The Big Picture |

- Iraq War Created More Terrorists

- Google’s Data Centers: An Inside Look

- 10 Thursday PM Reads

- Jimmy Kimmel Live – Who Won “Last Night’s” Debate?

- Earnings Multiple Expansion, QE & the Fed

- BP, finally, to do a good deal?

- Tech Talk: iPhone 5

- 10 Thursday AM Reads

- California Update

- China/Europe/Mortgage rates

| Iraq War Created More Terrorists Posted: 18 Oct 2012 10:30 PM PDT Congressman and Chairman of the House's Homeland Security Committee: Terrorist Threat Worse Now than Before 9/11The Washington Times notes:

If King is right, then it shows that America's anti-terrorism policies since 9/11 have been a dismal failure. 1 Why? D'oh! We're Supporting TerroristsInitially – in the name of fighting our enemies – the U.S. has directly been supporting Al Qaeda and other terrorist groups for the last decade. See this, this, this, this and this. If Al Qaeda is a greater threat now than before 9/11, maybe it's because – oh, I don't know – we're supporting them? Our Program of Torture Created TerroristsIn addition, torture creates new terrorists:

So the widespread program of torture under the Bush administration didn't help. Our Wars In the Middle East Have Created More TerroristsMoreover, security experts – including both conservatives and liberals – agree that waging war in the Middle East weakens national security and increases terrorism. See this, this, this, this, this, this, this and this. Ooops.

Killing innocent civilians is one of the main things which increases terrorism. As one of the top counter-terrorism experts (the former number 2 counter-terrorism expert at the State Department) told me, starting wars against states which do not pose an imminent threat to America's national security increases the threat of terrorism because:

(Indeed, Al Qaeda wasn't even in Iraq until the U.S. invaded that country.) And top CIA officers say that drone strikes increase terrorism (and see this). Furthermore, James K. Feldman – former professor of decision analysis and economics at the Air Force Institute of Technology and the School of Advanced Airpower Studies – and other experts say that foreign occupation is the main cause of terrorism University of Chicago professor Robert A. Pape – who specializes in international security affairs – points out:

1 King is a blowhard who basically thinks that all Muslims are terrorists … and who supported the Irish Republican Army for decades.

|

| Google’s Data Centers: An Inside Look Posted: 18 Oct 2012 04:00 PM PDT Very few people have stepped inside Google's data centers, and for good reason: our first priority is the privacy and security of your data, and we go to great lengths to protect it, keeping our sites under close guard. While we've shared many of our designs and best practices, and we've been publishing our efficiency data since 2008, only a small set of employees have access to the server floor itself. Today, for the first time, you can see inside our data centers and pay them a virtual visit. On Where the Internet lives, our new site featuring beautiful photographs by Connie Zhou, you'll get a never-before-seen look at the technology, the people and the places that keep Google running.

In addition, you can now explore our Lenoir, NC data center at your own pace in Street View. Walk in the front door, head up the stairs, turn right at the ping-pong table and head down the hall to the data center floor. Or take a stroll around the exterior of the facility to see our energy-efficient cooling infrastructure. You can also watch a video tour to learn more about what you’re viewing in Street View and see some of our equipment in action. Finally, we invited author and WIRED reporter Steven Levy to talk to the architects of our infrastructure and get an unprecedented look at its inner workings. His new story is an exploration of the history and evolution of our infrastructure, with a first-time-ever report from the floor of a Google data center. Fourteen years ago, back when Google was a student research project, Larry and Sergey powered their new search engine using a few cheap, off-the-shelf servers stacked in creative ways. We've grown a bit since then, and we hope you enjoy this glimpse at what we've built. In the coming days we'll share a series of posts on the Google Green Blog that explore some of the photographs in more detail, so stay tuned for more! Source: Google Blog |

| Posted: 18 Oct 2012 01:30 PM PDT My afternoon train reading:

What are you reading?

