The Big Picture |

- Cheney Admits that He Lied about 9/11

- Weekly Eurozone Watch – Markets “Revert Back”

- Succinct Summation of Week’s Events (March 8, 2013)

- Questioning Why Treasury Defends TBTF Banks

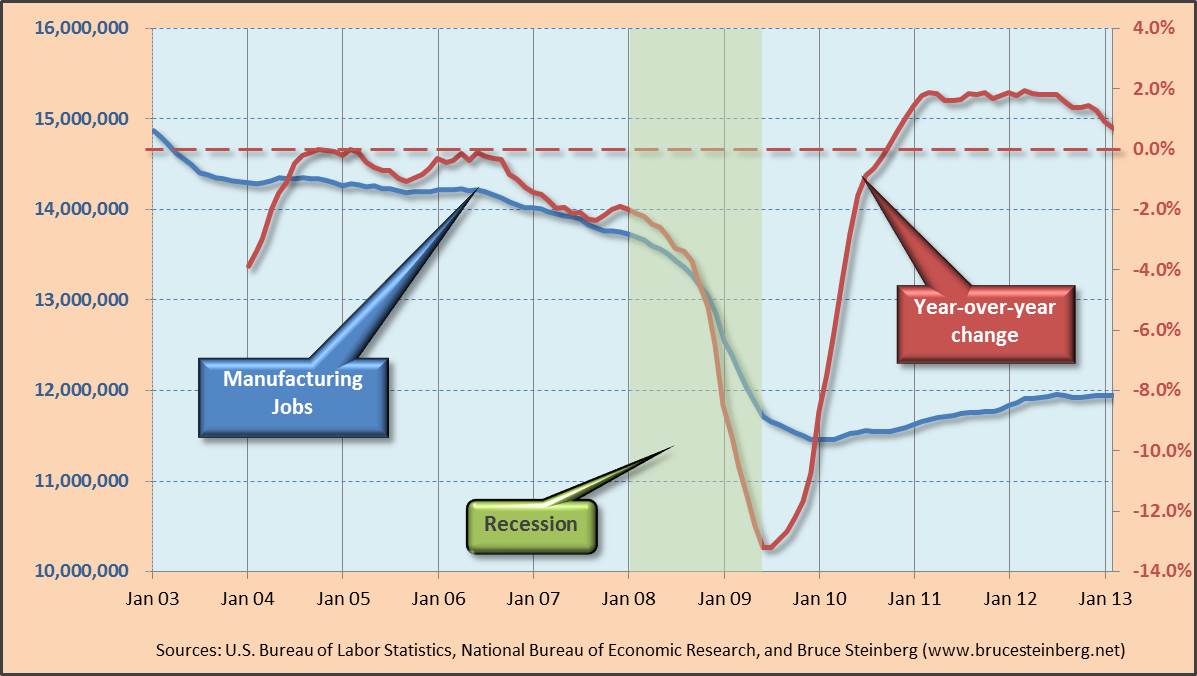

- Manufacturing Jobs 2003-2013

- Bullard: Inflation Modest, Jobless Claims Dropping

- $30 Million Pinajian Art Found in Abandoned Garage

- 10 Friday AM Reads

- NFP Day: Consensus 165k

- Digging Out from Snow

- Chanos: Do Your Own Work

- Anti-Money Laundering and the Bank Secrecy Act

| Cheney Admits that He Lied about 9/11 Posted: 08 Mar 2013 10:30 PM PST Cheney Admits that He Lied about 9/11 — What Else Did He Lie About?The New York Times' Maureen Daud writes today:

In other words, Cheney pretended that Bush had authorized a shoot-down order, but Cheney now admits that he never did. In fact, Cheney acted as if he was the president on 9/11. Cheney lied about numerous other facts related to 9/11 as well. For example, Cheney:

|

| Weekly Eurozone Watch – Markets “Revert Back” Posted: 08 Mar 2013 03:30 PM PST

Key Data Points

Comments

**************************************************************************

**************************************************************************

**************************************************************************

|

| Succinct Summation of Week’s Events (March 8, 2013) Posted: 08 Mar 2013 12:30 PM PST Here is the week’s succinct summation of the week’s events: Positives:

Negatives:

|

| Questioning Why Treasury Defends TBTF Banks Posted: 08 Mar 2013 10:00 AM PST WITNESSES:

POWELL: Thank you, sir. I’ll start by addressing your first comment question, which was the comments of the Attorney General yesterday. And I just want to say it’s fundamental in this country that everyone is equal before the law. And I think his comments only underscore the need to end Too Big To Fail, and the need for the agencies to forcefully implement Title I and Title II as it relates to Too Big To Fail. And just to address that part of your comment. SENATOR WARNER: I also have enormous concern that the length of time to prosecution and are we — the amount of potentially illegally and also potentially threatening in terms of terrorist financing? WARREN: Thank you Mr. Chairman, and thank you all three for being here today. As Senator Reed just pointed out, the United States government takes money laundering very seriously for a very good reason. And it puts very strong penalties in place. In addition to monetary penalties, it’s possible to shut down a bank that’s been involved in money laundering. Individuals can be banned from ever participating in financial services again. And people can be sent to prison. Now in December, HSBC admitted to money laundering. To laundering $881 million that we know of for Mexican and Colombian drug cartels. And also admitted to violating our sanctions for Iran, Libya, Cuba, Burma, the Sudan. And they didn’t do it just one time. It wasn’t like a mistake. They did it over and over and over again across a period of years. And they were caught doing it. Warned not to do it. And kept right on doing it. And evidently making profits doing it. Now HSBC paid a fine, but no one individual went to trial. No individual was banned from banking. And there was no hearing to consider shutting down HSBC’s activities here in the United States. So what I’d like is, you’re the experts on money laundering. I’d like your opinion. What does it take? How many billions of dollars do you have to launder for drug lords and how many economic sanctions do you have to violate before someone will consider shutting down a financial institution like this? Mr. Cohen, can we start with you? COHEN: Certainly Senator. No question the activity that was the subject of the enforcement action against HSBC was egregious. Both in the money laundering that was going on at HSBC and the sanctions violations. For our part, we imposed on HSBC the largest penalties that we had ever imposed on any financial institution. We looked at the facts, and determined that the appropriate response there was a very, very significant penalty against the institution. WARREN: But let me just move you along here on the point Mr. Cohen. My question is, given that this is what you did, what does it take to get you to move towards even a hearing? Even considering shutting down banking operations for money laundering? COHEN: Senator, we at the Treasury Department under OFAC and (ph) authority, we don’t have the authority to shut down a financial institution.

