The Big Picture |

- Investing in China — Pitfalls and Promise

- Why Don’t Bad Ideas Die ?

- Hospitals: The cost of admission

- 10 Tuesday PM Reads

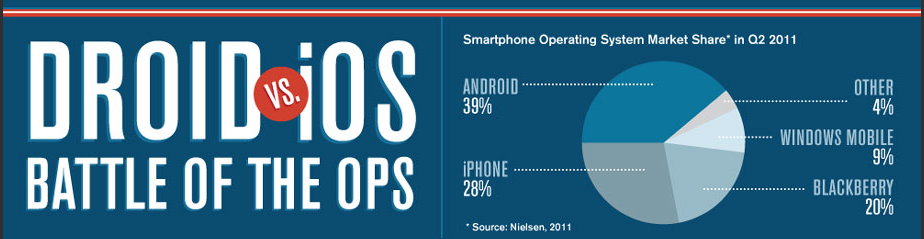

- Droid vs iOS

- Social Security: Best-Funded Government Program

- Materially better German investor confidence (ZEW) data

- Penny Stock Trading Jumped >50% in November

- 10 Tuesday AM Reads

- Trade Deficit/imports, exports weak

- Peak Oil or Peak Energy? – A Happy Solution

- Nighttime Earth From Space

| Investing in China — Pitfalls and Promise Posted: 11 Dec 2012 10:00 PM PST Great People – Terrible Economic Model

This is where China is heading. All those airports, railroads, empty cities etc etc are going to turn in an ever lower return on capital. Chinese proudly point to their spanking new infrastructure. Americans in the post Civil War era could have proudly pointed to their new, partly subsidized coast to coast railroad system as well. But British investors in American railroad securities often lost their shirts. So it is today with investors in Chinese stocks. Yes the Chinese people are hardworking, literate, relatively obedient and totally obsessed with getting rich. Good qualities for investors and ones that go a long way to offset what is really a terrible economic system. But investors have to be careful. Observers have noted with some wonderment that the Shanghai A Share Index has gone down for three straight years. No surprise as far as I'm concerned. The companies in the A Share Index are largely majority state owned enterprises (SOEs). These companies on balance destroy capital. Their investment decisions are often made with State/Party directives in mind and they are recipients of subsidized below market bank loans. And the SOE's have preferential treatment as far as access to the Shanghai stock exchange goes. The contrast couldn't be greater with true private sector Chinese companies which in many ways are starved for capital. I have looked at a number of private Chinese companies and with company after company I can find no or low debt. Growth is funded out of internal cash flows. Most of the true private sector companies have had to raise equity capital abroad in New York or Hong Kong. Forcing their own companies to raise capital in the US doesn't make a whole lot of sense for China, which has such a high savings rate and a huge cache of foreign reserves. What seems to have happened is that the bulk of China's savings are misdirected into the state sectors while the true private sector companies have to scrounge for capital abroad. This has led to a number of problems and value discrepancies. It is curious that the Hong Kong stock exchange wasn't more aggressive in getting these Chinese companies to list in Hong Kong. As discussed in a previous essay, after an initial infatuation phase the Chinese companies listed in the US have become "orphans", misunderstood, suspected of being frauds and grossly undervalued in many cases. Of course it hasn't helped that some of them were indeed frauds. One Way to Buy China—Invest in Southeast Asia Investing in companies is ultimately about investing in people. One ideal combination (not the only one to be sure) is the Chinese work ethic (the Puritan ethic as it used to be called in the US) without the Chinese economic and legal system. And in a number of Southeast Asian countries, especially Singapore, Malaysia, Thailand and the Philippines, that is what you get. You get a business community which is signifcantly Chinese in origin. Chinese entrepreneurs are legends in this part of the world. But you also get market friendly legal/economic systems that are either British (Singapore, Malaysia) or American (the Philippines) in origin or at least heavily influenced by Western legal traditions (Thailand). It goes beyond that. Southeast Asia is the destination of an ever increasing number of Chinese tourists as well as foreign investments. China is the number one destination for ASEAN (Association of South East Asian Nations) exports. So to a large extent Southeast Asia is part of the China growth story but without some of the drawbacks. Of course, if China were to have a really hard landing that would be a negative for Southeast Asia as it would be for the rest of the world. But Southeast Asia is more than a China story. Consider:

