The Big Picture |

- Forecasting National Inflation Rates

- Top 10 Improvised Scenes in Movie History

- Why Things Don’t Last

- From Woodstock to Wall Street

- MiB: FDIC Chairman Sheila Bair

- 10 Weekend Reads

| Forecasting National Inflation Rates Posted: 24 Aug 2014 02:00 AM PDT Forecasting National Inflation Rates

©Thinkstock/Drazen_ By Silvio Contessi, Economist A recent line of research has established that global factors significantly correlate with national inflation rate movements, so much in fact that they can help forecast national inflation rates.1 A forthcoming Federal Reserve Bank of St. Louis Review article2 follows this literature and estimates a one-factor model for global inflation using headline inflation rates for nine advanced economies, using monthly data for the period January 2002 through June 2014.3 The nine economies are from three groups:

These are all advanced economies, but are fairly heterogeneous in terms of size, openness and unconventional monetary policy experiences. The chart below plots the time series of the estimated global factor along with the large economies' inflation rates. Each time series is standardized by subtracting the sample average and dividing by the standard deviation.4

It is clear that there are generally high correlations between the global factor and the economy inflation rates, as well as between pairs of inflation rates. There are, however, also some notable deviations in the sample.5 Particularly noteworthy is the very visible deviation of the Japanese inflation rate (shown in the first chart) from the global factor series in the past 18 months, corresponding to the new set of economic policies advocated by Japanese Prime Minister Shinzo Abe, known as Abenomics. While most of the advanced world is experiencing low and quiet inflation, Japanese inflation is soaring to levels not seen in more than 20 years and therefore deviating from the factor very visibly. What correlates with this unobserved factor?

Recent low inflation rates are likely the combination of slack in the global economy (particularly in the eurozone) and the stability of commodity prices. While we would have a hard time tracking slack in real time, keeping an eye on global prices can tell us something about the short-term behavior of domestic headline inflation rates in the near future in several economies (but perhaps not in Japan!). The third footnote has been updated to clarify the personal consumption expenditure price index used in the analysis. Notes and References 1 Ciccarelli, Matteo; and Mojon, Benoit. "Global Inflation." The Review of Economics and Statistics, August 2010. Mumtaz, Haroon; and Surico, Paolo. "Evolving International Inflation Dynamics: World and Country-Specific Factors." Journal of the European Economic Association, August 2012. 2 Contessi, Silvio; De Pace, Pierangelo; and Li,Li. "An International Perspective on the Recent Behavior of Inflation." Federal Reserve Bank of St. Louis Review, forthcoming. 3 We used the consumer price index or the harmonized index of consumer prices. For the U.S., we also plotted the standardized headline personal consumption expenditure price index (PCEPI) for comparison with the headline CPI, as the Fed's inflation target refers to the core PCEPI. Data are not seasonally adjusted and obtained from the Organization for Economic Cooperation and Development. A factor model is a statistical technique that allows us to extract from time series data a latent unobserved common factor to which each of the series is related through an estimated parameter called "factor loading." Also see a similar exercise for Canada in: Macklem, Tiff. "Flexible Inflation Targeting and 'Good' and 'Bad' Disinflation." Presented at the John Molson School of Business, Concordia University, Montreal, Canada, Feb. 7, 2014. 4 The model used to calculate the series for the global factor yields a series with a mean of zero and a standard deviation of 0.97, so strictly speaking, the global factor is not standardized. However, standardizing and plotting the series would yield a graph nearly identical to the one displayed in this post. 5 Wang, Pengfei; and Wen, Yi. "Inflation Dynamics: A Cross-Country Investigation." Journal of Monetary Economics, October 2007. 6 Borio, Claudio; and Filardo, Andrew. "Globalization and inflation: New cross-country evidence on the global determinants of domestic inflation." Bank for International Settlements Working Papers, No 227, May 2007. Additional Resources

|

| Top 10 Improvised Scenes in Movie History Posted: 23 Aug 2014 05:00 PM PDT THE LIST Bridesmaids (2011) Apocalypse Now (1979) Iron Man (2008) The Jazz Singer (1927) Caddyshack (1980) Goodfellas (1990) The Breakfast Club (1985) This is Spinal Tap (1984) A Clockwork Orange (1971) Robin Williams |

