The Big Picture |

- U.S. Macro in Two Simple Charts

- Media Appearance: Dylan Ratigan, Fast Money (3.15.11)

- Rebuilding Japan

- FOMC speaks

- Finding the Lost City of Atlantis

- Nuclear Physicist on Japan Crisis

- Allocation Shift: Closing Shorts, Adding Longs

- Trading Japan’s EWJ

- Sherffius on Japan

- Interactive Graphics on Earthquakes, Nuclear Accident

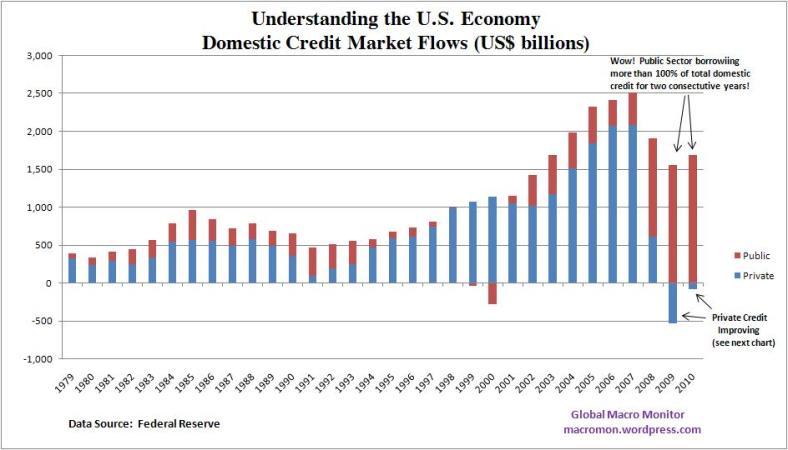

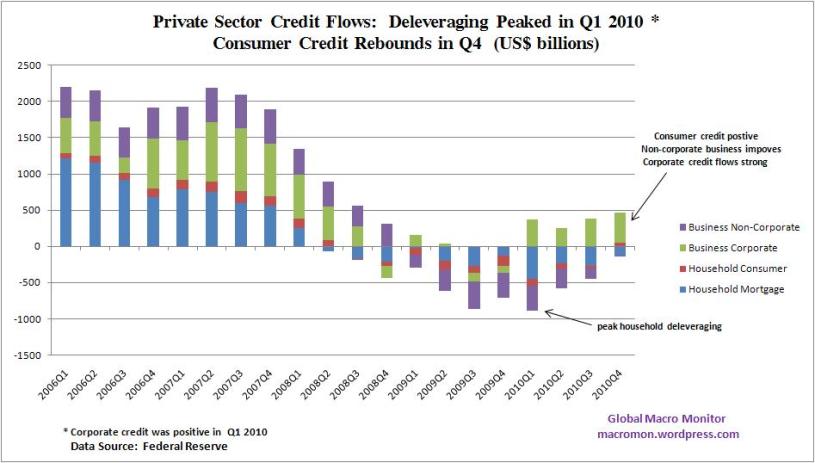

| U.S. Macro in Two Simple Charts Posted: 15 Mar 2011 01:30 PM PDT To understand the U.S. economy go no further than the following two charts. In 2009 and 2010, public sector borrowing was more than 100 percent of total net domestic credit flows. Federal government borrowing was 93 percent of these flows. The chart also shows the incredible collapse of U.S. credit bubble. Private sector deleveraging peaked in Q1 2010 and net consumer credit in Q4 was positive for the first time since Q2 2008. Net mortgage flows remain negative and corporate credit flows are picking up stream. The first chart illustrates why the U.S. money supply has not exploded even though the Federal Reserve has almost tripled the monetary base. The second chart shows why inflation concerns are increasing, however, as domestic credit markets heal and are primed with a massive arsenal high powered money.