The major exception to this otherwise favorable picture is Vietnam. Vietnam has a Chinese style State/Communist Party controlled political and economic system. It's no wonder Vietnam has been such a big disappointment in recent years. Vietnam spent a thousand years or so fighting off Chinese attempts to make the country into another Chinese province. But as any visitor will attest Vietnam seems in so many ways – culturally, politically – like China. The one disadvantage for foreign investors in Southeast Asia is that most of the companies are small and do not have ADRs in New York. But herein lies the opportunity for those willing to take the time. These markets are underfollowed and growth opportunities do exist. These companies have websites usually in English. Information thanks to the internet is not the problem it used to be. Some Statistics on Southeast Asia 2012 GDP Growth% Gov Exp/GDP% Population(Millions) Chinese Orig % incl mixd Singapore 2.4 17.7 5.4 74 Malaysia 5.1 28.2 29.0 25 Thailand 6.0 24.1 64.5 30-40 Philippines 5.5 19.2 97.7 25 Indonesia 6.3 19.8 244.5 3.7 Sources: IMF, Economist, Wikipedia

Regulators from Hell (1)—Will All Chinese Stocks in the US Be Delisted? The SEC said Dec. 3 that Deloitte Touche Tohmatsu CPA Ltd., Ernst & Young Hua Ming LLP, KPMG Huazhen and PricewaterhouseCoopers Zhong Tian CPAs Ltd. have refused to cooperate with accounting investigations into nine companies traded in the U.S. The SEC hasn't named the nine stocks it's focused on. The issue is the US accounting affiliates will not provide documents required by the SEC for its investigation of fraud because they claim this would be in violation of Chinese law. The SEC is threatening the US firms with penalties if the documents are not provided. If the SEC order is carried out to its logical conclusion all Chinese stocks will eventually have to be delisted from US stock exchanges since no accounting firm acceptable to the SEC will put itself in the position of having to not comply with an SEC order . This would mean the delisting of hundreds of companies including some major ones like Baidu or Sina. It also may bring problems for American multinationals that operate in China and require local auditors for these operations. This SEC order would bring about a major destruction of value for US investors as the rug of liquidity would be pulled out from under these Chinese stocks. Leveraged buyouts would be transacted at a fraction of these firms' true value. I cannot judge who is being unreasonable in this case—the Chinese or the Americans – and there certainly is a need for vigilance against fraud with Chinese stocks. But from the viewpoint of the American investor in Chinese stocks this SEC action has a "burn the village in order to save it" feel. One would hope adult behavior could prevail and this issue gets sorted out. One would have thought this issue could have been sorted out before the Chinese firms listed in the US. The delisting of all Chinese companies would be another nail in the coffin of New York's hopes to become the global center for equity financing. As if Sarbanes Oxley wasn't enough. If the Hong Kong exchange were smart, it would open a special pathway for these companies to migrate from New York to Hong Kong. Regulators from Hell (2) – Go for the Money

The above is one unhappy Hong Kong journalist's opinion. But it is pretty much my opinion as well. HSBC and Standard Chartered have been made to pay enormous fines for ostensibly violating American foreign policy. HSBC and Standard Chartered have a long and honorable history going way back in Hong Kong. They are still respected institutions there and comprise, along with Bank of China, the note issuing banks in the territory. The American regulators on the other hand represent bankrupt Federal and State governments. Because of the size of the US economy and the role the dollar plays in the world economy, dollar transactions must be cleared through the US. Like the medieval barons of old who exacted extortionate tolls on commerce transiting through their territory, the US regulators are doing likewise. -Peter T. Treadway ______________________________________________________ Dr. Peter T Treadway is principal of Historical Analytics LLC. Historical Analytics is a consulting/investment management firm dedicated to global portfolio management. Its investment approach is based on Dr. Treadway's combined top-down and bottom-up Wall Street experience as economist, strategist and securities analyst. Dr. Treadway also serves as Chief Economist, CTRISKS Rating, LTD, Hong Kong. |

| Posted: 11 Dec 2012 04:30 PM PST I was having a conversation the other day about some of the dumber ideas in finance that don’t see to want to die — which led to a laundry list of really bad economic memes, investment concepts, and other assorted silliness. But all of this begs the question:Why don’t bad ideas die? Why are there all of these zombie concepts that are clearly wrong, money-losing foolishness that seem to hang on forever? Where is Darwin in all this?

Any suggestions? I am really curious as to why this is . . . |

| Hospitals: The cost of admission Posted: 11 Dec 2012 03:00 PM PST Want to know why medical care is so expensive int he US, check out this video: Steve Kroft investigates allegations from doctors that the hospital chain they worked for pressured them to admit patients regardless of their medical needs. December 2, 2012 4:42 PM |

| Posted: 11 Dec 2012 01:30 PM PST My afternoon train reads:

What are you reading?

