| 10 Thursday PM Reads Posted: 11 Oct 2012 01:30 PM PDT My afternoon train reading: • The Great Recession: An ‘Affair’ to Remember (Business Week) see also The case for a 40% drop in the markets (MarketWatch)

• Beware the 'central bank put' bubble (FT)

• Michael Lewis: Wall Street's Forgotten Victims Have Some Advice (Bloomberg)

• Oil in new Gulf slick matches that of 2010 spill (WaPo)

• What Jack Welch should have said (Credit Writedowns)

• Baum: Here Are Five Things the Democrats Won't Tell You (Bloomberg)

• The Baby Boom and Economic Recovery (NYT)

• Apple Choice of iPhone Aluminum Said to Slow Down Output (Bloomberg)

• Apple Maps Accidentally Reveals Secret Military Base In Taiwan (Slashdot)

• Amazon Kindle White Paper (Daring Fireball)

• Louis C. K. to Take Hiatus From FX Series 'Louie' (Artsbeat)

What are you reading?

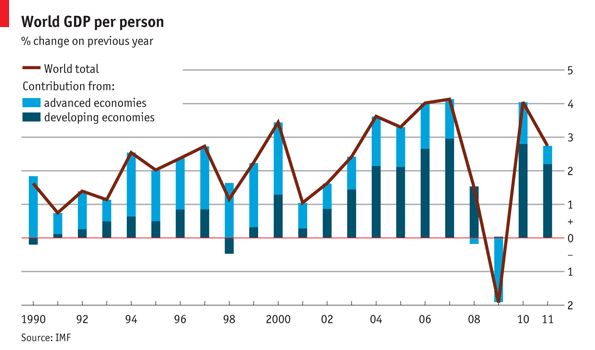

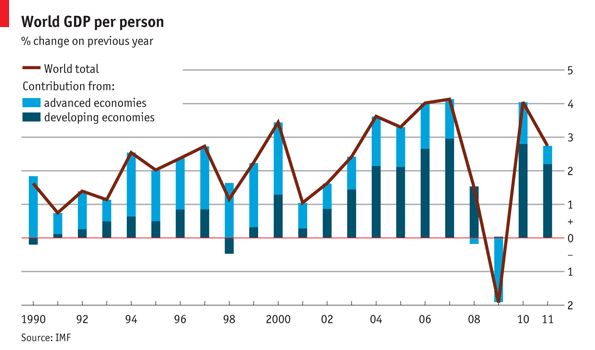

Source: Economist

|

| TBP Conference Presentations Posted: 11 Oct 2012 11:30 AM PDT |

