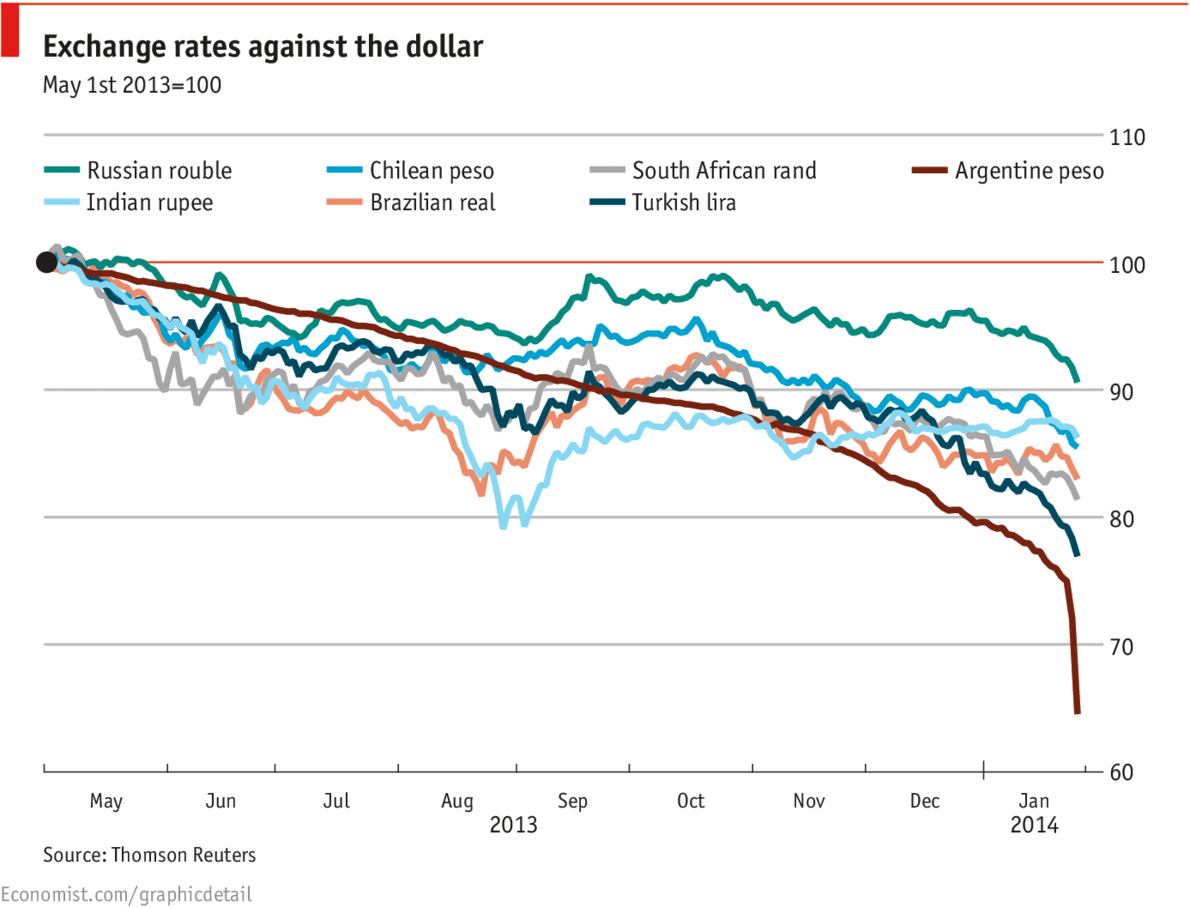

Many emerging-market currencies are falling against the dollar

|

| Posted: 28 Jan 2014 12:30 PM PST

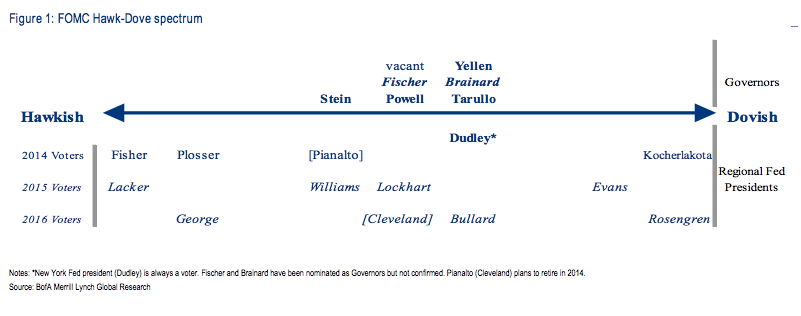

I always enjoy the intro of all the players in the Superbowl (though not as much as Key & Peele’s). Perhaps it is time to review all the players in the FOMC, given upcoming personnel changes. Michael Hanson at Bank America Merrill Lynch notes some of these changes

|

| Posted: 28 Jan 2014 11:30 AM PST |

| Don’t Expect Job Data Alone to Persuade Fed on Rates Posted: 28 Jan 2014 09:00 AM PST

|

| Posted: 28 Jan 2014 07:00 AM PST Here are my morning reads:

|

| Friday Was a 90/90 Day. What That Means Posted: 28 Jan 2014 05:23 AM PST Last week ended on quite the down note. Friday's big selloff saw the Dow Jones Industrial Average drop 2 percent, or 318.2 points. The Standard & Poor’s 500 Index fell 2.1 percent (38.2 points), while Nasdaq Composite Index declined 2.2 percent (90.7 points). The technically significant issue was that Friday was a 90/90 day — more than 90 percent of the volume (94 percent) and of the points (97 percent) was down. A brief explanation for those of you who may not be so technically oriented: When markets experience a bout of intense selling — those trading sessions when 90 percent of the volume is down, and nine out of 10 stocks close lower — it can mark a short-term reversal in a bull run. Typically, it signifies a shift in psychology among larger institutions.

|

| Uber vs Regulations, Taxi & Livery Services Posted: 28 Jan 2014 03:00 AM PST Uber, the mobile phone ride-hailing service, now operates in 26 countries. But as the San Francisco firm expands, it faces questions about its business practices, including liability in accidents.

|

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 comments:

Post a Comment