The Big Picture |

- Succinct Summation of Week’s Events (3.18.11)

- Cry Baby: The Pedal That Rocks The World

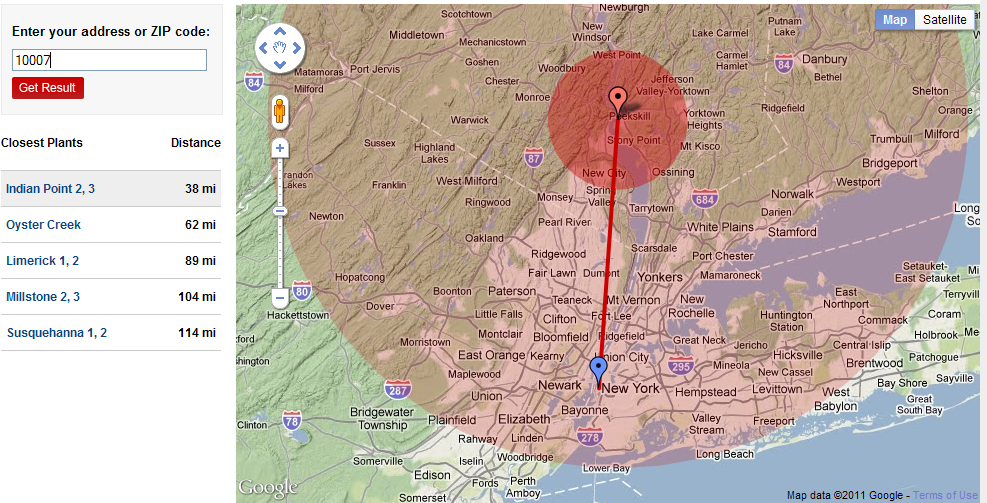

- Nearest Nukes (Jumping on the Fear Bandwagon)

- If Banks Can Resume Dividends, Can the Fed Resume Normalized Rates?

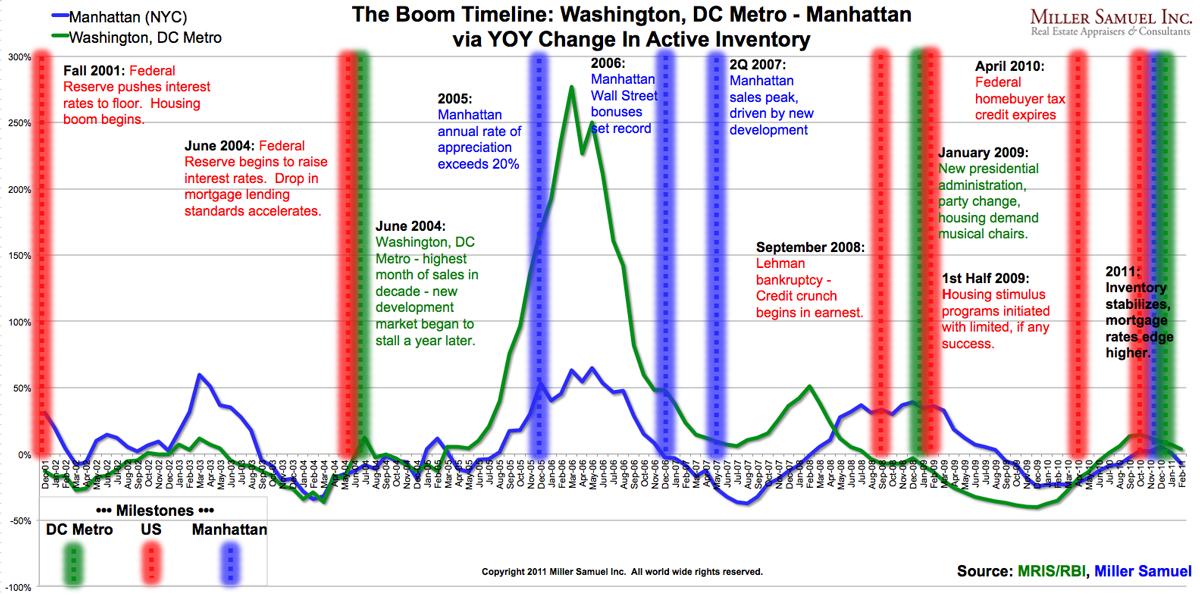

- Real Estate: NY vs DC

- Gross Federal Debt as a % of GDP

- Liquefaction from the Sendai Earthquake (Remarkable video)

