The Big Picture |

- 10 Mid-Week PM Reads

- Real Estate Recovery Cycle

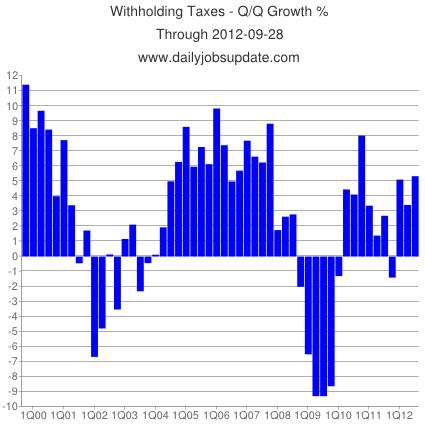

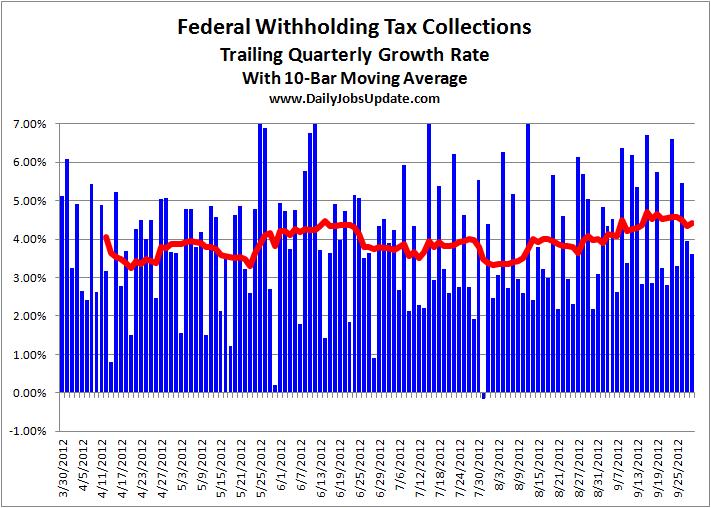

- NFP Preview: Withholding-Tax Collections Up 5.3% in Q3

- ADP job gains

- ISM services upside surprise

- 10 Mid-Week AM Reads

- Australian, Chinese and European data weaken further and further and….

- Ritholtz vs Siegel on SFTLR

- Refi’s jump/China slows/Spain still thinking

- The Big Picture Conference Oct. 10th and on Fora.TV

| Posted: 03 Oct 2012 01:30 PM PDT My afternoon train reading:

What are you reading?

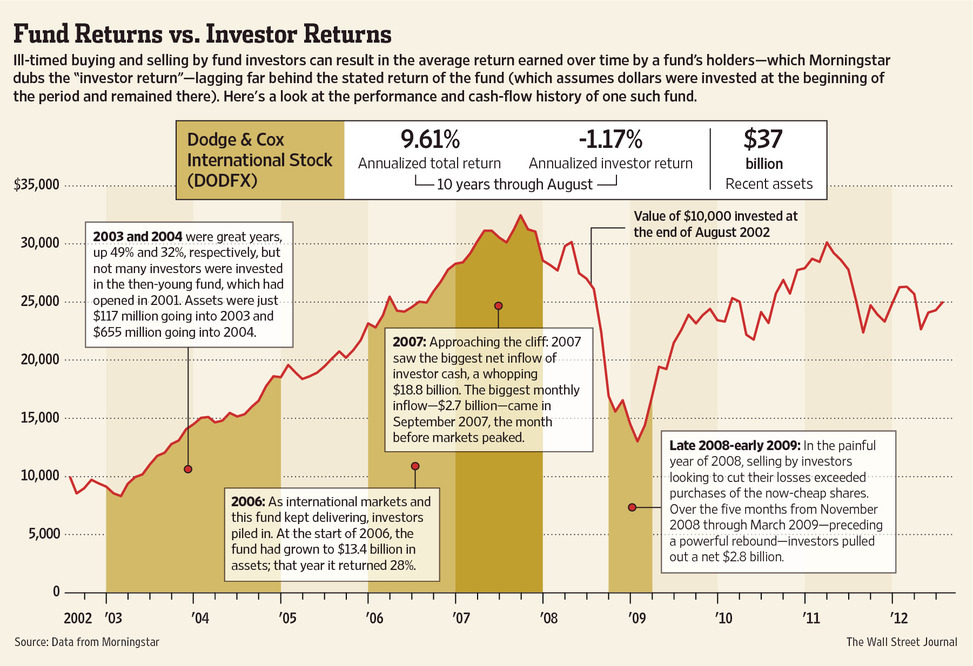

A Periodic Look at Performance and Where Investor Money is Moving |

| Posted: 03 Oct 2012 11:30 AM PDT

Riding the Trillion-Dollar Real Estate Recovery Roller Coaster. via Riding the Trillion-Dollar Real Estate Recovery Roller Coaster |

| NFP Preview: Withholding-Tax Collections Up 5.3% in Q3 Posted: 03 Oct 2012 09:30 AM PDT Inlight of this mornings stronger than expected ADP data, I thought it was a good time to see Matt Trivisonno’s Withholding-Tax Collection data from The Daily Jobs Update. Perhaps it that might provide some early insight into Friday’s NFP. The chart below shows that federal withholding-tax collections were strong in the Q3 – up a healthy 5.34%.