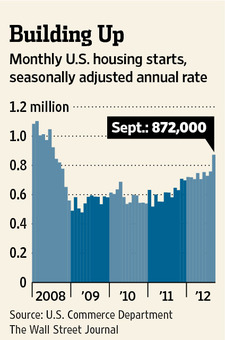

Why Housing Construction Is Rebounding

|

| Jimmy Kimmel Live – Who Won “Last Night’s” Debate? Posted: 18 Oct 2012 09:00 AM PDT Jimmy Kimmel Live took their cameras to the streets Wednesday in Los Angeles, conducting a casual poll on the outcome of the second presidential debate — at 2 p.m. PST. Four hours before the debate started, show producers asked people on the street which candidate fared better. "Who do you think won last night's debate?" the Kimmel interviewer asked. Hat tip Daily Caller

Website: http://www.jimmykimmellive.com |

| Earnings Multiple Expansion, QE & the Fed Posted: 18 Oct 2012 08:30 AM PDT

Over the years, I have described secular bull and bear markets as long periods of earnings multiple expansion and compression (respectively). What is the impact of the Fed’s QE on the P/E compression that began when the market peaked in March 2000 or October 2007? Dave Wilson of Bloomberg points us to Gina Martin Adams of Wells Fargo & Co. for the answer. Adams notes the parallels between QE2 and QE3 in terms of Standard & Poor's 500 Index's price-earnings ratio. Assuming the same patterns holds, current P/E expansion might be about a month or so away from peaking. Adams suggest that the S&P 500's higher valuation makes an argument for buying defensive stocks those companies least affected by economic swings. She likes food, beverages and consumer staples, along with health care.

