The Big Picture |

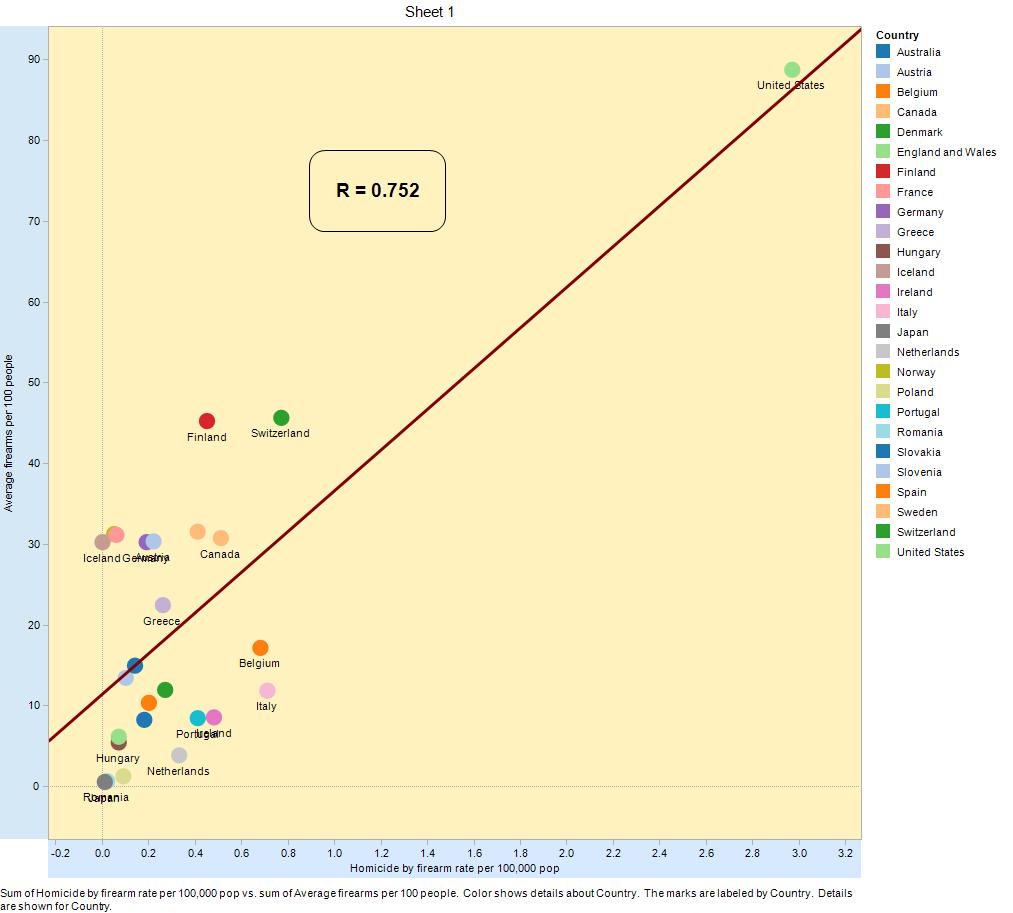

- Nate Silver: Why Gun Rights Rhetoric Is Winning

- Gift Giving Guide for the Traders in Your Life

- 10 Tuesday PM Reads

- U.S. Bank as Trustee v Merrill Lynch Mortgage Trust

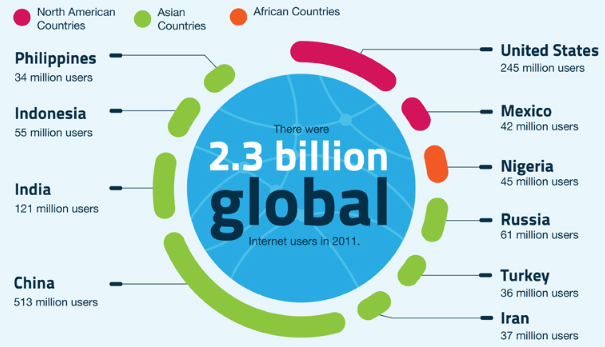

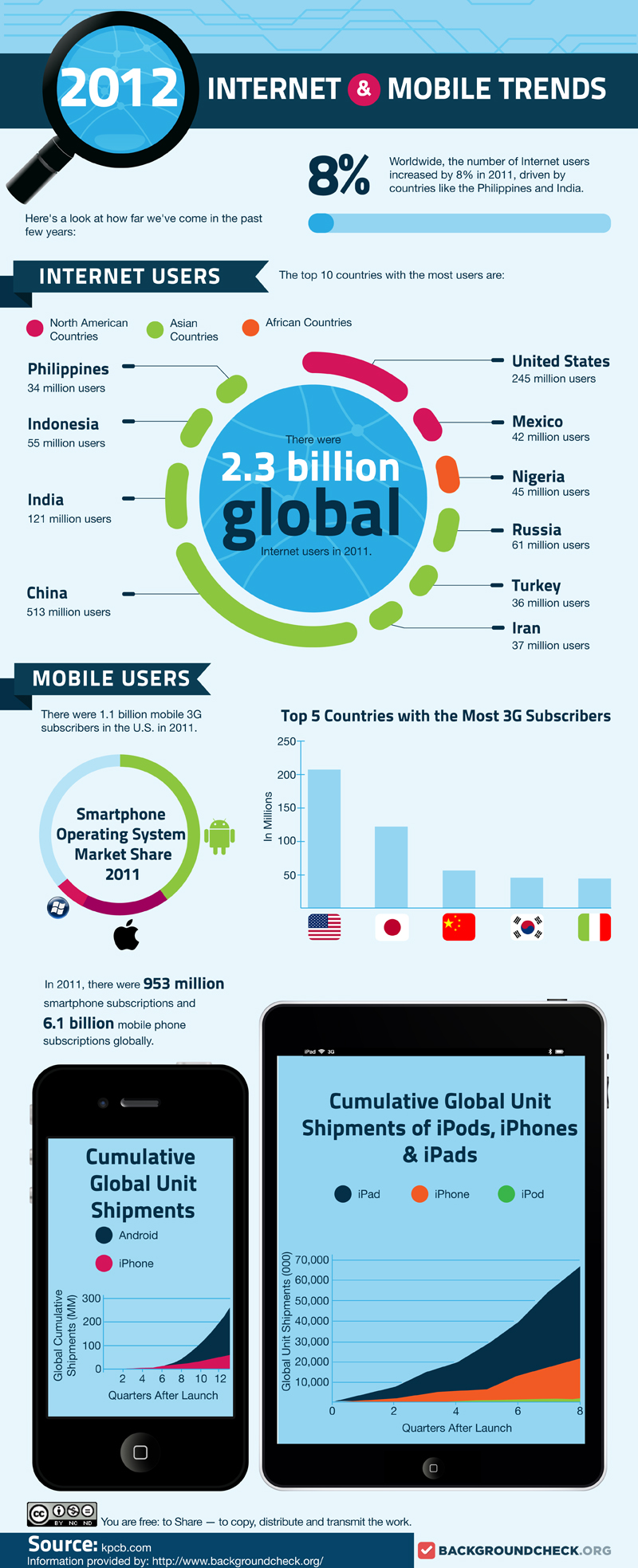

- Infographic: 2012 Internet & Mobile Trends Report

- QE til 6.5% Unemployment? How’s 2018 sound?

- Chinese home prices rise

- 10 Tuesday AM Reads

- Welcome to Crony Capitalism

- Know Your Myers-Briggs Type Indicator Type

- Facebook Destroys Instagram

- Rare Shocks, Great Recessions

| Nate Silver: Why Gun Rights Rhetoric Is Winning Posted: 18 Dec 2012 07:44 PM PST Nate Silver, author “FiveThirtyEight” blog, talks with Bloomberg’s Tom Keene about the discussion over gun right vs. gun control in the United States. He speaks on Bloomberg Television’s “Bloomberg Surveillance.” |

| Gift Giving Guide for the Traders in Your Life Posted: 18 Dec 2012 04:00 PM PST Gather round for the Trader version of our Shopmas suggestions. These aren’t the usual Bull & Bear cliches you typically see — its all good stuff for the trader in your life. (You can see out earlier suggestions: part one, part two and part three) This round of Shopmas ideas is for the guy who executes your trades and helps you work out of trouble — the list has something for everybody, be it gunslinger, technician or clerk on your holiday shopping list whose P&L has been very, very good. With tongue firmly placed in cheek, here is our gift giving guide for the trader in your shop Go forth and stimulate : ~~~

This 300-page sticky notepad is perfect for your best poison pen notes, letters of resignation, hit lists, and office to-do’s. Murder, Ink comes complete with blood spattered pen, so it’s sure to make a statement on your desk right beside that suspiciously sharp letter opener. Each pad and pen is packed In a full-color illustrated giftbox. • WTF Stamp $9 Every desk gets trade confirms they don’t recognize — the standard response is “DK” (Dont Know).

