The Big Picture |

- Music & Lyrics By Stewie Griffin

- From Surplus to Debt

- Profile of States

- Seth Meyers remarks at the 2011 White House Correspondents’ Dinner

- Ramachandran on your mind

- Uh-Oh: Is Shiller Defending the Failures of Economists?

- Sell in May………………?

| Music & Lyrics By Stewie Griffin Posted: 01 May 2011 05:02 PM PDT Why does this so consistently make me laugh? |

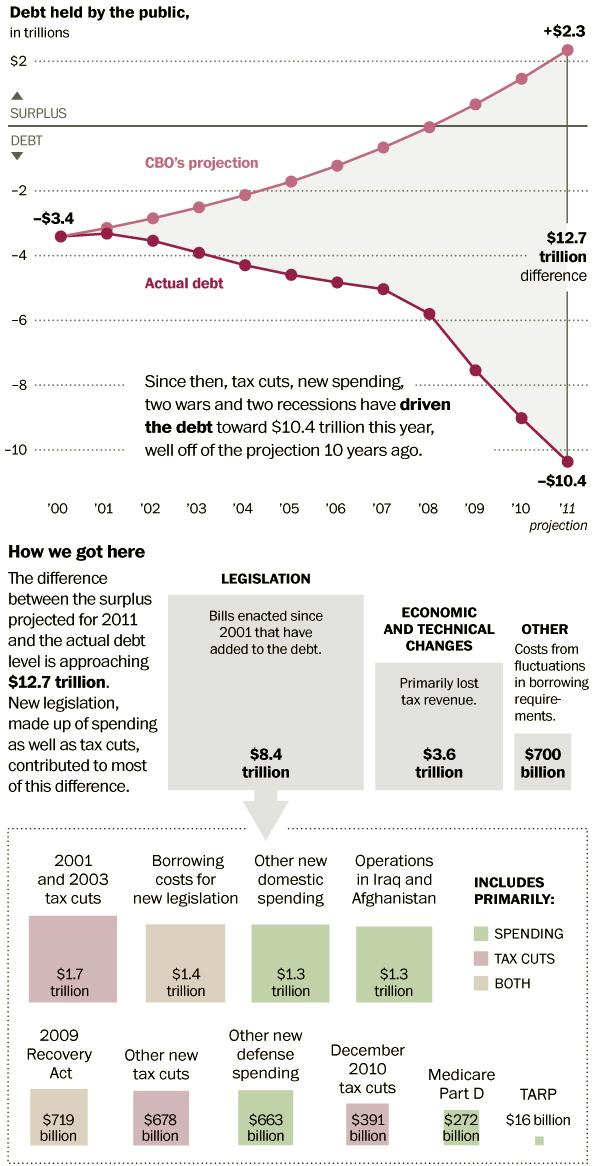

| Posted: 01 May 2011 01:30 PM PDT Washington Post:

