The Big Picture |

- Measuring Europe’s Contagion

- In Modern America, Being Anti-War Is Labeled Terrorism

- Global Manufacturing PMI: Saved by the U.S.

- Roach Calls Euro Central Bank Loans ‘Chump Change’

- Succinct Summation Of Week’s Events (12/02/2011)

- 1952 Alfa Romeo C52 ‘Disco Volante’

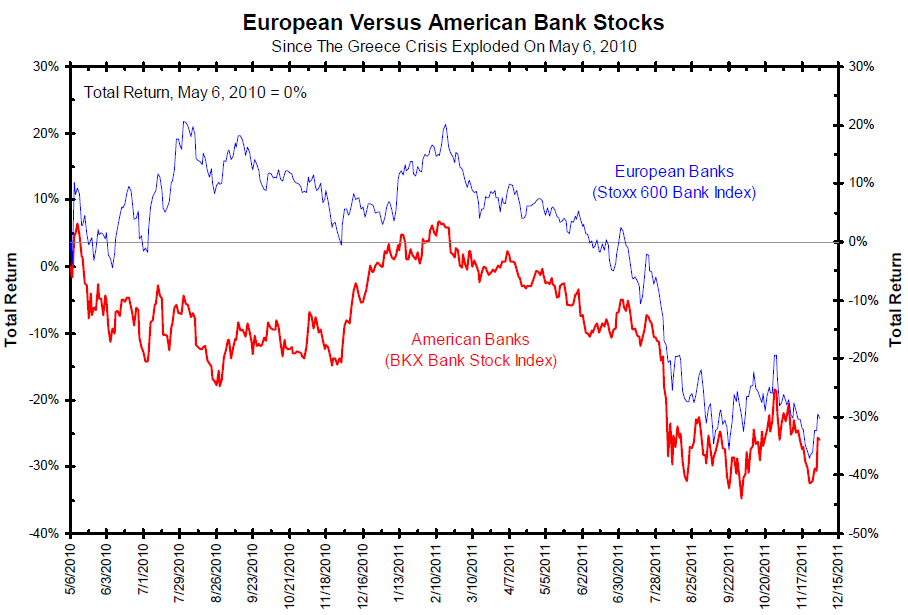

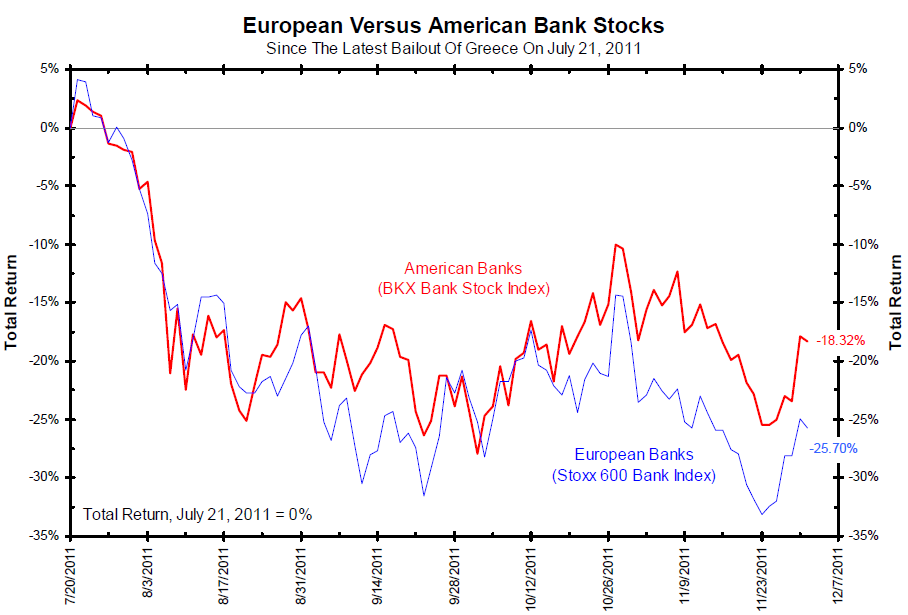

- American versus Europe Banks

- The Big Lie on CNBC Squawkbox

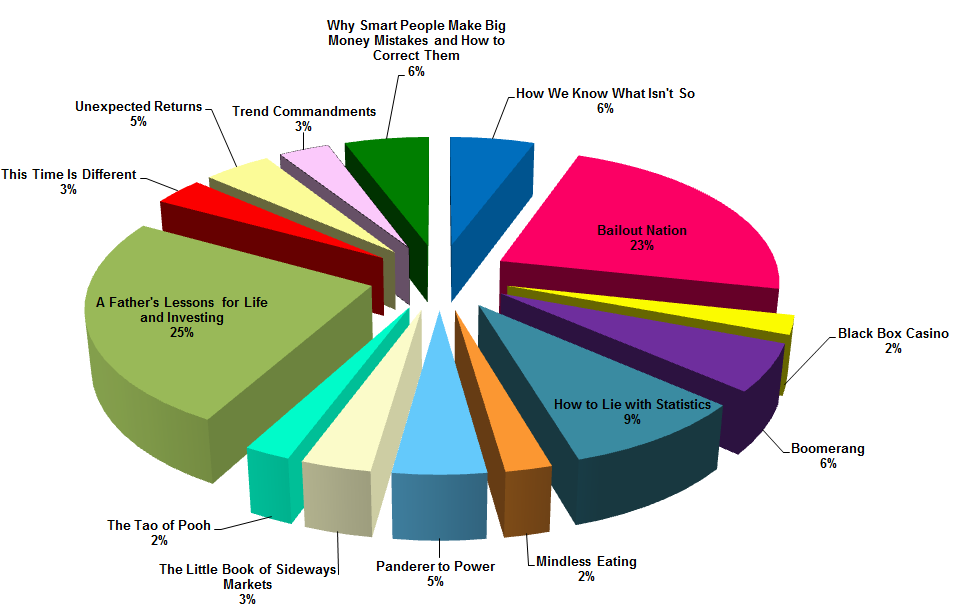

- Books Bought By Big Picture Readers (November 2011)

- Central Banks and Bullets

| Posted: 03 Dec 2011 02:00 AM PST Measuring Europe's Contagion ~~~

Cumberland Advisors has decided to collect data on the European contagion issue and present the information on a series of PowerPoint slides to be posted on our website, www.cumber.com. These charts can be found in the vicinity of the central bank balance-sheet charts, which we also track. We will now collect data on a weekly basis, with the goal of reflecting current data on Monday mornings. In one set of slides, visitors to our website will be able to view the G4 central banks, with the asset and liability sides of their balance sheets. On another set of slides we will track Europe's contagion. We have elected not to utilize credit default swaps (CDS) as the vehicle to price default risk and contagion risk in Europe. The historical pricing of CDS is meaningless on European sovereign debt. It was established during a period in which CDS users believed they had protection on payments, which they subsequently learned did not exist. The "voluntary 50% haircut" mechanism to reduce some of the sovereign debt obligations in Europe has been deemed to lie outside of CDS insurance coverage on European sovereign debt. Participants who previously established their positions on one CDS pricing mechanism have subsequently learned that they were wrong and their assumptions invalid. New York Times journalist Gretchen Morgenson discussed this dilemma in her column on Sunday, November 20th. Here is the link: Scare Tactics in Greece At Cumberland Advisors, we are going to track two elements. First, we are going to track the interest rate on the 10-year benchmark sovereign debt of various countries. Secondly, we are going to track the credit spreads of those countries against Germany, since the 10-year German government bond, affectionately known as "the Bund," is the benchmark for European sovereign debt. We have separated the countries into two groups: the "Good" and the "Bad." As their names suggest, the "Good" refers to those countries whose fiscal status and creditworthiness are more stable than in the other group. The "Bad" countries have poorer credit ratings, and their fiscal troubles are on a downward trend. The "Good" countries are Belgium, Austria, France, Finland, and the Netherlands. The "Bad" counties are Portugal, Italy, Ireland, and