These days, trades are coming back that are simply too silly to DK — they demand, a WTF!?! ~~~ • Trading/Wall Street Movies: After a long day in the turret, what can be more relaxing than kicking back and watching films about trading? Here are 4 recommended flicks for your keyboard jockey: -Eddie Murphy Trading Places ($13) Only tangentially related to trading, but filled with lots of oft quoted lines, this comedy is good for everyone. ~~~ • Paul Wilmott Introduces Quantitative Finance $57

Adapted from the comprehensive, even epic, works Derivatives and Paul Wilmott on Quantitative Finance, it includes carefully selected chapters to give the student a thorough understanding of futures, options and numerical methods. Software is included to help visualize the most important ideas and to show how techniques are implemented in practice. There are comprehensive end-of-chapter exercises to test students on their understanding. ~~~

Years ago, I was wearing a Ted Baker tie to a Fox News shooting. Just before we shot, I went to change into something much less loud, and the director stopped me, saying "TV washes everything out — the bright tie will pop. It works well — Trust me on this." I did, it did, and now all of my favorite ties come from Ted Baker. They are bright, colorful and fun. If you must wear a noose around your neck for work, well then this is the way to go. NYC just opened a new Ted Baker Store on 5th Avenue. And for you bargain hunters, you can find Ted Baker on sale at Century 21 — normally $89, on sale for $30-40. ~~~ • Olympus 142665 DM-620 SLV Voice Recorder $107

- Great audio recording quality Requires an adapter to plug into a phone jack ~~~

Investors have too often extrapolated from recent experience. In the 1950s, who but the most rampant optimist would have dreamt that over the next fifty years the real return on equities would be 9% per year? Yet this is what happened in the U.S. stock market, as the optimists triumphed. Sometimes an optimist is someone who never had much experience — and this book extends that experience across regions and across time, presenting a comprehensive and consistent analysis of investment returns for equities, bonds, bills, currencies and inflation, spanning sixteen countries, from the end of the nineteenth century to the beginning of the twenty-first. ~~~ • Books for the Trader's Library Three different book shelves for the different traders in your life. The Newbie Trader (Starter pack) The Historian The Technician ~~~

Spark 'em up with the Lotus 21 Twin Flame Torch Lighter ($49) — A great piece of hardware (I own two) ~~~ • Parrot AR.Drone 2.0 Quadricopter Controlled by Smart Phones/Tablets – Orange/Blue $300

Sometimes, you cannot get out of your chair, but you need to see whats going on in other parts of your hedge fund. The Quad receives 720p high-definition live video streaming to smartphone or tablet while flying; you can record & shares videos & pictures straight from the copter — great for compliance or sharing trails of inside information with the SEC to save your own bacon! Send incriminating evidence straight from your live flight videos in HD and send them directly to YouTube ~~~

These are solid, high performance multi-filter air cleaner is very quiet,efficient and effective. The Hepafilters can clear the air in a dirty trading room in 20 minutes. Pulls all of the contaminants, pollens, dust, smoke, allergens from the air and holds them in replaceable filters. The size of these should be a function of the size of the room they go in. Energy Star 3-speed air purifier with HEPASilent technology ~~~ • Spa Massage De-Stress Muscle Release: $150-500 This deeply restorative treatment is specifically designed for tight, stressed and aching muscles. Too many hours spent sitting on the trading desk leaves your body stiff, tight and painful. Swedish and cross muscle fiber massage techniques with stretching and draining are combined with essential oils known for their beneficial effects on the circulation. Try the Nickel Spa for Men: They do massages, manicure/pedicures, facials, and the infamous "Boyzillian" (if you have to ask, you don't want to know). ~~~ • Pax premium loose leaf vaporizer $250

“Easy to use, very solid and high quality. Feels right when you have it in your hand. Taste is awesome without the harshness. Extremely satisfied and not disappointed at all." ~~~

Gorgeous heavy duty briefcase comes in a variety of colors + a 100 year warranty. Its not light, but if you ever have to make a dash for the border, this is the bag you want to throw your bearer bonds into. -Crafted from 100% Full-grain boot Leather but thicker. http://www.amazon.com/exec/obidos/ASIN/B003JX5ANW/thebigpictu09-20 ~~~

The Aeron Chair? Thats so 1990s. This is the chair for anyone stuck in their seat for long periods of time and who needs to be alert, rested and comfortable (but not too comfortable). You point. You click. You fixate on your computer screen. And you sit still for hours. Mesmerized. Your body screams, “Move!”–unless you’re seated in Embody. Designed specifically for people who sit at computers, Embody makes you feel like you’re floating. It promotes health-positive sitting, creating harmony between you and your computer to help you focus on your work and think more clearly. In fact, it’s the first work chair that supports your body and your mind. ~~~

Especially if you are willing to take a day off from trading and go midweek — Weekdays (18 Holes): $130.00 ~~~ • CineMassive Trio Gemini 17D 6 Screen holder : $1,749

Using a multi-screen display for the first time is often described as feeling like having received a new lobe of brain. ~~~ • Caddy for a Cure: ($5,000 and up) For the avid golfer who is having an especially good year.