WARREN: I understand that. I’m asking, in your opinion, you are the ones who are supposed to be the experts on money laundering. You work with everyone else, including the Department of Justice. In your opinion, how many billions of dollars do you have to launder for drug lords, before somebody says, we’re shutting you down? COHEN: Well I think the authority to pull a license, pull the charter, is authority that is committed to the supervisors, to the OCC, the (ph) of the supervisor may be. We take these issues extraordinarily seriously. We aggressively prosecute and impose penalties against the institutions to the full extent of our authority. And as I said earlier, one of the issues that we’re looking at - WARREN: I’m not hearing your, I’m sorry, I don’t mean to interrupt. And I just need to move this along. But I’m not hearing your opinion on this. You’re supposed to be, Treasury is supposed to be, one of the, you are the leaders in how we understand and work together to stop money laundering. And I’m asking, what does it take, even to say, here’s where the line is. We’re going to draw a line here, and if you cross that line, you’re at risk for having your bank closed? COHEN: So Senator, we’re mindful of what our authorities are, mindful of what the Supervisor’s authorities are. We will, and have, and will continue to exercise our authorities to the full extent of the law. The question of pulling a bank’s license is a question for the regulators. WARREN: So you have no opinion on that? You sit in Treasury and you try to enforce these laws, and I’ve read all of your testimony. You tell me how vigorously you want to enforce these laws. But you have no opinion on when it is that a bank should be shut down for money laundering? Not even an opinion? COHEN: Of course we have views on - WARREN: That’s what I asked you for. Your views. COHEN: But I’m not going to get into some hypothetical line drawing exercise. WARREN: Well it’s somewhere beyond $881 million of drug money. COHEN: Well Senator the actions, and I’m sure the regulators can address this issue. The actions that we took in the HSBC case, we thought were appropriate in that instance. WARREN: Governor Powell, perhaps you can help me out here? POWELL: Sure. So the authority to shut down an institution or hold a hearing about it, I believe is triggered by a criminal conviction. And that is not something, we don’t do criminal investigation. We don’t do trials or anything like that. We do civil enforcement. And in the case of HSBC we, we gave essentially the statutory maximum - WARREN: So - POWELL: Civil money penalties. And we gave very stringent cease and desist orders. And we did what we have the legal authority to do. WARREN: I appreciate that Mr. Powell. So you’re saying you have no advice to the Justice Department on whether or not this was an appropriate case for a criminal action? POWELL: So the way it works is, the Justice Department has total authority. WARREN: I understand that. POWELL: This is the heart of what they do. It’s the heart of their jurisdiction to decide who gets prosecuted and for what. It’s not our jurisdiction. They don’t do monetary policy. They don’t give us advice on that. We cooperate with them and we, we discuss with them. We collaborate with them, and we did on HSBC. They ask us specific questions, how does this statute apply? What would happen if we did this? We answer those questions. That’s what we do. WARREN: So what you’re saying to me is you are responsible for these banks, and again, I read your testimony and you talk about the importance of vigorous enforcement here. But you’re telling me you have no view when it’s appropriate to consider even a hearing to raise the question of whether or not these banks should have to close their operations when they engage in money laundering for drug cartels? POWELL: I’ll tell you exactly when it’s appropriate. It’s appropriate where there’s a criminal conviction. WARREN: And so you have no view on it, until after the Justice Department has done it? POWELL: Again we, the Justice Department makes that decision. We play our role in that. We have a constant dialogue with them around, not