The Big Picture |

- Is Increased Price Flexibility Stabilizing? Redux

- Applause for Debt-Ceiling Courage

- Apple, Google, Microsoft: Where does the money come from?

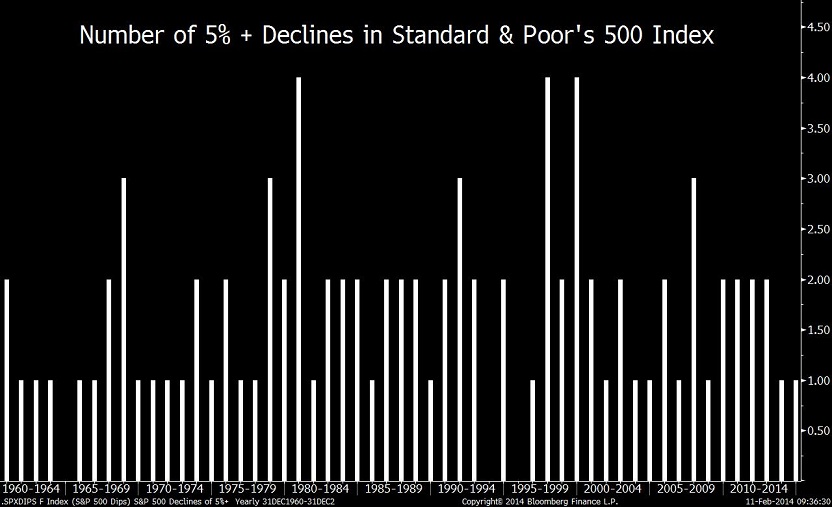

- Number of 5%+ Declines in S&P 500

- Everything You Need to Know About Stock Market Crashes

- 10 Tuesday Reads

- The Economics of Sex

| Is Increased Price Flexibility Stabilizing? Redux Posted: 19 Feb 2014 02:00 AM PST |

| Applause for Debt-Ceiling Courage Posted: 18 Feb 2014 04:00 PM PST Applause for Debt-Ceiling Courage

Two good things happened in Washington, DC. One received mass media fanfare, while the other escaped the radar. They are linked. Twenty-eight Republican members of the House of Representatives, including Speaker John Boehner, voted for a clean debt-ceiling increase. Those 28 Republicans were joined by 193 Democrats. Those Republicans and Democrats should be applauded for doing the right thing for the US. Their motivations may be partisan politics; but, that said, the outcome puts the good of the country ahead of political party. A clean debt-ceiling bill postpones debt-limit political squabbles until early 2015. It relieves a huge uncertainty that impacted the markets and economy. By using the debt limit as a political tool in the fight over spending initiatives, the Tea Party-esque conservative Republican wing introduced additional risks and costs to every business, investor, foundation, charitable institution, and other financial organization in the US. The debt limit squabble is a political contrivance. It represents a fiction. Everyone knows it. No one in the world expects the US to default on its debt. It has no reason to do so. US debt is a preeminent high-quality promise to pay in a timely way. It is an obligation with the capacity of the world’s largest economy behind it. It is also denominated in the US dollar, which is the world’s reserve currency and which dominates transactions globally. The Tea Party Republicans and the couple of Democrats who joined them in an attempt to use the debt limit as a blunt tool to hack at budget priorities performed a horrible disservice to the US and all of the constituencies within it. Please understand that we have no issue with a fight over spending priorities and taxation policy. Grappling with such issues is what our political system does, and that is why we elect a Congress. The fault we find is that members of Congress used the debt limit as the vehicle for the fight. We applaud the 28 Republicans who, along with the Democrats, courageously cast votes to get a clean debt-limit bill passed. They face political attacks within their own party, launched by Tea Party primary entrants who will urge voters to show them the door come Election Day. That is all the more reason to support those Republicans who put their country and conscience ahead of their party. The resolution of the debt-ceiling debate is good medicine for the recovering US economy, and its beneficial effect is already visible in the short-term interest rate sector of the financial markets. These markets are now clearing in the short end of the yield curve. And that is the important news that did not make the headlines. The combination of the Treasury’s new floating-rate notes along with the use of repo and reverse repo and the forthcoming issuance of large amounts of Treasury bills has impacted the markets in only a minimal way. Think about the fact that billions in short-term paper is now rolling in the Treasury market with no apparent volatility or dislocation. The US Treasury will be able to send tax refunds out on time. The Treasury will be able to easily issue up to $100 billion tranches in Cash Management Bills without any difficulty. One can quickly see the huge benefit that was obtained by all involved in short-term funding because those 28 Republicans had the courage, political will, and foresight to avoid another costly debt-limit fight. In other words, the whole process is going to work; and because it will work smoothly, it will not get any attention. No headline in the media will say, “Money markets functioning well.” No one will take the stage on Bloomberg Television, Reuters, Fox Business, Yahoo Finance, Al Jazeera or CNBC and pronounce how easily and smoothly the clearing mechanism of payments is functioning. The dividends paid by political courage will not make any news. That is a shame. It is very big news when the system is working. But as jaded American observers, we tend to pay attention only when there’s a crisis. When the system is working, we take its functioning for granted and move on to other matters. This writer watched interviews with the detractors who promoted Tea Party disruption. However earnest their intentions, to accomplish their ends they would restrain the functionality of our financial markets and impose risk premia and additional costs on each and every one of us. Some of them are politicians who cannot see the workings of the world except through the myopic lens of their own rigid ideologies. Others are commentators who join them to fan the flames of Tea Party sentiment. All of them promote injury to the US even as they try to advance fiscal spending restraint. We support restraint; we condemn raising risk premia needlessly. Of course this is a personal view, written by one individual who follows financial markets closely. Like so many others, we are quick to criticize when we do not like political actions. But the economist in us seeks symmetry. Therefore, we must also be quick to praise when praise is justified. Supporters of the clean debt limit helped all of us. By shrinking risk premia in globally correlated markets, all of us benefitted. Thus, praise is warranted, especially for the 28 Republicans who voted "aye." |