The next chart shows how the growth rate is evolving. In the beginning of Q3 (early July), it was under 4% — however, it moved higher in August and September (note the moving average (red line) rising.

Matt adds:

All charts from dailyjobsupdate.com |

| Posted: 03 Oct 2012 08:14 AM PDT ADP said 162k private sector jobs were created in Sept, 22k more than expected and follows 189k in Aug which was revised down by 12k. Even with the revision to Aug though, 189k still is well above what the Gov’t reported last month of 103k for the private sector. Of the 162k job gain, 144k came from the services sector and 18k from goods producing with small and median sized businesses adding most of the jobs as usual. Manufacturing added 4k jobs and 10k came from construction. Bottom line, while the 162k job gain was the smallest in 4 months, it was better than feared and points to a continued steadiness in the unemployment rate. The caveat though is job growth is a lagging indicator and will the slowdown in economic growth in part due to very limited visibility slow this pace further. In terms of the market response, ADP has lost its month to month relationship to the Gov’t Payroll figure and thus makes today’s market move possibly completely different from this Friday. Before today’s Sept release, ADP said the avg job gains Jan thru Aug was 172k while the Payroll reports said 151k. After further revisions to both though over time, the data should converge. |

| Posted: 03 Oct 2012 06:58 AM PDT After a better than expected ISM manufacturing # on Monday, the ISM services index also surprised to the upside at 55.1 vs 53.7 in Aug and the expectations of 53.4. It’s the best since March but these diffusion indices measure the direction of improvement, not the degree so we can’t extrapolate that things are the best since then. Business Activity improved to 59.9 from 55.6 and New Orders rose by 4 pts. Backlogs though fell by 2.5 pts to 48, Export Orders were down by 1.5 pts to 50.5 and Employment (the bulk of the labor force) fell 2.7 pts to 51.1. Prices Paid were up by almost 4 pts to the most since Feb. Of the 18 industries asked, 12 said things were better,4 worse and 2 unch. The ISM said “Respondents’ comments continue to be mixed; however, the majority indicate a slightly more positive perspective on current business conditions.” Bottom line, the US economy is hanging in there, especially compared to its other developed world brethren in Europe but with sub 2% GDP growth, it’s doing so barely with little cushion to absorb any further overseas weakness let along in the US due to our own fiscal issue concerns which seem to be clearly altering corporate investing decision making for the worse. |

| Posted: 03 Oct 2012 06:50 AM PDT My morning reading material:

What are you reading?