| Posted: 23 Aug 2014 01:00 PM PDT 1. Channel Overload Used to be there were 5,000 albums a year and only a few got on the radio and if you didn’t get airplay or press, you were doomed. Now there are a zillion products, all easily promoted online, and unless your friend verifies quality and interest or a track becomes a phenomenon, you don’t care, and suddenly most people don’t care, and it’s gone. There’s a fiction perpetrated by the record labels that terrestrial radio reaches everybody, but the truth is with so many other options for hearing music, radio is a sliver of the marketplace. To make it everywhere you need not only radio, but video and… Actually, that which is ubiquitous lives online, not on terrestrial radio. Terrestrial radio is a ghetto. You can cross over from terrestrial radio to the internet, you can rise simultaneously from both, but to be gigantic, known by everybody, you need to make it on both terrestrial radio and the internet, whereas you can spike quite nicely online and function well without terrestrial radio, terrestrial radio is the dollop of cream atop the sundae. Online is on demand, terrestrial radio is not, and that’s why it’s doomed amongst youngsters, who don’t want to wait, who believe everything should be instant. The only thing no longer instant is sex. You can hear anything online when you want, research anything online when you want, connect with all your friends instantly via a plethora of communication techniques, but sex is still something you yearn for, although the internet has made porn ubiquitous, one can argue we live in a masturbatory fantasy culture. 2. Limited Time They’re making no more time, everything has to fight for attention and very little sustains, because there’s constantly something new in the offing. Everyone is going ever faster, so the old paradigm of needing time to digest something is taboo. Industry has accepted this, art has not. Industry realizes the product has to be perfect in the first iteration and continue to work thereafter. Not buying a car in its first year is history, as is the fear that the electric windows will break. And with manufacturing so cheap, repairs (and repairmen!) have fallen by the wayside, why not buy something shiny and brand new! Yes, we all treasure some old favorites, but very few. So if you’re an artist, yelling may get you noticed for a day, but it won’t keep you atop the pyramid. 3. Competition I used to read “Rolling Stone,” now I read “Fast Company.” Oh, I still get “Rolling Stone,” it’s just that the magazine no longer knows what it wants to be, and covers the travails of too many nitwits. I remember when I salivated over the words of musicians. Now I salivate over the words of entrepreneurs, because they’re thoughtful, they’ve got something to say. I’m a media junkie, so I’ve got all my magazines and all my websites and constant updates on my phone, so this squeezes out available time for competing media. 4. Howard Stern He has single-handedly diminished my satellite radio music listening by hooking me. Many of us are hooked by something that pulls us down the rabbit hole, leaving little time for anything else. Used to be Howard Stern was on just a few hours a day, if you missed it, you had to wait for tomorrow. Now Stern is available 24/7, and I’m not driving 24/7, so most of the time I’m in my car there’s new Stern programming. We see this phenomenon in television. The late night talk show ratings have been decimated by the DVR, never mind on demand. We’re no longer victims of what’s on the tube, everything’s available all the time. 5. Cultural Norms We used to go to the movies to be part of the cultural discussion. But once we realized no one else was going, we didn’t either. Furthermore, there is no cultural discussion left, because we all share different experiences, there’s very little commonality. This makes that which is successful even more so, because we want to talk about it with others, leading to a superstar and no-star world. 6. Dominance With everything at our fingertips, we gravitate to the few that break through. Look at smartphones, there are multiple competing ecosystems, but iOS and Android dominate, Windows phone is an also-ran and BlackBerry is a joke. We only want the very best all the time and therefore it takes an incredible effort to penetrate our consciousness and stay there. Furthermore, the more successful something is, the more it continues to grow, reinforcing its success. The rich get richer and the poor get poorer. 7. Fatigue With so much new music, many people stop paying attention to the whole sphere, they go back to their favorites if they listen at all. Yes, when everybody yells, it becomes a noise you ignore. And you just retreat and burrow down deeper into the hole you already inhabit. 8. Quality Easy to recognize, hard to achieve, especially when it comes to art. Good used to be good enough, today good is awful, something no one cares about. We’re all in search of excellence, and if we don’t find it we don’t waste time, as we did in the three network and limited terrestrial radio world, we move on. This is why major labels use the usual suspects to create obvious hit singles, anything less, and the product is doomed. Sure, you can come from left field and dominate, but this is too scary to creators who grew up in a world where your personal network is everything, they’re fearful of being ostracized, left out, even worse in today’s connected society, ignored. But since art is not quantifiable, creators blame the system and the audience when the truth is people are surfing for greatness 24/7 and if they find it they tell everybody they know about it. A great media campaign can gain notice for a day, but it cannot sustain the underlying product. For that to happen, the product must be exceptional. Purveyors want to deny this rule, they believe smoke and mirrors still work. Cynics want to say promotion is everything. But the truth is once distribution has been flattened, which is the essence of the internet, only true excellence rises. As a result, you can remember Avicii’s “Wake Me Up,” it becomes the most played track in Spotify history, but you cannot remember number two, never mind number ten. And that which spikes and lasts, however temporarily, is usually a twist, it’s usually innovative. “Wake Me Up” merged acoustic and electronic, “Gangnam Style” introduced a whole new style of pony dancing and made fun of consumption. The sieve rejects nearly everything but that which titillates, usually because of its cutting edge newness. Your past history will gain you attention, but it won’t make you sustain. You can either play with the usual suspects, the Max Martins and Dr. Lukes, or you can risk failing on your own, like Lady Gaga. But Gaga didn’t realize it’s about product, not revenue, she stayed on the road, out of the internet spotlight, for far too long, and then she overhyped that which did not deserve it. It’s damn hard to create innovative excellence, but that’s what we’re all looking for, that is what lasts. ~~~

