The Big Picture |

- Look Who Is Blogging: The New York Fed

- Free ‘Angry Birds’ app at Amazon App Store

- How to Protect Yourself (Generally)

- Louise Yamada on Dollar, Trade Opportunity

- Media Appearance: CNBC Fast Money (3.22.11)

- HFT, Reverse Splits and Hidden Signals

- The Blog Economy

- Market Cap as a % of Nominal GDP

- GMail Issues?

- Here Comes eBook Lending

| Look Who Is Blogging: The New York Fed Posted: 23 Mar 2011 03:00 AM PDT This morning, we welcome to the blogosphere the NY Fed, who just launched Liberty Street Economics (the NY Fed’s street address is 33 Liberty Street): > |

| Free ‘Angry Birds’ app at Amazon App Store Posted: 22 Mar 2011 06:32 PM PDT If you have an Android device, then you must grab this addictive game (free) from Amazon’s new App store/litigation factory: > |

| How to Protect Yourself (Generally) Posted: 22 Mar 2011 06:23 PM PDT On Twitter, Pete Rozin asks: “If we are topping, give us a strategy to protect our longs!!!” Well, that is the strategy you should have in place already. Regardless of what markets are doing, you need an exit plan before things get dicey. The strategy should not depend upon any twist or turn in the markets. Pete, let me suggest these readings to get you started:

See if there are any things in those that are of help . . . |

| Louise Yamada on Dollar, Trade Opportunity Posted: 22 Mar 2011 04:48 PM PDT A weak dollar could provide investors with an opportunity to cash in. Louise Yamada, Managing Director, Louise Yamada Technical Research Advisors, LLC lays out a strategy. Airtime: Tues. Mar. 22 2011 | 4:40 PM ET |

| Media Appearance: CNBC Fast Money (3.22.11) Posted: 22 Mar 2011 01:30 PM PDT > Special Market Topping Edition! Tonight I will be on Fast Money on CNBC at 5:30 pm discussing the overall quality of the market rally, following the selloff and snapback post Japan:

~~~ |

| HFT, Reverse Splits and Hidden Signals Posted: 22 Mar 2011 12:00 PM PDT Jay Saluzzi > There is sadness in the HFT world today as they are about to lose their poster boy, Citigroup. Yesterday, Citigroup announced that they will attempt to get their stock price higher and try a 1 for 10 reverse split. We don't know if it will work but we do know that close to half a billion shares of meaningless volume is about to exit the market. The WSJ had this quote: "It's going to sting," said Joseph Mazzella, managing director for equities trading at Knight Capital Group. For high-frequency traders, in particular, he said, "it's going to have a big impact." We are not exactly feeling sorry for the HFT guys as we are sure they are cooking up some ways right now to offset this lost income. Speaking of HFT, we found a very interesting recently published academic study titled "A Dysfunctional Role of High Frequency Trading in Electronic Markets". Click here to read paper -High frequency traders can create a mispricing that they knowingly exploit to the disadvantage of ordinary investors. -High frequency traders see a common signal that they then transact instantaneously on before the signal is incorporated into the market price. -Since all HFT sees the same signal, they all do the same trades at the same time. They create their own momentum which generates profitable returns. -High frequency traders's trades cause the price movement creating a self-fulfilling profit. -The authors liken this activity to market manipulation from large traders except that with HFT profits are unknowingly generated via a market signal. The authors appear to be saying that when HFT sees a signal in the market, they all act immediately and simultaneously to trade off the signal. However, the authors don't tell us what the signal is that HFT is using to extract there profits. They say the signal could be the difference between the futures and forward prices of a stock index but don't say exactly for sure. We have some ideas on this that we will share with you in future posts. ~~~ |

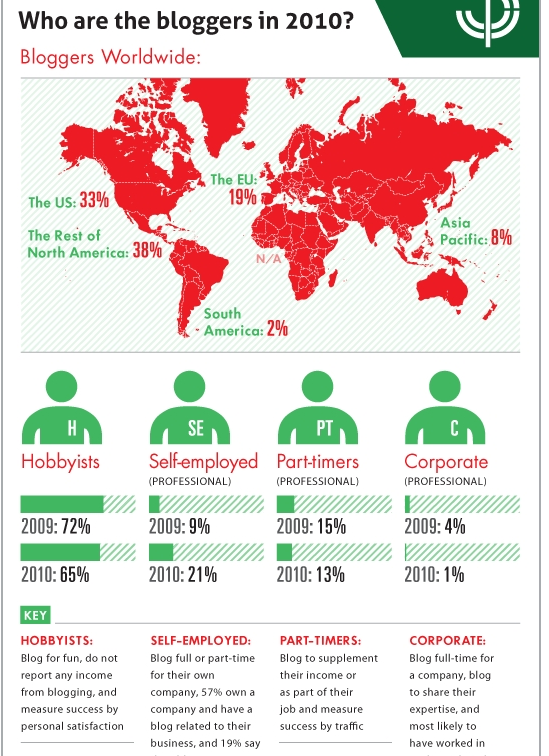

| Posted: 22 Mar 2011 11:30 AM PDT Yet another venture into Blogonomics, this time, via the Grasshopper group‘s bigass graphic: |

| Market Cap as a % of Nominal GDP Posted: 22 Mar 2011 08:30 AM PDT Is it that time already? Here is an updated look at NYSE/Nasdaq Market as a percentage of nominal GDP, via The Chart Store: |

| Posted: 22 Mar 2011 07:30 AM PDT I thought G-Mail was fixed – New emails arrive, but there is a huge gap between 2009 and last week. (Also, my archive of classic emails from the 1970s and ’80s are gone. |

| Posted: 22 Mar 2011 07:15 AM PDT Now how is this going to work? What does it mean for DRM? Here comes eBook lending . . . > hat tip Paul |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

The Big Picture (ritholtz)

The Big Picture (ritholtz)

0 comments:

Post a Comment