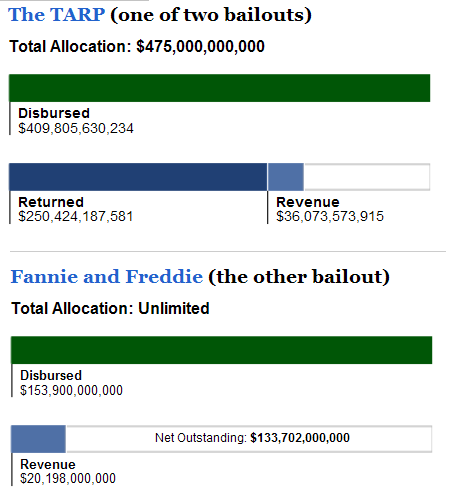

- TARP + GSE: $257 Billion in the Red

- The G7 is Not Permanent Manna from Heaven!

- Bilateral intervention more effective than unilateral

| Succinct Summation of Week’s Events (3.18.11) Posted: 18 Mar 2011 12:30 PM PDT Succinct summation of week’s events: Positives:

Negatives:

|

| Cry Baby: The Pedal That Rocks The World Posted: 18 Mar 2011 12:00 PM PDT By Joey Tosi The film features interviews with Brad Plunkett, the inventor of the pedal, plus many other musical luminaries such as Ben Fong-Torres, Eddie Van Halen, Slash, Buddy Guy, Art Thompson, Eddie Kramer, Kirk Hammett, Dweezil Zappa, and Jim Dunlop

Cry Baby: The Pedal That Rocks The World from Joey Tosi on Vimeo. |

| Nearest Nukes (Jumping on the Fear Bandwagon) Posted: 18 Mar 2011 11:30 AM PDT CNN/Money jumps on the fear bandwagon with this interactive graphic: > Hey, look! NYC is only 32 miles from Indian Point! We’re all going to die! (eventually) |

| If Banks Can Resume Dividends, Can the Fed Resume Normalized Rates? Posted: 18 Mar 2011 11:17 AM PDT The Fed is giving the green light to banks to resume paying divvies. I guess this means things are okay, everything is getting back to normal. This must also mean their extraordinary accommodation via zero interest rates should be ending soon as well, right?

Here is the punchline to the joke:

If I didn’t see the humor, I might end up crying . . . > Source: |

| Posted: 18 Mar 2011 09:30 AM PDT > Over at Curbed, Jonthan Miller (of Miller Matrix) looks at who has the more resilient RE market, New York or Washington DC. The result is the above chart (click to make giant). |

| Gross Federal Debt as a % of GDP Posted: 18 Mar 2011 08:30 AM PDT In light of yesterday’s charts on US debt (Who Does the US Owe Money To?), let’s take a quick look at two more, via Ron Griess of The Chart Store: > > > When ever I see an econ chart with “Gross” in the title, I cannot help but remember an All in the Family, when Archie Bunker was fighting with Meathead, he defend the nation’s honor by saying “The US of A has the highest standard of living! The grossest national product! |

| Liquefaction from the Sendai Earthquake (Remarkable video) Posted: 18 Mar 2011 07:45 AM PDT Here I am in Central Park in Tokyo. The park is situated on reclaimed ground. It’s filled in harbor from what I’m told. Here is a video showing the ground cracking open, liquefaction, water gushing up through the ground. It’s really scary and crazy to witness from so close a vantage point. Thanks for watching, Hat tip American Geophysical Union |

| TARP + GSE: $257 Billion in the Red Posted: 18 Mar 2011 07:15 AM PDT > No, we are not profitable on the bailouts. TARP has $123B to go before breakeven, and the GSEs are $133B in the hole. All told, the Taxpayers have a long way to go before we are breakeven. That’s before we count lost income from savings, bonds, etc., the increased costs of food stuff and energy due to inflation (the Fed’s has done this on purpose as part of their rescue plan), the higher fees the reduced competition of megabanks has created, and the future costs our Moral Hazard will have wrought in increased risks and disasters. As the nearby charts show, we are far far from breakeven: > Sources: The State of the Bailout |