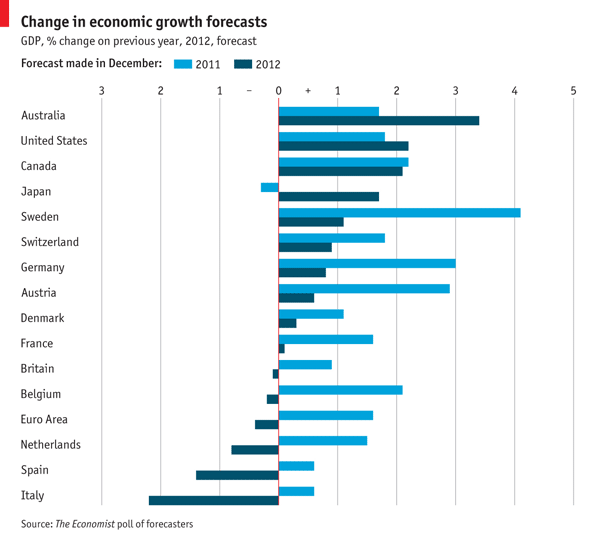

Precarious predictions |

| Posted: 11 Dec 2012 11:30 AM PST |

| Social Security: Best-Funded Government Program Posted: 11 Dec 2012 10:00 AM PST |

| Materially better German investor confidence (ZEW) data Posted: 11 Dec 2012 09:30 AM PST Australian NAB November business confidence declined to -9, from -1 in October, the lowest since May 2009. The business conditions index came in at -5, in line with October, the weakest since March 2009. The confidence index is currently 15 points below the long-run average of +6. The report reveals that retail, manufacturing and wholesale was weak, with the mining component slumping to -4, from +25 previously. Construction was flat, with manufacturing the weakest. The A$ declined on the news, but has rebounded back sharply – currently US$1.0514 – amazing !!!; Recent polls suggest that Mr Abe’s party, the LDP, together with their coalition partner, the New Komeito party, are heading for a victory in the lower house of Parliament – Reuters suggest that they may gain 300 seats out of the 480 seat assembly. The Japan Restoration Party, a conservative and nationalist leaning party, could gain a further 50 seats. Mr Abe has proposed that the BoJ act more aggressively in terms of monetary easing and has suggested a programme of fixed asset fiscal stimulus. Mr Abe has also been more vocal on China’s territorial claims in the South China Seas. A change in Japan’s pacifist constitution would require a 2/3rd majority in both the upper and lower houses, as well as a public referendum, though the interpretation of that policy is easier to accomplish, reports Reuters Chinese November bank loans amounted to Yuan 522.9bn (US$84bn) of local-currency loans, reports the PBoC, lower than the Yuan 550bn forecast and Yuan 562.2 in the corresponding period last year. M2 rose by +13.9bn Y/Y, lower than the forecast of +14.1%. Total financing came in at Yuan 1.14tr in November, the lowest since August and as compared with Yuan 1.29tr in October. Somewhat disappointing data; Greece has just announce that they received some E32bn nominal of bonds as part of their tender. The average price was E0.335 on the Euro. Given the price, the Greeks slightly missed (by E450mmn) their target – another fudge will occur; Having announced that he would resign as PM over the weekend, Mr Monti has hinted that he may now stand as a candidate for PM. Mr Monti is expected to announce his decision this week; Italian business lobby, Confidustria, has revised lower 2013 Italian GDP to -1.1%, from -0.6% previously. GDP is expected to contract by -2.1% this year, slightly better than their previous forecast of -2.4%. Debt to GDP is expected to come in just below 125.9% this year and 126.7% next; German ZEW December (investors) confidence came in at +6.9, significantly better than the -11.5 expected and the -15.7 reading in November. The economic sentiment index is positive for the 1st time since May 2012. The current situation component came in at 5.7, slightly lower than the 6.0 expected and 5.4 in November. The survey, albeit less important than the IFO survey, suggests that Germany will not face a recession next year. Exports to the US and the ROW (ex the EZ) are rising materially. Having said that Germany is expected to announce negative GDP this Q, with the economy stagnating in Q1 2013; The US trade deficit widened by +4.9% in October to US$42.2bn, from a downwardly revised US$40.3bn in September, though below expectations of a deficit of US$42.7bn. Exports declined by -3.6%, the most since January 2012. Reduced agricultural exports, due to the drought, hurt exports. Exports declined to US$180.5bn, the lowest since February and US$187.3bn in September. However, imports declined by -2.1%, the lowest since April 2011; US wholesale inventories rose by +0.6% in October, lower than the +1.1% increase in September, though higher than the +0.4% expected. US NFIB small business optimism index came in at 87.5 in November, lower than the 92.5 expected and 93.1 in October; Outlook Asian markets closed mixed. European markets are higher on the better German ZEW news. US markets are higher as well, as there is more optimism over the possibility of a deal between the Democrats and the Republicans on the fiscal cliff. In addition, the markets expect that the FED will increase its QE programme tomorrow. The ZEW data has also helped the Euro, which is currently trading around US$1.30. Spot gold is trading around US$1707, with January Brent at US$106.60 – oil has been weakening recently and my chartist friends suggest suggest that oil could weaken even further. All awaiting the FED’s decision re potentially an increased QE programme tomorrow.

