The Big Picture |

- CRAZY Good Akismet Update ?

- Succinct Summation of Week’s Events (5.27.11)

- The End Of Computers As We Know It

- Pimco’s Bill Gross says savers are at a disadvantage for years

- 2001: Steve Jobs Introduces the Apple Store

- Greek, Irish Risks Transferred to ECB

- Housing really sucks/Confidence picks up

- Zombie Idea: Defaulters’ Retail Spending Spree ?

- News of day

- FDIC: Regulatory Actions Related to Foreclosure Activities

| Posted: 27 May 2011 07:52 PM PDT I do not know what the changes are to my spam filter — or if some server farm in the Ukraine just went down — but my spam/troll/garbage links have gone down 90% this week. Whatever it is, its awesome! |

| Succinct Summation of Week’s Events (5.27.11) Posted: 27 May 2011 12:30 PM PDT Succinct summation of week’s events: Positives:

Negatives:

|

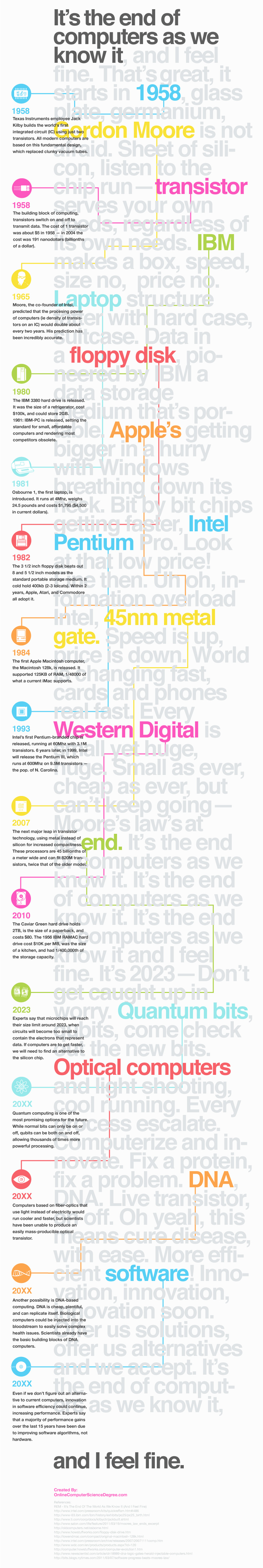

| The End Of Computers As We Know It Posted: 27 May 2011 11:00 AM PDT |

| Pimco’s Bill Gross says savers are at a disadvantage for years Posted: 27 May 2011 10:30 AM PDT Great video: Pimco’s Bill Gross spoke to Bloomberg Television’s Tom Keene this afternoon to discuss the Treasuries market. |

| 2001: Steve Jobs Introduces the Apple Store Posted: 27 May 2011 09:00 AM PDT A pre-launch tour of one of the original Apple Stores back in 2001. Apple got it right. Love the Flower Power iMacs at the cash register and the red “batphone” to call Cupertino at the Genius Bar!

|

| Greek, Irish Risks Transferred to ECB Posted: 27 May 2011 08:30 AM PDT Speigel has an interesting discussion on the Euro:

The full piece is worth a read . . . > Source: |

| Housing really sucks/Confidence picks up Posted: 27 May 2011 06:37 AM PDT April contract signings of existing homes fell a sharp 11.6% m/o/m, well more than expectations of a drop of just 1%. The Pending Home Sale index is at the lowest since Sept and is down 26.5% y/o/y from the tax credit induced spurt last year. The Northeast eked out a small gain but the sales drops in the Midwest, South and West were sharp. Whether it was the known reasons of economic concerns, weather disasters in the South, and tight lending standards, the industry drag remains a major problem for the nation’s household wealth and health of the US banking system which is betting their balance sheets that home prices don’t double dip which they seem to be in the process of doing. The final May UoM confidence figure at 74.3 was almost 2 pts better than expected, up from the preliminary reading of 72.4 and 69.8 in April. Both Current Conditions and the Outlook rose about 2 pts as it looks like the decline in gasoline prices off its peak had a positive influence as one year inflation expectations fell to 4.1% from 4.4% in the preliminary report and 4.6% in April. The level is still very elevated as it compares with a 20 year average of 2.9% but the direction certainly helps. AAA said last night that gasoline prices fell for a 14th straight day and .17 over the time period to $3.81. |