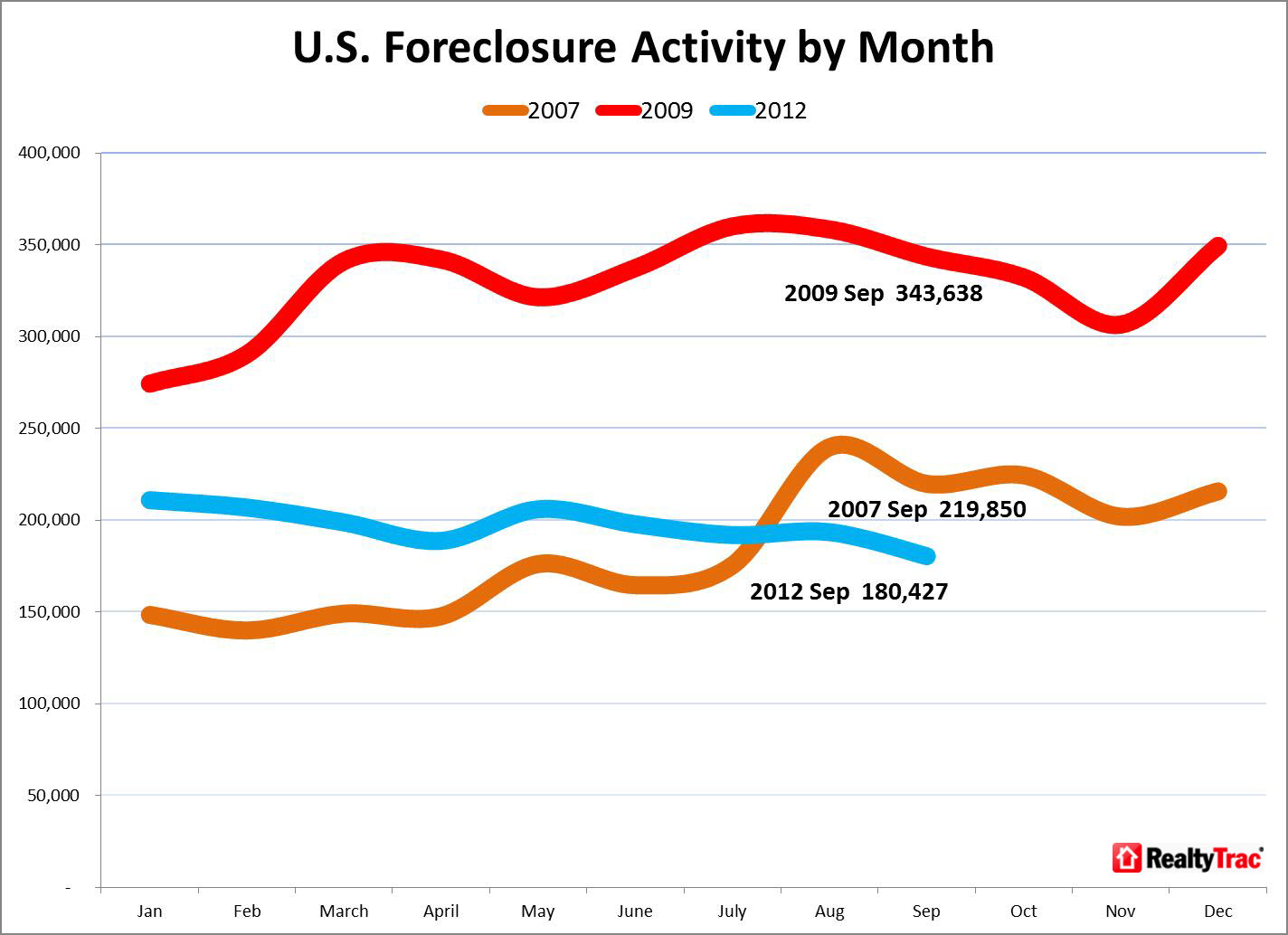

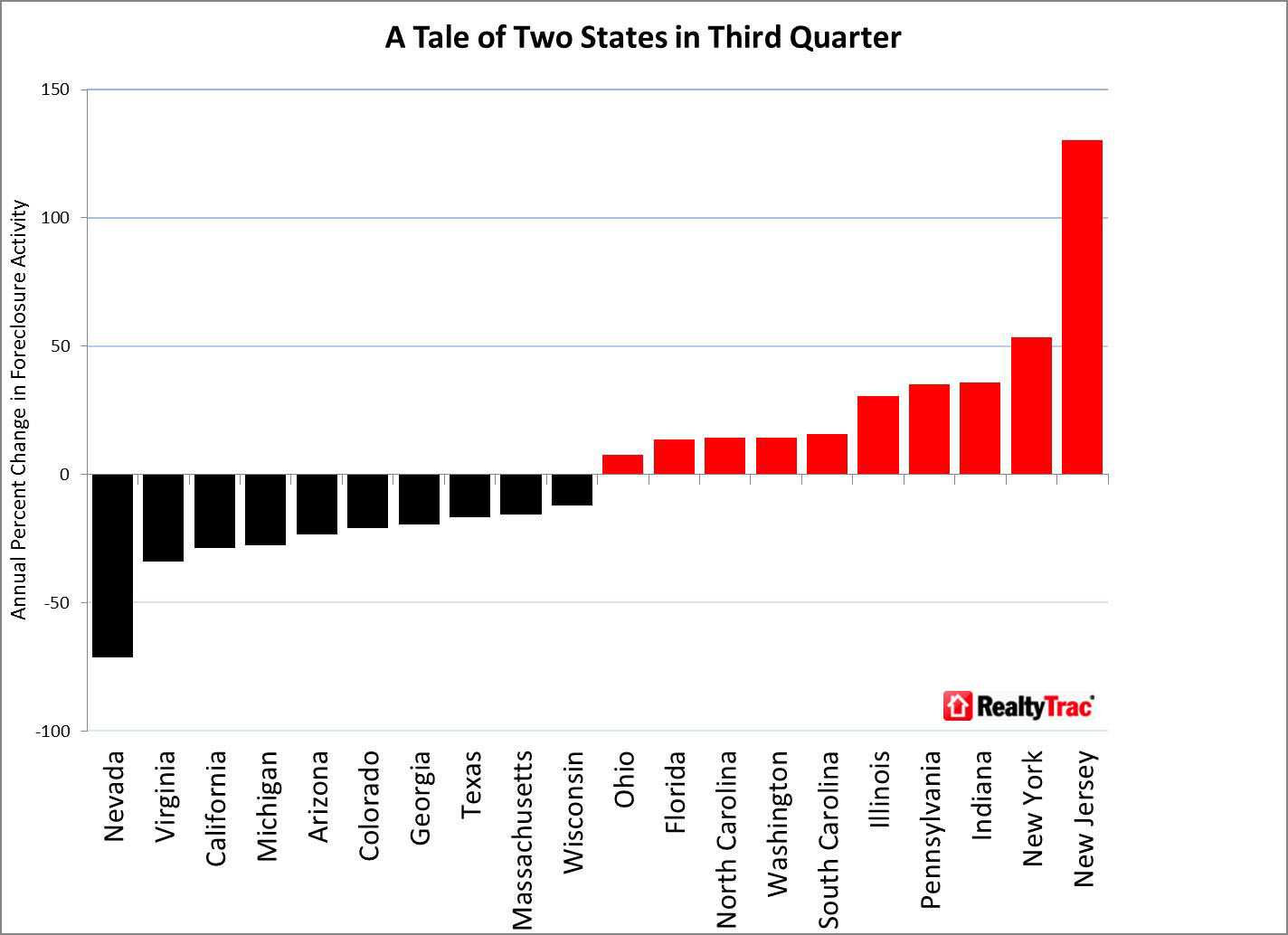

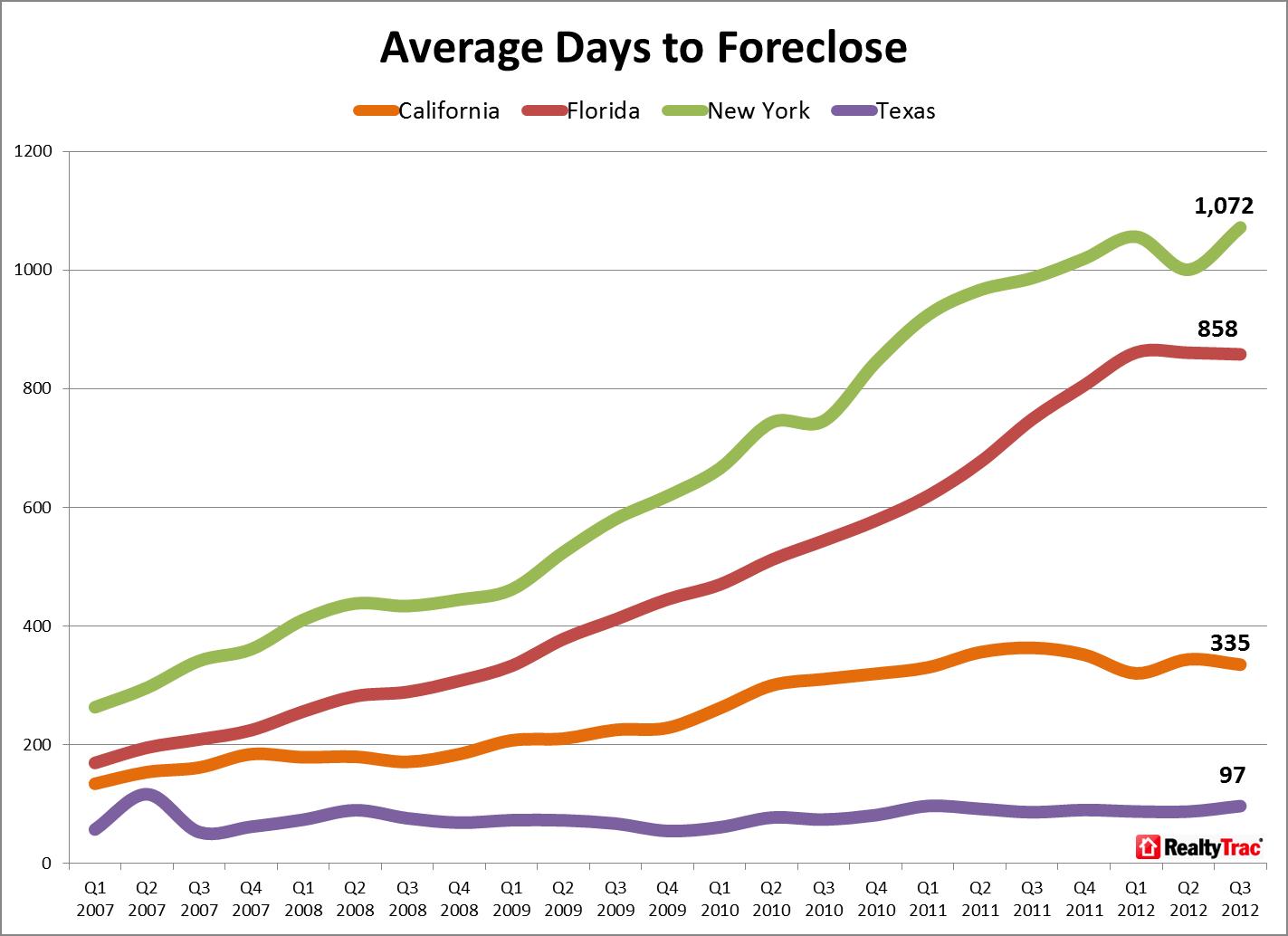

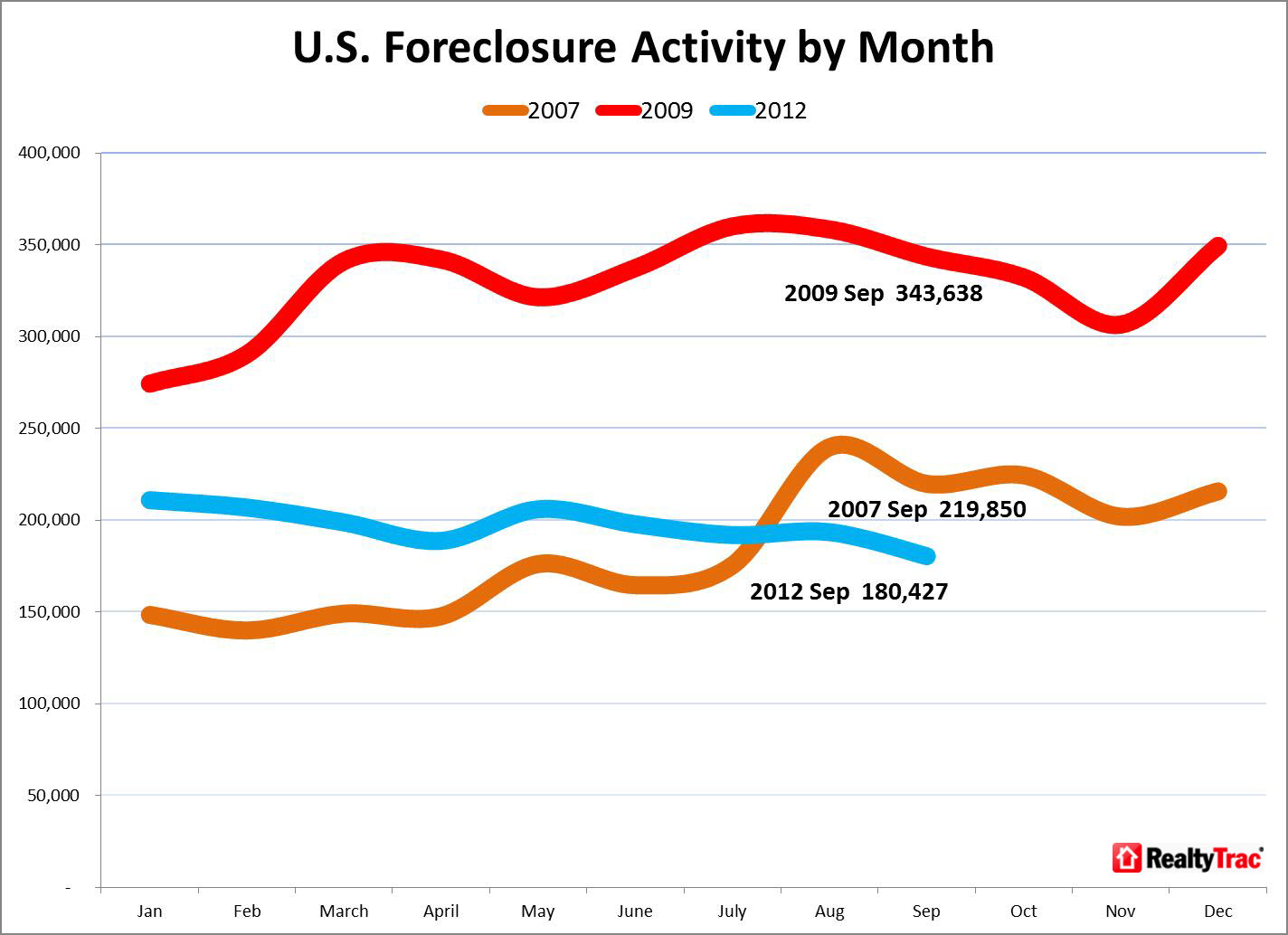

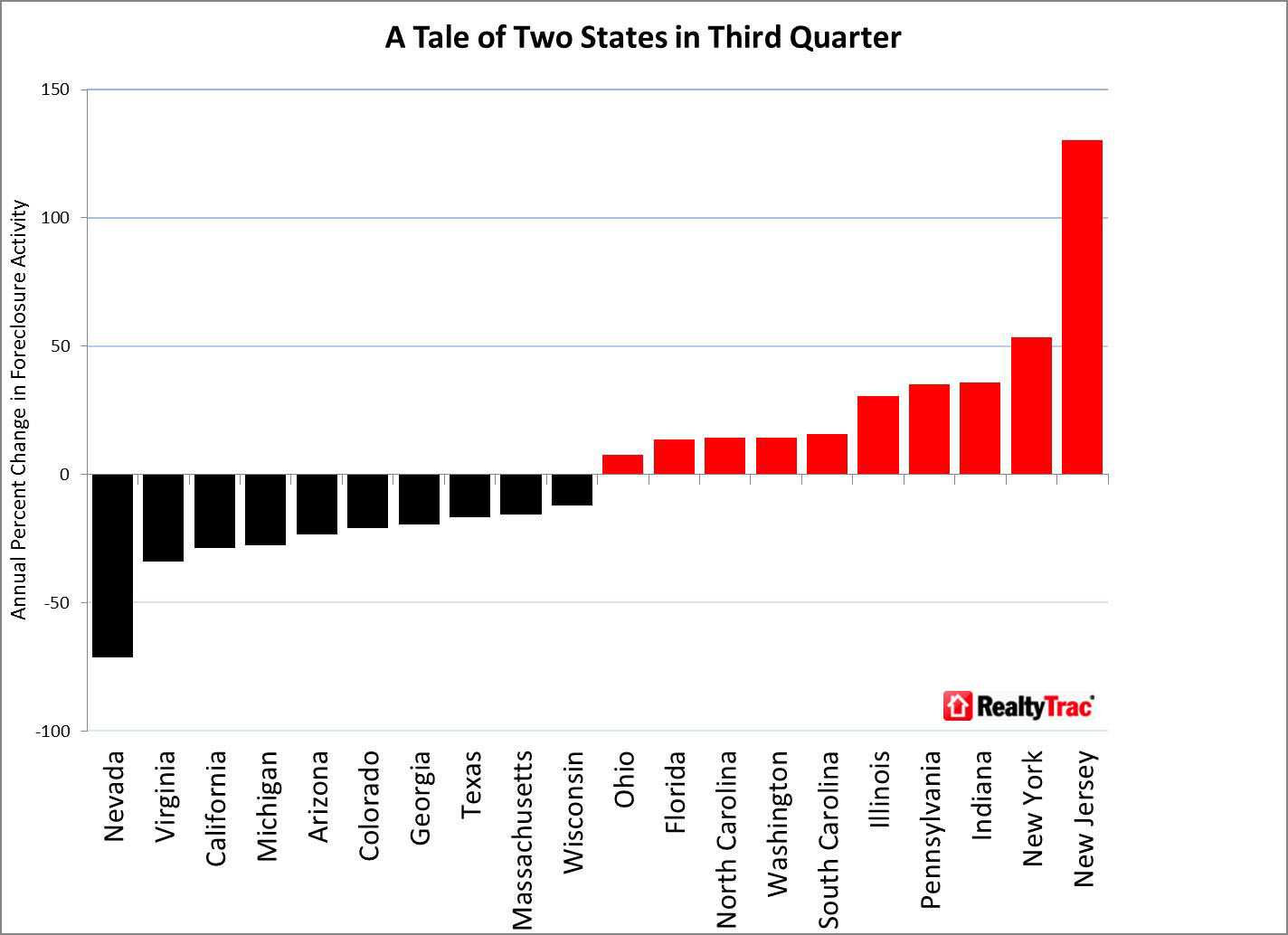

| Foreclosure Activity Drops to 5-Year Low in September Posted: 11 Oct 2012 10:30 AM PDT