|

| Media Appearance: Dylan Ratigan, Fast Money (3.15.11) Posted: 15 Mar 2011 12:45 PM PDT > Special Japanese Edition! Tonight I will be on Dylan Ratigan (MSNBC at 4pm) and then Fast Money (CNBC at 5:30 pm) discussing today’s market action, and Japan. Here are our relevant comments: ~~~ Videos posted: |

| Posted: 15 Mar 2011 12:14 PM PDT |

| Posted: 15 Mar 2011 10:36 AM PDT The FOMC said the “economic recovery is on a firmer footing and overall conditions in the labor market appear to be improving gradually.” This is an upgrade of their commentary in the Jan meeting. Their comments on spending on equipment and software and the housing market though were similar. With respect to inflation, the Fed acknowledged that “commodity prices have risen significantly since the summer” and specifically cited the “sharp run up in oil prices.” But not to worry the Fed says as they believe commodity inflation is “transitory” (no reason given) and that “longer term inflation expectations have remained stable, and measures of underlying inflation have been subdued.” They keep focusing on the core rate and apparently haven’t paid much attention to the rise in inflation expectations in TIPS before the Japanese earthquake and what was seen in the UoM confidence figure last week. |

| Finding the Lost City of Atlantis Posted: 15 Mar 2011 10:15 AM PDT I have to set the Tivo to record this tonite:

Is the lost city of Atlantis buried beneath the sea? Archaeologists are setting sail to find out. ~~~ http://channel.nationalgeographic.com/episode/finding-atlantis-4982/Overview#tab-Videos/10009_00#ixzz1Gc4BdT00 |

| Nuclear Physicist on Japan Crisis Posted: 15 Mar 2011 10:11 AM PDT Nuclear physicist Kirby Kemper gives us his assessment of the Japan nuclear crisis, including the likelihood of a meltdown and radiation risks. Plus, why global markets are off sharply today after Japan’s Nikkei average tumbled more than 10 percent. |

| Allocation Shift: Closing Shorts, Adding Longs Posted: 15 Mar 2011 10:00 AM PDT A quick update as to our trading posture: -For the past quarter, we have been about 50% cash with a handful (20%) of longs (HSY, MTZ, PZZA). -For the past month, we have been increasing our QID, SDS and VXX positions until as of the beginning of last week, they were 30% of our Long/Short portfolio. Today, we covered all of the short exposure Our current posture is 30% long, and 70% cash 25% long, and 75% cash. Before we make any large asset allocation moves, we will wait for the dust to settle and the picture to clarify. |

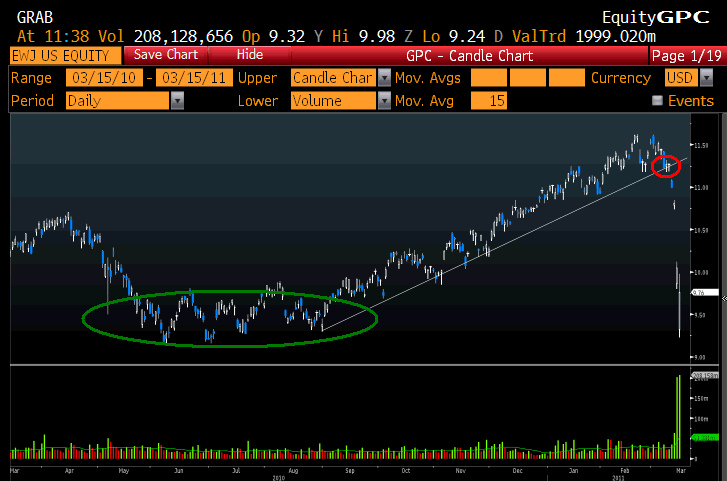

| Posted: 15 Mar 2011 09:00 AM PDT click for larger chart > I wanted to follow up a post from last year about EWJ. Back in December ’10, I mentioned 10 Reasons I Am Thinking About Japan. Regardless of your views going forward, if you owned or traded this, you should have had a plan in place, and executed your strategy on it. I wrote than “Note how many times EWJ got turned back at $11. What would get me really excited was a high volume breakout over $10.90-11.” EWJ did manage to get over $11, kissing $11.60 — but on rather mediocre volume. If you were thinking about a big position, the lack of volume should have kept you small (or out altogether). Regardless, you should have followed your discipline. It could have included such rules as:

You will never know when an event(s) such as an Earthquake/Tsunami/Nuclear accident will occur, but you certainly can have a trading plan in place way before hand. Having a plan, and having the discipline to execute that plan is crucial to success as an investor or trader . . . . |

| Posted: 15 Mar 2011 08:22 AM PDT John Sherffius, who did the brilliant cover and cartoons for Bailout Nation, has these two sad graphics on Japan: ~~~ |

