The Big Picture |

- Two Sectors & Two Observations

- 10 Tuesday PM Reads

- Genius Social Media Strategy

- Beware Anecdotal Sentiment Readings!

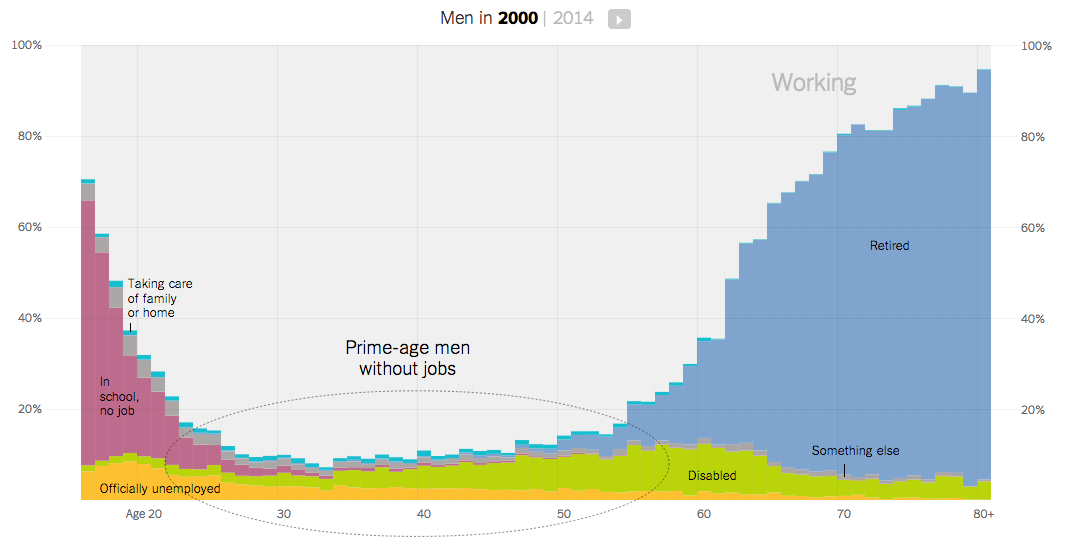

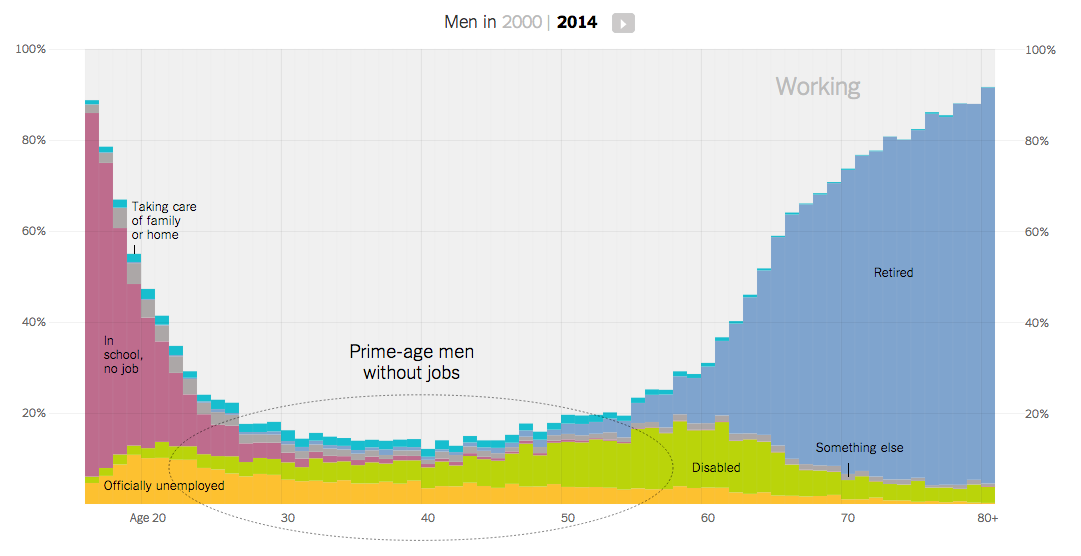

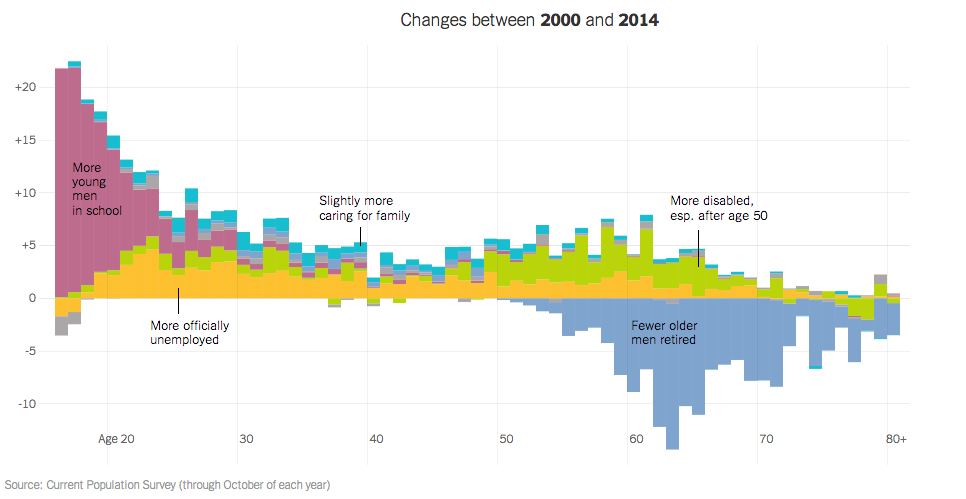

- The Rise of Men Who Don’t Work (and What They Do Instead)

- Masters in Business: Bill Grueskin

- 10 Tuesday AM Reads

- Dana Preist: CIA terror report “makes us stronger”

| Two Sectors & Two Observations Posted: 17 Dec 2014 02:00 AM PST Two Sectors & Two Observations