The guys I know who did this lost their minds, saying it was the greatest experience on a golf course they ever had. And, 100% of the proceeds goes to charity. ~~~ • Breguet Grande Complication Tourbillon Messidor $154,200 For the star trader on your team, this little gift will let him know that he — and his P&L — are appreciated by senior management. Sure, the rest of the office may resent the indulgence of this gift, but they are easily replaced off of Craig’s list.

~~~

That’s our tongue in cheek guide to Gift for Traders for 2012. If you have any other gift suggestions, by all means use the comments |

| Posted: 18 Dec 2012 01:30 PM PST My afternoon train reads:

What are you reading?

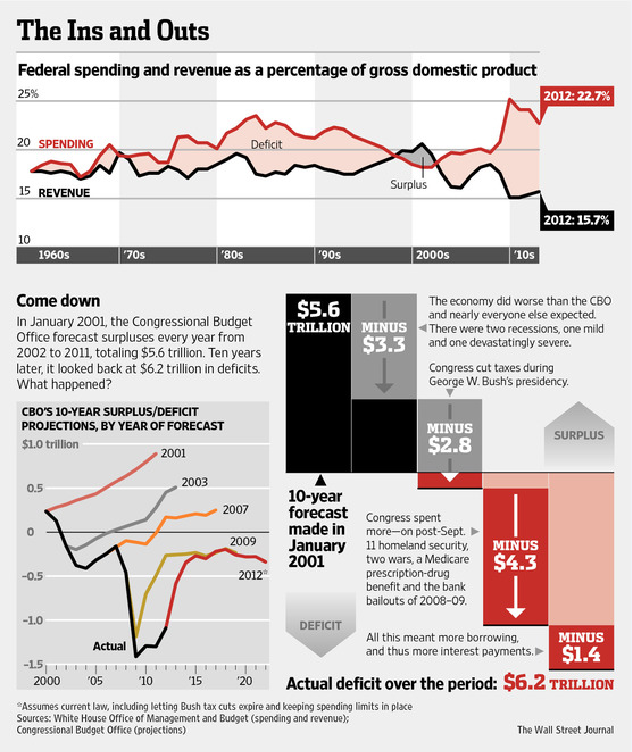

How Big Deficits Became the Norm |

| U.S. Bank as Trustee v Merrill Lynch Mortgage Trust Posted: 18 Dec 2012 11:40 AM PST MERRILL LYNCH MBS TRUST SUES BANK OF AMERICA OVER MBS –> Trustee Lawsuits beginning –> This is an important development in MBS litigation. *U.S. BANK AS TRUSTEE SUES MERRILL LYNCH AND BofA – REPRESENTED BY QUINN EMANUEL (SAME LAYWERS AS FHFA AND MBIA) Hat tip Manal Mehta

Plaintiffs Merrill Lynch Mortgage Investors Trust, Series 2006-RM4 ("RM4 Trust") and Merrill Lynch Mortgage Investors Trust, Series 2006-RM5 ("RM5 Trust", and collectively, the "Trusts"), by U.S. Bank National Association ("U.S. Bank"), not in its individual capacity but solely as current trustee with respect to the Trusts (the "Trustee"), by its attorneys, Quinn Emanuel Urquhart & Sullivan LLP, for their Complaint against Merrill Lynch Mortgage Lending, Inc. ("Merrill", the "Sponsor", or "Merrill Sponsor"), Merrill Lynch Mortgage Investors, Inc. ("Merrill Depositor"), and Bank of America, National Association ("Bank of America") (all collectively, "Defendants") allege as follows:

1. In this action, Plaintiffs are two securitization trusts that hold and administer mortgage loans on behalf of investors who own securities collateralized by such loans. Plaintiffs seek to enforce their contractual rights against the parties that orchestrated the securitizations and created the two Trusts, sold defective loans into the Trusts, and have refused to repurchase such loans in violation of the contracts governing the securitizations. 2. In 2006, as a part of its effort to increase its share of the then-highly profitable residential mortgage-backed securities ("RMBS") market, Merrill bought over 6,000 mortgage loans ("Mortgage Loans") with original principal balance of over $1.1 billion dollars from a third-party loan originator, ResMAE Mortgage Corporation ("ResMAE"). Through the process of securitization, Merrill turned these mortgages into tradable securities in the form of certificates ("Certificates"). Certificates were issued by the RM4 Trust and the RM5 Trust on September 27, 2006 and October 27, 2006 for the RM4 Trust and RM5 Trust, respectively, and sold to investors, which resulted in over a billion dollars of proceeds to Merrill Depositor. Each Certificate entitles its holder to cash flows from the loan payments on the corresponding mortgages. 3. Merrill accomplished each securitization primarily through three contracts: • The Master Mortgage Loan Purchase and Interim Servicing Agreement (the "Purchase Agreement") (a copy of which is attached hereto as Exhibit A), pursuant to which Merrill purchased Mortgage Loans from ResMAE; • The Mortgage Loan Sale and Assignment Agreement (each, a "Sale Agreement") (copies of which for each Trust are attached hereto as Exhibit B), pursuant to which Merrill Sponsor transferred the Mortgage Loans to an affiliated entity Merrill Lynch Mortgage Investors, Inc. that acted as a depositor; and • The Pooling and Servicing Agreement (each, a "PSA") (copies of which for each Trust are attached hereto as Exhibit C), pursuant to which Merrill Depositor transferred the Mortgage Loans to the Plaintiff Trusts. (collectively, the "Trust Agreements"). 4. To facilitate the sale of the Certificates to investors, who had no independent means of verifying the characteristics of the underlying mortgage loans, Merrill and ResMAE made extensive representations and warranties in the securitization documents about the quality and characteristics of the Mortgage Loans underlying the corresponding Certificates. The accuracy of the representations and warranties were a key component to closing a securitization transaction because, among other reasons—unlike Merrill and ResMAE—investors were not given access to the related loan origination files and could not have independently confirmed the loans' credit characteristics. Accordingly, the veracity of these representations and warranties were the drivers of the loans' risk profile. 5. In the Purchase Agreement, pursuant to which Merrill purchased the loans from ResMAE, the loan originator, ResMAE represented, among other things, that the loans complied with underwriting criteria, were issued to borrowers with sufficient income to repay them, and were backed by properties valuable enough to allow investors to recoup the value of the loan through foreclosure. If any of the loans were found to breach representations and warranties, ResMAE committed to buy back the loan. Merrill's rights against ResMAE were then assigned to the Trusts. 