Spain. Belgium is presently in the "Good" category; however, the market may be pricing in a change. This division between good and bad was originally suggested by Erwan Mahé. We have made only minor changes to his composition. In all cases, we ignore Greece. It is the "Ugly" country because it is insolvent as a governmental entity. There is no reason to track any sovereign debt spreads or interest rates for Greece. The government of Greece has lost market access and is now dependent upon quasigovernmental, institutional support for funding. Note that there are two vertical lines on the charts. One of them marks the Merkel-Sarkosy plan announcement which triggered a sharp rise in interest rates. We have annotated this trend with red arrows. The other vertical line marks the coordinated central bank action announcement. Note how the central banks announced AFTER the actual peaking of rates. Did some folks have an advance "inkling" of the action. There are reports of hedge fund managers meeting with Fed officials prior to the announcement. Did the "hedgies" prevail on the Fed to act. Did they surmise that the Fed would act and stake out positions that would be front running? Was there a suspected failure of a large European bank that triggered the action. Rumors abound. There is a separate controversy involving Greek and other European debt. It involves the TARGET2 payment settling system in Europe. And there is the issue that Dr. John Whittaker, Visiting Fellow at Lancaster University, has written about. It involves the ability of national central banks to print currency and thus add additional liabilities to their TARGET2 payments: Eurosystem debts, Greece, and the role of banknotes. Note that TARGET2 liabilities and currency-creation liabilities are not reflected in the balances of outstanding sovereign indebtedness. They are in addition to it. A technical debate rages on how TARGET2 liabilities will impact the eventual euro-crisis outcome. We hope readers find the four charts concerning European contagion of interest. They depict dramatic changes and how rapidly those changes are occurring. A fifth chart shows the Bund yield and compares it with other non-euro benchmark yields. At Cumberland Advisors, we do not have any peripheral Europe country ETFs in our portfolios. In our international accounts, we have an 8% weight in Eurozone country ETFs, with the entirety of it in Northern Europe (France, Netherlands, and Germany). Adding the exposure we get from broad aggregate ETFs brings the Eurozone exposure to 12%. This compares with a 20% weight in the worldwide ex-US benchmark. In the global multi-asset class, our total Eurozone exposure is just 4%, with no specific country positions. We continue to watch the developments closely. We hope readers find both chart stacks of interest. We welcome constructive comments and suggestions. David R. Kotok |