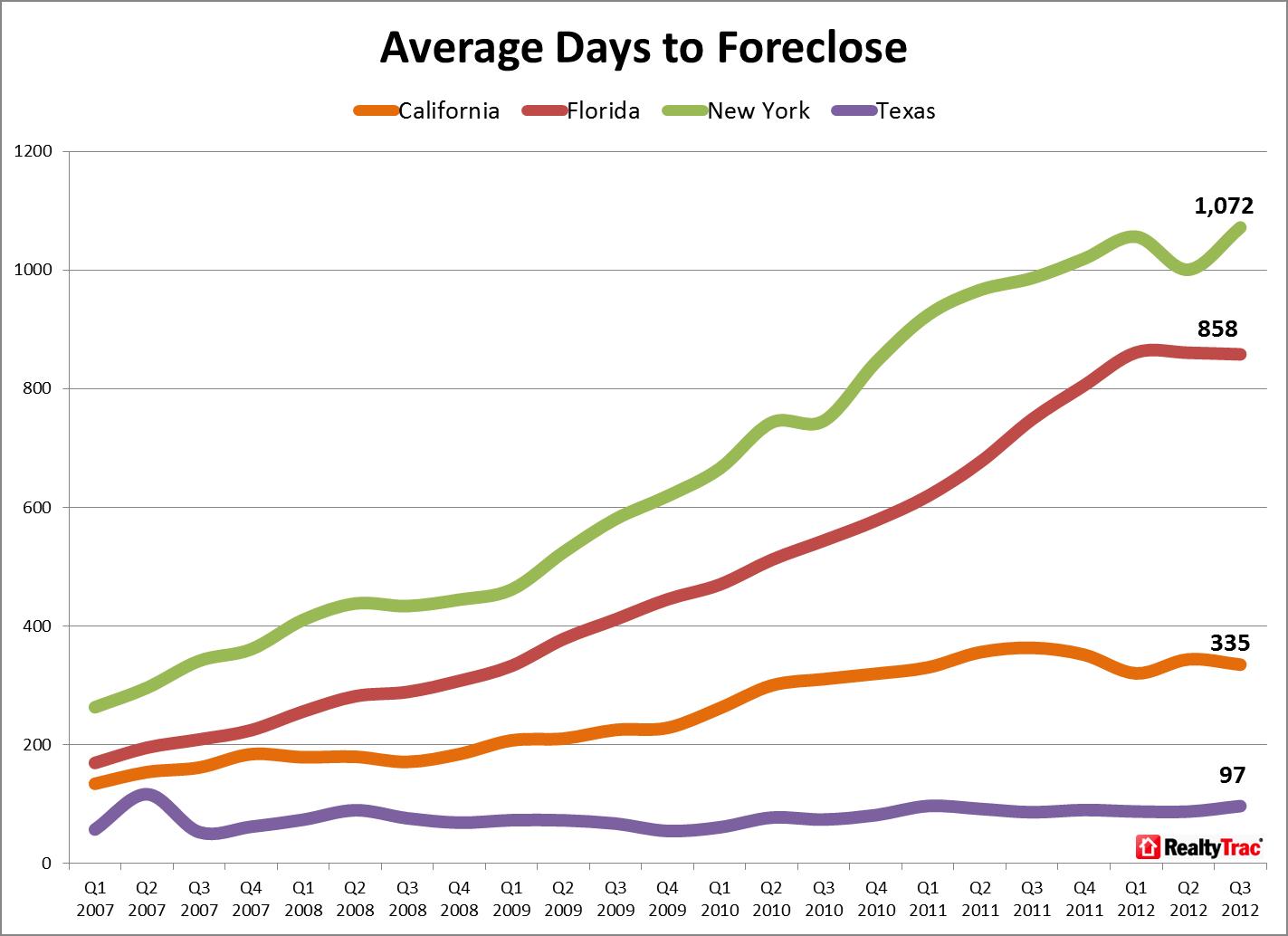

Nice set of informative charts from RealtyTrak Other key findings from the report: - The national decrease in September and the third quarter was driven mostly by sizable decreases in the non-judicial foreclosure states such as California, Georgia, Texas, Arizona and Michigan.

- Several judicial foreclosure states — including Florida, Illinois, Ohio, New Jersey and New York — continued to buck the national trend, registering substantial year-over-year increases in foreclosure activity in September and the third quarter.

- U.S. foreclosure starts in the third quarter decreased both from the previous quarter and a year ago, reversing a bump in foreclosure starts in the second quarter.

- California foreclosure starts (NOD) in September decreased 18 percent from the previous month and were down 45 percent from a year ago to a 69-month low, although the state's foreclosure rate still ranked in the top three for the month and quarter.

- Florida foreclosure starts (LIS) in September increased 24 percent on a year-over-year basis, the 11th consecutive month with an annual increase, and the state's foreclosure rate ranked highest nationwide for the first time since April 2005.

- Of the 24 states where the non-judicial foreclosure process is primarily utilized, 20 reported annual decreases in foreclosure activity in the third quarter, including Nevada (71 percent decrease), Oregon (63 percent decrease), Utah (60 percent decrease), Virginia (34 percent decrease), California (29 percent decrease), Michigan (28 percent decrease), Arizona (23 percent decrease), Colorado (21 percent decrease), Georgia (20 percent decrease) and Texas (17 percent decrease).

Source:

Realty Trac

October 11, 2012  |

| Missed The Big Picture Conference? Don’t Worry. Here’s Where You Can Watch It and Read All About It. Posted: 11 Oct 2012 09:56 AM PDT

click for videos

Click on the image above or the link here to go to FORA.tv’s full video coverage of all the speakers at The Big Picture Conference. Below is a list of items that ran about the conference speakers to get you in the mood to buy the video. -

