The Big Picture |

- Wolfram Language

- Gone to Texas: Immigration and Transformation of the Texas Economy

- 10 Reasons Why Russia Invaded Ukraine

- 10 Monday PM Reads

- Sorry Banks, Millennials Hate You

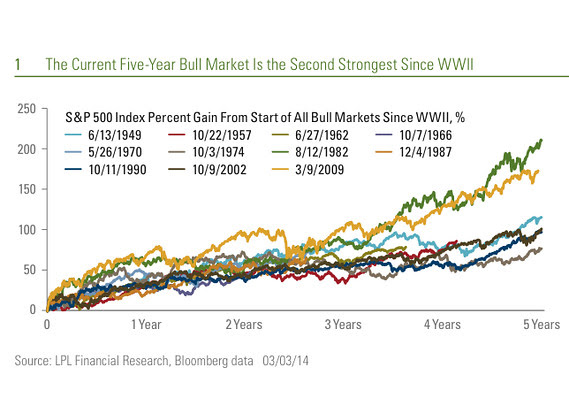

- Current Five-Year Bull Market Second Strongest Since WWII

- 10 Monday AM Reads

- Get Lucky: 5 Years Ago Today

| Posted: 11 Mar 2014 03:00 AM PDT Stephen Wolfram’s Introduction to the Wolfram Language |

| Gone to Texas: Immigration and Transformation of the Texas Economy Posted: 11 Mar 2014 02:00 AM PDT |

| 10 Reasons Why Russia Invaded Ukraine Posted: 10 Mar 2014 06:15 PM PDT |

| Posted: 10 Mar 2014 01:30 PM PDT My afternoon train reading:

What are you reading?

Stocks Are No Longer Moving in Tandem With Broad Market

|

| Sorry Banks, Millennials Hate You Posted: 10 Mar 2014 11:30 AM PDT

|

| Current Five-Year Bull Market Second Strongest Since WWII Posted: 10 Mar 2014 09:00 AM PDT |

| Posted: 10 Mar 2014 07:45 AM PDT Good Monday morning, let’s start your workweek out right with these reads:

|

| Posted: 10 Mar 2014 06:00 AM PDT Five years ago today, I made the luckiest market call of my career. A few details and some context first, than an explanation as to why this was so lucky. In 2005, I knew something was amiss in the global markets. The various metrics we track showed that credit had become a full on bubble, and was manifesting itself in residential housing. We discovered this by looking at such factors as median income to median home prices – at the time it was two going three standard deviations from the norm. Cost of owning versus cost of renting was also flashing warning signals, as was Housing value relative to GDP. Indeed, half of all new jobs being created were Real Estate related. That in itself was a giant red flag. All other signs pointed to a major correction in Housing, despite the denials from pundits In 2006, I had done a huge analysis as to the fair market value of the Dow Industrials. At the time, the Dow was heading to 12,000, but by my calculations, was worth only 9,800. My expectations was that to reach fair value something was likely to have gone wrong in housing, and that could lead to a 3,000 point panic. My best guess was that Dow 6800 – and that hitting this was more a greater possibility than most traders might bet. It was just a guess – and an early one at that. But after Housing began to reverse, it was apparent it would spill into the real economy. The stock market stubbornly ignored the collapsing residential real estate market until October 2007 – making that time feel like the longest year in my career. But as equities started rolling over, I began to wonder if my guess might come to pass. And so I made a promise to myself, not to become one of those one-way pundits who got one thing right in their career, and never changed their stripes ever again. There is a laundry list of such one hit wonders, and I vowed not to become one of them. Continues here |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 comments:

Post a Comment