The Big Picture |

- Majestic Planet

- How the Banking System Is Destroying America

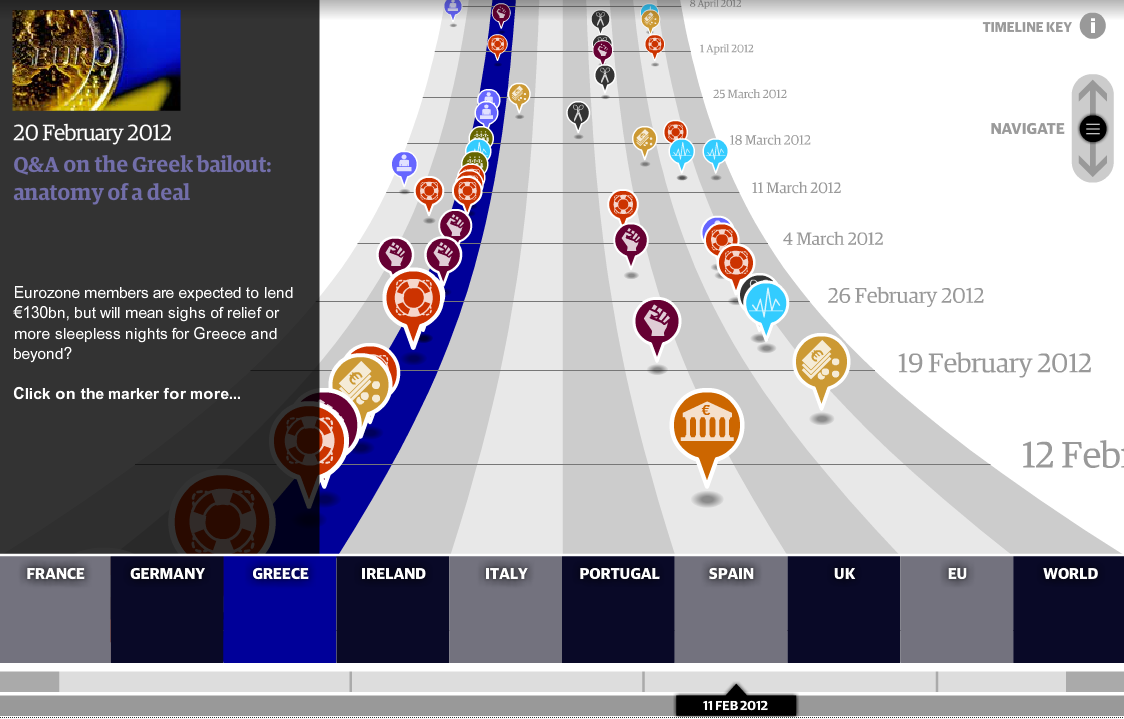

- Eurozone Crisis Timeline

- Which Type of Returns Are You Referring To ?

- 10 Thursday AM Reads

- Kotok: Complete Report from Dubai

- Cumberland Dubai Presentation

| Posted: 29 Mar 2013 02:00 AM PDT |

| How the Banking System Is Destroying America Posted: 28 Mar 2013 10:00 PM PDT Stunning Facts About How the Banking System Really Works … And How It Is Destroying AmericaReclaiming the Founding Fathers' Vision of ProsperityTo understand the core problem in America today, we have to look back to the very founding of our country. The Founding Fathers fought for liberty and justice. But they also fought for a sound economy and freedom from the tyranny of big banks: "[It was] the poverty caused by the bad influence of the English bankers on the Parliament which has caused in the colonies hatred of the English and . . . the Revolutionary War." "There are two ways to conquer and enslave a nation. One is by the sword. The other is by debt." "All the perplexities, confusion and distress in America arise, not from defects in their Constitution or Confederation, not from want of honor or virtue, so much as from the downright ignorance of the nature of coin, credit and circulation." "If the American people ever allow the banks to control issuance of their currency, first by inflation and then by deflation, the banks and corporations that grow up around them will deprive the people of all property until their children will wake up homeless on the continent their fathers occupied". "I believe that banking institutions are more dangerous to our liberties than standing armies…The issuing power should be taken from the banks and restored to the Government, to whom it properly belongs." "The Founding Fathers of this great land had no difficulty whatsoever understanding the agenda of bankers, and they frequently referred to them and their kind as, quote, 'friends of paper money. They hated the Bank of England, in particular, and felt that even were we successful in winning our independence from England and King George, we could never truly be a nation of freemen, unless we had an honest money system. " Indeed, everyone knows that the American colonists revolted largely because of taxation without representation and related forms of oppression by the British. See this and this. But – according to Benjamin Franklin and others in the thick of the action – a little-known factor was actually the main reason for the revolution. To give some background on the issue, when Benjamin Franklin went to London in 1764, this is what he observed:

(for more on the Currency Act, see this.) Alexander Hamilton echoed similar sentiments:

As historian Alexander Del Mar wrote in 1895:

And British historian John Twells said the same thing:

In fact, the Americans ignored the British ban on American currency, and:

Indeed, the first act of the New Continental Congress was to issue its own paper scrip, popularly called the Continental. Franklin and Thomas Paine later praised the local currency as a "corner stone" of the Revolution. And Franklin consistently wrote that the American ability to create its own credit led to prosperity, as it allowed the creation of ample credit, with low interest rates to borrowers, and no interest to pay to private or foreign bankers . Not Ancient History … One of the Most Vital Issues of TodayIs this just ancient history? No. The ability for America and the 50 states to create its own credit has largely been lost to private bankers. The lion's share of new credit creation is done by private banks, so – instead of being able to itself create money without owing interest – the government owes unfathomable trillions in interest to private banks. Read this background to understand how money is really created in our crazy current banking system. And read this and this to learn why we are paying trillions of dollars to the big banks in unnecessary interest costs. America may have won the Revolutionary War, but it has since lost one of the main things it fought for: the freedom to create its own credit instead of having to beg for credit from private banks at a usurious cost. No More Federal than Federal ExpressWhile many Americans assume that the Federal Reserve is a federal agency, the Fed itself admits that the 12 Federal Reserve banks are private. See this, this, this and this. Indeed, the money-center banks in New York control the New York Fed, the most powerful Fed bank. Until recently, Jamie Dimon – the head of JP Morgan Chase – was a Director of the New York Fed. Everyone knows that the Fed is riddled with conflicts of interest and corruption. The long-time Chairman of the House Banking and Currency Committee (Charles McFadden) said on June 10, 1932:

And congressman Dennis Kucinich said:

The Fed Is Owned By – And Is Enabling – The Worst Behavior of the Big BanksMost people now realize that the big banks have become little more than criminal enterprises. No wonder a stunning list of economists, financial experts and bankers are calling for them to be broken up. But the Federal Reserve is enabling the banks. Indeed, the giant banks and the Fed are part of a malignant, symbiotic relationship.

Indeed, the Fed and their big bank owners form a crony capitalist cartel that is destroying the economy for most Americans. The Fed has been bailing out the giant banks while shafting the little guy. Fed boss Bernanke falsely stated that the big banks receiving bailout money were healthy, when they were not. They were insolvent. By choosing the big banks over the little guy, the Fed is dooming both. No wonder many top economists say that we should end – or strip most of the powers from – the Federal Reserve. Even long-time Fed Chairman Alan Greenspan says that we should end the Fed. A Better AlternativeConservative and liberal economists both point out that the big banks are already state-sponsored institutions … so the government should create a little competition through public banking. State-owned public banks – like North Dakota has – would take the power away from the big banks, and give it back to the people … as the Founding Fathers intended. Even a 12-year old sees the wisdom of public banking. And see this. |