| In Modern America, Being Anti-War Is Labeled Terrorism Posted: 02 Dec 2011 10:30 PM PST I noted last year:

Promoters of peace in Maryland, Minneapolis, Chicago and elsewhere were also considered potential terrorists, as was an individual Quaker peace activist. The Inspector General's report confirms that – at least in some instances – anti-war views were specifically targeted:

In addition, anti-war websites like AntiWar.com are listed on various terrorist watchlists: see number 16 here, and number 37 here. AntiWar's sin? It is (according to the watchlists):

The irony, of course, is:

And Nobel-prize winning economists say war is destroying our economy. Top American military and intelligence leaders, economists and the majority of Americans, by this logic, must be terrorists. Nazi leader Hermann Goering's famous statement is relevant to this issue:

Is Everyone Who Criticizes the Government a Terrorist?Of course, anti-war protesters shouldn't take it too personally, since they are in good company:

|

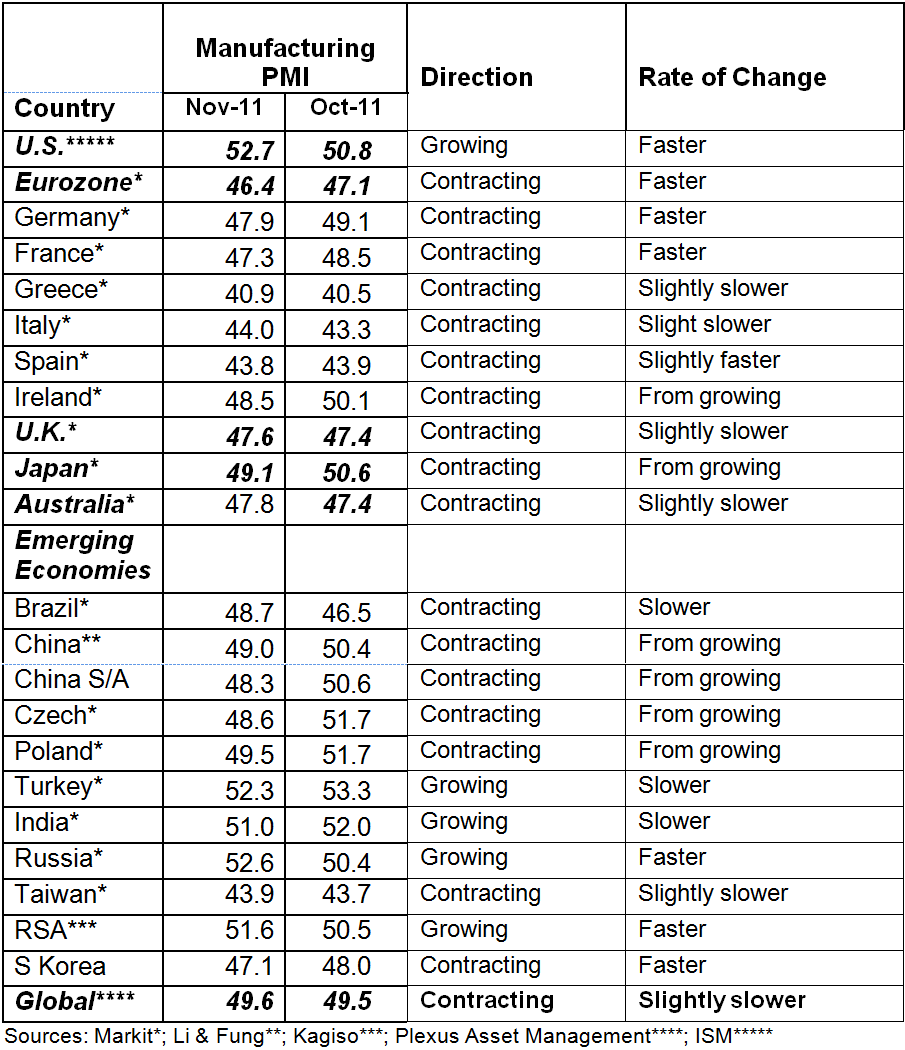

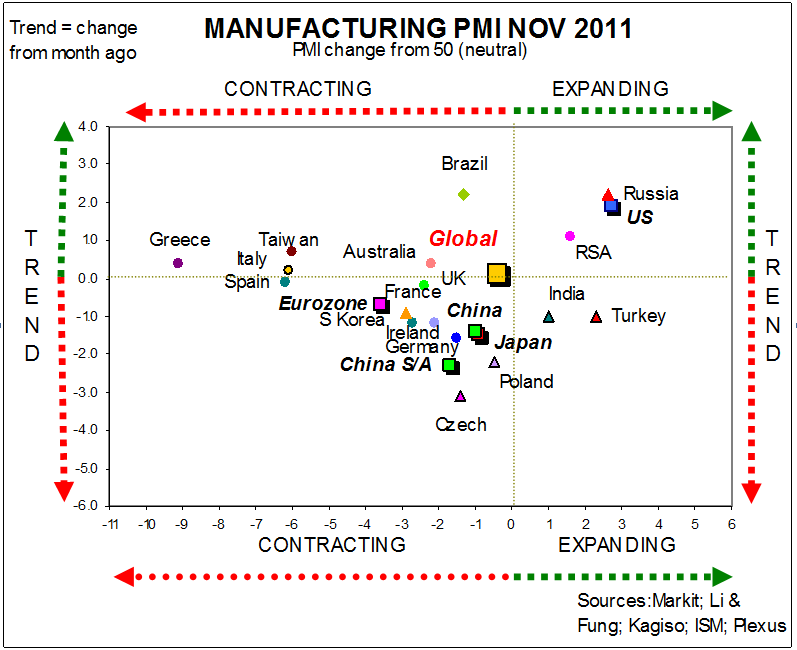

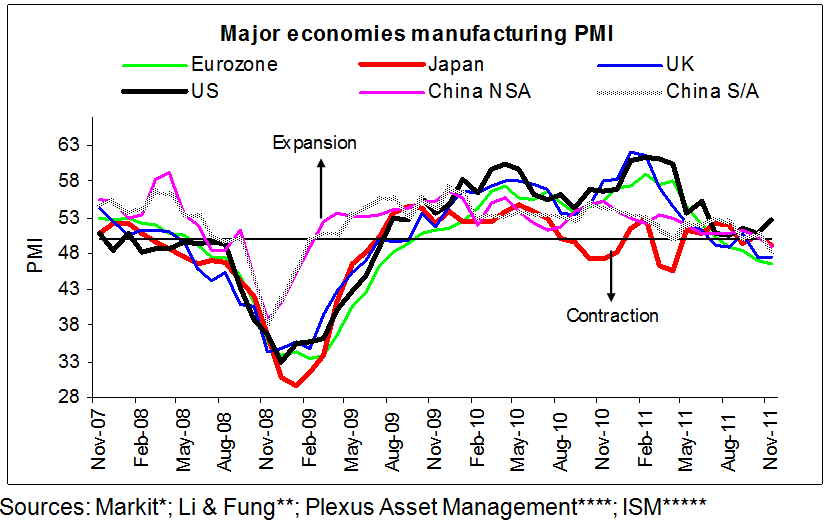

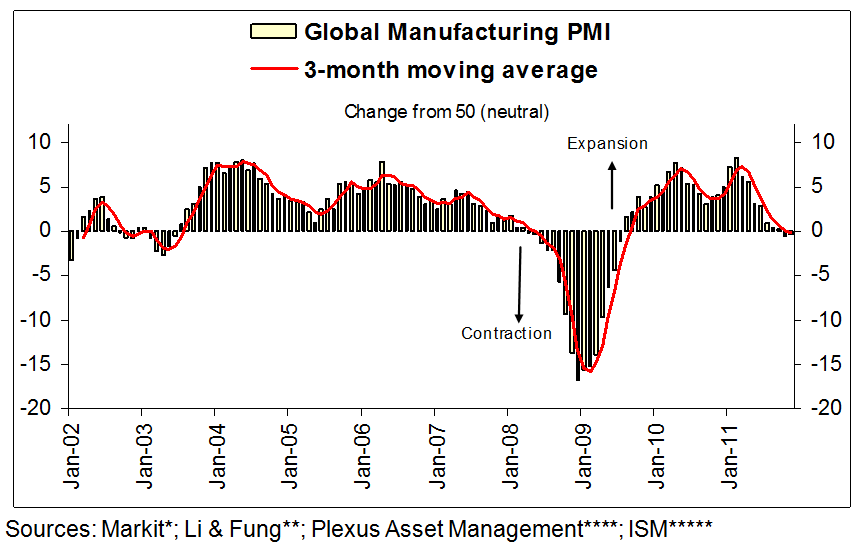