Two Sectors. The Utilities sector benefits from current conditions in a number of ways. It is in an environment of very low interest rates. It enjoys regulatory stability imposed on it in many political subdivisions. It depends on gradual increases in consumption for growth. It has a very long view of its investment time horizon. Thus Utilities gain steadily in a persistently low-interest and low-inflation-rate environment. The lower oil price fuels further momentum because pressures from fuel clauses are reduced. The industry enjoys a continuous expansion in the provision of its services. It is hard to make a case against Utilities. The issue about Utilities is that they have a long history of being boring. In traditional market cycles they tend to underperform the hotter sectors of the market, but in 2014 the old, boring, dull, under-scrutinized, and under-owned Utilities have outperformed the rest of the pack. Utilities started the year with a 4% yield in the benchmark sector ETF. The price is up, so the yield is down. But the yield is still over 100 basis points better than the riskless alternative. The prospect for increases in dividends over time is intact. As a practical matter, Utilities' earnings are directionally upward. At Cumberland Advisors the Utilities position has been our maximum sector overweight for the entire year. It remains overweight as we enter 2015. The Transportation sector benefits from lower energy prices in a different way. The obvious benefit is lower fuel costs. Air and rail travel, truck transport, and other means of US transportation also benefit when the US economy picks up. In 2015, the US economy is going to get a boost from low energy prices. The energy patch component, on the other hand, will not get a boost. At the margin, its growth rate will be suppressed, and we will see an incremental slowdown in the expansion rate of the US energy renaissance. But today's lower oil price will not stop the expansion. Various estimates of the negative impact a falling energy price is likely to have on the US economy are centered at about $150 billion annually. Offsetting that hit is the positive impact the lower oil price will have on the US economy. We think about it like this. Everything that originates with oil is cheaper now. All of the derivative products that come from oil are cheaper. Every household budget is improved by the drop in the cost of fuel. Various estimates of the positive impact that lower energy prices will have on the US economy are centered at about $450 billion. So, let's say the negative impact from low oil is $150 billion and the positive impact is $450 billion. Our simple model suggests that the net positive impact equals about $300 billion. That is more than double the entire 2% payroll tax cut of a few years ago. It is bigger than the tax-cut amount debated this year in dysfunctional Washington DC. And it is about three-fourths the size of the revised federal deficit estimate for the fiscal year ending in 2015. That estimate is trending toward $400 billion. If we are close to right, and if these estimates are within a 20% to 30% margin of error, 2015 will deliver accelerating growth in the US. We will enjoy continuing low interest rates as the Fed gradually normalizes policy. Low inflation lends additional confidence to the forecast, because energy price pressures are removed. The US stock market is likely to reflect these trends. The stock market does worry about a global currency crisis and about debt structures tied to a falling energy price (high-yield bonds in the Energy sector). It has to worry about banks and bank credit in Europe and the derivative of that bank credit in the US, because many debtors worldwide borrowed in currencies other than their host currency. Those borrowers may have thought the oil price would remain at $100 per barrel. Put yourself in the position of a Russian business that borrowed US dollars based on $100 oil and now, facing a plummeting ruble and a falling oil price, has to repay the dollars. It simply cannot do it. We expect some selective turmoil in the credit markets. Turmoil in credit markets and violent currency reactions are always scary. The Mexican peso in the early 1990s and the Russian ruble in the late '90s made violent moves originating in currency exchange rates, and we witnessed exploding pressures on countries and currencies. We may see some more of that in 2015. Some of this present market correction may be attributable to that risking risk. Our forecast for 2015 is up, not down, for the US stock market. We remain fully invested and deployed in ETFs in sectors and industries with a composition as discussed at the opening of this commentary. We are aware that volatilities are higher, and we expect that they will continue to rise as the Fed normalizes US central banking policies. At zero interest rates, volatility is suppressed. As