– |

| Posted: 23 Aug 2014 09:30 AM PDT From Woodstock to Wall Street

Forty-five years ago this morning I and about 400,000-500,000 others (which included my pals Dennis Gartman and Larry Kudlow!) were at the last day of the Woodstock Music & Art Fair at Max Yasgur’s farm in Bethel, New York. The weekend was serendipitous and unexpected. At its peak Woodstock was the third most populated town in New York state. The previous week I had quit a job at Camp Chipinaw on Swan Lake to attend the festival with my girlfriend Toby. We spent five days on a blanket fairly close to the stage. We bathed in the nearby lake and survived on sunflower seeds, some fruit, stale rolls, bottled water and plenty of marijuana.

At around 4:00 a.m. Crosby, Stills & Nash had just completed singing “Marrakesh Express” and were in the middle of their set. Crosby, Stills, Nash & Young were so unknown that they had to introduce themselves at the beginning of their Woodstock appearance. Woodstock was only the group’s second live performance — the first live appearance was two days before Woodstock began at a Chicago gig with Joni Mitchell. (Joni Mitchell missed Woodstock, watched the accounts on television and instead appeared on “The Dick Cavett Show” during the weekend.) The air was filled with the stench of cannabis and cheap wine. There was no sleeping throughout Sunday night as we were serenaded by an extraordinary nonstop barrage of musicians that continued through Monday morning.

“But when I played Woodstock, I’ll never forget that moment looking out over the hundreds of thousands of people, the sea of humanity, seeing all those people united in such a unique way. It just touched me in a way that I’ll never forget.” – Edgar Winter The party was still going on, and the traffic congestion was so terrible that many, including myself, stayed on for another two or three days. Years later I played squash at the Princeton Club in New York City with Joel Rosenman, and weeks later learned from him that he, along with Michael Lang, Artie Kornfeld and John Roberts, was one of the founders of the Woodstock Festival. Blackstone’s Byron Wien is good friends with Joel, and he put us back in touch with each other last spring after reading “My Pilgrimage to Warren Buffett’s Omaha,” which mentioned that after having gone to the Woodstock Music & Art Fair, I found myself in a unique sort of symmetry 44 years later attending the “Woodstock of capitalism” — small world. All weekend I was in wonderment about the changes in my life over the past four and a half decades. Consider that:

The memories of Woodstock linger on and conjured up a nostalgic feeling throughout the past weekend for me. At times, when viewing the YouTube videos of those original Woodstock performances I got goosebumps and, quite honestly, teary-eyed. It was an age gone by. There were no cell phones 45 years ago and no selfies. Nor was any merchandise sold at Woodstock. A three-day pass cost $18 in advance, $24 at the gate. But by the second day there were no gates, as the concert was free. To me Woodstock was both a demonstration of peaceful protest and a global musical celebration — considering that nearly 12% of the world is at war today, these are two things we need more of these days. Over the years Woodstock has been romanticized, glorified and has become a final page in our collective memory of a different era, an age of innocence. In a sense it was the last waltz of the decade of the sixties. While I had already cultivated a great interest in the stock market for three or four years, I was still a year and a half away from getting my MBA at Wharton when I left Woodstock and Yasgur’s farm. To be sure the capital markets have changed materially over the past 45 years. The DJIA stood at 825 back in 1969 vs. 16,660 today. The yield on the 10-year U.S. note was 6.70% vs. 2.35% this morning. And 1969 was a momentous year.

From Woodstock to Wall Street: What a long, strange trip it has been. Douglas A. Kass Seabreeze Partners Management Inc. 411 Seabreeze Avenue Palm Beach, Florida 33480 Web Site: http://www.seabreezepartners.net Email: dkass@seabreezepartners.net Twitter: @DougKass |

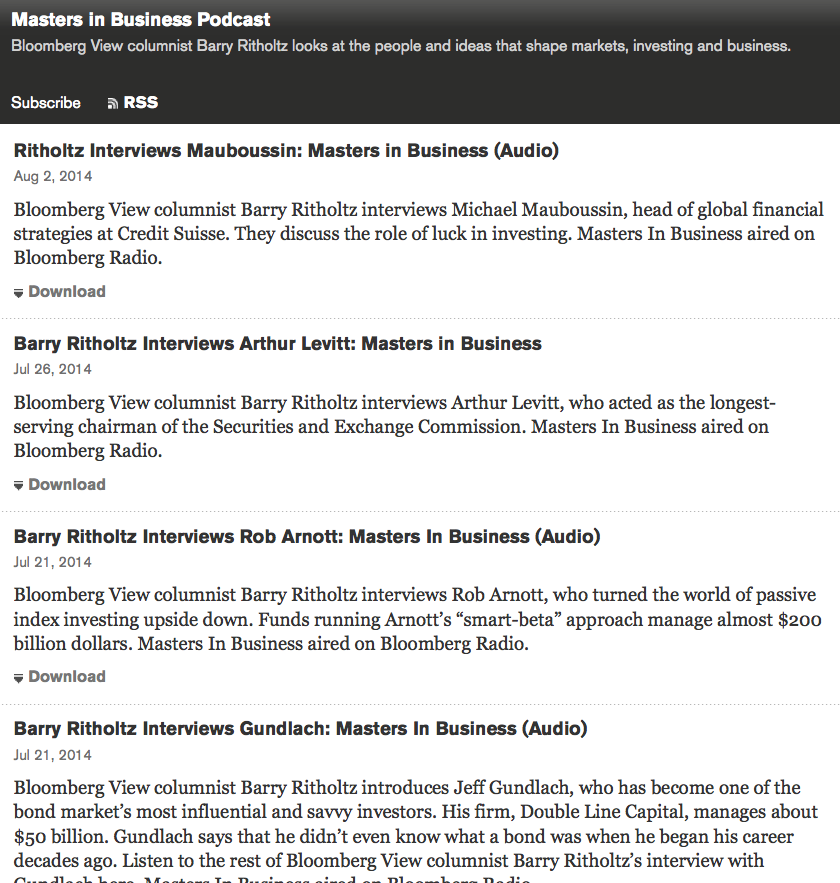

| MiB: FDIC Chairman Sheila Bair Posted: 23 Aug 2014 06:45 AM PDT This week's Masters in Business Radio show is on at 10:00 am and 6:00 pm on Bloomberg Radio 1130AM and Siriux XM 119. Our guest is former FDIC chairman Sheila Bair. You can listen to live here or stream it below or at Soundcloud or download the 79 minute podcast here. All of the past Podcasts are here and coming soon to Apple iTunes). Next week, James O’Shaugnessy of O’Shaugnessy Asset Management and author of What Works On Wall Street.

|

| Posted: 23 Aug 2014 04:00 AM PDT Good Saturday morning. Pour yourself a tall cup of hot black, settle into your favorite chair, and enjoy an especially robust set of hand curated longer form weekend reads:

Whats up for the 2nd to last Summer weekend?

Interest-Rate Fears Trample Gold |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 comments:

Post a Comment