The Big Picture |

- Hand Lettered Bob Dylan Subterranean Homesick Blues

- 5 Theories Why Romney Won’t Release His Tax Records

- Chinese 2013 GDP to decline to 6.5%, or even lower?

- Misinformation & Manufactured Myths

- Comediansincarsgettingcoffee: Carl Reiner and Mel Brooks

- 10 Sunday Reads

- Podcast: Learn to Accept Market Realities & Invest Accordingly

- QE Infinity: Unintended Consequences

- Richmond Fed Research Digest

| Hand Lettered Bob Dylan Subterranean Homesick Blues Posted: 23 Sep 2012 03:00 PM PDT How awesome are these hand lettered lyrics to one of my favorite Dylan songs? Hand lettering the lyrics to Bob Dylan’s “Subterranean Homesick Blues” Bob Dylan Subterranean Homesick Blues – A HAND LETTERING EXPERIENCE from Leandro Senna on Vimeo. hat tip boingboing |

| 5 Theories Why Romney Won’t Release His Tax Records Posted: 23 Sep 2012 03:00 PM PDT Invictus here. Mitt Romney didn’t have a very good week. When the Romney Campaign releases his 2011 taxes as a subject-changer, it’s a safe bet that things haven’t been going swimmingly. Let’s oblige them by wading into this tax story. Here is what we know: GOP candidate Mitt Romney has released his two most recent tax returns. According to Politifact, that’s far fewer than most presidential candidates disclose. As an example, Romney’s father, George, had released 12 years of tax returns. He has steadfastly refused to release the rest, despite being goaded by many players — not just Democrats and media pundits, but by members of the GOP establishment as well. Regardless, he has not been very forthcoming. Why has he refused? There are no good answers, only speculations. Given that not releasing additional tax docs has cost Romney politically only increases the arm chair hypothesizing. All summer, the incumbent has battered the challenger on this (and related issues). Romney’s approval ratings have been hurt. His refusal is helping to coalesce a detrimental media narrative: There are different rules for people of privilege than for the rest of the country, and Romney has taken advantage of them. These week’s 47% gaffe only plays into that same narrative. While the Obama ads have been politically effective, it’s been even more surprising that there has not been a successful counter from the GOP candidate. Romney was even vetted as a Veep candidate in 2008 by the McCain camp, where they ostensibly saw his tax records. McCain himself said Romney provided 20 years of records, and has paid his taxes . . . but then again, he passed over Romney for Sarah Palin as Veep. The Obama campaign has offered to drop the issue if Romney releases just 5 years of tax docs. Still, the Romney camp has refused. All of these minor sleights and unanswered accusations have led to a cottage industry of imagining what secrets might be hidden in these tax records. We do not know, but we can use some deductive reasoning to come up with some reasonable theories as to why Romney won’t share with voters what he showed the McCain camp (or perhaps, what took place post-McCain). Here are our 5 top contenders: 1) 0% Tax Rates: The released tax documents show a very low tax rate, and Romney has said he never paid less than a 13% rate over the past 10 years. However, its not inconceivable that through a combination of aggressive tax planning, use of Trusts, earned income carry forwards and use of tax havens like Switzerland, Lichtenstein, Cayman Islands and Bermuda, Romney may have paid no taxes whatsoever in 2009 and years prior. His advisors may have correctly surmised this would be fatal to his Presidential aspirations. Since I began composing this post, the Romney campaign has released a letter from his accountants to the effect that, over the period reviewed, the Romneys’ lowest tax rate was 13.66 percent (though there was a bit of numerical gymnastics to make that true in 2011). Note that Romney’s letter from PricewaterhouseCoopers discusses “adjusted gross income” — not total income; this subtle difference has already been debunked. Not surprisingly in the post-Enron, post-WorldCom world, the word of an accountant ain’t worth the pixels used to write it. And, if it’s true, why not just get them out there and be done with with? Well, maybe it’s: 2) Voter Fraud: The Guardian and others came up with an even simpler theory: That Romney has voted in a state in which he was not technically a resident (i.e. voting in Massachusetts when he was actually a resident of California). I first saw this in Forbes, which mentioned that “Romney appears to have escaped relatively unsinged from the apparently unrelated revelation that he may have committed voter fraud in January 2010, when – despite not owning a house in Massachusetts and having given every appearance of having moved to California…” 3) Broken Tax Laws: Personally, I assign this a very low to moderate probability. However, without releasing his returns, Romney leaves himself open to speculation that he may perhaps have crossed a line and submitted returns that are somehow numerically fraudulent and/or otherwise illegal (separate and apart from the aforementioned address issue). BR has raised the issue of Romney’s IRA. William Cohan at Bloomberg has also wondered how he was able to legally amass $102 million in his individual retirement account — tax free! — during the 15 years he was at Bain Capital, despite contribution limits that would seem to make that all but impossible. What sort of rate of return is that, anyway? Regarding the IRA contributions, Victor Fleischer, Professor of Law at University of Colorado is rather blunt: “Bottom line: Mitt Romney has not paid all the taxes required under law.” Beyond that, it’s possible he is:

