The Big Picture |

- Where is the Land of Opportunity?

- 54% of Republicans Say We’ve Got Too Much Inequality

- Kiron Sarkar Week in Review (1.25.14)

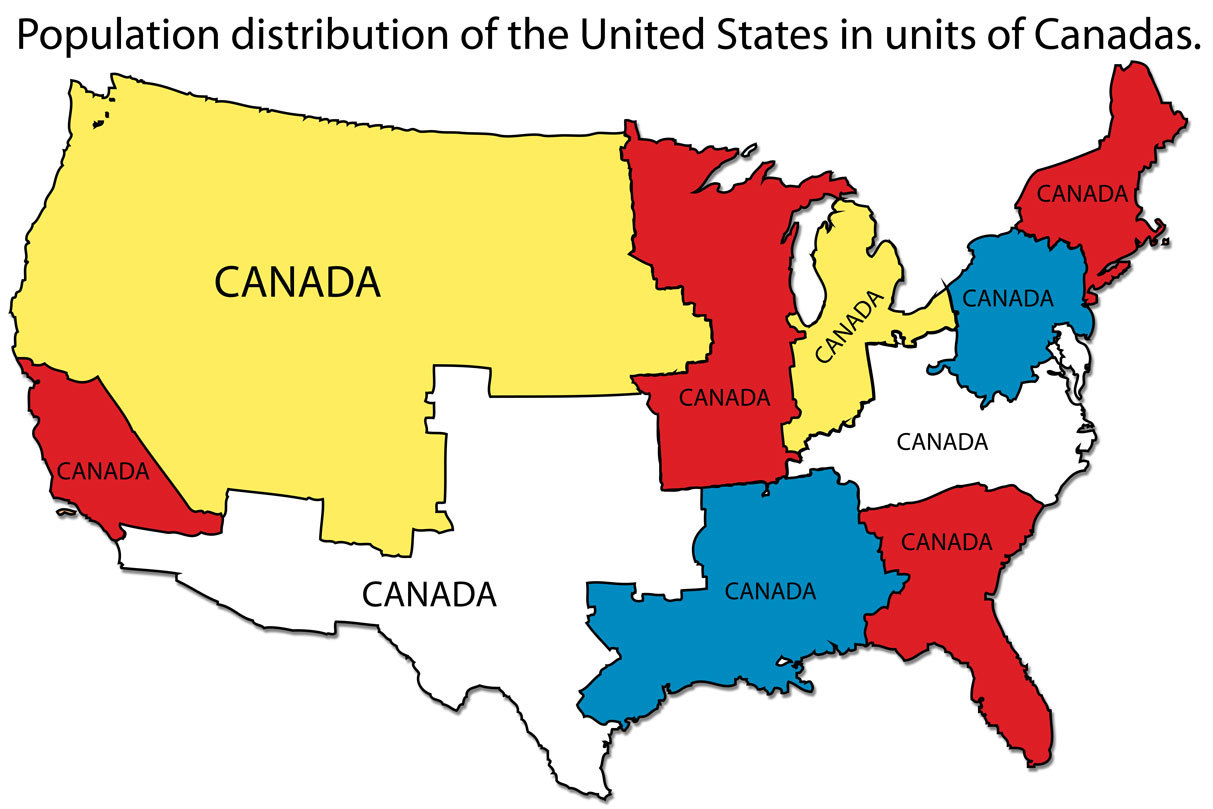

- New Population of the US in Units of Canadas

- Why Google Bought Nest Labs

- 10 Sunday AM Reads

- Bloomberg TV: Innovation, Netflix, Dimon’s Paycheck

| Where is the Land of Opportunity? Posted: 27 Jan 2014 02:00 AM PST |

| 54% of Republicans Say We’ve Got Too Much Inequality Posted: 26 Jan 2014 10:30 PM PST It's a Myth that Conservatives Don't Care About InequalityWe've noted for years that it's a myth that conservatives accept runaway inequality. Conservatives are very concerned about the stunning collapse of upward mobility. A poll from Gallup shows that a majority of Republicans think we've got too much inequality:

And the conservative website Townhall.com ran a story last month entitled, "Inequality is a Conservative Issue". In fact, there are at least 5 solid conservative reasons – based upon conservative values – for reducing runaway inequality:

This is an area of agreement between people of good faith on the left and on the right. As Robert Shiller said in 2009:

If we stop bailing out the fraudsters and financial gamblers, the big banks would focus more on traditional lending and less on speculative plays which only make the rich richer and the poor poorer, and which guarantee future economic crises (which hurt the poor more than the rich). Indeed, if we break up the big banks, it will increase the ability of smaller banks to make loans to Main Street, which will level the playing field. Moreover, both conservatives and liberals agree that we need to prosecute financial fraud. As I've previously noted, fraud disproportionally benefits the big players, makes boom-bust cycles more severe, and otherwise harms the economy – all of which increase inequality and warp the market. And prosecutors could claw back ill-gotten gains from the criminals and use that money to help the economy:

Postscript: If you want to know the stunning truth of how bad inequality has gotten, read this. If you want to hear what top economists say inequality does to our economy, click here. And if you want to find out whether government policy is making things better or worse, here's your answer. |

| Kiron Sarkar Week in Review (1.25.14) Posted: 26 Jan 2014 04:00 PM PST Overview As I stated last week, I believe that risks are rising and that it was time to take profits on equity positions, whilst buying protection (the VIX) and wait for a better time to re enter markets. US earnings, in particular of some of the leading companies, have been lackluster to weak. Furthermore, valuations are no longer cheap. I cannot see the upside potential at present, though I believe that risks are rising. At some stage, the ECB will be forced to act, which may be a trigger to re enter markets. I continue to believe that emerging markets will continue to decline across all asset classes (equities, currencies and bonds) and that the higher beta names are particularly vulnerable. Its time for wealth preservation, rather than play the risk on equity trade. The VIX having been trading around just 12 a few days ago rose to 18, which is no longer the bargain it was. I continue to believe that the US$ will outperform this year. Sterling is strengthening, but will be impacted by problems in the EZ and the BoE is in no hurry to raise rates. The A$ looks vulnerable to problems in China. The Yen has strengthened in a flight to safety trade. However, I believe that Japan faces significant problems and do not consider that Japan is the safety trade that it has been historically. In calendar Q2 this year, the sales tax doubles in Japan which will be a significant headwind for domestic consumption. As a result, I believe that the Yen, which has rebounded, will weaken in coming months. The decline in the US 10 year bond yield (inspite of the tapering programme), which was one of the triggers that made me suggest that investors take profits, has declined even further this week. Emerging market issues were also a concern. The market is talking about Argentina. However, the much bigger problem is the so called Chinese “wealth management products”, most of which are junk and unrepayable. The problem is that the sheer amount of these products that are out there – it will be no easy task for the Chinese authorities to manage. As a result, I remain bearish. US Markit reported that US PMI declined to 53.7 in January, lower than the reading of 55.0 in December. An unchanged reading was expected. Output and new orders declined. Weekly jobless claims came in at 326k, lower than the 330k expected and near the lowest in over a month. The US index of leading indicators which indicates the outlook for the next 3 and 6 months rose by +0.1%, slightly below the forecast of +0.2%, though still indicating growth. Novembers index was much stronger, having been revised higher to +1.0%. Congress needs to agree to increase the US debt ceiling. Congress did pass the budget deal, which suggests that the debt ceiling will be increased, though with the usual political theatrics. The US house price index rose by just +0.1%, lower than the +0.4% expected and the rise of +0.5% in October. December existing home sales rose by +1.0% to an annualised pace of 4.87mn units, slightly below forecasts of 4.93mn, though better than the downwardly revised rate of 4.82mn units in November. Europe The German ZEW investor confidence index declined unexpectedly to 61.7, from 62.0 in December and below the rise to 64.0 expected. It was the 1st decline in 6 months. However, the current and future expectations components were better, which makes the headline number difficult to understand. Better manufacturing PMI data in the EZ. The index rose to 53.9, from 52.7 in December and higher than the rise to 53.0 expected. As usual, the German manufacturing data (56.3, as opposed to 54.3 in December and the 54.6 expected) was particularly positive, with factory output rising to a 32 month high. German manufacturing companies reporting increased output and new orders. French manufacturing PMI rose to 48.0, from 47.8 in December and better than the rise to 47.5 expected. However a number of companies reported that they would seek to reduce employment further and that selling prices were lower. The services sector rose to 48.6, higher than the 47.0 in December and better than the forecast of 48.1. Whilst both indexes remain in contraction territory, it is slightly better news, though France still has a long way to go. Services PMI in the EZ also rose to 51.9, from 51.0 in December and better than the rise to 51.4 expected. The composite index rose to 53.2, from 52.1 in December and better than the 52.5 expected. Whilst Spanish data has been improving recently, unemployment remains a problem. The jobless rate rose to 26.03% in the 3 months to December, slightly higher than the 25.98% in the previous Q. As expected, GDP rose by +0.3% in Q4 Q/Q, though was -1.2% lower on the year Y/Y. However, both imports and exports declined by -0.6%, though household demand rose by +0.4%. Spanish bond yields continued to decline, though sold off towards the end of the week. UK unemployment declined sharply to 7.1% in the 3 months to November to the lowest level since April 2009, as compared with the 7.4% rate in the 3 months to October and much better than the 7.3% rate expected. Unemployment fell by 167k, the largest decline since 1997. The unemployment rate is expected to decline to 7.0% or lower this Q. The much better data has forced the BoE Governor to signal that the BoE's forward guidance policy of linking interest rates to unemployment would cease. He did add that the BoE had no plans to raise UK interest rates "immediately" and that the BoE would look at a number of indicators, rather than just the unemployment rate. The BoE is in no hurry to raise rates.