Kiron Sarkar

12th December 2012

|

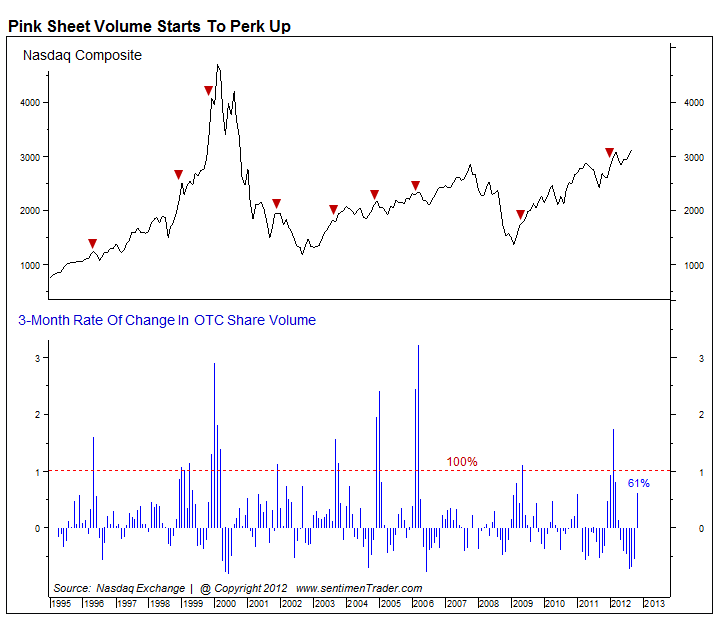

| Penny Stock Trading Jumped >50% in November Posted: 11 Dec 2012 08:30 AM PST click for larger chart

There is not much to say about this, other than its not where you want to see the flows of capital rolling to over the long haul . . . |

| Posted: 11 Dec 2012 06:45 AM PST My morning reads:

What Are You Reading?

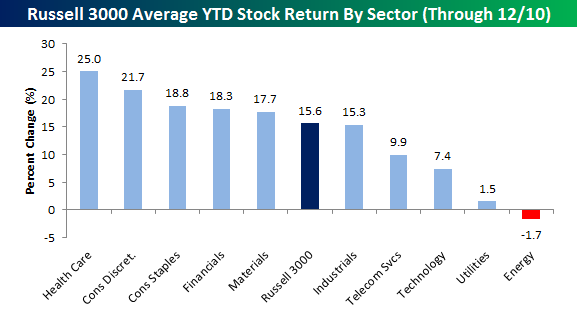

Russell 3000 Top Performing Sectors YTD |

| Trade Deficit/imports, exports weak Posted: 11 Dec 2012 05:51 AM PST While out online late yesterday, today’s paper version of the WSJ is reporting that the “Obama-GOP Cliff Talks Take Positive Step…Neither Side Gives Details, but Strict Moratorium on Public Comments is Considered Sign of Progress at Bargaining Table.” We’ll see but while we wait, small businesses are getting more and more fed up. The NFIB small business optimism index was not optimistic as the index fell sharply to 87.5 in Nov from 93.1, to the lowest since March ’10. Most glaring, those that Expect a Better Economy plummeted to -35% from +2%. The NFIB claims that 1mm small businesses will be hit by the hike in taxes on the top 2%. In Asia, China said bank loans in Nov totaled 523b yuan, bouncing a touch off the lowest since Sept ’11 but was a bit below expectations of 550b. Money supply growth was 13.9% y/o/y vs the est of 14.1%. In response to both data points, the Shanghai index fell .4% off its 4 week high. Business confidence in Australia fell to the lowest since Apr ’09 as they deal with a strong Aussie$ and China moderation. Indonesia left rates unchanged as expected. In Europe, investors are optimistic for the German economy over the next 6 mo’s but less so currently. The ZEW expectations component rose to +6.9 from -15.7, positive for the 1st time since May but the Current situation was +5.7 vs +5.4 (lowest since June ’10), slightly below the est of +6.0. Spain sold 12 and 18 mo bills that went well as 3.89b euros were sold vs their max target of 3.5b. Yields in Spain and Italy are lower after yesterday’s move up. Greek stocks are up 1.6% and the 10 yr bond is at a new high of .44 as more signs point to Greece meeting the 30b euro buyback target level. |