| Posted: 28 Mar 2013 12:00 PM PDT |

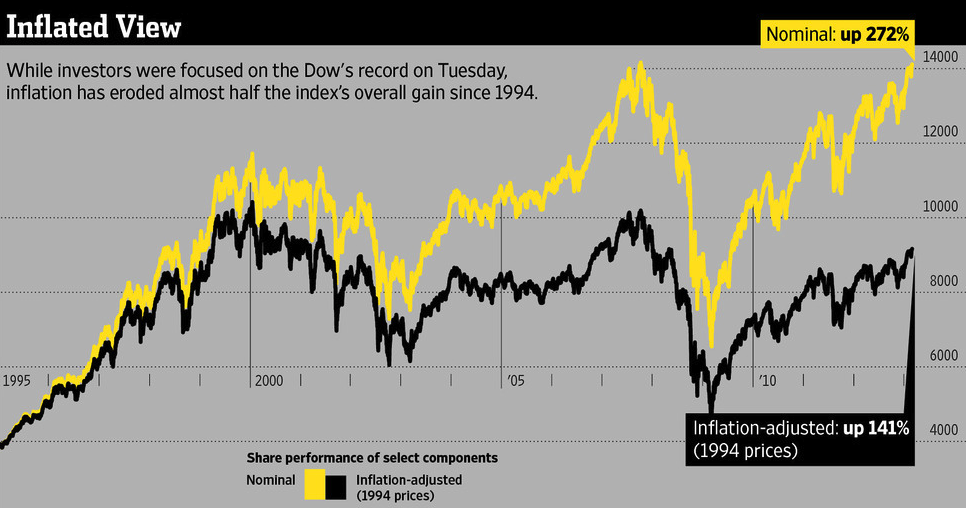

| Which Type of Returns Are You Referring To ? Posted: 28 Mar 2013 08:30 AM PDT

I wanted to take a moment out this morning to briefly discuss the differences between real, nominal, after tax, and total returns: Why is it that nearly any chart that gets posted — be it index, stock, bond or commodity — invariably results in a knee jerk demand for an inflation adjusted version? I half expect to see those comments on even intra-day stock charts.* Different return measures (and the corresponding charts that go with them) provide information about different things. It is not, as some suggest, that one is inherently superior to another. Rather, they measure different things, provide a different context, and are appropriate in different circumstances. Perhaps a few definitions are in order:

All of these return measures are valid ways of depicting slightly different measures of investing results. They seek to gauge returns in slightly different forms relative to each other. They actually measure different things, and each are more (and often less) appropriate in specific settings. While the numbers used to depict these varied forms of returns are neutral and objective measures, how they are employed often is not. I see an awful lot of biases revealed in some quarters always selecting one type of return or another. Always showing inflation adjusted returns is an attempt to reduce the returns of a rally, typically one missed by the speaker. Never showing inflation adjusted or Total returns reveals a similar if opposite bias. Which brings us to the chart shown up top. If you want to get a true picture of returns, inflation adjusting alone is misleading. Consider the typical investor saving for retirement in an IRA or 401k. For these investors, the real inflation adjusted return is important, but so is their total return. Their real total return informs them both of the dollar amount of their investments’ worth plus any change in its purchasing power. This leads investors to the most important questions about their long-term investing in the first place. It is a fair question to ask: How much money will you have when you retire, and what will that sum of money be worth?

___________ * Yet another reason to look askance at comments. |

| Posted: 28 Mar 2013 06:45 AM PDT My morning reads:

What are you reading?

US Gains Ground (recovers) versus Rest of the World |

| Kotok: Complete Report from Dubai Posted: 28 Mar 2013 03:00 AM PDT Report from Dubai