just, essentially many, a broad range of violations that take place. We always have the Justice Department involved. But when they, when they make these decisions, they make them themselves. WARREN: I understand that I’m over my time. And I’ll just say here, if you’re caught with an ounce of cocaine, the chances are good you’re going to go to jail. If it happens repeatedly you may go to jail for the rest of your life. But evidently, if you launder nearly a billion dollars for drug cartels and violate our international sanctions, your company pays a fine and you go home and sleep in your own bed at night. Every single individual associated with this. I just, I think that’s fundamentally wrong. WARNER: Senator Kirk. KIRK: Driving it (ph), you would think I agree with most of the direction you’re going in. You would think there would have been one hell of a penalty for money laundering for terrorists who are building nuclear weapons. MERKLEY: On I believe it was the day after the announcement that HSBC had essentially been caught laundering billions of dollars in funds, there was a woman – there was a story about a woman who her boyfriend had stored I believed a suitcase or a coffee can with his drug money in her upstairs or her attic or something like that, and she was doing something like 10 years in prison for having that tangential connection to the flow of this illegal money. So if an individual gets 10 years in prison, can you explain – each of you – how you would explain to an ordinary citizen in America that a company which launders billions of dollars tied to criminal syndicates that in northern Mexico 40,000 people have died – I don’t know about the terrorist side of this, but the drug side is pretty well-documented – how do we explain that that is a system of justice in the United States of America? Mr. Cohen? MERKLEY: No, I understand that, but that wasn’t my question. But you’re welcome to simply say, I don’t feel it’s appropriate for me to answer your question. That would be better than just pretending not to answer it. MERKLEY: I don’t want you to recite history I’m already familiar with. Let me ask the question differently. Do we have a situation where banks have become so large that, in the words of Attorney General Holder, if you prosecute them “it will have a negative impact on the economy and the financial system at large”? And does that mean essentially we have a prosecution-free zone for large banks in America? MERKLEY: Thank you. And Governor Powell, is – does this create a fundamental concern about a fair system of justice across America? POWELL: Yes, it does. It’s absolutely fundamental that we’re all equal before the law. And that’s why we’re all committed to ending too big to fail. HEITKAMP: If – if you were a bank executive today faced with the opportunity to make millions and millions of dollars laundering drug money or facing you guys, looking at, you know, what you’re going to suffer in terms of consequences, do you think there is an effective deterrent today to prevent this from happening again? HEITKAMP: And Mr. Cohen, just – just for – for my edification, you know, I was a attorney general. I was somebody who both did civil and criminal prosecution. And I can assure you criminal prosecution of white collar crime is much more effective than fines and penalties and shame that you might experience when you’re talking into a courtroom. HEITKAMP: Yeah. But Mr. Cohen, one of the – the disturbing parts of this dialogue that we’re having is there – at every sense, there seems to be it’s not my job. It’s not my problem. That this is some place else. And one of the great tragedies I think for the American people looking at government is too much “it’s not my job.” And so what we’re really asking is that this be everybody’s job. HEITKAMP: Yeah, I understand that. And – and the problem is that the expertise is with your agencies and you’re asking the Justice Department – or the Justice Department sees a lot of complexities in what you do and there doesn’t seem to be a real opportunity for a comfort level of a prosecution that needs to happen. At least it needs to be tried. It needs to be attempted.