6. In the securitization process, Merrill also made its own representations and warranties in the Sale Agreements concerning loans' quality, restating many of ResMAE's promises verbatim for the benefit of the Trusts (listing specific representations and providing that such representations "are hereby restated by the Sponsor as of the Closing Date"). In addition, Merrill contractually guarantied ResMAE's performance under the Purchase Agreement, ensuring that the risk of non-conformance with representations and warranties was not borne by the Trusts. The right to enforce Merrill's representations and warranties was assigned to the Trusts. 7. Merrill's promises were designed to give investors comfort that not just ResMAE but also Merrill ultimately stood behind the quality of the loans. If the loans did not hold up to their stated standards, not only was ResMAE liable for repurchases, but so was the sponsor of the deal, Merrill. Merrill's "backstop" guaranty allowed Merrill to market the deal to investors on favorable terms, as certificateholders received two layers of protection for the mortgage quality, and were assured that the Sponsor, Merrill, had done its diligence and stood behind the loans. This was also important because, at the time, ResMAE was financially a much less secure institution than Merrill, as its bankruptcy only three months after the securitizations bore out. 8. By the time of the bankruptcy, filed in February 2007, a number of the loans in the Trusts suffered from early payment defaults ("EPDs"), where the borrowers missed either the first or second monthly payment under their mortgages. These EPDs violated ResMAE's and Merrill's representations and warranties. Accordingly, the Trusts, through LaSalle Bank, National Association, acting in its capacity as the original trustee with respect to the Trusts ("LaSalle"), filed claims against ResMAE in bankruptcy, demanding that ResMAE repurchase the EPD loans or otherwise compensate the Trusts. 9. In July 2008, LaSalle, then a subsidiary of Bank of America, consented to a settlement of the bankruptcy claims against ResMAE on behalf of five Merrill-sponsored trusts, including the Plaintiff Trusts (the "Bankruptcy Settlement"). Merrill, which had filed its own claims against ResMAE on EPD loans it held on its balance sheet, likewise consented to the Bankruptcy Settlement. The settlement provided that Merrill and the Merrill-sponsored trusts would collectively accept a lump sum from the bankruptcy estate as consideration for releasing their individual bankruptcy claims against ResMAE. They would separately allocate that sum among themselves. LaSalle sent a notice to investors informing them of the settlement with ResMAE. Because ResMAE had very limited funds to satisfy a large number of bankruptcy claims, the Trusts ultimately received only a small part of the money owed for those EPD loan breaches. 10. To allocate the proceeds, Merrill and the trusts entered into a second settlement agreement later that year (the "Allocation Agreement"). By the time of the Allocation Agreement, Bank of America had taken over as the trustee for the Plaintiff Trusts (in this capacity, "Bank of America as Successor Trustee"), and its parent, Bank of America Corporation, was in the process of acquiring Merrill. The Allocation Agreement is dated "as of December 31, 2008," the day before Bank of America's acquisition of Merrill closed, but the date stamped on the faxed signature page for the Allocation Agreement is January 22, 2009, which suggests that the settlement was not signed until three weeks after Bank of America acquired Merrill and less than a month before Bank of America as Successor Trustee resigned as trustee due to the obvious conflict of interest. Bank of America as Successor Trustee did not send a notice to investors, informing them of the Allocation Agreement or its terms. 11. In late 2011 and early 2012, forensic review of Mortgage Loan files ("Origination and Servicing Files") from both Trusts was undertaken and payment analysis of certain Mortgage Loans was conducted. These reviews found that at least 1,221 loans for the RM4 Trust and 1,411 loans for the RM5 Trust suffered from breaches of representations and warranties and did not have the represented characteristics. The breaching loans were subject to the cure and repurchase provisions in the transaction documents due to defects relating to, among other things: a) Misstatement of Income and Employment. Loan documents for many loans misstated the borrowers' incomes, misstated the borrowers' employment, or listed incomes that were clearly not reasonable for the borrowers' stated occupations. b) Misstatement of Debts. Loan documents for many loans misstated the borrowers' existing debt obligations, despite clear indications that the borrowers had more debts than were listed in the borrowers' applications. c) Misstatement of Debt-to-Income Ratios. A borrower's "debt-to-income" ratio (or "DTI" ratio) compares the borrower's monthly debt obligations to the borrower's monthly income. The higher the DTI ratio, the greater the likelihood of a default. For many Mortgage Loans, the actual DTI ratios were far higher than represented. d) Misstatement of Property Value. Property value is an essential loan characteristic that allows investors to make sure that they could recoup the loan amount in full through foreclosure if the borrower defaults. Merrill misrepresented the true values of the underlying properties throughout the Trusts' mortgage loan pools. e) Misstatement of Loan-to-Value Ratios. A property's "loan-to-value" ratio or "combined loan-to-value" ratio ("LTV" and "CLTV" ratios) expresses the amount of the Mortgage Loan as a percentage of the property's total value. The higher the LTV or CLTV ratio, the greater the likelihood of default because the borrower has less equity invested in the property. For many Mortgage Loans, the actual LTV and CLTV ratios were far higher than the ratios represented by Merrill. f) Misstatement of Owner-Occupancy Status. Borrowers who live in mortgaged properties are much less likely to default than borrowers who do not, which is reflected in the industry practice of assessing higher lending rates to non-owner occupied properties. If a property is not owner-occupied, then the risk of default increases. Loan documents for many loans listed properties as being "owner occupied," despite clear indications that this was not the case. 12. These defects constitute breaches of multiple representations and warranties under the Purchase Agreement and Sale Agreements that were independently made or guarantied by Merrill. (The breaches for the Mortgage Loans are catalogued in the reports attached hereto as Exhibit D and Exhibit E.) These defects alone and in combination show that the loans in the two Trusts did not have the credit quality they were represented to have, and that there is a higher likelihood that the borrowers would fall behind on their loan payments or would default on their loans altogether, as many in fact did. The increased risk of borrowers' delinquencies and defaults materially and adversely affects the value of the Mortgage Loans and the interests of Certificateholders therein. 13. Having been liquidated in bankruptcy, ResMAE can no longer fulfill any of its contractual repurchase obligations and thus Merrill must repurchase loans under the terms of the Sale Agreements. 14. Promptly upon becoming aware of the defects, beginning in March 2012 and continuing as the loan file investigation bore results, the successor Trustee U.S. Bank started to inform Merrill of the results of the review of the Origination and Servicing Files (See Ex. F; Ex. G1). According to the terms of the Trust Agreements, when Merrill learns that a loan in the pool is defective, it must buy back the loan from the Trust within 75 days. But despite being on notice of particular defects in at least 2,632 Mortgage Loans in the two Trusts, Merrill refused to honor its repurchase obligations to the Trusts. 15. Instead, Merrill claimed that all of its liability to the Trusts had been released in connection with the ResMAE bankruptcy settlement. Merrill informed the Trustee that the Allocation Agreement, which allocated proceeds of the Bankruptcy Settlement among the Trusts and Merrill, somehow released Merrill of all its liability to the Trusts. This would be an illogical result, given that claims had not been asserted against Merrill in connection with the bankruptcy proceeding. The papers in the bankruptcy court described the settlement as concerning only claims made against ResMAE and the notice that LaSalle sent to certificateholders disclosing the settlement and soliciting objections only discussed the release of claims against ResMAE. 16. Merrill's position cannot hold. It is clear from the language and circumstances that the release of claims against Merrill in the Allocation Agreement only addressed allocation of the Bankruptcy Settlement proceeds and did not release Merrill from any independent liability it had to the Trusts. Indeed, Bank of America as Successor Trustee under the terms of the Trust documents, had no authority to release Merrill (its affiliate) from any such claims, and any such release would be void. 17. Separately, the Trusts also assert claims against Bank of America, as successorin-interest to the initial servicer, Wilshire Credit Corporation ("Wilshire"), and as successor servicer itself. Those companies have modified 247 delinquent Mortgage Loans in the RM4 Trust and 296 delinquent Mortgage Loans in the RM5 Trust. During the modification process, Wilshire and Bank of America as servicer would have examined the loan files and in the process would likely have discovered breaches of representations and warranties in the loan pools. However, despite their likely discovery of breaches, neither Wilshire nor Bank of America, as servicer has notified the Trustee of any such breaches. Indeed, documentation in the loan servicing files uncovered during the loan file investigation