The Big Picture |

- Colbert Report: Channeled Rage

- Succinct Summation of Week’s Events (3.25.11)

- Plosser says What but not When

- How China Ran the Japanese Playbook

- Best Buy (BBY): Amazon’s (AMZN) Showroom?

- Have you seen the little PIIGs?

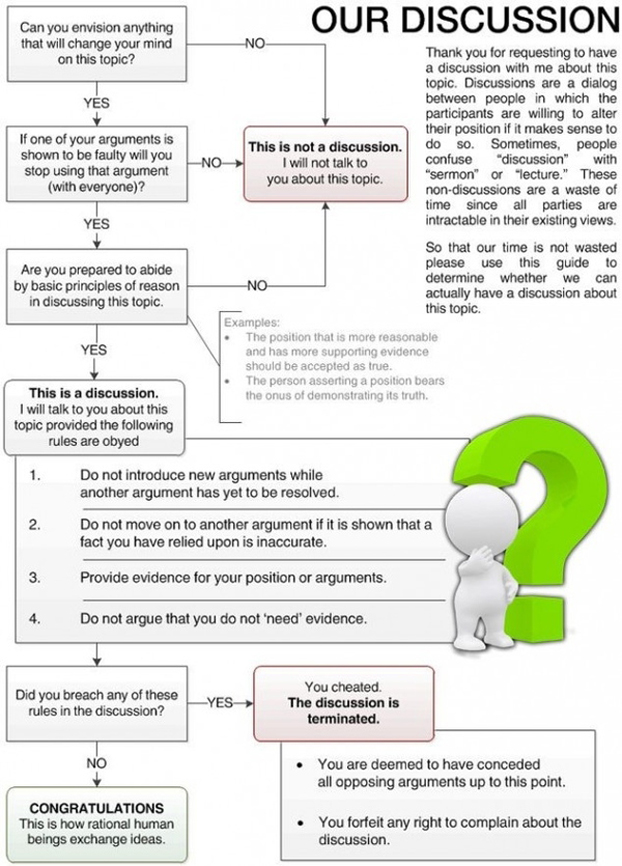

- How To Have A Rational Discussion

- NYSE = Chad Ridgeway?

- Earnings the driver, real test though in 2 weeks

- Forclosure Fraud Dates to 2006

| Colbert Report: Channeled Rage Posted: 25 Mar 2011 02:40 PM PDT The conflict in Libya between CNN’s Nic Robertson and Fox News’ Steve Harrigan escalates. Thursday, March 24, 2011 |

| Succinct Summation of Week’s Events (3.25.11) Posted: 25 Mar 2011 12:03 PM PDT Succinct summation of week’s events Positives:

Negatives:

|

| Plosser says What but not When Posted: 25 Mar 2011 10:48 AM PDT Fed voting member Plosser, I call a semi hawk who still votes with the majority, unlike Hoenig who voted to raise rates now, is laying out his own strategy for removing “the massive amount of accommodation” they have “supplied to the economy.” He was specific though in saying he will NOT be “focusing on the choice of when to begin reversing course. That, too, is a difficult issue, but not an unusual one.” His sole focus was thus “the design of an exit strategy.” From a market perspective, we’ve heard before the ‘we got a strategy’ discussion. It’s the WHEN that markets care about and WHEN is still not now, until at least after June 30th as the Fed is run by a majority of doves. After June 30th, they will likely take a step back and see how things unfold before making any decision of what comes next. |

| How China Ran the Japanese Playbook Posted: 25 Mar 2011 09:32 AM PDT Craig Dougherty has been a banker for 20 years, and was the President of the Union Bank Private Capital Group. He was the former CFO of Replay TV (now part of Direct TV), and was co-founder of Content & Company. ~~~ The Chinese took a page out the Japanese playbook, and re-invested the FX reserves earned from their burgeoning current account surplus into US Treasuries. This is how they kept the yuan from appreciating, which induced more and more companies to invest in Chinese manufacturing (i.e. low cost labor) – which perpetuated the surplus. Of course, the normal corrective action of an appreciating currency bringing down a surplus never happened, which was the intent of the Chinese! The Chinese took away Western manufacturing, they got jobs for their peasants, and huge trade surplus … but now own huge amounts of Treasuries as the price. Going forward, they now dominate manufacturing, so they don’t have to artificially suppress the yuan nearly as much as before. And they are free to invest their hard currency reserves not in UST, but in hard assets/materials/oil, etc. And precious metals. We got screwed as a nation. The US Chamber of Commerce, wielding extraordinary power on behalf of their constituents (US corporations) … well, they’re happy as big US multinationals just moved manufacturing offshore, to low wage countries. They benefit via lower labor costs. The US worker got fucked. The bond market going forward? The Fed has become the default buyer, as the Chinese are buying less. As the Japanese buy less, and other BRIC nations follow the Chinese lead and buy hard assets, there will be less demand for a huge supply of Treasuries. With the Fed ending QEII, $600 billion in demand goes away. They WILL re-invest the interest from the securities on their $3 trillion balance sheet, but you still have a $600 billion buyer leaving the market. This is why Bill Gross has said adios. IF our clueless, bought-off politicians did something meaningful on the budget (defense, ag and energy subsidies, Medicare, buying generics, re-importation of drugs from Canada …. I could go on), the equity markets would rally, and the wealth effect Bernanke has created successfully via QE I and II would continue WITHOUT QE III. If not, I submit higher rates when the national debt rises inexorably will kill us. 25% of revenues for debt service is not far off. Once you’re national debt starts to creep over 90% of GDP, it’s a slippery slope that’s hard to get off. |