MANCHIN: We all have a hard time understanding why you haven’t cracked down on banks that are using illicit funds, something that’s just wreaking havoc at subendemic proportion and drugs in American culture — American culture and you have a chance to do it. MANCHIN: this is one thing you see as probably united from the Democrat and Republican side, and there’s very few things that you’ll find that we have had chances to agree on but this one we do and I think we’re so frustrated. And if the banks are going to do business in this country, they should do them by our values. And if you don’t enforce those values, you know, we’ve got to find people that will enforce those values, I think is what we’re saying. MANCHIN: But the — but the HSBC, I mean you — you — they paid the largest fine in the history and nobody was prosecuted. Nothing was done, but you found them guilty. MANCHIN: Mr. Chairman, I’m running out of time. I would just ask for the consideration of the chair if you would ask the DOJ to — to come and give testimony on why they have not prosecuted? Why they will not enforce the laws of our land? If you would have and — and ask and request them to appear before this committee? WARNER: At least today, I think — I think we — you’re — what you’re hearing from all of is an enormous concern that coupled with some of the comments the Attorney General made and I appreciate Mr. Powell’s directness that. You know, we’ve got to make sure there is no institution that is too large to prosecute and there is — there is also concern. When you look at not just — we’ve talked about HSBC, but there are ten other cases the committee has cited. Each of these are cases that have taken literally years to get to the fine stage, let alone the fact that there’s not been actual prosecution. WARNER: everybody seems to be passing the hot potato. WARREN: Thank you, Mr. Chairman. I just want to follow up to make sure that I’m just following what’s going on here. So do you consult with the Department of Justice on each of these major drug- laundering (ph) cases and terrorism cases? Is that right, Mr. Cohen? COHEN: Certainly. In the course of the investigation, there’s a constant dialogue among the investigators about what’s being found, what the facts are, sharing information. WARREN: And so when the Justice Department is making the decision about whether or not to make a criminal prosecution, do they ask you about the impact on the economy for one of these large banks? COHEN: So I can’t speak to every instance whether that occurs, that did occur in the HSBC matter. We told the Justice Department that we weren’t in a position to offer any meaningful assessment of what the impact might be of whatever criminal (ph) disposition they make take. But I would distinguish between the ongoing communication among investigators… WARREN: Wait, I… COHEN: … and the ultimate decision. WARREN: I want to be sure I understand what you just said. The Justice Department, in making its decision whether or not to pursue a criminal prosecution, checked with the Department of Treasury to determine your views on whether or not there would be a significant economic impact if a large bank were prosecuted. Is that what you just said? COHEN: What I said was the Justice Department contacted us, asked whether we could provide guidance on what the impact to the financial system may be of a criminal disposition in the HSBC case. We informed the Justice Department that given the complexity of the potential dispositions, given the fact that we’re not the Prudential regulator, given the fact that we’re not privy to the different charges that the Justice Department may bring and we’re not privy to the responses that the regulators may have to the variety of different ways that the Justice Department may resolve the case, that we were not in a position to offer any meaningful guidance to the Justice Department in that matter. WARREN: So you just said to the Justice Department, “You’re on your own in figuring this out”? COHEN: We said that — we said exactly what I just said. WARREN: I know you said it in a nice, long way. But… COHEN: That’s what we said to the Justice Department, was exactly what I just told you, Senator. WARREN: OK. Mr. Powell, did the Justice Department get in touch with the Fed on this question before making a decision whether to prosecute HSBC? POWELL: Senator, there were conversations between Justice and the Fed, but I don’t believe that question was asked or answered. I will make sure of that and follow up. But I believe that the questions we were asked were specific questions about the application of this or that statute, for example, can certain kinds of investors not invest in a company that has been indicted — or, sorry, not indicted, but convicted or pled guilty to a felony. So that’s, I believe, the role we’ve had and I don’t think it went any farther than that. WARREN: Mr. Curry? CURRY: The only question that we discussed… WARREN: I’m sorry, Mr. Curry, could you push your button? There we go. CURRY: The only question that the Justice Department asked us was with the application of the charter revocation provision of our National Bank Act. WARREN: And who is responsible for making a determination about whether to revoke the charter? CURRY: That is a — there’s a statutory process that requires notice and hearing and we went through how that process would work. WARREN: And who would initiate that? CURRY: That process would be initiated by the Comptroller’s Office, but only upon a conviction for any money-laundering violations. WARREN: So whether or not you could revoke the charter depended on what the Justice Department did. Did you have that discussion with the Justice Department to encourage them to bring up criminal prosecution so that you could have a hearing about whether to revoke the charter? CURRY: Our position was that that’s a criminal justice determination that is left to the discretion of the Justice Department. We are and were prepared to follow our statutory procedure if and when there was a criminal conviction. WARREN: So you did not make it clear to the Justice Department that if the Justice Department did not bring a criminal prosecution that you would not be able to use one of the significant tools of enforcement given to you by Congress? CURRY: We explained to them how… WARREN: You did explain it. CURRY: … the statute works and that would be the consequence of not having a conviction, the statute would not be triggered. WARREN: All right. If I can, can I just ask a little more, overview (ph) question about this? I’m hearing four major actors, the three of you here and the Justice Department. Why are their four departments trying to figure out money-laundering? I read through your reports. They seem to overlap significantly. We seem to have a lot of people with the same expertise and yet not quite the same expertise. Why is this not consolidated into a single function? MERKLEY: Thank you. I want to go onto the next piece of this, which is we basically had a fine that was a small amount of the annual profits, I believe about 10 percent of the annual profits. I know it’s been described as a very severe fine. But we’re talking about action that continued over a 10 year period. In 2003 the bank said it was going to reform its anti-money laundering conduct. There was continuous concerns about it. So I don’t know what the profits were over 10 years, but over one year they were $20 billion (ph). So let me just extrapolate that. Maybe it’s not accurate, but let’s say the profits over 10 years were $200 billion (ph). So now we’re talking about a fine that was one percent of the profits over the time that this conduct was occurring. Is that, does that really send a message that this type of conduct is unacceptable? Mr. Curry? MERKLEY: We worked with this bank 10 years, admonished it apparently a number of times. They apparently promised reforms that were never done. And I don’t find that one percent of their profits over the time period of this conduct, really sends a chilling message that this is unacceptable. It sounds more like the price of doing a very profitable business. Thank you. COHEN: The decision to prosecute in any particular case, is a decision for the Justice Department to make. WARNER: At what point, do you turn that over to the Justice Department? What is the threshold for turning over information to the Justice Department?