The slides used at the Global Interdependence Center conference in Dubai on March 26, 2013, are now posted under the "Special Reports" section on Cumberland's website. Here is the link. The guide to the slides follows. Slide 1 is the asset side of the Federal Reserve (Fed) balance sheet. Notice that the size of the Fed's balance sheet has grown from slightly over $900 billion before Lehman-AIG to approximately $3.2 trillion. The Fed continues to increase assets pursuant to its current policy. Slide 2 is the liability side of the Fed's balance sheet. The key to that slide is the green section labeled "Currency in Circulation," which totals approximately $1 trillion. The red component is the excess reserves deposited at the Fed through the US banking system. Slides 3 and 4 come from a 2013 special paper entitled "Crunch Time: Fiscal Crises in the Role of Monetary Policy," by Greenlaw, Hamilton, Hooper, and Mishkin. We have used the slides that the writers placed in their paper. Those slides show the projected peaking of the Fed's balance sheet at about $3.5 trillion and the gradual decline through 2020. The color codes match those of the slides we showed of the Fed's current balance sheet, so viewers can track them more easily. In slide 4, you can see that, according to the authors' projections, by 2020 the Fed's mortgage backed paper will also have shrunk. The Fed will have permitted the excess reserve liability to run off as it reduces the asset side. Thus slides three and four depict that in 2020 the Fed's balance sheet size will be approximately $1.7 trillion. The holdings on the asset side will be Treasuries, and the liabilities will be currency in circulation. These are just projections that may or may not occur. The authors of the paper made assumptions on future Fed policy that would result in a successful exit strategy. Slide 5 lays out some simple assumptions to help us project the answer to the question: When will the unemployment rate hit 6.5 percent? Slide 6 is a table that was designed by Cumberland's Chief Monetary Economist, Dr. Robert Eisenbeis. Dr. Eisenbeis used historical data in order to translate estimates of GDP growth into job-creation rates. The table projects job growth for both high- and low-confidence intervals. Slide 7 shows how much time it would take for the unemployment rate to fall to 6.5 percent, depending on GDP growth rate (vertical axis) and certain baseline assumptions. The estimates range from 2015 to 2017. Slide 8 shows the number of jobs the US economy needs to produce per month in order to hit a 6.5 percent unemployment rate. This too is an estimate based on a lot of assumptions. Slide 9 shows the U3, U4, U5, and U6 unemployment rate measures and the definition of each. The Fed has selected the U3 unemployment rate for its 6.5 percent target. The parallel structure of these curves derives from the fact that these measures of unemployment are built one upon the next. The results of disaggregating this data and drilling into it in detail are depicted in slide 10. Here the large green band shows the percentage of the labor force that is part-time workers who want full-time work. In other words, about four percent of the labor force consists of part-time workers who want full-time work and cannot find it. That is what is different about the current economic cycle, and this particular composition issue is not addressed by the Fed's 6.5 percent target. Think about what this means. The labor force in the US comprises approximately 135 million people. Five to six million people fall into this category of part-time workers who cannot find full-time work. That is a huge overhang not addressed by the Fed's policy of targeting 6.5 percent on the U3 measure of unemployment. On slide 11 you see a Beveridge curve, named for economist William Beveridge. The curve tells you about the regime change that took place between the previous expansion, from December 2001 to November 2007 (shown in blue), and the present expansion (shown in green). The '07-'09 recession is shown in red. The curve is created by taking the job vacancy rate and dividing it by the U3 unemployment rate. Beveridge curves tell you a lot about expansions and recessions and how difficult it is for recovery to take place in the labor force. Clearly, the recession was a regime change, according to these Beveridge curve calculations. The U3 unemployment rate is used in the curves on this slide. When you use the U6 unemployment rate, which the Fed is not doing, you find that the regime shift was actually much greater. Slide 12 tracks the Phillips curve, or inverse relationship between the unemployment rate and inflation rate. The concept was introduced to me by Thomas Synnott, a colleague at the National Business Economic Issues Council (NBEIC). Synnott uses the tracking system shown, with monthly data points. He describes it as an "under-damped oscillatory system." The idea is to show the difference in shifts in duration, slope, and composition of the Phillips curve. One can see the pre-crisis levels in blue, the shift during the crisis in red, and the current green expansion period, through February 2013. The Fed's target is marked with an "X." Clearly there is a large gap between the current situation, in February 2013, and the Fed's targets of 6.5 percent for the U3 unemployment rate and 2.5 percent for the inflation rate. Again, if we were to use the U6 in this curve instead of the U3, the gaps would be much more extreme. Slide 13 lists the total assets of the major central banks. Those are the Federal Reserve, European Central Bank, Bank of England, Bank of Japan, and Swiss National Bank. We have added the Swiss National Bank since Switzerland now practices a policy maintaining a pegged floor in the exchange rate between the Swiss franc and the euro. Essentially, these central banks started pre-crisis with about $3.5 trillion in total assets, in US dollar terms. Their assets now exceed $10 trillion and are growing. We have broken out the individual central banks for tracking purposes. Slides 14 and 15 show the assets and liabilities of the European Central Bank. Slides 16 and 17 show the assets and liabilities of the Bank of England. Slides 18 and 19 show the assets and liabilities of the Swiss National Bank. Slides 20 and 21 depict the assets and liabilities of the Bank of Japan. Note that Japan is the only major country that has experienced extraction from quantitative easing. That happened in 2006. At the time, the Japanese quarter-end extraction shocked world markets quite seriously. This is the only case in modern history where a large extraction at quarter-end occurred. We have noted it for both the assets side and liabilities side in slides 20 and 21. The conclusion of our remarks in Dubai outlined the various factors that world markets and economies confront as this immense expansion of central bank balance sheets, along with massive liquidity injections, runs its course. We do not know how long this game of monetary quantitative easing will continue in the world. We do not know when it will stabilize. We do not know what will happen after that period, and we do not know how extraction will occur. What we do know is that world monetary affairs have never been in a situation like this before. ~~~ David R. Kotok, Chairman and Chief Investment Officer, Cumberland Advisors |

| Posted: 28 Mar 2013 02:30 AM PDT |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 comments:

Post a Comment