| Global Manufacturing PMI: Saved by the U.S. Posted: 02 Dec 2011 06:00 PM PST The contraction in the global manufacturing sector continued in November. The global manufacturing PMI that I calculate on a GDP-weighted basis for the major economic regions was virtually unmoved at 49.6 from October's 49.5. The relatively unchanged PMI masks significant changes in the individual countries and regions, though. The global manufacturing sector was saved by a higher than expected showing in the U.S. as my calculations show the global PMI excluding the U.S. fell from 48.7 in October to 47.8 In November. The ISM Manufacturing PMI surged by 1.9 to 52.7 from 50.8 in October. Outside the U,S., South Africa, Russia, Turkey and India were the only other economies where manufacturing expanded. The contraction in Brazil's manufacturing sector eased significantly. The downturn in the Eurozone is gathering pace as the contraction in France and Germany, the two major economies in the region, is deepening. The Markit Eurozone Manufacturing PMI fell to 46.4 in November from 47.1 in October. After Ireland fell back into contraction, the manufacturing sectors of all countries in the Eurozone are now in recession while the contagion widened to emerging European economies. In both China and Japan the expansion ended abruptly. Elsewhere in the Far East the contraction in Taiwan continues and the contraction in South Korea has deepened. ˜˜˜ The current state of the global manufacturing sector leaves global central bankers no other choice but to act aggressively to stop the rot. We should expect more announcements in coming weeks regarding lower reserve requirements for banks and interest rate cuts in countries where these cuts can still have a major impact on the economy, especially countries in the BRICS block. Source: |

| Roach Calls Euro Central Bank Loans ‘Chump Change’ Posted: 02 Dec 2011 01:30 PM PST Stephen Roach, non-executive chairman of Morgan Stanley Asia, talks about a European proposal to channel central bank loans through the International Monetary Fund. Roach, speaking with Betty Liu on Bloomberg Television’s “In The Loop”, also discusses the U.S. and Chinese economies.

|

| Succinct Summation Of Week’s Events (12/02/2011) Posted: 02 Dec 2011 12:30 PM PST Succinct summation of week’s events: Positives:

Negatives:

|

| 1952 Alfa Romeo C52 ‘Disco Volante’ Posted: 02 Dec 2011 12:15 PM PST |

| Posted: 02 Dec 2011 11:15 AM PST

The Economist – Contagion? What contagion? American banks have been strangely immune to Europe's crisis

|

| Posted: 02 Dec 2011 09:30 AM PST Apparently, the financial industry was not deregulated: Kudos to Becky Quick for at least trying to push back against this nonsense. And Austan Goolsbee is too nice a guy to call someone out for their bullshit If I were on, I would have decapitated the talking points of this BBT guy. Transcript after the jump

~~~ Do you think there is a — i look at all these places, whether it’s food, medical, or transportation or energy. part of what we’re concerned about is the horizon. within the government there is a lot of activity to really write constraining regulations that go substantially further than where we’re at. one of the factors we’re concerned about, when you’re trying to create a business, you look at what the horizon looks like. and with that trying to create a business, you look at what the horizon looks like. and with that regulatory climate that is in virtually every department in the administration, how do we get at or don’t you think that is having real impact on our economy? well, i think two things. one, if they’re making — if any agency is making mistaken regulations, if we got things that are either inefficient or impairing the growth of small businesses, we ought to go look at that and we ought to get rid of the regulations that aren’t working. i think, though, a mentality that says the only things that good for business is getting rid of all regulations and ripping up the rules of the road, i kind of think if you look at the financial system and what havoc it’s reeked on the economy from ripping up the rules of the road so that we lost public trust in financial markets, i think that mentality took a heavy blow in the financial crisis. it doesn’t mean that what replaced it is exactly perfect. the issue is not deregulating or misregulated. we passed three major laws under bush, privacy act, patriot act and sovereign act. we misregulated the system. the call to the financial crisis wasn’t a mistake on wall street although a number of firms should have failed. it was government policy that goes all the way back — i disagree. you’re wrong. , no i’m not wrong. to try to create affordable housing. because i saw this over my 30-year career. we grow — we can point a lot of fingers. freddie mac and fannie mae — i understand freddie and fannie. a business model where guys get to pocket profits for years and then when everything goes wrong dump it on the government. that was a recipe for failure and it failed. but to try to blame that is like you remember the year detroit lions were 0-16. they had a bad kicker. you can’t blame them being 0-16 on them having a bad kicker. there were a lot of blame to go around. you have $2.5 trillion — but there were a lot of problems. borrowing more than they should have. but we didn’t decide it was wall street. i believe wall street absolutely was — fannie and freddie were not the majority of subprime mortgages. yes, they were. no, they were not. the worst performing subprime mortgages have nothing to do with fannie and freddie. that is not mathematically true. yes, it is mathematically true. i’ll get data for you. i already looked at the data. i was in the mortgage business. i saw this. government policy put intense pressure on the banking ministry going all the way back to the aerly ’70s to do subprime lending. the banks were not prepared to do it. fair housing and then bill clinton — that act has been in place for decades. we had a financial crisis after they deregulated and allowed these entities to go into business. increased pressure under bill clinton set a goal for freddie and fannie to have half of the mortgage portfolio in subprime lending. that drove everybody down because — republicans and democrats. and republicans contributed. to allow investment banks to massively leaver up to a greater agree than they did before, that allows to put an unbelievable risk on to the system that blows up. who took the big losses? have you figured out the losses that fannie and freddie already have? the taxpayers. okay. the taxpayers. it’s going to be over a trillion dollars before it’s over. they were the driver. they were awful. i’ve never been a fan of and no economist is a big fan of a business model of socialized r your losses and keep all your profits. but to try to say that that is the cause of the financial crisis, it was just — do the math. mathematically certain that banks were not involved? no! no! no! it is one leg of the crisis. one leg, absolutely. wall street was another leg. yes. it was the primary driver. i don’t agree with that. i was in the mortgage business and saw them driving down the standards. we didn’t do it. we didn’t get in trouble because we didn’t do it. but they were driving down the standards. and they were also incentivizing people like country dsz wiwide mutual to provide affordable housing. they were bad. they were in search of — the financial sector and activities got well beyond what they should have been doing. the pure size of the banks made them systemic so they could — we had to subsidize all that private risk. and connectedness. but