Source: |

| Posted: 08 Mar 2013 09:00 AM PST U.S. Employment Situation (February 2013)

Bruce Steinberg puts the past decade (or 5) of Employment data into a bigger context, detailing in particular the impact of Manufacturing Jobs:

The obvious point is that manufacturing jobs in the US have been in a secular decline since the end of World War II. While there is a definite renaissance of manufacturing, and modest improvement in manufacturing sector jobs, we are nowhere near as dependent on the sector of employment. |

| Bullard: Inflation Modest, Jobless Claims Dropping Posted: 08 Mar 2013 08:30 AM PST Federal Reserve Bank of St. Louis President James Bullard talks about the outlook for the U.S. labor market, the central bank’s policy and the economy. He speaks with Tom Keene and Michael McKee on Bloomberg Television’s “Surveillance.” U.S. Jobless Claims Drop Encouraging, Bullard Says Fed’s Bullard: 200K A Good Benchmark for Jobs |

| $30 Million Pinajian Art Found in Abandoned Garage Posted: 08 Mar 2013 07:30 AM PST Bellport Man Finds Arthur Pinajian Artwork Appraised At $30 Million Pretty astonishing story:

Source: CBS New York |

| Posted: 08 Mar 2013 07:00 AM PST My morning reads:

What are you reading?

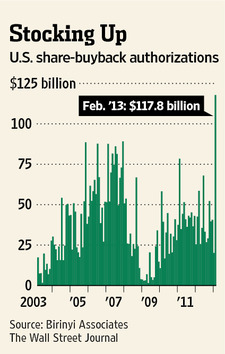

Firms Send Record Cash Back to Investors |

| Posted: 08 Mar 2013 05:21 AM PST A quick note on today’s employment situation report: Consensus of 90 economists surveyed by Bloomberg is for additional 165,000 workers for February (January was 157,000 gain) . The jobless rate is expected to hold steady at 7.9%, although a potential improvement would not surprise me. Note that ADP numbers were very good: 198k private sector jobs added in February, almost 20k above consensus. January was revised upwards by another 23,ooo, making the private sector gains for the 1st month of the year 215k. Consider that ADP 2 month average to start the year of 207k compares quite favorably versus the 2012 average of 144k. (Note ADP’s correlation with BLS is spotty at best) As always, I am watching Hours worked, Wages, and Temp help. This month, watch the revisions as well. My guess? I have no opinion . . . ~~~ Employment situation report released at 8:30am

UPDATE: Payrolls added 236k; Unemployment falls to 7.7% |

| Posted: 08 Mar 2013 04:08 AM PST |

| Posted: 08 Mar 2013 04:00 AM PST Jim Chanos on Dell, Herbalife & Importance of Doing Your Own Work: Latest Interview Jim Chanos on Shorting Herbalife, Dell ~~~ Doing Your Own Work Hat tip: Market Folly |

| Anti-Money Laundering and the Bank Secrecy Act Posted: 08 Mar 2013 03:00 AM PST Governor Jerome H. Powell March 7, 2013Chairman Johnson, Ranking Member Crapo, and other members of the committee, thank you for inviting me to discuss the important role the Federal Reserve plays in the U.S. government’s effort to combat money laundering and terrorist financing. I will begin by describing our efforts to ensure banking industry compliance with the requirements of the Bank Secrecy Act (BSA) and the economic sanctions authorized by the President and Congress. I will also highlight some of the important actions we have taken to enforce the law and to promote safe and sound practices in this area. Background The particular steps a banking organization must take to develop a BSA compliance program have been documented extensively. The foundation for such a program begins with a well-developed and documented risk assessment that identifies and limits the risk exposures of the banking organization’s products, services, customers, and geographic locations. Monitoring systems should be in place to identify and report suspicious activity, in particular any account or transaction activity that is not consistent with the bank’s expectations. These systems should be accompanied by a strong training program to ensure that personnel, including those in offshore offices, are familiar with U.S. regulatory requirements and bank policies. The BSA compliance program should be reviewed by management, subjected to periodic independent tests that measure whether the program is functioning properly, and improved as needed. Finally, a qualified bank officer should be given sufficient authority to ensure that regulatory requirements and bank policies are being followed on a day-to-day basis. Banking organizations are also expected to maintain a program for ensuring compliance with U.S. economic sanctions administered by the Treasury’s Office of Foreign Assets Control (OFAC). The OFAC program should identify higher-risk areas within a bank’s operations, and implement appropriate internal controls for screening and reporting prohibited transactions. Banks are expected to perform independent testing for compliance, designate a bank employee or employees that are specifically responsible for OFAC compliance, and create training programs for appropriate personnel in all relevant areas of the bank. A bank’s OFAC compliance program should be commensurate with its activities and its risk profile. The Supervisory Process