we move away from zero, volatility will restore itself to a more normal range. Two Observations. We received an email from a reader in Spain. He argues that focusing on government, monetary and central bank policy, and the banking system is not sufficient to explain Europe's economic woes. He cites an example. We will preserve the anonymity of the writer but copy his email below. Hello David, I live in Spain, and it saddens me no end to read what you and others say about Europe and why it isn't working. You talk of central banks, monetary policy, more or less QE, the Bundesbank, etc., etc. You should live here, and the problems and their solutions are easy and everywhere to see, unless you are a politician or financial expert. In Spain, I know a father who is a skilled motor mechanic, but he is 66 years old. He son runs a very busy, successful garage, but as a small business he would like a break or a holiday or a little help from time to time, and his father would be ideal. But the police, yes the police, visit this business regularly to check his employment records. If they found his father working even 5 minutes in that business, they would not only fine him but he would lose his pension. I know a cleaner lady who earns less than 100 euros per week, who took on a little extra work to help her budget “on the black” and was caught and fined 10K euros. Self-employed people have to pay 250 euros a month “tax” every month simply because they are self-employed. That represents for many over 40% of their total earnings. No wonder they don't work self-employed willingly. I could go on and on and on. Liberty? It doesn't exist in Europe. Until governments are reduced to insignificant size per the teachings of Karl Popper, and the people are allowed to develop and express their natural talents, no amount of your writings or analysis is going to change a thing. Our second note is this observation. Thousands of US citizens are responding to the ongoing discussion of American's race relations. They focus on police actions and training, on killings, and on other problematic behavior. Police departments are internally examining how they are to maintain order and still allow peaceful protests. Watching news releases, this writer recalls a half-century ago when the images that were broadcast included dogs, billy clubs, and guns. This writer remembers personal family history in which the expression of debate in order to diminish racial tension was suppressed ruthlessly and with bloodshed. This writer also remembers riots involving destruction of property and life. There were unedited versions of riots in American cities in the 1960s. The US media edited the domestic versions and "bleeped" out the audio; but those of us serving abroad in the US military could watch TV and see the unedited versions of this news as it was reported on the foreign channels, so we had a different view. I personally recall watching someone shout "Burn, baby, burn!" in 1968, during TV coverage of the riots in Los Angeles. We were thinking, "Our country is coming apart. The US is falling into anarchy." That is how it looked. Contrast that time with now. Yes, we have some violence. Yes, we have protests and public displays that are intense. Yes, the country is in the throes of examining whether and how it can bring together its diverse population. At the same time, it is able to conduct most of these expressions relatively peacefully most of the time. Think about the world as we enter 2015. How few places are there where citizens of a particular country can express themselves in this way? Some who violate peaceful rules are arrested and penalized, but most do not violate the law, and they are allowed to express their views in our society. The greatness of America is found in those amendments to our Constitution that permit us certain freedoms like assembly, press, and the ability to express and debate views in a relatively civil way. In the US today there is a deep examination of how we are going to organize our society and progress for the rest of this decade and beyond. How will we do it? What will be the component parts? What will it look like when we are finished? The more we are able to discuss these issues without damage to property and threat to life, the better job we will do as a society. Notwithstanding some very violent expressions and property damage, it seems to this writer that we are not doing such a bad job at having this dialogue. If that holds true, 2015 is going to be a terrific year in the US. Americans will have a great debate about the character and structure of our country. We will do so in a period where there will be continuing economic recovery that supports peaceful discussions and diminishes the risks of the more violent expressions. This coming year is going to be interesting. David R. Kotok, Chairman and Chief Investment Officer, Cumberland |