4) Much Wealthier Than Previously Reported: Romney’s wealth has been guesstimated at around $250 million. Returns from which we might infer that his wealth is significantly greater – not that $250 million isn’t a huge number – might be somewhat off-putting to the electorate, particularly in light of Romney’s recent well-publicized 47% gaffe (which actually was not a gaffe at all, but a core belief among some conservatives). And, finally, a theory I have not seen advanced elsewhere that seems to me as plausible (maybe more so) as any other. I can’t take credit for this idea, but it certainly seems viable: 5) Did Romney Make a “Bet Against America”?: Some facts in support of this theory: Romney suspended his presidential campaign on February 7, 2008. At that time, the Case-Shiller Comp 20 (NSA) stood at ~175 on its way to ~139 in the spring of 2009. The S&P500 stood in the low-to-mid 1300s, off the fall 2007 high, on its way to the infamous March 2009 666 low. In 2011, we learned that:

And, earlier this year, there was this:

Paulson’s housing market short, of course, is now widely considered one of the greatest trades of all-time. Now, I do not know the depth of the relationship between Romney and Paulson. And, importantly, I don’t know when it began. The Romney campaign could, of course, answer those questions – assuming, that is, they ever get asked. But the question needs to be asked: Do Mitt Romney’s unreleased tax returns - in particular for 2008 & 2009 - contain evidence that he “bet against America” via participation in John Paulson’s wildly successful housing market short and/or, more generally, by being short equity markets during the decline? Of course, such behavior is hardly illegal. But I doubt his personal enrichment during that period (particularly via a housing market short) would play well with the tens of millions of Americans who were simultaneously being financially devastated. If this is the case, it could explain a lot. For example, Romney could not release, say, 2000 – 2007, withhold 2008 and 2009, and have 2010 and 2011 already in the public domain. That’s clearly a non-starter which would only focus the country on those two years and what might be contained in those two returns. The only alternative – which appears to be the way his campaign is playing it – is to declare everything prior to 2010 off-limits. Further, when McCain saw Romney’s returns and declared their contents benign, his (McCain’s) campaign would obviously not have seen the 2008 and 2009 returns, as they’d not yet been prepared or filed. Profiting handsomely from a housing/stock market short could easily be turned into an anti-Romney sound bite that would only add to the narrative of the candidate as a ruthless über-capitalist concerned only for himself while the 47 percent moocher class struggles. The bottom line is that there’s something in Mr. Romney’s tax returns that he doesn’t want made public. Having bet against America would be at the top of my list – far more devastating, in my opinion, than simply having paid an absurdly low rate. h/t You Know Who You Are @TBPInvictus Adding: I’d be remiss not to acknowledge the comments raising the possibility that Romney participated in the 2009 Swiss Bank Account Amnesty program. Yet another possibility – #6. |