| The G7 is Not Permanent Manna from Heaven! Posted: 18 Mar 2011 07:00 AM PDT The G7 is Not Permanent Manna from Heaven! http://www.cumber.com > "We need to be sure to note in any comments that the G7 move was decided by the finance ministers, not the central banks. Foreign exchange intervention decisions are the responsibility of finance ministries. Central banks then carry out the intervention. The Fed actually does not hold much yen to sell. The ECB has more, and the Japanese have an unlimited amount. I expect the intervention will target the price of 80, countering speculative moves for a higher yen, and eventually fundamental forces will likely bring the yen lower." Source: Bill Witherell, Cumberland's Chief Global Economist, Friday morning, March 18, 2011, and following the Thursday night announcement of the G7 "secret" agreement. I have excerpted the above from our internal Cumberland exchanges this morning. Bill summarized it well, so there is no reason for me to paraphrase it. Readers may not know that Bill Witherell spent many years at the OECD in Paris and headed the Finance Directorate there. In his previous role, he participated in many of these "secret" or closed meetings. Last night and this morning we had dialogue as we dissected the G7 action. In this morning's news, we have heard several erroneous statements coming from anchors who were not reading a teleprompter, or from TV guests. Let's try to add clarity. The Group of Seven countries are Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States. They each have a national central bank and a finance ministry. In the US, we have the Federal Reserve (Bernanke) and the US Treasury (Geithner). France, Germany and Italy each have a national central bank. They are also in the Eurozone and coordinate their monetary polices at the European Central Bank (Trichet). Central bankers usually participate in these types of discussions because they are the ones who have to execute them. In the US, the execution will be carried out at the Federal Reserve Bank of New York; it will represent the US Federal Reserve. The NY Fed does not make the intervention policy; they are the administrative arm of the US. For the US, the decision is made by the Treasury Secretary, with the approval of the President. This intervention means selling yen in order to weaken the yen in the foreign exchange markets. In order for one of the nations involved to sell yen, they have to hold it. They hold some for commercial trade purposes and they hold some as reserves. As Bill notes, some of those holdings are relatively small. If they do not hold enough yen, they may borrow it from the Bank of Japan and then sell it. This is an indirect form of the Bank of Japan selling it themselves. The borrowed yen is likely to be paid back at a later date when the markets have calmed and are stable. A key issue is whether the intervention will be sterilized. Sterilization means offsetting transactions. In this case, the intervention will be unsterilized, according to the Bank of Japan. That is the only way it can achieve any success. The G7 have not said what their targets are; however, they may be easily surmised. Bill emailed me that he concurs with the analysis that was on CNBC this morning. He notes, "David Kan just gave a great analysis of the yen situation on CNBC. It may shortly be available on their web site. He argued the G7 intention is to bring the yen back to where it was before the quake and stabilize the market. Then yen is likely to ease thereafter from market forces." Bill Witherell is on his way to Chicago. I'm now going to the office. Next week, we can ask Bill to elaborate. All errors in this morning's commentary are mine. A final note: this intervention will certainly be added to the discussion in Rome at the GIC conference on April 6-7-8. Any last minute registration may be accomplished at www.interdependence.org. David R. Kotok, Chairman and Chief Investment Officer |

| Bilateral intervention more effective than unilateral Posted: 18 Mar 2011 05:42 AM PDT “In response to recent movements in the exchange rate of the yen associated with the tragic events in Japan, and at the request of the Japanese authorities, the authorities of the US, the UK, Canada, and the ECB will join with Japan, on March 18, 2011, in concerted intervention in exchange markets,” said the G7 statement. While the news has been highly effective in reversing the strength of the yen, it is just a one day act for now. With this said though, coordinated intervention has historically been much more effective than unilateral action in having a longer lasting impact. Buying the euro in Sept 2000 was the last time we’ve seen such a G7 move. Then, the euro immediately spiked, then fell to new lows one month later but has of course risen steadily ever since. An aside, China followed India’s rate hike with another rise in reserve requirements to quell inflation. |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

The Big Picture (ritholtz)

The Big Picture (ritholtz)

0 comments:

Post a Comment