| Business Insider-10 hours ago Today I had the awesome opportunity to hang out for a few hours at The Big Picture conference hosted by Barry Ritholtz, one of the original … |

Business Insider | -

| MarketWatch-1 hour ago NEW YORK (MarketWatch) — Noted gloom-merchant Dylan Grice took to the stage at The Big Picture Conference in New York Wednesday to … | | -

| Wall Street Journal (blog)-19 hours ago … of life, Neil Barofsky said at the Big Picture conference in Manhattan today. The only question is whether the financial system will be reformed … |

Wall Street Journal (blog) | -

| Wall Street Journal (blog)-13 hours ago Speaking at The Big Picture conference in New York City, Rosenberg stressed the Fed’s efforts are intended to push investors to stocks, … |

Wall Street Journal (blog) | -

| MarketWatch-2 hours ago … Law and outspoken critic of the Washington establishment, made these remarks at The Big Picture Conference in New York on Wednesday. | | -

| MarketWatch (blog)-16 hours ago … central banks are playing games they don’t understand, according to tweets by MarketWatch’s Sam Mamudi from the Big Picture Conference. | | -

| Business Insider-15 hours ago Independent analyst Jim Bianco just just wrapped a very bold presentation at The Big Picture conference, where he talked about the weak … |

Business Insider | -

| MarketWatch (blog)-21 hours ago Neil Barofsky, the former inspector general of TARP, is offering some pointed comments at The Big Picture conference in New York Wednesday … | | -

| MarketWatch-12 hours ago But though there was a strong atmosphere of negative sentiment at The Big Picture Conference in New York Wednesday — one speaker went … | | -

| Business Insider-17 hours ago … the middle of watching Gluskin-Sheff economist David Rosenberg present a gloomy outlook for the economy at The Big Picture conference. | -

| Business Insider-13 hours ago Definitely check out Jim Bianco’s presentation at The Big Picture conference, where he talks about the state of the economy, earnings, and the … | | -

| Business Insider-16 hours ago Here at The Big Picture Conference, independent analyst Jim Bianco suggests that of course you should: Because according to him, Jack … |