Click for ginormous chart porn: > > Source: |

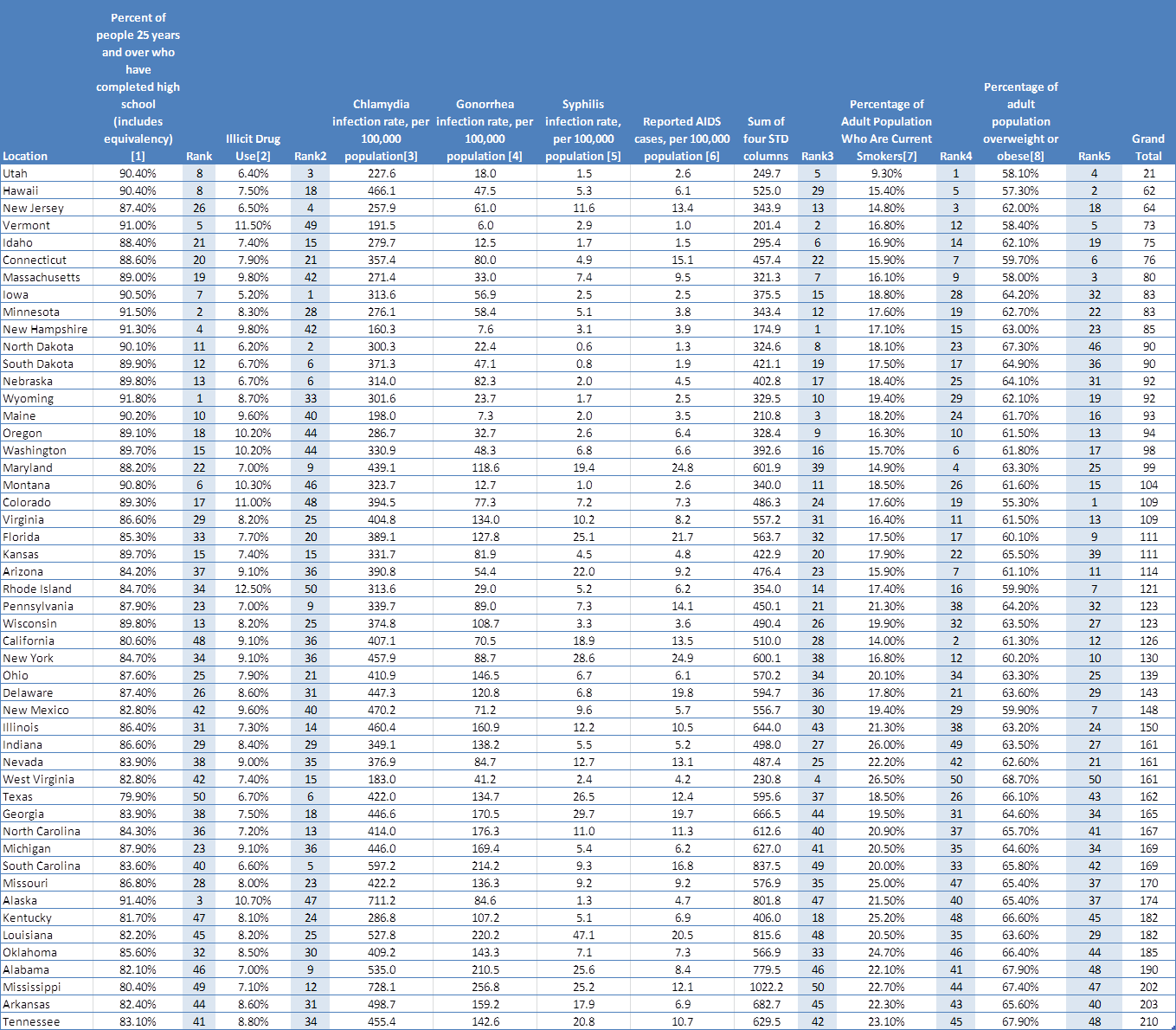

| Posted: 01 May 2011 09:00 AM PDT Data addicts like me typically don’t care where our next fix comes from, as long as it’s credible. Most of the time I’m looking for correlations to jobs or incomes, in an effort to see where we might be headed or what we might reasonably do to improve the growth of either (or both). But sometimes the mind — and the mouse — wanders, and I find myself exploring new and different data sets with information completely unrelated to my usual areas of interest. And so it was recently. Among the under-mined data repositories on the web is an off-shoot of the Council on State Governments, which maintains a very robust data set on various metrics for the individual states. The portal to the data I mined is here. Using the data available at States Perform, I have created a table to rank the states by some less-desirable characteristics — five of them, to be exact:

As you can see, the “worst” state in any category gets a 50, the “best” gets a 1. As in golf, the lower the score, the better. A “perfect” score would be 5 (1 x 5 categories), a “perfectly hideous” score would be 250 (50 x 5 categories). And yes, a more rigorous analysis should probably assign some weightings (i.e. I would probably care less about the prospect of getting involved with a smoker than I would about contracting an STD), but this is light Sunday fare and not being submitted for peer review, so we’re going quick-and-dirty. Draw your own inferences; single readers make your residency plans accordingly.> Click for ginormous table > Sources (all via States Perform): |

| Seth Meyers remarks at the 2011 White House Correspondents’ Dinner Posted: 01 May 2011 06:30 AM PDT |

| Posted: 01 May 2011 06:00 AM PDT Vilayanur Ramachandran tells us what brain damage can reveal about the connection between celebral tissue and the mind, using three startling delusions as examples. |

| Uh-Oh: Is Shiller Defending the Failures of Economists? Posted: 01 May 2011 05:35 AM PDT Was it the hammers or the carpenters? That is the question alluded to this morning by Yale Professor Robert Shiller in the NYT. Shiller is one of my favorite academics working in the field of finance. He tries to (diplomatically) argue we can prevent future crises if only we had better econometric tools. I would counter that future crises could be avoided if only we had less economists who were fools. Lets look at what the Professor wrote:

Uncharacteristically, Professor Shiller is deeply wrong about this. There were numerous “persuasive warnings” and “convincing arguments” prior to the most recent disasters. They were mostly ignored for a variety of cognitive reasons. It was not that they were not understood, it is that most people selectively refused to believe what was against their own interests. When the potential damages of what might occur is too ugly to contemplate, the silly humans find ways to ignore the truth; we seem to prefer comfortable fictions to painful reality. And while many “smart people” may not have seen the crisis coming, many did. (Perhaps we need to rethink who we call “smart people” in the future). It is noteworthy that one such smart person, Professor Shiller himself, had convincingly warned about the dot com bubble in 1999 and the housing collapse in 2005. And he did so using readily available data. So if some smart people did see the crisis coming, and made appropriate warnings, perhaps it is not the tools that are at fault? Back to the Professor:

While having better tools to measure the economy is a good thing, it would not have changed a single thing when it came to the crisis. What matters more than those tools and the data collection format are the institutions charged with overseeing the process, and who is actually interpreting that data. Back in 2009, we discussed these 10 factors Why Economists Missed the Crises:

Hence, it is not the tools but the fools who were at fault. Even if we had better data — a social good we all should enthusiastically support — it would not have mattered. Few economists have had more insight into various aspects of behavioral finance than Professor Shiller. His work has been hugely influential in getting more people to see how human cognitive failures lead to significant errors. But it also explains why the data was not what was not the problem. The fault, dear Professor, is not in our stars, but in ourselves. > Previously: Source: |

| Posted: 01 May 2011 05:00 AM PDT Sell in May………………? > Sell in May and go away? Is it a cliché or is this the year to obey? First, let me offer a personal thank you to CNBC for the invitation to discuss this issue on Power Lunch with Michael Farr, Sue Herera, and Tyler Mathison. For those who were advised of the TV schedule and were looking for us, we were seated in the chair at the remote studio in Sarasota, when there was a satellite glitch in that facility. By the time they reconnected to CNBC, the segment had concluded. In addition, thank you to my friend Michael Farr, who covered for me on the bank stock outlook. Michael and I agree that they are ripe candidates for underweighting. For the discussion, see CNBC.com and search on "Farr". Choose the clip for Friday, April 29, at 1:05 PM EDT. Here are the bullet notes we had planned to use in the interview. Michael and I concur that the key to the US stock markets' forward behavior is held in the hands of the Federal Reserve.

One more element must be added to the list. The US stock market rises and the US dollar falls. There is a relationship. Global investors are allocating flows of funds away from the dollar. This activity is at the margin and explains why the US currency is weak. When the Fed completes QE2 in June, it will go to a holding pattern. It will purchase treasuries in enough quantity to offset the maturities in the Fed's mortgage portfolio and to roll the rest of the US Treasury holdings. So the Fed will still be in the market buying treasuries. And the mortgage market is still under pressure from liquidation of the GSEs and from the very tepid conditions in the US housing markets. That is the likely case in July and for the rest of the year. So is that a form of Fed easing, in which case selling in May is premature? Or is this a Fed at neutral, in which case the cliché may be ready for respect. The honest answer is, we do not know, because we have never been in this position of Fed construction before. We may get our first clues from the action in the foreign exchange markets. We believe the economy is showing more signs of weakness. And we believe the oil price shock is starting to bite as the gasoline price rises into the $4-plus range. It just topped $5 in Connecticut. And we see the foreclosure rate remaining high and the employment reports continuing weak. This tells us that the Fed wants to avoid any chance of tightening, whether it is passive or active. If we are correct, the Sell in May syndrome will be muted, the dollar will remain in a weakening trend, and the stock market bull run is not over. All of this could change very quickly. So while we are fully invested today and while we are overweighted energy today and underweighted banks today, we could change this at any time. Sell in May does not specify the date in May. May 30 is a long time from today, with the indicators this sensitive. Many thanks again to Michael Farr and CNBC and especially to Jennet Chin, who worked behind the scenes so patiently to put the segment together. ~~~ David R. Kotok, Chairman and Chief Investment Officer |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

The Big Picture (ritholtz)

The Big Picture (ritholtz)

0 comments:

Post a Comment