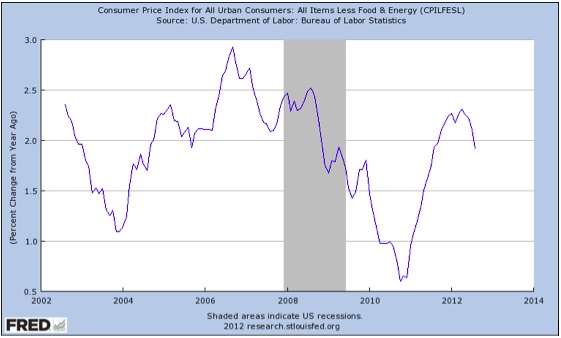

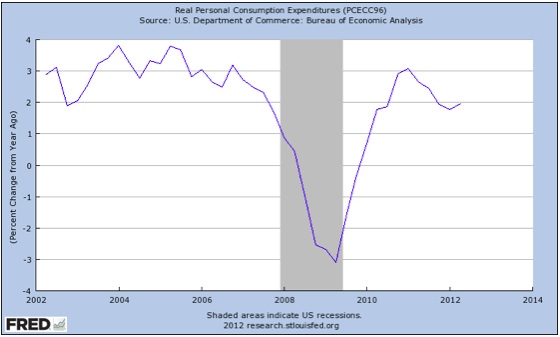

| Chinese 2013 GDP to decline to 6.5%, or even lower? Posted: 23 Sep 2012 10:30 AM PDT Mr El Arian of PIMCO reports that Chinese GDP will decline to between 6.5% to 7.0% in coming Q’s. Most analysts are forecasting GDP growth of around 7.5%, as suggested by Premier Wen. Recent reports by Chinese economists suggest GDP will be around 7.2% to 7.4%. Personally, I believe that Me Al Erian is right. Indeed I believe that Chinese 2013 GDP will be around 6.5% at best (indeed, likely lower), unless the new administration at that time introduces real and significant stimulus measures – a great deal of the recent announcements were essentially rehashing previously announced capex projects. Furthermore, announcements of massive projects by the regions are great, but wheres the money coming from boys and girls?. The rice bowl is empty. There are also increasing reports of material capital flight out of China which, if true (and it sure looks like it), does not inspire confidence. The greatest threat is that most analysts expect the Chinese authorities to engineer a “soft landing”. I’m not sure how they arrive at this conclusion. Indeed, I remain unconvinced. The next meeting of the Communist Party has indeed been set for 10th October and, in addition, the authorities have confirmed that the number of members on the Standing Committee of the Politburo will be reduced to 7, from 9 currently. There are reports that the responsibilities of most of the members, elected to the Standing Committee, will not be disclosed at this time – yet more uncertainty if true; The head of the Cypriot ruling Communist Party reports that the country should exit the EZ, if the EZ imposes tough bail out terms - well please do, these guys are living in cloud cuckoo land. The Cypriot government tried to get an additional rescue package from the Russians, but the Russians baulked. However, the important issue is that if Cyprus exits, the pressure will mount on Greece. Last week, representatives of the Troika announced that they would leave Greece to return in a week. Other reports (purportedly by IMF representatives) suggested that no announcement on Greece will be made ahead of the US Presidential election, though were officially denied by EU officials - officially denied – whoops that means that its likely to be true. Greece has yet to agree on all the additional budget cuts that the Troika is requesting. In addition, the IMF will face problems from their board if they are to provide more financing – unlikely. The EZ will not provide more financing and Greece’s request for more time is going to be a tough sell with, for example, the Finns, though it remains a possibility. The German finance minister states that the EZ wants Greece to remain in the Euro, but it must fulfil the conditions of its 2nd aid package ie all the proposed austerity measures - pretty close to impossible. Greece remains in the EZ because Mrs Merkel fears the contagion effects of a Grexit – that’s it. Her finance minister, Mr Schaeuble believes otherwise, though to date, Mrs Merkel has won the argument. Basically, a complete mess, as usual. It looks as if I will be reporting on Greece, yet again – I’m truly sorry; The Spanish banking, fiscal, economic and political situation is deteriorating so rapidly as to suggest that a major crisis is likely pretty soon. The EZ had previously agreed that a sum of E100bn be allocated to recap Spanish banks. The Spanish authorities have reported (even as late as last week) that they would need only E60bn to recap their banks, which I have been deeply sceptical of, as you know. Well what a surprise – recent reports suggest that Spanish banks will need more than E100bn. Results of a stress test are due out this coming Friday (28th September). Bad loans have risen to E169bn in July, or 9.86% of total loans, up from 9.42% in June and will be even higher at present, as the economy has continued to deteriorate, unfortunately at an increasing pace. The Spanish, it must be said, have been “economical with the truth” for many years and, even now, just don’t seem to understand that they have to come clean. The Spanish budget deficit for H1 2012 was north of +8.5% – remember the (upwardly revised) target for the current year is +6.3% – clearly impossible to meet. The head of the (economically very important – some 20% of Spanish GDP) Catalonia region is talking about breaking away from Spain – the meeting between PM Rajoy and the head of Catalonia, Mr Mas went very badly last week. Furthermore, Spanish authorities remain in denial and are trying to negotiate a condition light bail out, when they are being told in terms which are crystal clear (from the ECB and the EZ/Germany etc) that tight restrictions will be imposed. Spain faces 2 regional elections – in Galicia and the Basque country on the 21st October and the government does not want to agree to a bail out (with tough terms) ahead of that – the current PM promised that he would not accept, in effect, EZ oversight of Spain. Finally, the Germans are not keen to have Spain request a bail out at this stage, due to possible problems with their Parliament, the Bundestag - some members of the coalition are likely to oppose further aid packages and the government has had to rely on the opposition in the past to pass the necessary measures, for example on the establishment of the ESM. However, the opposition, whilst more pro Euro, has suggested that they will demand more political concessions if the government need their support, which clearly Mrs Mekel will not be keen on. Basically, yet another complete and total mess in the EZ. I have reported previously that Spain cannot sustain its current debt levels – I am now convinced about it. Adding more debt onto a country whose debt is increasing as rapidly as it is in Spain is a recipe for an impending disaster. Spain needs to introduce additional structural measures, including labour reforms (which, reluctantly, they are beginning to understand, though are still far from acting upon), though with the population becoming increasingly hostile (unemployment remains above 25%) the government is dragging it feet. As a result, the economy will continue to decline, as the EZ heads into a recession, just making the situation even worse. The current plan of kicking the can down the road is way, way past its ”sell by date”. Spain will need to restructure its debts – better to take that action now, accompanied with the necessary structural reforms and a sensible bail out package, in particular, to recap their insolvent banks. Yes, that will force countries such as Portugal, at the very least, to have to restructure its debt and address their banks, as well – quite likely other countries. However, the current plan is unworkable and will buy far less time than the allegedly “good and the great” in Brussels and the rest of the EZ believe. Essentially, it is time to take the painful, but necessary, action. It looks as if previous (pessimistic) estimates on US corn and soya production were unwarranted and that production forecasts will be revised higher. Farmers are beginning to report that yields are looking as if they will come in higher than expected. If confirmed it will be good news for EM’s in particular, as their inflation basket is weighted far more heavily towards food (and energy) and a resulting decline in inflation will allow central banks in the region to reduce interest rates. Oil prices have also declined, in spite of QE3 and the actions by the ECB and BoJ. Generally, I remain unconvinced as to the arguments that inflation will rise materially as a result of recent central bank action – certainly over the next 3 to 6 month horizon. Indeed, I believe that inflation will decline globally over that period; The latest CFTC data suggests that the number of Euro shorts has declined materially. Whilst a number of analysts expect the Euro to climb, I do not. The EZ has a remarkable ability to screw things up and deliver bad, rather than good, news. Outlook The FED, ECB and, to an extent, the policy action by the BoJ have been helpful for equity markets. However, dark clouds are beginning to gather, far sooner than expected. The situation in China is deteriorating quite fast and (much needed) remedial policy action has not been announced, as yet. Tensions between China and Japan are increasing. The EZ is, as usual, a total mess. The US is heading towards a Presidential election, with Obama, at present the clear favourite, though a “fiscal cliff” issue to address. However, the good news in the US is that the residential property market is doing much better than expected in my view which, if sustained, will have a material positive impact on the US economy. The hysteria over inflation, I believe, is way overdone, particularly over the next 3 to 6 months. There are strong deflationary forces out there, which suggests to little old me that inflation is likely to decline, rather than accelerate, in coming months. If I’m right, the good news is that more central banks globally will reduce interest rates – likely in my view. I am net long at present, though will be watching markets even more carefully – though, overall, I remain of the view that central bank policy action supports markets, for the moment. I continue to believe that the Euro and the A$ remain overvalued, against the US$ and other currencies - NOK possibly even the CAD, though there are (increasing) concerns relating to the Canadian residential property sector. Have a great weekend. Kiron Sarkar 23th September 2012 |

