The Big Picture |

- Nonlinear Thinking: Robot Run Warehouses

- Whose Been Really Good? Whose Been Awful?

- 10 Year iPod Anniversary: Music in the Digital Age

- 30 yr auction poor

- 10 Thursday PM Reads

- Social by Design: Design Thinking & Business

- 29% of Mortgages Are Underwater

- S&P on France

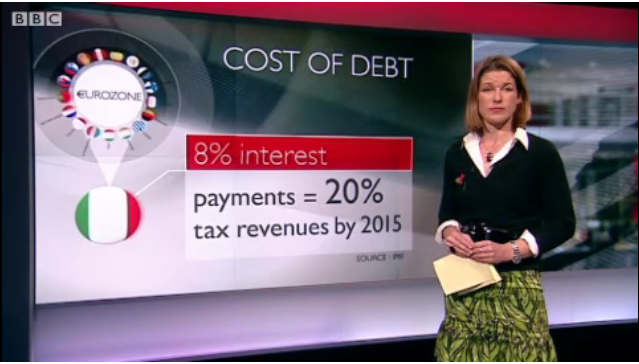

- Is Italy Too Big To Bailout?

- Supercommittee Impact On Your Stock Investments

| Nonlinear Thinking: Robot Run Warehouses Posted: 10 Nov 2011 10:30 PM PST Here's an interesting video clip that reinforces our view that almost all new innovation and technology is labor saving/destroying and that U.S. unemployment is much more structural than most perceive (click here to view video). Even the military, with the advent of drones and robots, is moving to a smaller "boots on the ground" force. There are lags in the Schumpeterian creative destruction process as the labor force has to be retrained for the new high tech economy. It also illustrates, at least to us, why corporate profits are at record highs while unemployment is also stuck at historically high levels. This is the future of what the private sector is looking to employ and, unfortunately, the political economy doesn't fully comprehend these trends and is trying to pour old wine into the new wineskin. Trying to reinflate bubbles and the housing and stock market ghosts of Christmas past, which are the root of current macro woes, are futile quick fix attempts in our ADD political and economic culture.

Stay tuned. |

| Whose Been Really Good? Whose Been Awful? Posted: 10 Nov 2011 07:13 PM PST Got an interesting question from a journalist today: What researchers, analysts, economists, strategists and journalists have gotten their field of work dead on right? Who has been totally awful? Feel free to name names, give examples, etc. |

| 10 Year iPod Anniversary: Music in the Digital Age Posted: 10 Nov 2011 04:00 PM PST Pretty cool piece of work from Bloomberg, taking the broad look at Selling Music in the Digital Age, not coincidentally, on the 10th anniversary of the iPod: > Video after the jump:

|

| Posted: 10 Nov 2011 02:19 PM PST The 30 yr bond auction was poor. The yield was almost 5 bps above the when issued and the bid to cover of 2.40 was below the 12 month avg of 2.65 and the 2nd weakest since Nov ’10. Also, dealers got stuck with the 3rd biggest % amount of the year with less going to direct and indirect bidders. Today’s auction follows the weak 10 yr yesterday and is a sign of some market pushback to these historically low interest rates. Bernanke said today that “inflation likely to stay close to 2% or less.” Maybe the bond market disagrees with this forecast as the last CPI reading was closer to 4%. Also, the other dynamic that 10 yr and 30 yr maturities will capture is the fiscal health of the US government with the Super Duper Deep Undercover Secret Committee in DC just weeks away from unveiling their compromise or lack thereof in the midst of our entitlement state reaching a breaking point over the next decade plus. |

| Posted: 10 Nov 2011 01:45 PM PST My afternoon train reading:

What are you doing? > • How the 99% and the Tea Party can Occupy WhiteHouse.gov (Anil Dash) |

| Social by Design: Design Thinking & Business Posted: 10 Nov 2011 01:00 PM PST Social by Design: Design Thinking & Business View more presentations from David Armano |

| 29% of Mortgages Are Underwater Posted: 10 Nov 2011 12:00 PM PST MSNBC – Nearly 29% of mortgaged homes underwater

USA Today – Foreclosure backlogs could take decades to clear out Foreclosure sales are moving so slowly in half the states that at the current pace, it will take more than eight years on average to clear the 2.1 million homes in foreclosure or with seriously delinquent mortgages, new research shows. That's about twice as long as a year ago in the states where foreclosures go through courts — before the mortgage industry was upended by last fall's disclosures that court papers in many foreclosure cases were improperly prepared. Since then, new checks have slowed the process. The backlogs suggest that the fallout from the nation's worst housing-market collapse is likely to weigh on real estate prices in many markets for years to come, and on some markets for longer than on others. Comment: According to Census data, a total of 76.428 million owner occupied units existed in the U.S. as of 2009. Of those, 50.3 million currently had a mortgage on their property. Recently, Core Logic estimated that 22.5% of all homes in the U.S. were underwater and another 5% had near negative equity. Additionally, JP Morgan has estimated that 27% of all foreclosures are walkaways. Zillow's estimates offer another data point on mortgages, suggesting nearly a third of all homes are now underwater. |

| Posted: 10 Nov 2011 09:31 AM PST From S&P on France correcting that they've changed their rating on France. "As a result of a technical error, a message was automatically disseminated today to some subscribers of S&P's Global Credit Portal suggesting that France's credit rating had been changed. This is not the case: the ratings of France remain AAA with a stable outlook, and this incident is not related to any ratings surveillance activity. We are investigating the cause of the error." |

| Posted: 10 Nov 2011 09:15 AM PST As the crisis unfolds in Rome, bankers and investors all over the world are weighing up whether to continue lending to Italy. If they stop – Italy could quite simply run out of money. But many fear that Italy’s economy – the third largest in the eurozone – is simply too big to bail out. > Source: |

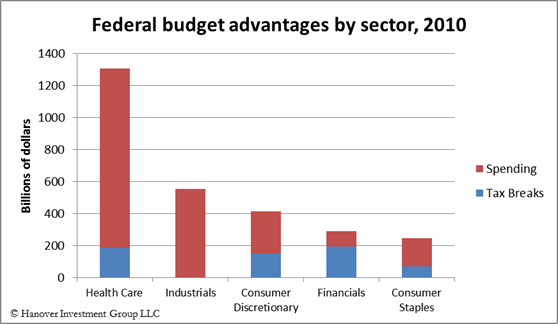

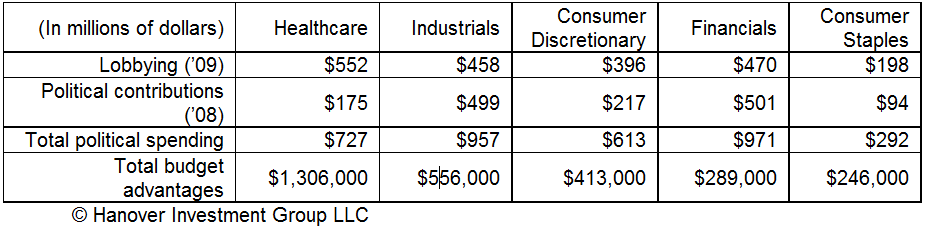

| Supercommittee Impact On Your Stock Investments Posted: 10 Nov 2011 09:00 AM PST Very interesting observations from Robert Dugger of Hanover Investment Group: They looked at the Federal budget, sector by sector, to see if they could determine the stock market winners and losers, or at least advantages, as well as lobbying and political contributions. >

> The full commentary is on their blog. |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 comments:

Post a Comment