we still do. right? do we need to break them up? see, i don’t think it was — it’s an interesting idea. i wonder what your view is. if we let them fail — i don’t think it was just size. you can take bank of america and say you were a person that said let’s break up the banks. can you break bank of america into six pieces and every one of the pieces would be bigger than bear stearns. right. it wasn’t the size that made bear stearns dangerous. it’s how connected it is. so that’s why i think on addressing too big to fail, they have to work on the connectedness. a siegel thing? that is a separate issue. like the derivatives and counter parties. isn’t everything levered? it goes to rhine heart. can you have as many factors as you want on the stage doing as many bad things, regulators, bankers, everything, but as long as there is not enough leverage in the system, you can’t start a fire. this is a huge mistake thinking this is a bad actor. it was multiple in this. the bush administration was proudest of the fact that homeownership reached the highest possible — highest level in u.s. history under the bush administration which is based on these practices. it is linked. zbh don’t think the construction industry doesn’t like what was happening. absolutely. as long as pricing went up on housing, it was a social virtue in every context. but andrew, if you — if your company goes under and you lose all your stock and all your employees, you don’t leverage next time. but they didn’t go under. i think andrew is right. it was predominantly an equity bubble. it wasn’t leverage. so when it popped, the damage to the entire credit system in the united states is quite limited. so i do think if you did — and if you look across countries, those that had more equity in their system, those that had the lower loans to value ratios i think that’s quite true. but i think there’s more than just that. yes, you could have somewhat solved the problem if you had less leverage. but we had a whole lot of things going wrong at the same time. and so i just think — it was almost a societal, you know, motivation to increase homeownership. how about this — who that owned a house didn’t like what was happening, too? the flipper. everybody. everybody owned a house. but it’s not just the — it’s not just to be blamed on the homeowners. there are multiple legs on this stool. just saying, hey, it was fannie and freddie and the government encouraging homeownership, they have been encouraging homeowner shp for a long time. it was muplied with something ee that leads it to blow up. but nobody should have been surprised by the private sector trying to maximize profits if given the chance. and then you throw aig in. you could pretend to be triple-a with those credit default swaps. you’re totally right. yeah, you’re totally right. i think the system, understanding it from inside the system, it is grossly exaggerated. we’ve been doing business with bear stearns for 7 ayears. if they would have failed, we would have said so what. we had a lot of contracts. we managed our derivative contracts. we required to have cash collateral. not everybody did this. no. that was relatively safe. if you looked at the — the implication of saving bear is much worse than letting them fail. if you look at what happened, lehman doubled their bets. why not? if a government is going to bail you out and you got a down side, you’re going to double your bet. as soon as bear got — lehman didn’t double the bets from — no. from the time that bear stearns went under to the time they ultimately collapsed, they were reducing their leverage. they were reducing leverage. but they were doubling a lot of the debts in the market because they had no down side risk. and also they weren’t prepared for bankruptcy. why weren’t they prepared for bankruptcy? they thought they were going to get saved. that’s why the bankruptcy is so — i think that is — we didn’t trust the government so we covered our loem position. a lot of people did trust the government and expanded derivatives because they thought the government was going to bail lehman out. very wrong. lehman is so much more important than bear. i do think that this important dynamic, that the thing that is hard to understand is after bear, the fed announces we’re going to open the discount window to investment banks. you saw the bear stearns people say wait a minute! why didn’t do you that before we ended? and so the question always was, well why didn’t lehman just go to the discount window? and the auns was thnswer was th have the collateral. sure. but one of the things the psychologyst market, remember, there was a lot of perception that paulsen didn’t like lehman and that was why he let him fail. whether that’s true or not, i don’t know. but the psychology in the market is terrible when you have government leaders making what appear to be very arbitrary decisions. they save citigroup, they let wachovia fail. a lot of the down fall was in. this i went through the ’80s and early ’9 o’s, a long time ceo. we didn’t have a loss of confidence. this is under george bush. the arbitrariness of the decision was stunning. at one point they let citigroup that was broke and everybody knew it agree to buy wachovia. and then they reneged on the contract. i mean that was — paul voelker who is a good friend and a