| Apple, Google, Microsoft: Where does the money come from? Posted: 18 Feb 2014 11:30 AM PST |

| Number of 5%+ Declines in S&P 500 Posted: 18 Feb 2014 08:30 AM PST The CHART OF THE DAY shows the number of times that the Standard & Poor's 500 Index declined 5 percent or more during each year between 1960 and 2013, according to data compiled by Deutsche Bank. In 22 of the 54 years, only one retreat crossed the threshold. Another 22 had two losses of that size. This year, the S&P 500 closed at a record on Jan. 15 and then dropped 5.8 percent through Feb. 3. The size of the loss approached an average of 7 percent for the index's dips since 1957, which Bianco cited in a Feb. 7 report. Losses like the latest one "usually stay under 10 percent and are quick," the New York-based strategist wrote. The S&P 500 reached its low in 12 trading days, less than half the average of 28 days since 1957. Bianco wrote that he's unsure which way stocks will go in the next 5 percent-plus swing, although he added that higher oil prices are encouraging. Crude settled at more than $100 a barrel yesterday for the first time this year in New York trading after rising 9 percent from a low set last month. "We wait for more information" before turning bullish, he wrote, citing data that showed weakness in U.S. employment and manufacturing. During January, fewer jobs were added than economists in a Bloomberg survey predicted. A manufacturing index from the Institute for Supply Management matched its biggest one-month drop in the economy's current expansion. |

| Everything You Need to Know About Stock Market Crashes Posted: 18 Feb 2014 05:30 AM PST Since everyone is talking about stock market crashes this week, let's add some context here… Since the invention of the Dow Jones Industrial Average at the turn of the last century, there have been eleven instances in which stocks declined by more than 35% from peak to trough, or what you would term a market crash. We'll talk about how the Dow Jones Industrial Average behaved during these crashes as it is our oldest index; there was no such thing as the S&P 500 until 1957 and the Nasdaq didn't come along until later. The most benign of these eleven crashes took place between January of 2000 and October of 2002. It lasted for 999 days and lopped off 37.8% of the Dow's price, ending that fall at around 7286. The damage in the tech-heavy Nasdaq was obviously much worse but, unless you had abandoned all of your blue chips to chase dot com stocks exclusively, it wasn't the end of the world. It should be noted that the tech crash was augmented by the uncovering of massive frauds at both Enron and WorldCom and punctuated with the September 11th attacks. The worst of these eleven crashes took place from April of 1930 and ended July of 1932, investors had lost 86% of their money in just 813 days. This was the big one, far grislier than the 48% killer of the fall of 1929, although that '29 crash took place in an astonishing two months. Within a few years, stocks would crash twice more. The Dow once again dropped 47% from March 1937 through March 1938 and then another 40% between September 1939 through 1942. This was followed by the Second World War and it took until the late 1940′s before stock prices had fully recovered. The very first crash in Dow Jones history happened within a year or so of the advent of the index. In June of 1901, the Dow began to fall and it didn't stop until November of 1903, handing investors (there weren't many of them in those days) a brutal loss of 46% inside of 875 days. To give you some perspective of what life in America was like during this first crash of the modern era, consider the following facts:

We've certainly come a long way since then, both in terms of society and the maturation of the modern markets. This is not to say that we don't remain every bit as susceptible to panics and crashes as we always have. Fear and greed are the two variables that never change throughout human history and certainly since the beginning of the stock market. Some of these eleven historic crashes had proximate causes – concrete developments we could point to that began the event. Most of them began mysteriously, with no warning or historically important reason. The cause of the 1929 crash is still shrouded in fog, all we know is that markets had been running up in a speculative fever for a decade and then one day – out of the blue – people didn't feel like playing anymore. If you are reading this, it is likely that you will witness another Dow Jones crash of greater than 35% at some time during your life. It could begin tomorrow or you may not see one for decades. There is no schedule and it is unlikely that anyone will be able to pinpoint the spark in advance. But it is important to remember the following before despairing over the pain that will someday come:

Most of your favorite crash-fetishists have track records that you wouldn't wish on your worst enemy. It is one thing to be aware of the potential for terrible things to happen, it is quite another to give up on life and opportunity altogether. |

| Posted: 18 Feb 2014 04:00 AM PST Good Tuesday morning — Here is what I am skimming on Fhloston Paradise:

What’s up for this holiday shortened week?

|

| Posted: 18 Feb 2014 03:00 AM PST Essential to the mission of the Austin Institute is the dissemination of both thought-provoking and rigorous academic research on family, sexuality, social structures and human relationships. In order to engage a wider audience, we are developing select research projects into a medium amenable to our digital age.

Published on Feb 14, 2014 For more about the Economics of Sex: Like the Austin Institute on Facebook: Follow the Austin Institute on Twitter: Hat tip NYP |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 comments:

Post a Comment