| Zombie Idea: Defaulters’ Retail Spending Spree ? Posted: 27 May 2011 06:23 AM PDT In April 2010, we discussed the false meme that defaulting homeowners were about to cause a surge in retail spending (Are Defaults Really Driving Retail Spending?). That blessedly data free idea turned out to be false. But as the backers of Supply-Side economics will tell you, its hard to keep a bad idea down. Thus, the same Defaulter/Retail spending theme has once again resurrected. How did this pop up again? A wild-ass JPM estimate that defaulters had $50B in additional spending dollars led to a lame Bloomberg article on 'Squatter Rent' boosting spending; James Cramer mentioned it in passing, and from there, it spread. (Global Macro Monitor brought it to my attention). Didn’t we see this movie some time last year? Let’s take another crack at this, beginning with our two-handed economist: On the one hand, there are some 6.4 million mortgage holders behind on their mortgage — some are paying nothing, some are only a month behind and trying to catch up, some are in default. (I expect this to turn into another million foreclosures in 2011). On the other hand, more than 15 million people are out of work, with little or no income. Not paying the mortgage when you have no income does not suggest any sort of shopping spree — other than essentials like food, gas, auto insurance, electricity, etc. (Better hope no one in the family needs health care). In terms of stimulus, that is baseline spending that will not rev up the economy anytime soon. The key issue is that there is less income, the default means less spending (not more). The banks are the ones who are not receiving the cash, and that has actual ramifications. Call it a variant of the broken window fallacy: The monies not spent paying the Mortgage means banks have that much less to loan out. Most defaulters’ overall spending is down, not up; When total net spending slides, that is hardly stimulative. And, the lack of mortgage payments to banks ends up reducing their total capital, and ultimately, that will pressure lending and investment downwards. ~~~ What started this entire debate last year was an amusing March 23 2010 post at Calculated Risk (HAMP applicants tanned and juiced) of an attempted mortgage mod by some free spending, nail salon loving bimbo; Paul Jackson extrapolated that on April 5 2010 to the whole economy (For Consumers, Time to Shop Until the Mortgage Drops); From there, it got picked up by CNBC’s Diana Olick (Mortgage Defaults May Be Driving Consumer Spending). It was like a bad game of telephone. One anecdote, zero data. No doubt, not paying your mortgage frees up cash — assuming you have any. But we have no hard data on the amounts. JPM made a seat of the pants $50B estimate, but thats all it was. What data we do have on this are retail sales numbers — and they are a weird mix of high Gasoline sales (price increases), cheaper low end stores (Dollar stores, WalMart) and luxe goods (Rolex, BMW, Tiffanys). Reconcile that retail sales data. High end is doing well, low end is doing well. What would help add weight to the claim of Defaulters driving retail spending? Maybe if the stores in the middle — above Target and Kohls, below Nordstrom or Bloomingdales — stopped struggling. That might show that people are no longer retail slumming, and that folks other than the wealthy are splurging. The average American family’s balance sheet (in default or not) makes this less likely. One run in this analysis are store specific issues that prevent us from drawing broader conclusions based on how some retailers are doing. Home Depot and Lowes are mired in the Housing mess; Sears is an Edddie Lambert induced disaster; Lord & Taylor or Macy’s might be a good tell — assuming they have no issues unique to them (absorbing a Merger, excess debt, etc.) The bottom line remains that the money not paid to banks for mortgages ultimately hurts something else somewhere elsewhere eventually. Even if you can find data showing defaulter shopping sprees driving retail — and so far, there is nothing but anecdotes — there is a price to be paid for that down the road with reduced bank lending and investments. Previously: Mortgage Defaults and Retail Sales See also: Cramer’s Eureka Moment Mad Money Recap (May 23, 2011) The New Economic Stimulus: Default on Your Mortgage? Global Macro Monitor (May 24, 2011) |

| Posted: 27 May 2011 05:45 AM PDT The market news of relevance today is out of Europe. After Junker’s comments yesterday questioning whether Greece will meet the conditions of the IMF to get the next tranche of their bailout, ECB member Wellink said today they Greece will meet these conditions. May Euro zone economic confidence fell slightly but to a 7 month low. May German inflation did slow slightly from April as oil prices led the way. While European banks are leading stock markets there higher after some upgrades, the iTraxx financial CDS index did rise to a 2 month high. The Irish 10 yr yield is rising to a new high as we know the markets will turn quickly to Ireland if there is any change in the terms of existing Greek debt in the next week. UK Consumer confidence in May jumped 10 pts unexpectedly to the best of the year. Without a Royal wedding in June we’ll see if that holds. While most Asian markets traded higher, the Shanghai index continued to lag, falling for a 7th straight day to a fresh 4 month low but copper prices are rising to their best level in 3 1/2 weeks. A big question for industrial metals outside of China over the next yr is at what point Japan starts to rebuild after the current clean up. Both income and spending in April rose .4% and March was revised down by .1% for each to .4% and .5% gains. The pace of gains sounds good but unfortunately inflation had a big influence. The PCE price deflator rose .3% after a .4% rise in March. Thus the REAL gains in income and spending were just .1% and in March income was flat on a real basis with just a .1% gain in spending. The Savings Rate was unchanged at 4.9%. Bottom line, this data point is always grade b in terms of market impact but is worth looking at to gauge the influence of late that rising prices are having on our standard of living. |

| FDIC: Regulatory Actions Related to Foreclosure Activities Posted: 27 May 2011 05:30 AM PDT Regulatory Actions Related to Foreclosure Activities by Large Servicers and Practical Implications for Community Banks FDIC Supervisory Insights Bulletin May 2011 |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

![image-218156-galleryV9-skww[1]](http://www.ritholtz.com/blog/wp-content/uploads/2011/05/image-218156-galleryV9-skww1.jpg)

0 comments:

Post a Comment