Fund Return vs Investor Return |

| Australian, Chinese and European data weaken further and further and…. Posted: 03 Oct 2012 06:48 AM PDT Australia’s trade deficit widened to A$2.03bn in August, the highest since 2008, much higher than the forecast of A$685mn. Worse still, last months deficit was revised much higher to A$1.53bn, from the A$556mn deficit, previously reported. Exports fell by -3.0%, whilst imports declined by -1.0% M/M. The Australian performance of service index (put together by Commonwealth Bank of Australia) declined by -0.5 points to 41.9, in September. Australian new home sales declined by -5.3% to the lowest level on record in August, which itself saw a -5.6% drop from July. However, house prices rose by the most in 30 months in September – I’m getting that bubbly feeling, me thinks. Traders are pricing a 70% probability that interest rates will be cut further next month, though I think that’s a bit too aggressive – a cut in December seems more likely to me. The A$ is weaker again today and is trading at US$1.0214, the lowest in a month; More talk by Japanese politicians as to the unwelcomed strength of the Yen. This time from the Japanese vice Finance Minister. In addition, he added that the G7 would not issue a statement this time around. Interesting; Chinese non manufacturing PMI fell to 53.7 in September from 56.3 in August. Whilst the manufacturing PMI is more important, the data confirms that it is becoming more difficult for China to develop the services side of its economy, something that the Chinese authorities very much want to do. The reading was the weakest since November 2010. Transport and construction services were weaker as were new orders; The Asian development bank has cut its GDP forecast for Asian countries (ex Japan) to +6.1% this year, the weakest since 2009 and lower than the +6.6% forecast in July and +6.9% in April. Its inflation forecast was reduced to +4.2% for this year, down from +4.4%. However growth is expected to climb to +6.7% next year, down from a previous forecast of +7.1%, with inflation at +4.2%. The 2013 growth forecast seems optimistic to little old me; Looks like the Troika is finding it difficult to reach agreement with the Greeks, on the latest round of austerity measures. The Troika are demanding far reaching labour reforms and a reduction in the minimum wage and pensions, together with an increase in working hours – pretty difficult for Pasok (a member of the coalition), in particular, to agree to. In all, there is a dispute in respect of E3.5bn, of the E13.5bn of austerity cuts, that the Troika are unhappy about. The Greeks are suspicious that the Troika is delaying reaching an agreement until after the US Presidential elections, scheduled for 8th November. I really, truly, fundamentally do not understand why anyone is surprised. The Greeks will promise yet more austerity (but, in reality, just further hot air), the German’s may be able (not going to be easy at all) to force the EZ to waste more good money by providing additional bail out funds for Greece and Greece, sooner rather than later, will fail to meet its commitments and default. The script has been written. The Greek Finance Minister reported that Greece and the Troika may not be able to agree on a deal by the EU summit this month (18th to 19th October). However, the real sufferers are the Greek people – youth unemployment is over 50%. The IMF has forecast that the Greek economy will decline by -4.3% next year; If its not Greece, its Cyprus. The Cypriot government stated that their government could not accept the Troika’s bail out terms. In particular, the government would not accept the privatisation of profitable state owned enterprises or the abolition of inflation linked wages. Well great, then save yourselves, I suppose will be the attitude of the Troika; The Spanish PM, Mr Rajoy, stated that a bail out request was not imminent – no doubt due to German reluctance, at this time. Investors were disappointed at the news and the Euro dipped. He is to meet with the German economy minister Mr Roesler, who is visiting Madrid for “a routine visit”. Routine, hmmmmm !!!!, though I must admit Mr Roesler is not that important. The French President, who was hosting a visit by the Finnish PM, states that Spain should request a bail out imminently – Hollande does not want the markets to focus on France – don’t worry Monsieur President, that will come soon enough. Moody’s states that they will announce their decision on Spain’s credit rating this month. Finally, Mr Rajoy states that he has reached agreement with the Spanish provinces to cut Spain’s deficit – does that include Catalonia, Mr Rajoy?; September services PMI data for a number of EZ countries is listed below. Spain 40.2 from 44.0 in August and the lowest since November last year. Italy 44.5, from 44.0 in August, though the employment component declined to 43.8, from 46.0 in August, the sharpest fall since June 2009. France (final) 45.0, from a flash estimate of 46.1. Germany (final) 49.7 from a flash estimate of 50.6, though up from August’s 48.3. However, business expectations collapsed to a 3 year low of 43.5, from 50.9 in August. The final EZ composite services PMI index came in at 46.1, down from 46.3 in August. The new business component came in weaker at 43.8, from 44.4 in August, though slightly better than the flash estimate of 43.6. Markit reports that there is little hope of growth in Q4. The EZ final composite PMI index came in at 46.1, weaker than 46.3 in August, though slightly better than the flash reading of 45.9; EZ August retail sales were up +0.1% or -1.3% Y/Y, though better than the -0.1% M/M, or -2.0% Y/Y forecast. July’s data was revised higher, as well, to +0.1% M/M, or -1.4% Y/Y, from -0.2% M/M or -1.7% Y/Y; The French Socialist head of the National Assembly, Mr Bartolone, opposes President Hollande’s recent budget cuts and tax increases. Ooops – here we go. The head of the Socialist party has stated that the deadline (2013) to reduce debt to GDP to 3.0% is “not essential” and, in any event, was “untenable”. The recent French budget unveiled tax rises and spending cuts amounting to E30bn. However, more will be needed, as the assumptions for growth next year are optimistic to say the least – as is the case for Spain, for example. A final vote is due on 9th October – I, for one, will be watching carefully. Entrepreneurs are up in arms over tax changes which treat capital gains as income, taxed at roughly the same rate. In addition, a number of rich French are voting with their feet and are exiting the country following the increase in the tax rate to 75%. For the 1st time since the late 1990′s, there are more than 3mn unemployed in France. Approximately 25% of under 25′s are also unemployed. As you know, my biggest fear for the EZ is France; The EU is to propose that all EZ countries agree to undertakings that enable Brussels to oversee and, indeed, approve their budgets. The German’s, in particular, want more centralised control over individual EZ countries budget process. This is going to be a big deal; UK September services PMI fell to 52.2 in September, from 53.7 in August and lower than the 53.0 forecast. The composite index fell to 51.1, from 52.2 in August. Sterling declined on the news. Olympics related effects could have lowered the number. Generally, the UK data has been mixed, but seems to be picking up; Good news from the EZ – yep there is some. The Irish government’s budget deficit for the period January to September this year came in at E11.1bn as opposed to E 20.7bn for the corresponding period last year. Tax revenues are rising across the board – a good sign; ADP reported that US employment rose by +162k in September, down from +201k last month, though better than the forecast of +140k. However, the data differs materially from the NFP data – it has been some 50k to 60k higher recently;