confirms that Wilshire and Bank of America knew of information indicating breaches because that information was contained in the servicing files they created. In one instance, for example, the borrower claimed to earn $6,700 per month on the loan application, but subsequent bankruptcy filings included in the servicing file reflected an income of only $2,122 per month. To the extent the servicer, i.e., Wilshire or its successor, Bank of America, became aware of breaches of representations and warranties in the process of servicing the loans, their failure to notify constitutes a breach of their contractual obligations to do so under Section 2.03(c) of the PSAs. 18. In sum, Merrill has breached the Sale Agreements and the PSAs. These breaches materially and adversely affect the value of the Mortgage Loans and the interests of the Certificateholders therein because, among other things, the risks of delinquency and default associated with the Mortgage Loans were higher than what the Trusts bargained for, and, as a result, the value of the Mortgage Loans and Certificates is diminished. Wilshire's and Bank of America's likely conduct as servicers likewise breaches their obligations under the PSAs as Servicer. 19. Finally, and alternatively, if the Allocation Agreement is interpreted to release Merrill from liability to the Trusts as Merrill asserts, very troubling questions would be raised as to how Bank of America as Successor Trustee could have released its own affiliate, given its role as a trustee with respect to the Trusts, without meaningful consideration, disclosure to Certificateholders, or court approval. In such event, the release of Merrill from liability to the Trusts would be void and unenforceable as a product of self-dealing and beyond Bank of America as Successor Trustee's authority as a trustee with respect to the Trusts. In addition, Bank of America as Successor Trustee would also be liable to the Trusts for any losses resulting from any such release. 20. Therefore, the Trusts, acting through the Trustee, now bring this action for breach of contract, specific performance, and declaratory judgment to enforce the obligations of Merrill and Bank of America as Successor Trustee under the PSAs and the Sale Agreements, and in the alternative, for damages suffered as a result of Bank of America's release of the Trusts' claims against Merrill.

PARTIES 21. Plaintiff Merrill Lynch Mortgage Investors Trust, Series 2006-RM4 is a New York common law trust established pursuant to the respective PSA. U.S. Bank National Association is a national banking association, organized and existing under the laws of the United States with its main office in Cincinnati, Ohio. U.S. Bank presently serves as Trustee for the RM4 Trust pursuant to the respective PSA, and has served as Trustee since March 31, 2009. 22. Plaintiff Merrill Lynch Mortgage Investors Trust, Series 2006-RM5 is a New York common law trust established pursuant to the respective PSA. U.S. Bank presently serves as Trustee for the RM5 Trust pursuant to the respective PSA, and has served as Trustee since March 31, 2009. 23. Defendant Merrill Lynch Mortgage Lending, Inc. is a Delaware corporation with its principal place of business in New York, New York and is a subsidiary of Bank of America Corporation. It is engaged in the business of, among other things, acquiring residential mortgage loans and selling those loans through securitization programs. It acted as the Sponsor for each of the Trusts. 24. Defendant Merrill Lynch Mortgage Investors, Inc. is a Delaware corporation with its principal place of business in New York, New York. It is a subsidiary of Bank of America Corporation. Merrill Lynch Mortgage Investors, Inc. was the depositor for each of the Trusts. 25. Defendant Bank of America, National Association is a nationally-chartered United States bank with substantial business operations and offices in New York, New York. It is a wholly-owned subsidiary of Bank of America Corporation. It acted as the trustee for each of the Trusts from October 2008 until April 2009. In addition, it is a successor by merger to LaSalle, which was the initial trustee for each of the Trusts. Bank of America Corporation acquired LaSalle in October 2007 and remained as trustee until the end of March 2009. Bank of America is also the current Servicer for each of the Trusts and a successor-in-interest to the initial servicer, Wilshire.