giant, he — as that whole thing — he is a giant. he is a giant. but he was saying as that was going along, you can’t do this. you do this weekend by weekend, it’s arbitrary and then everybody says well what are the rules? how does it apply? we have to have something more systemic. i do think that was an issue. if we were on the super committee, he would have done a damn deal. this is my thing. i think that if you got reasonable people to sit around and say what does this country need to grow and where do we need to be in five years? i think there’s a lot — i got a little teary thinking about it. we’re almost out of time on this discussion. but what are the areas where we could reach agreement where we say, yes, this makes a lot of sense. do it right now and do it quickly and get 60, 65% of the people to agree? i got the alliance. as you got into the dialogue, there weren’t reasonable people there. the issue quickly turned into either blame or political. there was no grounds to have a sort of reasonable discussion. yes. because immediately it became which side are you on as opposed to — how about bowles-simpson. you were there. what if the three guys went and sat down with the president and valerie jarrod, i think — by the end of it, i think someone might have a black eye or something. i don’t think that’s true. really? the president has actually met many times in private lunches with ceos to companies to get their ideas. and oftentimes, you know, they can be fairly tough with the president about particular issues. but he doesn’t want to get in a fight about that. why did he turn his back to simpson-bowles? he didn’t turn his back. the president offered — now we get into the debt ceiling negotiations. he did nothing with it. now we’re drifting apart again. this is a tremendous conversation. we’re glad you all could be here. john allison, my good friends. you have andrew. okay. if you have comments or questions about anything you |

| Books Bought By Big Picture Readers (November 2011) Posted: 02 Dec 2011 09:00 AM PST Click to enlarge view: I always find it interesting to see which books TBP readers are buying. In addition to throwing off minor referral revenue, the Amazon embed code lets me track every click from these links — how many people look at the page, how many books gt collectively purchased. Its anonymous — I don't know who bought what — but there's lots of data on the various books generated. These were the most popular TBP books for November:

|

| Posted: 02 Dec 2011 08:45 AM PST Bullets are flying in markets and in policy shifts. Here are a few.

Cumberland US stock ETF accounts remain fully invested. We have stated the following position for months. 2011 will NOT be a recession year. That seems to be validated by the data, which is slowly improving. The US stock market peaked on April 29 and subsequently a non-recession-year bear market ensued, which lasted until the early August selling climax. The lows were tested twice more in stock futures markets, and there was a final selling climax on October 3. US stocks have been headed higher since. We have been and remain fully invested in our US portfolios. We target a level of 1350 on the S&P 500 index in the nearer term (yearend or early 2012). We target a longer-term (end of decade) level of 2000 on the S&P 500 index. We have another year, two, or three of low interest rates, low inflation, slow but positive growth, slowly curing employment, slowly stabilizing housing – all this will work its way through our system at its own natural pace. All of this is bullish for the US economic recovery and the US stock market. The biggest risk to the US comes from its political leadership, which has demonstrated the extreme of failure. Reid-Pelosi Democrats failed us. McConnell-Boehner Republicans failed us. Obama White House failed us. It is not hard to explain why US politicians are viewed with the lowest measure of respect in modern history. America would like to throw them all out and start over. However, it will take third-party initiatives, independent candidates, and new faces to make this happen. That is not easy in the American system, because the incumbents have rigged the game to make it difficult. The incumbents actively disenfranchise the challengers as much as possible. Nevertheless, new faces are still possible. It is still possible. We expect to see some of it in 2012. We may not get a new version of the Bull Moose (Progressive Party – Teddy Roosevelt – 1912). Or again, we may. This is not yet determined. But we may at least see some new faces appear. We hope so. We have not given up on America, whose citizens are slow to anger but forceful once they do. And we haven't given up on a 15-trillion-dollar US economy that is growing nominally by more than a half a trillion a year in additional GDP. We remain fully invested. Many thanks to NPR, CBS News and Associated Press for covering our comments on the central banks' response. Bloomberg TV (Sara Eisen @ 6:45 am) and Bloomberg radio (Tom Keene & Ken Prewitt @ 7-8 am) are scheduled for next Wednesday morning. CNBC-Asia Squawk Box is booked for next Tuesday night (5 pm EST). And tomorrow we plan to be on with Kathleen Hays of Bloomberg Radio at the Philly Fed conference. Source: |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 comments:

Post a Comment