| Posted: 16 Dec 2014 01:30 PM PST My afternoon train reads:

What are you reading?

US economy close to full capacity |

| Posted: 16 Dec 2014 11:00 AM PST My boy Mike, inspired by this, is busy testing the waters on a new Social Media project:

|

| Beware Anecdotal Sentiment Readings! Posted: 16 Dec 2014 09:00 AM PST It’s the time of year when predictions are in order. Not by us, but by other people. We have spilled plenty of pixels on why forecasts are folly (see this, this, this, this and this); we won't revisit that well-trod ground, at least not today. Instead, I wanted to discuss the rather annoying tendency of commentators to extrapolate market sentiment to well, infinity and beyond. Two recent news items have reminded me that it’s time to discuss sentiment. The first was this weekend's Barron's Strategist Outlook; the second was the CFA Institute's Global Market Sentiment Survey. Let's cut to the chase: Sentiment readings have very little correlation with markets, except when they reach extreme levels. I defy you to find anyone who has consistently made money off of the American Association of Individual Investors weekly sentiment readings; even on a monthly basis, they are so noisy as to be useless to traders. In our office, we have been debating what it means when Barron’s survey of 10 top Wall Street strategists is devoid of bears. Collectively, they expect the Standard & Poor's 500 Index to gain 10 percent next year. Their predictions range from 2,100 to 2,350 for the S&P (it’s now about 1,990), while they anticipate gross domestic product growth of 2.75 percent to 3.5 percent. This could be taken as a contrary signal that we have become too bullish and are due for a major correction or worse. The problem is that strategists are bullish pretty much all the time, with very few bears showing up in most surveys.

|

| The Rise of Men Who Don’t Work (and What They Do Instead) Posted: 16 Dec 2014 08:00 AM PST |

| Masters in Business: Bill Grueskin Posted: 16 Dec 2014 07:30 AM PST In this week’s "Masters in Business" podcast, I speak with William Grueskin, former managing editor of the Wall Street Journal Online, and former academic dean of the Columbia School of Journalism. (Since our interview, Grueskin has joined Bloomberg as executive editor for training.) In our conversation, we discuss the challenges of competing against "free." Grueskin witnessed the transition of the Wall Street Journal under Rupert Murdoch and discusses some of the changes. From his unique vantage point, he has observed how the business of journalism has evolved since the advent of the Internet and digital technologies. We discuss the substantial financial pressures on the dissemination of news that are changing the role of the press in a democratic society and imagine what journalism might look like in the future. You can download the podcast here or on Apple iTunes, or stream it at SoundCloud. All of our prior podcasts are available on iTunes.

|

| Posted: 16 Dec 2014 04:30 AM PST The news flow is fraught with distractions and irrelevancies, but we have your back: Morning train reads:

|

| Dana Preist: CIA terror report “makes us stronger” Posted: 16 Dec 2014 03:30 AM PST |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

0 comments:

Post a Comment