| Best Buy (BBY): Amazon’s (AMZN) Showroom? Posted: 25 Mar 2011 09:00 AM PDT Bloomberg television ran a brief segment in which they posited that Best Buy (BBY) has effectively become Amazon’s (AMZN) biatch. And I think there’s some truth to that. This is no doubt one of the consequences of a population that walks around with smartphones running barcode scanning applications that allow us to see, touch, examine, try out a potential purchase and then, if it is to our liking, immediately search the web to find its best price — possibly (probably?) elsewhere, and maybe even order it before we leave the site at which we went to go see it in the first place. Unless it’s an impulse buy — walk in for a $12 thumb drive, walk out with a $700, 50″ flat panel? — why wouldn’t you:

And the proof of the pudding seems to be in the performance: I’d postulate this trend is a contributing factor to this news item about weaker BBY sales in general, but which contained this interesting tidbit (I’d guess the sale of mobile devices has a much higher immediate, on-site close rate than, say, digital cameras or other higher-end electronics) :

And yes, I’m aware of Amazon’s far more diverse offerings — consider this post as applicable only to electronics. ~~~ BR adds: I have been playing with the Amazon PriceCheck barcode scanning app — it spells the end of retailing as we previously knew it . . . |

| Have you seen the little PIIGs? Posted: 25 Mar 2011 07:15 AM PDT |

| How To Have A Rational Discussion Posted: 25 Mar 2011 06:15 AM PDT |

| Posted: 25 Mar 2011 05:15 AM PDT Sal Arnuk:Chad Ridgeway is the actual character in the Scottrade commercials, and he makes us laugh almost as hard as "Ghadafi, Martin Sheen, and Gary Busey" jokes. There are many different actual Scottrade commercials with Chad front and center, and they all basically have him in his self-interested glory, and highly transparent, despite his insistence that "our focus is on you, Dan…" Well I can't help but think of Chad as I watched my Twitter Feed yesterday, and specifically the NYSE_Euronext tweets late in the day: NYSE_Euronext (NYX) NYSE Euronext Look for NYSE's co-branded TV spots on during the Sweet 16 of the @NCAA Men's Basketball Tournament! 5 hours ago Favorite Retweet Reply NYSE_Euronext (NYX) NYSE Euronext Watch NYSE's co-branded TV campaign. See how NYSE excels & accelerates business http://bit.ly/g7naUT 5 hours ago Favorite Retweet Reply So, apparently the NYSE has gotten the message that Investor Relation departments at stock issuers are not exactly convinced that the Exchanges care so much about helping them raise capital, versus the price-distorting needs of HFT firms. Apparently the NYSE has gotten the message that corporate issuers prefer to not have their stocks trade down 10% (or up 10%) in seconds, let alone trade at $0.01. We think they must have read Tim Quast's article What Would A Bookie Do? written exactly two months ago. This would explain why the Exchanges have just decided to stop focusing on the hyper nano-second traders that generate volume, but not liquidity. This would explain why the Exchanges have decided to allow trading to be slowed down in times of stress, so that cooler heads can prevail. This would explain why the Exchanges have denounced their collocation and market data revenue models, as those models only promoted steroidical volume that served HFT traders and the Exchanges' bottom lines, and not the needs of investors and issuers. Umm wait.. I have this wrong. They have corrected none of these things. Hang on I'll get this… I just need to flip through my notes… one second please… and ummm here I got it… The Exchanges now care for corporate issuers because they are going to chip in money for GM NYSE co-branded commercials that will tell CNBC viewers how GM is getting it right by partnering with the NYSE to Excellerate their future. Apparently Chad Ridgeway is doing the tweeting! "But you and me, we go way back! Why spoil the fun! The fun??!!!" LOL. Oh… and from Cantor's Craig Cummings some real good stuff; I am so with him on the Book Club thing! ATTENTION LADIES! .. I'm calling B.S. on this whole " Book Club" scam. My wife and her 8 friends had "Book Club" at my house. 3 of them never bought this month's book. I walked through the room twice during the night and they were talking about "Dancing with the Stars". This morning there were 7 empty bottles of wine. These are DRINKING clubs, not book clubs. If you ladies don't agree to change the name I'm inviting all male readers to the Manhattan HOOTERS next week for Bible Study Club… I can't believe I'm saying this but the FRENCH shot down a plane in the Libyan no-fly zone. It must have been the Baron von Snoopy or something… There is talk that one of the Japanese reactors may have a crack, which may have led to water contamination. Death toll now over 10,000. Summer blackouts announced for Tokyo, Muslim extremists torched a church in Ethiopia… explosions reported just outside Tripoli… Talk in Europe that Spain might be right behind Portugal in asking for a bailout ( reported in WSJ). Rocket attacks and bombings in Israel… So, LETS HAVE A RALLY !!! There must REALLY be no other place to hide money right now… … Don't forget your Mega Millions Tickets boys and girls. $300 million tonight!!