Japan Basic wages declined by -0.6% Y/Y in November (the 18th consecutive monthly decline) and with rising inflation and a doubling of sales tax in April to 10.0%, consumption will decline, which will negatively impact GDP. I cannot see how the current BoJ policy will work in these circumstances. The unemployment rate remained at 4.0% in October, with the number of people seeking employment as compared to the number of jobs available rising to the highest since 2007. China Industrial production increased by +9.7% in December Y/Y, as compared with +9.8% in November. Retail sales rose by +13.6% Y/Y, in line with estimates. Whilst the economy is cooling, new home sales increased to US$1.0 tr last year, an 11.0% rise on the previous year. The PBoC has been trying to reduce the pace of property price increases, though to date, has had little success. To cope with rising short term rates the PBoC had to inject further funds into the system. Whilst the PBoC wants to curb lending, it has realised that it cannot be to aggressive and cause a systemic risk in the financial sector. Bloomberg reports that China's working age population declined for the 2nd consecutive year, due to the one child policy. This problem is set to continue for many years and will prove a material headwind to growth. The preliminary HSBC Chinese manufacturing PMI reading came in at 49.6, below December's 50.5 and the forecast of 50.3. It was the 1st decline to below the 50.0 neutral level in 6 months.The new orders component declined to 49.8 and the employment component also declined. The report cited weaker domestic demand. The data indicates that the manufacturing sector is contracting, which should not come as a surprise. Chinese authorities are trying to prevent a default of a US$500mn wealth management product to the coal sector in the Shanxi province. The bank (ICBC) that issued the bonds stated that they would not provide a backstop. This is a major issue as a significant amount of these wealth management products remain outstanding (guestimated at around US$1.7 tr), a large number of which are clearly unrepayable. Other Kiron Sarkar |

| New Population of the US in Units of Canadas Posted: 26 Jan 2014 01:00 PM PST

|

| Posted: 26 Jan 2014 07:00 AM PST >

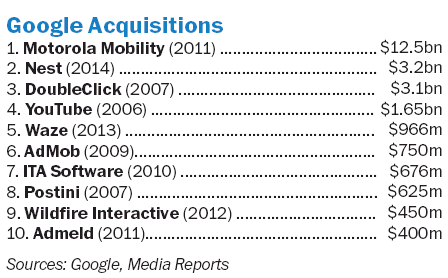

My Sunday Washington Post Business Section column is out. This morning, we look at Google’s acquisition of Nest Labs. My perspective is that Google is trying to avoid being disrupted or marginalized the way so many other tech companies have been. Here’s an excerpt from the column:

If we look at the 10 largest Google acquisitions, half are directly related to their core advertising, and none stands out as an obvious dog.

The full article is here

Source: |

| Posted: 26 Jan 2014 04:00 AM PST Pour a tall cup of Joe, and settle in with these reads:

Whats for brunch?

U.S. Markets Tumble as Fear Spreads

|

| Bloomberg TV: Innovation, Netflix, Dimon’s Paycheck Posted: 26 Jan 2014 03:30 AM PST Bloomberg’s Cory Johnson and Bloomberg View Columnist Barry Ritholtz discuss the price of innovation on Bloomberg Television’s “Street Smart Can You Put a Price on Innovation? ~~~ Ritholtz Wealth Management CIO Barry Ritholtz discusses Netflix and its release of "Mitt," the new Mitt Romney documentary. He speaks with Trish Regan and Mark Crumpton on Bloomberg Television's "Street Smart." Is There Anyone Who Can Compete With Netflix? ~~~ Ritholtz Wealth Management CIO Barry Ritholtz discusses Jamie Dimon and executive compensation. He speaks with Trish Regan and Mark Crumpton on Bloomberg Television's "Street Smart." Why All the Fuss Over Jamie Dimon's Paycheck? ~~~ |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 comments:

Post a Comment