Fortune | -

| MarketWatch (blog)-14 hours ago Bianco made the comments at the Big Picture conference, the report said. – Russ Britt. Follow Political Watch on Twitter at @mktwpolitics …

|  |

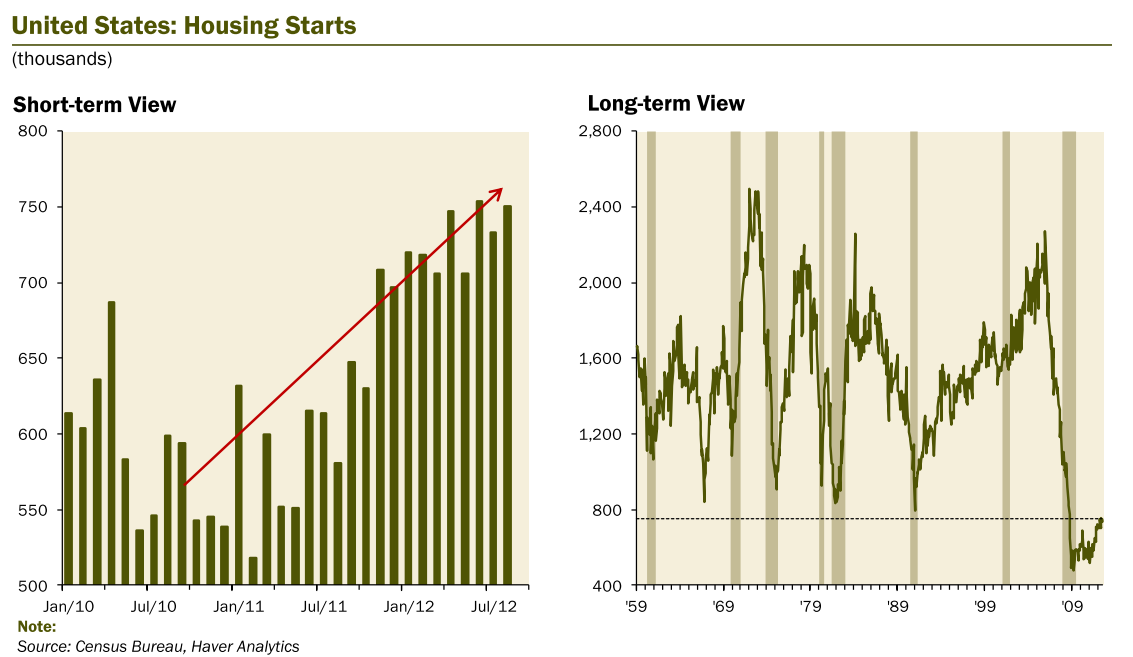

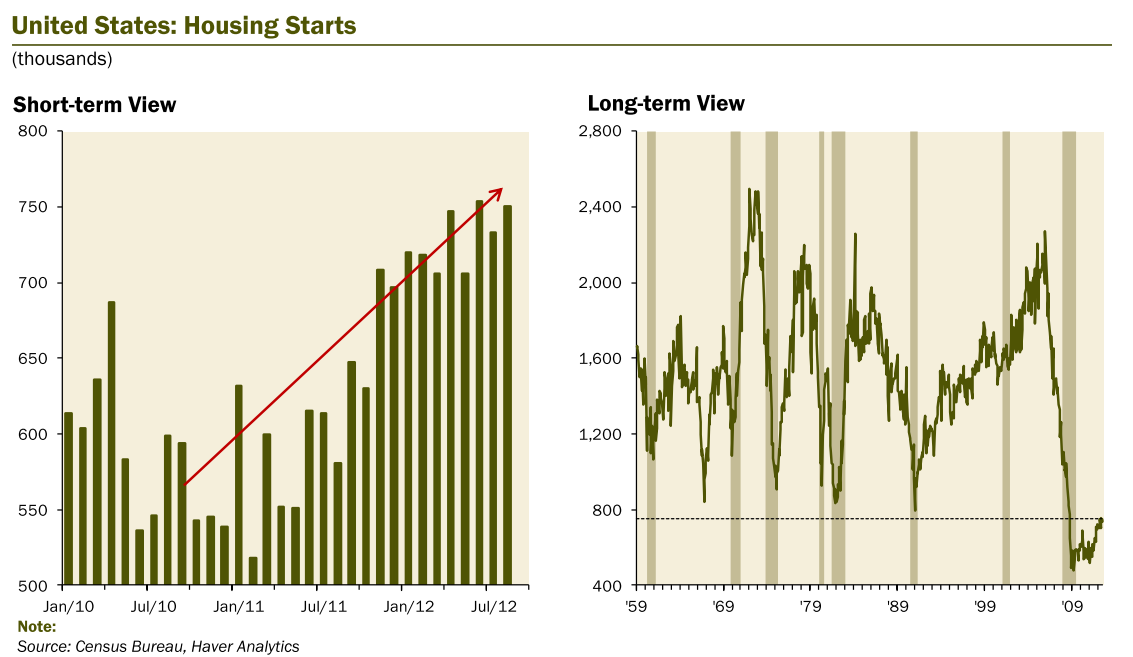

| Housing Recovery in Perspective Posted: 11 Oct 2012 09:55 AM PDT I loved the way this slide from Rosie’s presentation yesterday contextualized the Housing recovery:

|

| 30 yr auction soft Posted: 11 Oct 2012 09:40 AM PDT Following excellent 3 yr and 10 yr auctions, the Treasury found the results of the non inflation protected 30 yr not as good. The yield was a few bps above the when issued and the bid to cover of 2.49 was below the previous 12 auction average of 2.65. Also, dealers got stuck with 59.3% of the auction, the most since Jan. Bottom line, the make up of buyers of 30 yr paper is somewhat different than other areas of the curve as more pension funds and insurance co’s like the long term asset to match up with their liabilities. This said, inflation expectations are still very important especially with yields this low. Today’s 30 yr is the 1st longest term bond auction since the Sept 13th Fed news.  |

| QOTD: Housing Recovery Posted: 11 Oct 2012 08:00 AM PDT I moderated a few panels at the PEW conference in DC this summer with Sheila Bair — and the stand out to me was Laurie Goodman. I think this quote today sums up the Housing recovery meme perfectly: “While we have seen many dramatic headlines touting the housing recovery over the past 3.5 years, these headlines and the analysts who author them have been over-predicting changes in the housing market.” -Laurie Goodman, Amherst Securities

Source: Is the Housing Recovery For Real?  |

| 10 Thursday AM Reads Posted: 11 Oct 2012 07:00 AM PDT My morning reads: • Markets are up. Earnings are down. Here's what's really going on. (WP) see also Market Warning Signs (Stocktwits)

• Narula Masters Fed, Beats Funds With 500% Gain: Mortgages (Bloomberg) so sorry about that down 100% year in 2008…

• Stocks Skid Into Earnings Pothole (WSJ) see also 20% (WTF?) of US Firms Cook the Books During Earnings: Report (CNBC)

• New York mortgage trial could have broad impact on Wall Street (Reuters)

• On the Unsustainability of Austrian Business-Cycle Theory, Or How I Discovered that Ludwig von Mises Actually Rejected His Own Theory (Uneasy Money)

• Facebook: The Making of 1 Billion Users (Business Week) see also Facebook Fought SEC to Keep Mobile Risks Hidden Before IPO (Bloomberg)

• out of office reply (The Reformed Broker)

• The Index of Missing Economic Indicators; The Unemployment Myth (NYT) see also US underemployment is not as bad as you think (FT)

• The Renminbi Challenge (Project Syndicate)

• Does Biology Make us Liars? (The New Republic) see also Half of the Facts You Know Are Probably Wrong (Reason)

What are you reading? > There 3.5 People Looking for a Job for each Position available in August 2012

Source: Economic Populist  |

| The Unemployment Rate And Presidential Elections Posted: 11 Oct 2012 05:30 AM PDT Comment

The table below shows the U.S. unemployment rate, the incumbent and challenger of each presidential election, and the winner of each election from 1904 to present. Prior to 1944 (above the bold line) the unemployment rate shown is a yearly average. After 1944 (below the bold line) the unemployment rate shown is from October of the election year (the last unemployment rate before the election). If the incumbent candidate was not running for re-election, then we assume the party of the previous president was the incumbent. Click to enlarge:

Observations Since WW2, no incumbent has won reelection when the unemployment rate was above 7.4% (Reagan in 1984 was the extreme, highlighted in green). Currently the unemployment rate is 7.8%. So, if Obama wins, he will accomplish what no other incumbent has in the past 70 years. At the other extreme, the incumbent lost in 1952 (Stevenson), 1968 (Humphrey) and 2000 (Gore) when the unemployment rate was below 4% (highlighted in red). If the unemployment rate matters, these incumbents should have won. In the 1930s, Roosevelt won repeatedly despite the highest unemployment rates in the country's history (highlighted in green). He also won in 1944 with the lowest unemployment rate in the country's history (also highlighted in green). Bottom Line If one is trying to use unemployment as the sole factor in determining election outcomes, we do not see a consistent relationship. If you're the incumbent, falling unemployment is always preferred to rising employment, but do not confuse this with increased re-election chances. Source: Bianco Research

For more information on this institutional research, please contact: Max Konzelman

max.konzelman@arborresearch.com

800-606-1872  |

| Spain/Brazil/South Korea/Australia/China. I span the world. Posted: 11 Oct 2012 05:12 AM PDT While the S&P downgrade of Spain’s credit rating by 2 notches to one above junk at BBB- (with negative outlook) is now just in line with Moody’s and is not much of a surprise, the possibility that 2 of the 3 rating agencies are on the cusp of having Spain in junk territory will influence the category of institutional buyers of Spanish bonds. The Spanish 2 yr and 10 yr yields are near 2 week highs. Brazil unexpectedly cut interest rates by 25 bps to 7.25%, a new low and South Korea did as expected by cutting rates also by 25 bps to 2.75%. Australia reported a Sept job gain that was 3 times what was expected. After two days of gains, the Shanghai index fell .8% after the PBOC only injected 59b of yuan in reverse repos, well below the 265b they put in on Tuesday. The yuan did rise to the highest level vs the US$ since 1993. AAII: Bulls 30.6 v 33.9 Bears 38.9 v 33.2  |

0 comments:

Post a Comment