Outlook Asian markets closed flat to slightly higher. European markets are weaker and US futures suggest a flat to marginally higher opening. The Euro is weaker – currently just below US$1.29. Brent (November) oil is trading at US$109.36, sharply lower than yesterday’s highs, given the weaker global data. Gold is at US$1778. Bond yields of the major countries are drifting marginally lower. Whilst Central Bank action has reduced tail risk, I am finding it difficult to buy the equity markets and far prefer playing the currency markets. Cant see much upside and/or downside at present, ex geo political issues. The commodity currencies (A$ and Rand) look like shorts to me – for full disclosure purposes, I’m short the A$, against the US$. Apart from being long certain European financials (particularly UK) and short Australian financials, which I have been for some time, together with UK (London based) property stocks and UK/US focused building material companies, I’m reluctant to play at present. The EZ data looks dreadful. France and, of course, Spain look seriously awful. In particular the rate of decline of both France and Spain is alarming. In addition, Germany is not immune. Its export based economy (around 50% of GDP) looks vulnerable and whilst domestic demand has held up, there are signs of weakness – unemployment has been rising for example. EM’s don’t seem the place to be at the moment either. Awaiting the change of leadership in China at the Congress starting on 8th November. Here in the US (in NYC at present), the economic situation looks much, much better than the rest of the world. Housing continues to improve, as mortgage rates decline, resulting in a rush to refi. Yes credit is constrained, due to still tight lending standards, but pent up demand certainly looks as if its there and lending should rise. The US residential housing market remains the key to the US economy and I believe that it continues to improve. The “fiscal cliff” problem needs to be addressed – quite possibly will be, at least partially. The 1st of the US Presidential debates are on tonight – will certainly be watching. US markets have opened some +0.1% to +0.2% higher. Kiron Sarkar 3rd October 2012 |

| Posted: 03 Oct 2012 06:35 AM PDT |

| Refi’s jump/China slows/Spain still thinking Posted: 03 Oct 2012 05:04 AM PDT Responding to the new record low in mortgage rates, the MBA said for the week ended 9/28 that refi’s jumped 19.6% to the highest level since Apr ’09 and 40% above the 12 month avg. The rise in purchase apps were more subdued, up by 3.9% but to the most in almost 4 months and is 5% above its 1 yr avg. The direction of inflation from here, post endless QE, will determine the longer term sustainability of the Fed’s new attempt to artificially suppress interest rates. In Asia, China’s PMI services index fell to 53.7 from 56.3, the lowest in its short 19 month history. While the Shanghai index was closed, the Hang Seng didn’t respond much to it, rising .2% after a short holiday. Australia, an economic Chinese proxy, said its trade deficit widened to the most since Mar ’08 as total exports fell to the lowest since Feb ’11 with merchandise exports specifically to China falling to a 6 month low. In Europe, the Spanish Economic Minister gave details on the bad bank being set up but on the request for more EU help said they “must consider all consequences before a bailout decision.” The final Euro zone mfr’g and services composite index was little changed with the preliminary with Germany’s services index remaining below 50 and France’s falling to 45, giving back all of the Hollande honeymoon jump in the summer. |

| The Big Picture Conference Oct. 10th and on Fora.TV Posted: 03 Oct 2012 03:00 AM PDT If you can join us, buy a ticket below: Can’t join us for the Big Picture Conference on October 10th? Catch all the speakers on Fora.TV live during the day or for weeks after. Online Ticketing for The Big Picture Conference 2012 powered by Eventbrite 8:00 Registration and Breakfast in the Atrium 8:30 Introductions 8:45 Neil Barosfsky 9:30 Dylan Grice in conversation with Rich Yamarone 10:15 –break– 10:30 James O'Shaugnessy 11:15 Barry Ritholtz 12:00 Lunch sponsored by TD Ameritrade served in the Atrium 1:00 David Rosenberg 1:45 Jim Bianco 2:30 Michael Belkin 3:15 –break– 3:30 Bill Gurtin 4:15 Sal Arnuk, Scott Patterson & Josh Brown 5:00 Wine & Cheese served in the Atrium |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

1 comments:

Thanks for your great information, the contents are quiet interesting.I will be waiting for your next post.

best forex signal provider

Post a Comment