| Misinformation & Manufactured Myths Posted: 23 Sep 2012 08:00 AM PDT Your Sunday deep dive:

Never underestimate those who have a vested interest in hiding the Truth from the public . . .

Source: |

| Comediansincarsgettingcoffee: Carl Reiner and Mel Brooks Posted: 23 Sep 2012 06:00 AM PDT |

| Posted: 23 Sep 2012 05:30 AM PDT Some fascinating items to start your Sunday:

What are you eating for brunch?

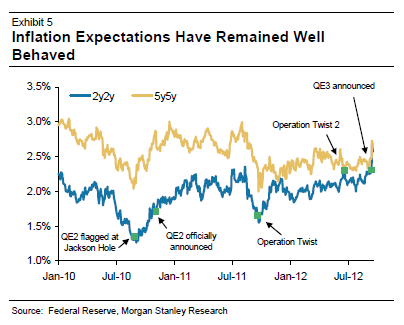

Inflation expectations have remained well behaved |

| Podcast: Learn to Accept Market Realities & Invest Accordingly Posted: 23 Sep 2012 05:00 AM PDT

Source: |

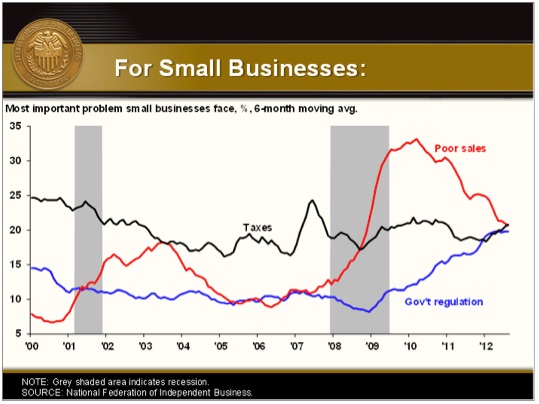

| QE Infinity: Unintended Consequences Posted: 23 Sep 2012 04:00 AM PDT QE Infinity: Unintended Consequences

5.5% Unemployment Is Acceptable |

| Posted: 23 Sep 2012 02:00 AM PDT |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 comments:

Post a Comment