Source: |

| BP, finally, to do a good deal? Posted: 18 Oct 2012 07:30 AM PDT Japanese PM, Mr Noda, yesterday ordered his Cabinet to draw up stimulus plans by November. The authorities are considering using reserves of around US$17bn, in this years budget. However, any greater sums will be politically impossible, given that the opposition (DJP) is blocking such measures and is demanding that the government call general elections. The current administration is pressing the BoJ to adopt a clearer inflation target – pretty dangerous stuff. I continue to be deeply sceptical of Japan’s ability to get out of its crisis and am getting even more bearish, if that is possible. However, today, the Nikkei rose on the much better US housing data, though the Yen is weakening – time to short?. Its been the graveyard trade in the past, but this time around………; Chinese Q3 GDP came in at 7.4% Y/Y, in line with expectations, though lower than the +7.6% reported in Q2. Industrial production rose by +9.2% in September Y/Y, up from the 3 year low of +8.9% in August, though slightly below the forecast of +9.0%. Retail sales rose by +14.2% Y/Y in September, the most since March this year, above the +13.2% forecast. Fixed asset investment, excluding rural households, rose by +20.5% in the 1st 3 Q’s, slightly higher than the +20.2% forecast. Chinese authorities (Premier Wen) suggest that their economy will pick up in the 4th Q. The numbers suggest some kind of stability, though as Dao Tong of Credit Suisse adds “I do not see China bouncing back quickly”, a sentiment I agree with. (Source Bloomberg) More importantly, home prices rose in 31 of the 70 cities the government tracks in September, compared with 35 in August. Prices fell in 22 cities, though overall, prices seem to have stabilised and, indeed appear to be rising; South African GDP growth is expected to decline to +2.3% this year (the governments forecast is +2.6%, but is likely to be revised lower), the lowest since the recession in 2009 and below the previous forecasts of +2.5%, before the recent spate of strikes. Unemployment is around 25% and is expected to increase. For full disclosure purposes, I remain short the Rand; Rosneft executives are in London and are discussing buying BP’s 50% share of TNK-BP, in exchange for a cash and shares package worth US$28bn. There is also talk about buying the oligarchs 50% stake in TNK-BP- allegedly for US$28bn in cash. The deal is likely to go ahead, though the financing of this deal is going to be an issue. Does this mean that finally BP has achieved at least one reasonable deal – well, miracles can occur. The deal, if concluded, will transform Rosneft into the worlds largest oil companies; Reports from the Troika suggest that agreement has been reached with Greece on additional austerity measures. Well great, but are the measures credible and/or will be implemented – well, if you believe that, ………No deal on Greece at the EU Heads of State meeting, though; Spanish bad loans rose to 10.5% of all loans in August, up from an upwardly revised 10.1% in July, 9.86% previously. An additional E9.3bn of loans were classified as in default. A total of E178.6bn of loans are in default.The NPL ratio has risen in the last 17 months and up from just 0.72% in December 2006. Lending declined by -1.1% in August from July, as did deposits, which are -8.7% lower Y/Y. The recent stress tests conducted by Spain’s advisers are well, lets just say, a flight into fantasy, as is Spain’s assertion that its banks will require under E60bn in new capital. Having said that Spanish government bond yields continue to decline (the 10 year yield is down to 5.41% this morning), as the market is focused on the potential of ECB buying and a rescue by the EFSF/ESM. Spain still dithers and a deal on requesting a bail out is unlikely until mid to late November. I continue to believe that Spain will have to restructure its debt in due course. Spanish authorities advise that they have raised 94.4% of its 2012 financing requirements, which will give the Spanish PM, Mr Rajoy, more time to dither – he’s already become the EU champion ditherer – next he goes for the global title; The EU starts is Heads of State meeting. The French are pushing for a banking union (well they would, given the significant problems with their banks), easier conditions on EZ bail outs and debt mutualisation. Germany on the other hand is emphasizing the need to supervise/verify EZ country budgets, calling for the appointment of an independent monetary commissioner. Don’t expect any real progress at this meeting – basically, yet another fruitless event. However, the really important issue, is that the traditional axis of France and Germany is (has?) broken down, with France becoming more Mediterranean and Germany retaining its Teutonic monetary stance, though, importantly, becoming the sole political leader in the EZ, certainly – the UK, will not play ball. Mrs Merkel as the 1st non elected political head of the EZ – quite possible, boys and girls. In addition, France, like Japan is looking more and more like a total basket case and I believe that Germany’s will, in the future, “loosen” its relationship with France; S&P cut Cyprus’s rating to B, from BB previously with a negative outlook. The current Communist regime is well. just nuts; The ECB’s bank supervision plan is illegal, according to a “secret” EU report – come now, there are no secrets within the EU. Its proposed powers go “beyond the powers” permitted under law. Well great, another EU cock up. The “secret” report advises that a treaty change will be required. The legal advice will increase Germany’s reluctance to agree to a speedy approval of banking supervision within the EZ; UK retail sales rose by +0.6% (ex fuel) in volume terms in September, from August, when they fell by -0.1% and above the +0.4% forecast. Retail sales (ex fuel) rose by +2.5% Y/Y, higher than expectations of +2.1%. Retail sales have risen by +1.0% in the 3rd Q, the most since Q2 2010. Some claw back, post Olympics, may well have flattered the numbers. However, with declining unemployment, overall a better inflation trend, better retail sales etc, etc, the UK should be doing better than official ONS data suggests. I repeat, the official ONS data is notoriously more pessimistic than reality. Sterling rose on the data; Interestingly, there appeared to be a sell of of US Treasuries yesterday, with the 10 year yield back up to 1.80%. That does not support the equity bears. For you bears out there – Repeat after me – DON’T FIGHT CENTRAL BANKS; US jobless claims rose by 46k to 388k in the week to 13th October, up from a revised 342k in the previous week and worse than the forecast of 365k. The better 4 week moving average rose to 365.5k, roughly the same as last weeks 364.75k. The data suggests that November NFP data may be weaker. Outlook Asian markets responded positively to the Chinese data. European markets are flat to slightly higher. The Euro is trading around US$1.30. Absolutely crazy, though expectations over a deal on Spain is holding it up – cant see a deal in the immediate future. I certainly will look to increase my shorts if the Euro rises further, but am on hold at present. Gold is trading at US$1741, with Brent (December) at US$112.68. US futures suggest a marginally lower open. A fiend of mine sent me a copy of a report from CLSA. I have to say, that their research is consistently amongst the best I read. However, on this one occasion, they compare the QE experience in Japan (who invented QE) to the US. Essentially, they have doubts as to whether it will work. I will write a piece on this subject, but to compare a demographically older population, as is the case in Japan, combined with crazy policies employed by the BoJ to date and their stratospheric debt levels, with the more proactive and targeted measures employed by the FED is pretty silly in my view. JAPAN IS DIFFERENT. Kiron Sarkar 18th October 2012 |

| Posted: 18 Oct 2012 07:15 AM PDT |

| Posted: 18 Oct 2012 06:48 AM PDT Here is my morning collection of confirmation biases:

What are your biases? > |

| Posted: 18 Oct 2012 05:00 AM PDT California Update

Some follow-up notes to our commentary about California cities are in order. The most recent news involves San Bernardino and other California cities attempting to defer payments to CalPERS. For a timely article on this subject see "San Bernardino defers CalPERS payments as it pushes toward bankruptcy eligibility" published by DebtWire. http://www.cumber.com/content/special/DWMuniSB1016.pdf Now let's incorporate some comments forwarded to us by Sherman Bruchansky, an enrolled actuary for over 30 years and an expert in pensions. We've known Sherman for a long time. He is forthright and doesn't mince words. His response concerning Vallejo and the situation there follows. "David, I have been following the Vallejo bankruptcy since it first occurred. My reading has informed me that there were no changes to police and firefighter pensions. They were and still are 90% of final year’s salary and can begin as early as age 50. Obviously, much overtime is worked in that final year to enhance the pension to over 100% of final pay. I have not seen where the cost of living increases were removed. This means that an officer can work 25 years, retire and collect 5 times or more in retirement than when they working. When I looked at this situation 3–4 years ago the average police officer was making $122,000 per year and the captains were over $200,000. As of this year the average police officer is costing the city $230,000 in salary and benefits and the average firefighter $211,000. For a city of 120,000 people this is unsustainable. Apparently another battle is looming with these unions, since this was not handled during the bankruptcy. As you well know, pensions like these are not available in the private sector under ERISA. The debtors vs. the unions litigation will be here again shortly. Apparently, many CA cities are in this same boat. I find it strange that private company pensions can be curtailed and terminated, but municipal pensions cannot be, or so the unions claim." Other commentaries about the California city systemic evolution have flowed from readers, analysts, and reporters who cover those cities in national and California-based media. Some Wall Street "mavens" have taken the position that the California city problem is "not a big deal." Those views tend to be centered in the "sell side" where the affiliated firm is in the business of marketing the municipal bonds of many California jurisdictions. Note: it is hard for a broker to sell a bond when his firm is recommending caution about holding it. Readers are invited to draw their own conclusions about any biases implied here. Other views, that are more in agreement with us, seem to be concentrated on the "buy side." Buy side analysts are usually more independent and therefore less constrained about making negative or cautionary recommendations. That said, many are restrained in the degree with which they take positions on risk. This is especially true when common fund vehicles are used. Time will tell which view is correct. Meanwhile, Cumberland's view originates in a fee for service only management firm. We do not sell bonds. We ONLY manage separate accounts and we are state specific in almost all 50 states (I think the current count is 48). We emphasize risk management and avoidance is problems; thus, we tend to sell early. This view of preserving capital and diminishing risk is the driver behind our investment conclusion about California. In sum, we see developments in CA and also in Illinois as the worst two states in the country. In both, the source of trouble is the underfunded pension systems and the underfunded or unfunded post-retirement benefit systems. A final point is necessary when it comes to selection of each individual bond. It is important to distinguish among the various seniority status levels of claims on local budgets. There are differences among these claims. For example, an essential-service revenue bond secured by a first lien on the revenue of a municipal water utility has been upheld by courts as a senior claim. In this example, the bond holders lend money to the municipality, its water utility, or other governmental form. The money is used to drill wells, maintain water lines, process and purify water, maintain reservoirs, and do all the other things that happen when one is engaged in the municipal water business. The revenues from the sale of the water to municipal users secure, and make the payments to, the bond holders who loan the money to the water company to create the water project. That is usually structured as a senior claim. In addition, the water company promises, through covenants in the bond indenture, to maintain sufficient coverage and financial reserves. This protects the bond holders, so that they are paid the agreed principal and interest in a timely manner. In this example, if the town folds up, ceases to exist, becomes a ghost town where no citizens remain and there are no customers to buy water, the water utility bond holders will be in trouble. The bonds will default. That is not the dominant case in the cities we are talking about in California or elsewhere. Why would anyone want to buy the bond of a water utility in a city in which the population was declining, the economic ability to sustain and develop the town was disappearing, and the likelihood that the water company would continue to exist was growing increasingly remote? Anyone who bought such a bond would be guilty of financial foolishness. The point of the above description is that there are many tax-free municipal bonds issued to support essential-service revenues. These bonds have senior claims and are very well protected. The bond holder can expect payment of principal and interest in a timely manner, even when circumstances in the economic arena are adverse. That safety is not the case when payment streams are funded without such detailed and legally upheld structural commitments. We see examples of the latter case taking place in California cities where lease bonds, certificates of participation, and other forms of indebtedness are being used to finance these cities. These are weaker claims that are not tied to specific general obligations or specific revenue liens. They are more likely to be tied to the availability of monies in the general funds of the cities. What happens when the city is trying to use Chapter 9 bankruptcy or other legal forms to diminish its payments? Standard & Poor's has warned about cities engaging in the use of Chapter 9 to avoid payments. "Willingness to pay" is the code term for the political resolve of a city governing body to meet obligations. So what happens in these communities? In order to demonstrate that they have a financial emergency, they must, by definition, not be able to make payments. So they play games with municipal budgeting in order to weaken the credit structure of the more questionable types of bonds, notes, certificates, or lease payments. The communities can then go to the state and say they do not have the money; therefore they have an emergency and need help. At Cumberland Advisors we are avoiding this level of weaker credit. We don't want to own it. We don't advise clients to buy it. If a client brings a portfolio into our firm for management and the client has already purchased this type of bond, we will advise that it be sold. In sum, don't lend your money to a municipal government, or any government, that is not actively demonstrating the commitment and willingness to pay you back. If you do, you engage in financial foolishness. In Cumberland's view, there is a systemic problem in California. It is rooted in the pension system, which has promised more than it can deliver. California has enacted legislation that is supposed to address this problem over a long period of time, but we are highly skeptical as to whether the legislation is sufficient. We also think the economic assumptions that led to the legislation may be flawed. We will not know for several decades whether the legislation can cure the pension problem. Meanwhile, as investment advisors, we do not want our clients to find out the hard way. Our position continues to be that there is systemic municipal risk in California. It is evolving in the cities now and is likely to spread. The old cliché applies: there is never just one cockroach. In this case, we already know there is an infestation of cockroaches in California, and they seem to be spreading. ~~~ David R. Kotok, Chairman and Chief Investment Officer, Cumberland Advisors