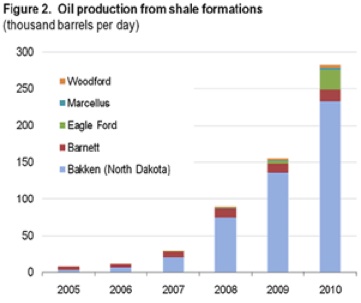

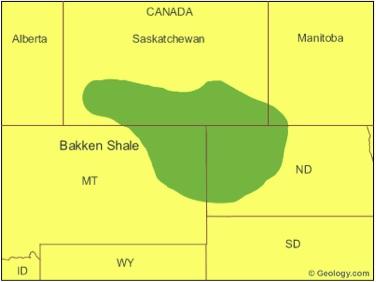

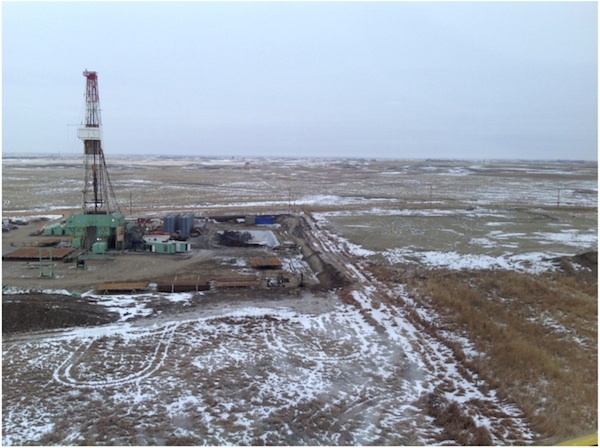

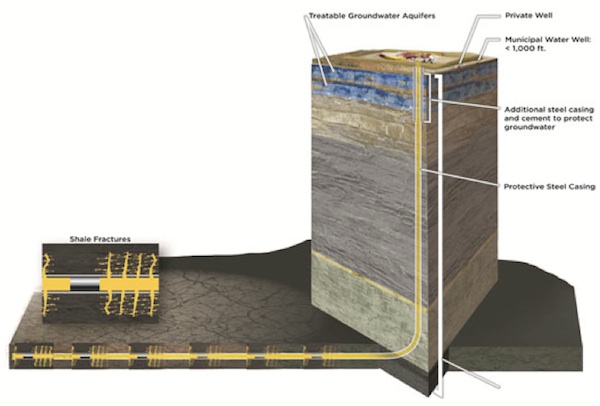

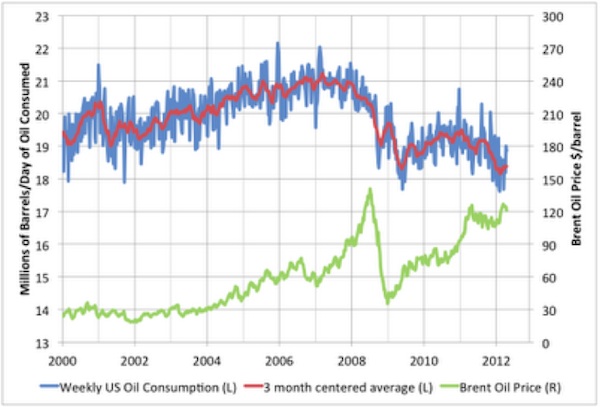

| Peak Oil or Peak Energy? – A Happy Solution Posted: 11 Dec 2012 05:30 AM PST Peak Oil or Peak Energy? – A Happy Solution

Looking Over My Shoulder |

| Posted: 11 Dec 2012 05:00 AM PST click for more photos |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 comments:

Post a Comment