JURISDICTION AND VENUE 26. This Court has jurisdiction over this proceeding pursuant to CPLR §§ 301 and 302 because the Defendants have offices in New York. Additionally, each Trust was formed under New York law pursuant to the respective PSA. 27. Venue is proper in this Court pursuant to CPLR § 503(a) and (c) because each Defendant is a domestic or foreign corporation authorized to transact business in the State of New York, with principal offices in New York County. FACTUAL BACKGROUND I. MERRILL CREATED THE SECURITIES BY PACKAGING OVER 6,000 RESIDENTIAL MORTGAGE LOANS ORIGINATED BY RESMAE 28. This case concerns residential mortgage-backed securities and breaches of representations and warranties made by Merrill, the entity that organized the securitizations. As the name suggests, these are asset-backed securities (termed Certificates), secured by a pool of mortgage loans made to borrowers for the purchase of residential properties. The Certificates are owned by investors and represent beneficial ownership interests in the respective Trust. In general, distributions of interest and principal on the Certificates are made from payments on the Mortgage Loans underlying the respective Trust. Essentially, as borrowers make payments on the underlying loans, those funds are pooled and distributed to the holders of the securities in accordance with the related securitization documents. 29. The ability of the transaction parties to successfully create and market the RMBS and mortgage loan sales rests on the following essential elements: (i) contractual obligations, payments and other rights set forth in the securitization documents; (ii) representations, warranties and covenants of the institutions that created the RMBS; and (iii) those institutions' commitment to performing their contractual obligations (such as the cure or repurchase obligation). Absent these contractual rights, Merrill could not collect hundreds of millions of dollars of sales proceeds for the Trusts. 30. In an RMBS securitization, the trust and trustee hold the mortgage loans for the benefit of the certificateholders, but the certificateholders ultimately bear the economic consequences of the mortgage loans' performance or underperformance. The characteristics and risk profiles of those mortgage loans drive the securitization: they affect the interest rates the certificates pay, the amount of certificates that can be issued with certain rating, and the extent of protection or "credit enhancement" built into the securitization.2 Consequently, the value of the mortgage loans—and with them, the price that the certificateholders are willing to pay for the corresponding certificates—is directly contingent on the credit quality of the underlying mortgage loans and the repurchase remedy for breaches of the representations and warranties that accompanied the loans. 31. In the two securitizations at issue here, ResMAE made (or "originated") the Mortgage Loans to individual borrowers. In 2006, Merrill bought the Mortgage Loans from ResMAE pursuant to its Purchase Agreement with ResMAE and trade confirmations for individual purchases. Merrill then transferred 6,089 such Mortgage Loans with an aggregate principal balance of over $1.1 billion to an affiliate depositor entity, Merrill Lynch Mortgage Investors, Inc., pursuant to an individual Sale Agreement for each Trust. In the Sale Agreements, Merrill assigned to Merrill Depositor its rights to enforce ResMAE's repurchase obligations in the Purchase Agreement and committed to repurchasing the breaching loans, should ResMAE fail to do so. 32. Merrill Depositor in turn conveyed the Mortgage Loans to each Trust (also known as "depositing" the Mortgage Loans) and assigned all of its rights in the Purchase Agreement and the Sale Agreements to the Trusts, in each case pursuant to a PSA. The Trustee is the Party identified under the PSAs with respect to enforcement of the Sale Agreements and the Purchase Agreement on behalf of the Trusts. 2 Credit enhancements are features of RMBS that raise the security's credit quality above that of the underlying collateral pool (e.g., extra cash reserves or subordinate securities that will bear losses first). 33. The PSAs, which created and govern the Trusts, outline the substantive rights and obligations of parties to the transaction and outline administration of the Trusts. The PSAs were created by Merrill Sponsor, its underwriter affiliate Merrill Lynch, Pierce, Fenner & Smith Incorporated ("Merrill Underwriter"), Merrill Depositor and their counsel. The PSAs are cited in the offering materials to describe administration of the Trusts and rights of the Certificateholders, and are generally relied upon by investors in purchasing the Certificates. 34. The following diagram shows an overview of the transactions and the parties involved. From a glance, it is easy to see that each transaction was designed to allow Merrill and its affiliates to securitize Mortgage Loans and sell the resulting securities to investors. 35. The RM4 Trust and the RM5 Trust then issued securities, termed Certificates, pursuant to the respective PSAs on September 27, 2006 and October 27, 2006, respectively. The Certificates issued by each Trust were backed by the ResMAE Mortgage Loans purchased by such Trusts and each represented an interest in the respective Trust. The Trusts each conveyed their Certificates back to Merrill Depositor, which in turn passed them to the Merrill Underwriter for sale to the public. 36. Another Merrill affiliate, Wilshire, acted as the Servicer following the issuance of the Certificates in each of the Trusts. Wilshire was subsequently acquired by Bank of America Corporation along with Merrill and Bank of America ultimately took over as the Servicer for each of the Trusts.