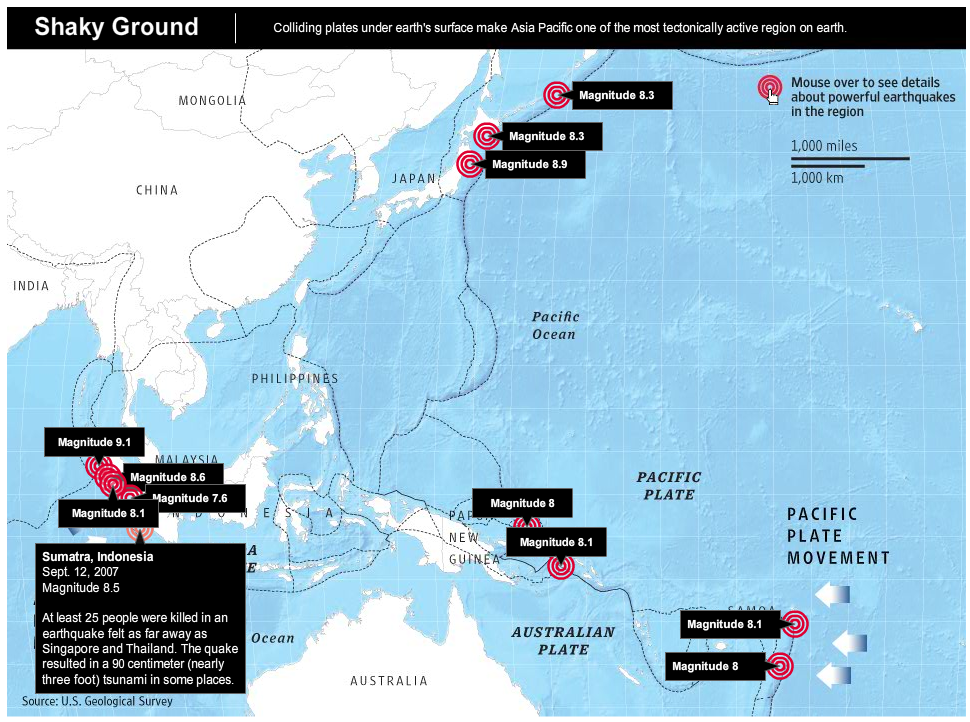

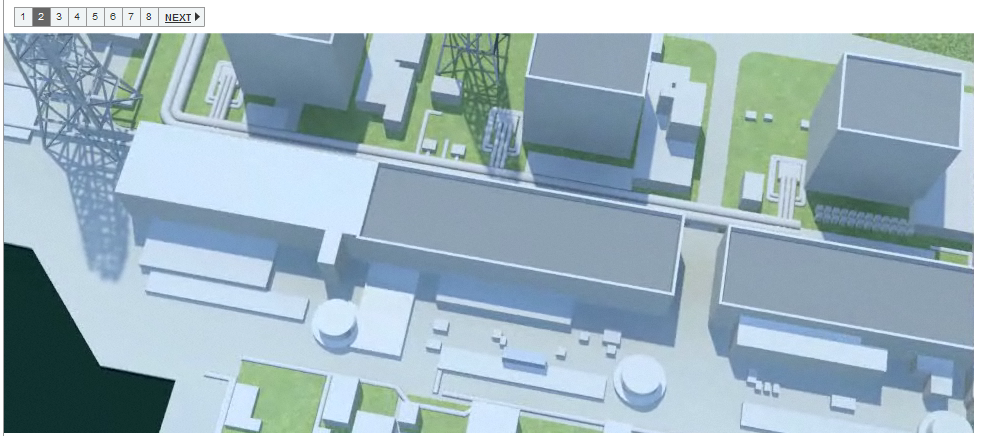

| Interactive Graphics on Earthquakes, Nuclear Accident Posted: 15 Mar 2011 07:22 AM PDT The MSM has a series of terrific interactive charts, maps and animations: Let’s start with the WSJ‘s Pacific/Australian tectonic plates. Note how many major earthquakes have occurred in this region.

click for larger chart, go here for article and interactive graphic > Next up is the NYT, which first looks at both how reactors work: click for interactive graphics > And then the specific issues in the Japanese Fukushima Daiichi Nuclear Power Station: > Sources Panic Selling in Japan Weighs on Global Markets (NYT) How a Reactor Shuts Down and What Happens in a Meltdown (NYT) |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

The Big Picture (ritholtz)

The Big Picture (ritholtz)

0 comments:

Post a Comment