|

| Posted: 18 Oct 2012 04:49 AM PDT As has been widely known, China’s economy continued to slow in Q3 to a rate of growth of 7.4% (believe it or not, focus on trajectory). It’s the slowest pace since Q1 ’09 but in line with expectations. Other Chinese stats overnight point to stability and in particular the shift to consumer consumption. Retail sales rose 14.2% y/o/y, the best rate since March and above est of 13.2%. IP was up 9.2% y/o/y and fixed asset investment was higher by 20.5% ytd, both a touch better than expected. On the signs of economic stability, the Shanghai index closed up 1.2% to a one month high and the Hang Seng index rallied for a 6th straight day to the highest since March. The yen is falling to a 2 month low vs the US$ and it helped to spike the Nikkei by 2%. European leaders meet where there will be more discussions but not decisions as the WSJ said. Spain sold 4.61b euros of 2′s, 3′s and 10′s, above their target amount of 4.5b and with yields continuing to drop, we’ll see if Spain continues to drag its feet. UK retail sales in Sept were better than estimated. In the US, the avg 30 mortgage rate according to Bankrate.com rose to 3.46% from 3.43%, the highest since Sept 24th. The Fed’s endless QE plan has lowered rates by a whopping 11 bps. Cost/benefit analysis anyone? |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 comments:

Post a Comment