The Big Picture |

- Holiday Shopping Ideas!

- Thursday PM Reads

- EU summit draft

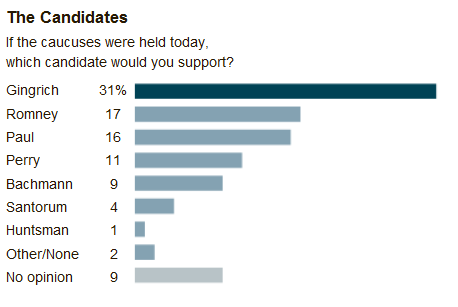

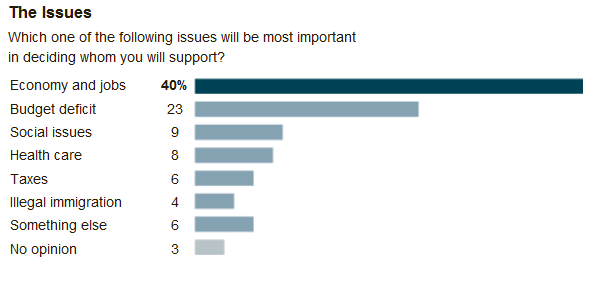

- Iowa Poll: The Candidates And The Issues

- Edward Tufte Notes

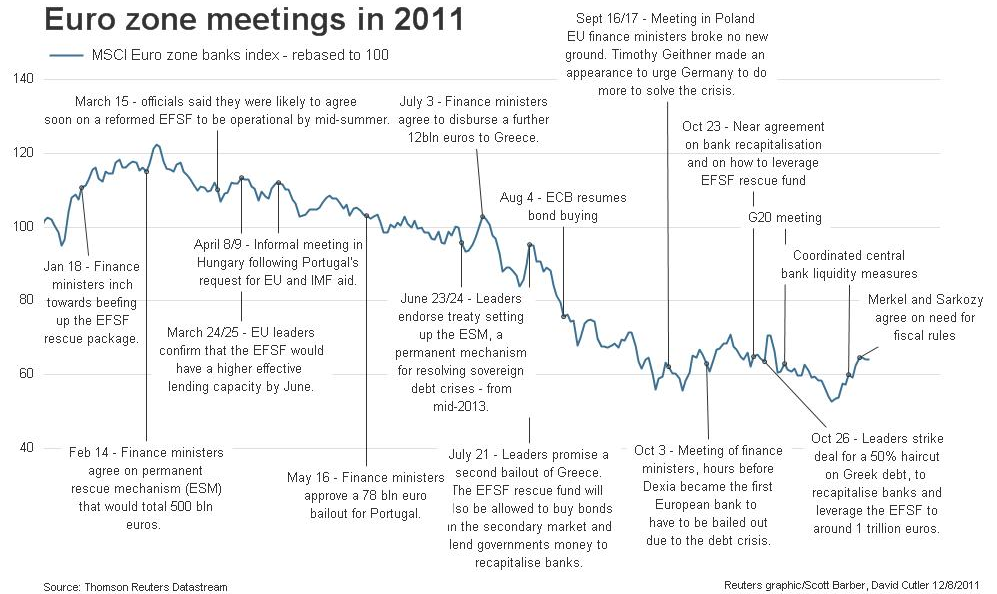

- Impact on Bank Index of EU Meetings

- Correlation In The Markets

- More from Draghi

- Tough love

- 10 Thursday AM Reads

| Posted: 08 Dec 2011 06:00 PM PST Its become an annual tradition — each year, I cull some of the more interesting things I stumble across in my travels; I also pull some items off of my own wish list. Last year, we got lots of great feedback about the breadth of gift ideas — so to kick off the season, here is the first round of Shopmas ideas for those of you who have loved ones on your holiday shopping list who have been very, very good. Go effect your own personal stimulus package, in various price ranges: ~~~

James Taylor singing your favorite Christmas songs, nice and easy pop and jazz selections, and an occasional ballad. A seasonal no brainer, perfect for your office’s Secret Santas. ~~~

I am a difficult shave, subject to razor burn, ingrown hairs and shaving bumps. This was a surprise find from a Canadian friend — light, non greasy, with Shea Butter — its a bit pricey, but this one tube has lasted me 6 months and counting! ~~~

Last year, I mentioned seasons 1 and 2 — a few of you told me you how much you loved the series also. Season three ties together the women in Hank’s life in a clever, bittersweet way. A “brilliant train wreck.”

~~~

It is difficult to describe exactly what this book is: by turns, it is both beautiful and ugly; It is a brilliant military history, and an apology for the necessities of war. It is a travel book about life in the desert at the time of writing. It is perhaps most of all a colorful epic and a lyrical exploration of the mind of a great man who helped shape the Middle East as it exists today. It looks like a pretty fascinating book to read. ~~~

I have these damned things on my desk in the office, and I am constantly fondling them. Damned near everyone who comes in feels compelled to play with them. Mindless, addictive fun. ~~~ 14 DVDs of much of Carlin’s classic work, from 1977 through 2005, including all 12 of his HBO specials. Includes: Baseball and Football, A Place for My Stuff, Losing Things, Al Sleet the Hippie-Dippie Weather Man, Hitler, We Like War, It s Not A Sport, Why We Don’t Need Ten Commandments and Seven Words You Can Never Say on Television. Of course, plenty of Carlin’s stuff is missing, but this is a good starter set. ~~~

~~~

Of all the gift suggestions I have made over the years, this one has generated the greatest response.