Where we left off 4:00pm EST: INDU 12,170.56 +84.54 SPX 1,309.66 +12.12 CCMP 2,736.42 +38.12 Futures now at 7:00 am EST: DJA +45 SPA +5.10 NDA +9.25 Key Data out today:

08:30: GDP (expecting 3% growth) 08:30: Personal Consumption 09:55: Michigan Confidence

Since the prior close, some key stories:

- Stock futures higher after ORCL and ACN beat. - Merkel Forces European Leaders to Cut Startup Capital of 2013 Bailout Fund (Bloomberg) - CDS market to face UK Insider Trading Investigation. - Foreigners piled in to Japanese equities after the earthquake. - Fukushima plant may have breached reactor core. - MENA unrest continues, mostly in Libya and Egypt. Syria will "look into" ending 38 year emergency rule. Yup. Uh huh. And the NYSE will look at dismantling Mahwah. - Barnes and Noble can't find bids at 60 cents on the dollar? - RIMM adds GOOG aps to new tablet. This could get interesting. - RIMM disappoints with May guidance. - Equities have large $2.4 billion outflow this week from funds despite the rally. - BLK's Larry Fink bullish. - WSJ article discusses how Larry Silverstein is hoping to use tax-free muni debt to pay for some of the reconstruction costs of the WTC but higher rates could jeopardize those plans. WSJ http://on.wsj.com/hXXhlx - MLB working on a deal to limit the amount of debt that each team can carry. Maybe they can teach our government?

Earnings:

Pre-market: KBH

After the Close: NONE

Significant Movers This Morning: BODY +10%, CAN +6%, WTSLA +6%, ORCL +3%, THQI +4%, RIMM -11%, HS -5%, FINL -2% This entry was written by sarnuk, posted on March 25, 2011 at 7:30 am, filed under Uncategorized. Bookmark the permalink. Follow any comments here with the RSS feed for this post. Post a comment or leave a trackback: Trackback URL. |

| Earnings the driver, real test though in 2 weeks Posted: 25 Mar 2011 04:45 AM PDT Solid earnings from ORCL and ACN are the main drivers of the morning’s market strength. With about two weeks to go before Q1 earnings releases begin and notwithstanding these good reports, the market has to prepare for what I believe will be a more challenging quarter relative to expectations on the margin side. ORCL and ACN are comparatively immune to the rise in commodity prices because of their technology focus but many other industries are not and with corporate profit margins in the aggregate at near record highs, there is little room for error. We also have to watch for what disruption to business there will be from the Japanese disaster and while Q1 GDP forecasts have fallen to the 2% range from 3%+, I haven’t seen one equity strategist lower their ’11 earnings estimates. In Europe, soon after Fitch downgraded Portugal’s rating to A- to match S&P and Moody’s, S&P downgraded them to BBB and yields there are spiking again. |

| Forclosure Fraud Dates to 2006 Posted: 25 Mar 2011 04:19 AM PDT The spate of Foreclosure Fraud that reared its head in late 2010 dated as far back as 2006, according to an internal Fannie Mae report that year. That is according to a WSJ article. The Journal notes that the GSE’s lawyers were suspicious that Bank counsel was cutting corners to save money and time in their foreclosure process. Lost mortgage notes, false affidavits, material misrepresentations in recreated loan documents were surprisingly common actions.

Fannie claims they did not authorize such conduct, but they certainly failed to notify thew appropriate legal authorities about obvious criminality, either. Well, at least some of the Stater Attorney’s General are on the case . . . > Source: |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

The Big Picture (ritholtz)

The Big Picture (ritholtz)

0 comments:

Post a Comment