The Big Picture |

- Sarkar on Greece

- The “Greek Issue”

- MiB: Howard Lindzon

- 10 Weekend Reads

- Apple Earnings Show Why You Can’t Trust Pundits

| Posted: 01 Feb 2015 02:00 AM PST There has been a great deal written about Greece recently. I therefore, somewhat timidly, add my penny’s worth. The Syriza Party, through their PM and their finance minister, has rejected the idea of cooperating with the Troika, the EU, ECB and the IMF. They are seeking debt forgiveness to meet their election pledges to the Greeks population. Right from the start, it must be said that the EuroZone will not entertain debt forgiveness. Two simple but crucial reasons as to why. —- Debt forgiveness for Greece will encourage other countries, who have far larger and unsustainable debt (including Italy and even France), to seek a similar deal, which at this stage is impossible to accommodate; and —- Equally importantly, debt forgiveness will encourage and embolden popular support for right wing fanatics in Northern Europe and left wing loonies in Southern Europe. As a result, debt forgiveness will not happen. The EZ will, however, agree to —- Lower interest rates on the IMF/ECB/EZ loans to Greece; —- Agree to an extension of maturities on the outstanding loans; —- Allow the Greek government to reduce the primary surplus requirements, in order to provide fiscal stimulus; and —- in due course, allow debt forgiveness. In any event, the net present value of debt, which attracts virtually zero interest rates over say 50 years (both of which, the EZ will agree to) is considerably lower than the current value of the outstanding debt. Who has the upper hand. It is clear that the EZ does. No debate. The risk of a Greek default/exit is considerably lower than it was 5 years ago. The outstanding debt is mainly to EZ governments, ECB and the IMF and not to EZ banks. Furthermore, the introduction of QE in March dispels fears, other than short term panic by ill informed investors. At the peak, the Greek Central Bank provided some E124bn of emergency lending assistance (ELA) to Greek banks, with Target 2 as far as the rest of the system was concerned, of around E102bn. In December 2014, there was E56bn in normal financing and just E1bn of ELA. The IMF cannot take a write off in its loans – it is a preferential creditor. As a result, the EU and the ECB will have to accept haircuts on outstanding loans if they agree to debt forgiveness. The ECB wont. That leaves the EZ countries, who have guaranteed the vast majority of the outstanding debt to Greece. Politically, the EZ, for the reasons mentioned above, cannot agree to a debt “haircut” either, certainly not at this moment. Whilst recovering, the Greek economy in January has started to flag. Last year, the Bank of Greece reported that the country produced a primary surplus of +2.0% of GDP – clearly that is going to contract. Furthermore, a number of Greeks have reverted to their bad old habits and are not paying taxes in anticipation of relief by Syriza. Greek bank are losing deposits by the truckload in anticipation of a Grexit. The ECB will not agree to ELA if the country does not comply with its commitments – that’s the bottom line and the real killer for Greece. Neither will the ECB include Greek debt in its QE programme. OK, what if there is no deal. Well Greek banks will collapse and the country will be forced to stop those depositors who still have funds in Greek banks from withdrawing their cash. The Greeks will then revert to the Drachma, which will be less valuable that soiled toilet paper. Inflation will skyrocket. Greece will be cut off from international capital markets. The conclusion will be that Greeks will have to start living in caves. Political tensions will erupt and the threat of civil disorder/violence will be real, given the neo-Nazi elements in the country. What happens next and when. Greek banks and the country need funding in the next week or so. As a result, this crisis has to be resolved one way or another imminently. No matter what Syriza states in public, they have to concede that there will not be any debt forgiveness. That’s the problem of over-promisng – under-delivery inevitably follows. They could, I suppose agree to a deal, get ECB ELA and then renege. However, that still busts Greece, as the ECB will not play ball on QE. Insulting the Germans, which the Syriza party is doing, will not help – indeed, it will make the German public (whose opinions Mrs Merkel follows religiously) to force their government to agree to Grexit. It can happen, even though, in theory, there is no mechanism to kick anyone out of the Euro. I am clear as to the German/EZ view. What I certainly do not know is how the Syriza party will react. They comprise academics and theoretical economists – an explosive mixture. Their problem is their electoral promise to demand and get a debt haircut. To concede withing a couple of weeks of being elected will bring down the government, most likely this year. Well, you reap what you sow. All of this is hugely Euro negative. The Euro, last week, appreciated, though there was some weakness on Friday. I suspect the Swiss National Bank (SNB) was intervening, as the Euro appreciated noticeably against the Swiss Franc. However, not even the SNB can withstand the selling pressure following problems with Greece. My own view (hope) is that Greece exits the Euro – I for one am sick and tired of them. Regrettably, the odds are that the Greeks will back off at the last second. Not much time to wait anyway. SELL THE EURO, against the US$ though, though it will recover if there are signs of a deal late next week or the following week. Please note that I am short the Euro against the US$, up to my maximum limit. I’m not sure whether this is a Greek comedy or tragedy, but it’s certainly amateur dramatics time. Best |

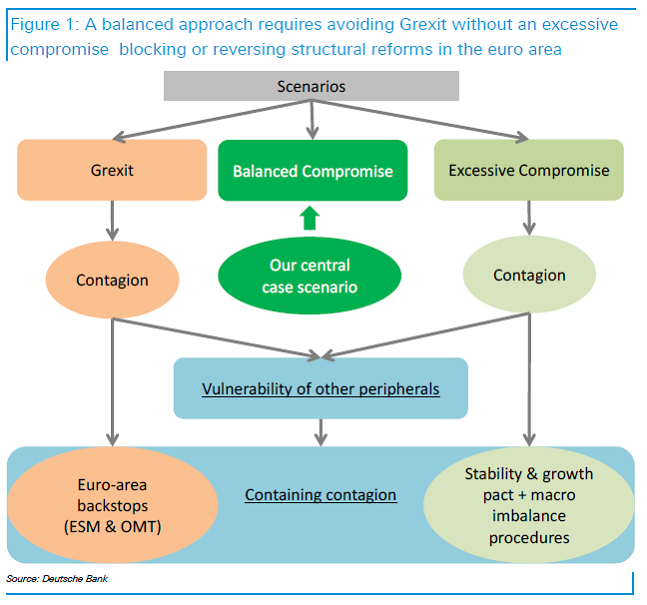

| Posted: 31 Jan 2015 01:30 PM PST Fascinating flowchart from Deutsche Bank:

Source: Deutsche Bank, The Greek Issue |

| Posted: 31 Jan 2015 07:00 AM PST This week, the "Masters in Business" podcast features angel investor Howard Lindzon, who runs the Social Leverage venture fund (amongst other things). Lindzon discusses the differences between public and private investing, how he got lucky with his first angel investment, and why making mistakes is one of the best ways to learn what not to do (like passing on investing in Twitter at $20 million valuation). You can hear it live on Bloomberg radio, download the podcast here or on Apple iTunes (when its posted, you can also stream it on Soundcloud below). All of our prior podcasts are available on iTunes.

|

| Posted: 31 Jan 2015 04:00 AM PST Good Saturday morning. Well, thats the first time we’ve had two consecutive negative months in several years. No worries, we have some longer form weekend reads while you digest that info:

Be sure to check out our Masters in Business interview this week with angel investor Howard Lindzon (Bloomberg and iTunes).

BoE: Higher Rates Aren't the Right Tool to Tame Bubbles

|

| Apple Earnings Show Why You Can’t Trust Pundits Posted: 31 Jan 2015 03:00 AM PST |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

0 comments:

Post a Comment