Not only did Deborah tell me you guys flooded her with orders from around the country, but I received many thank you emails from men who apparently made an impression on their significant others. Prices range from $150 – $1500 — and you can do very well at any end of the price scale. ~~~ • Ocean Porcelain Serving Tray ($400)  I saw this lovely serving platter at a Vagabond House and was charmed by it. If you entertain at home, this platter is perfect for serving seafood: Crabs, cockles, clams and prawns “intricately and realistically detailed and cast in pure Vagabond House pewter” are clustered to form the handles of this porcelain serving tray — perfect for Frutti del Mare! Note that the Vagabond House supports the Dory Fishing Fleet and believes “supporting sustainable, cooperative based fishing is one small way that we can help care for the oceans of the planet and build strong, eco-minded, diverse coastal communities.” I saw this lovely serving platter at a Vagabond House and was charmed by it. If you entertain at home, this platter is perfect for serving seafood: Crabs, cockles, clams and prawns “intricately and realistically detailed and cast in pure Vagabond House pewter” are clustered to form the handles of this porcelain serving tray — perfect for Frutti del Mare! Note that the Vagabond House supports the Dory Fishing Fleet and believes “supporting sustainable, cooperative based fishing is one small way that we can help care for the oceans of the planet and build strong, eco-minded, diverse coastal communities.”~~~ • BMW Performance Driving School: I've done course at Limerock and Sebring, but always wanted to try this particular one. These aren't race classes, but rather, aim to "extract the highest level of performance from an automobile by its driver under any circumstances." My high performance driving school was one of the most memorable gifts I ever received. The BMW prices range from "Not Bad" to "Holy shit" ) ~~~ That is our first version of Holiday Shopping Ideas! More to come next week… |

| Posted: 08 Dec 2011 01:30 PM PST My afternoon train reading:

What’s on your Instapaper? |

| Posted: 08 Dec 2011 12:55 PM PST CNBC and DJ are reporting that EU members have agreed to proposals that have been discussed for weeks, 1)The creation of a fiscal compact that will likely encompass an EC commission that will stand as an oversight of EU budgets and a Court that will be the enforcer, 2)The ESM fully in place by July 2012 that will stand side by side with the EFSF instead of replacing it, 3)EU to follow IMF protocol on private sector involvement in debt restructurings which means voluntary debt exchanges instead of forced, and 4)Euro area central banks will likely provide the IMF with bilateral loans (which then get recycled into loans back to Europe). On the ESM, some want it to be considered a bank and thus be able to access ECB funding but the Germans seem to be dead set against it. With respect to the markets, while the possibility of an agreement was always uncertain, Merkel and Sarkozy shook hands on all of these proposals on Monday so today was just convincing the others in the region. It was the ECB response to the EU summit that markets were looking to and Draghi told us what he thought today. Now will Draghi change his mind next week and say he liked the draft and maybe instead of buying 5-10b euros a week of sovereign debt, he’ll buy 10-20b and sterilize (because he doesn’t seem to want to print right now)? Maybe or maybe not. Bottom line, the market has become completely untradeable with all that is going on in Europe. |

| Iowa Poll: The Candidates And The Issues Posted: 08 Dec 2011 11:30 AM PST |

| Posted: 08 Dec 2011 11:00 AM PST MCJ Edward Tufte Notes View more presentations from McGarrah Jessee |

| Impact on Bank Index of EU Meetings Posted: 08 Dec 2011 08:15 AM PST

> The chart above shows the correlation between meetings of various EU leaders and the bank index. I am not sure if the index leads or follows various meetings – correlation does not equal causation — but its certainly a fascinating relationship . . . |

| Posted: 08 Dec 2011 07:30 AM PST > Bloomberg.com – Volatile DJIA Preoccupied With Euro Crisis

MarketWatch.com - From America to Asia, we're all in the euro zone

Comments: The high degree of correlation in the markets is a topic we have covered extensively as of late. The market is not being driven by individual stock fundamentals, but rather by macro themes that dominate the investing landscape. If one correlates each of the individual stocks in the S&P 500 to the index itself over a 50 day period, the average correlation hit 86% in October and is still near 80% today. No other period since the inception of the index has yielded a higher correlation, not during the Great Depression, rampant inflation of the 1970s, the stock market crash of 1987 or even during the financial crisis of 2008. This suggests 80% of a stock's movement can be explained by a stock market index rallying or declining. The other 20% of a stock's movement can be explained by the unique fundamental characteristics of that company such as management, product, a strategic plan and/or financial health. Similar record correlations can be found between the S&P 500 and currencies (the euro), commodities (crude oil), foreign markets (emerging market and European stocks) as well as interest rates (corporate and Treasury yields). In the entire history of the S&P 500, there has never been a day in which all 500 stocks in the index go up or all 500 go down. There have been 11 days in which 490+ stocks all move in the same direction on a given day. Of those 11 instances, 6 have occurred since July 2011. Add this all up and it appears as though macro themes, such as government intervention in the marketplace, will dictate returns. For the time being, stock picking is a dead art form and diversification is a largely unattainable goal. Source: Arbor Research |

| Posted: 08 Dec 2011 07:18 AM PST Reiterating that he is not putting on his Ben Bernanke Halloween costume, Draghi is saying the “ECB continues to sterilize bond purchases”, “says sterilization of SMP is precondition for program, and “failure to sterilize on occasion is not a problem.” Lastly, he said “shouldn’t try to circumvent spirit of the treaty.” |

| Posted: 08 Dec 2011 06:50 AM PST BN:*DRAGHI SAYS HE DIDN’T SIGNAL MORE BOND PURCHASES LAST WEEK. It’s this one headline that has the market lower. While so many want him to print, he doesn’t want to give EU countries a free pass. It’s called tough love. I repeat again, the sustainability of this stock market rally comes down to money printing or not. |

| Posted: 08 Dec 2011 06:30 AM PST My Thursday (yeah!) morning reads:

What are you reading? > |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 comments:

Post a Comment