The Federal Reserve’s BSA and OFAC reviews are risk-focused. In other words, supervisors have the flexibility to apply the appropriate level of scrutiny to higher-risk business lines. To ensure consistency in the design and execution of our BSA and OFAC examinations, we use procedures developed jointly with the member agencies of the Federal Financial Institutions Examination Council (FFIEC),1 FinCEN, and OFAC. The findings of our BSA and OFAC reviews are taken into account in determining the institution’s examination ratings, either as part of the management component rating for domestic institutions, or as part of the risk management and compliance component ratings used to evaluate the U.S. operations of foreign bank branches and agencies we supervise. The Federal Reserve reinforces its supervisory program by conducting targeted examinations of financial institutions that show signs of being vulnerable to illicit financing. Banks are selected for such examinations based on, among other things, our analysis of the institution’s payments activity, suspicious activity reports, currency transaction reports, and law enforcement leads. The Federal Reserve devotes substantial resources to BSA compliance. Each Federal Reserve Bank has a BSA specialist and coordinator on staff, and, since the late 1980s, the Board’s Division of Banking Supervision and Regulation has included an anti-money laundering section, overseen by a senior official, to help coordinate these efforts. Coordination Efforts First, to ensure that the banking industry has clear understanding of regulatory expectations, the Federal Reserve has actively participated in supervisory forums, such as the FFIEC, which has an expansive BSA working group that promotes high standards for bank examinations and compliance. In addition, we participate in the Bank Secrecy Act Advisory Group, a public-private partnership established for the purpose of soliciting advice on the administration of the BSA. The Federal Reserve also joined the U.S. Treasury’s Interagency Task Force on Strengthening and Clarifying the BSA/AML Framework (Task Force), which includes representatives from the Department of Justice, OFAC, FinCEN, the federal banking agencies, the Securities and Exchange Commission, and the Commodity Futures Trading Commission. The primary focus of the Task Force is to review the BSA, its implementation, and its enforcement with respect to U.S. financial institutions that are subject to these requirements, and to develop recommendations for ensuring the continued effectiveness of the BSA and efficiency in agency efforts to monitor compliance. Second, to make the supervision of internationally active banking organizations more effective, we are engaged as a member of the U.S. delegation to the Financial Action Task Force, an international policymaking and standard-setting body dedicated to combating money laundering and terrorist financing globally. Further, as a member of the Basel Committee on Banking Supervision (BCBS), we have been involved in various efforts to prevent criminal use of the international banking system. For example, in 2009, as a complement to BCBS efforts to promote transparency in cross-border payments, the Federal Reserve issued guidance with other federal banking agencies that clarifies U.S. regulatory expectations for U.S. banks engaged in correspondent banking activities. Finally, we are working cooperatively with other federal banking agencies, state regulators, the Department of Justice, the Department of Treasury, and foreign regulators to ensure comprehensive enforcement of the law. We have participated in many of the largest, most complex enforcement cases in the BSA and U.S. sanctions area. Collectively, these cases have focused attention on potential misuse of the financial system for financial crimes, strengthened compliance programs at banking organizations (both in the U.S. and abroad), and generated billions of dollars in fines paid to the U.S. Treasury. Our coordination efforts begin at an early stage in the supervisory process. For example, the Federal Reserve brings every instance of an anti-money laundering deficiency or violation to the attention of FinCEN so that FinCEN may consider assessing a penalty for violations of the BSA. We also notify OFAC of any apparent, unreported sanctions violations discovered in the course of an examination, and direct the banking organization we supervise to provide information directly to OFAC as required by regulation. In addition, we share information and coordinate with the Department of Justice, state law enforcement, the federal banking agencies, and state regulators, as appropriate, as part of our enforcement program. The Enforcement Process Most of these problems are resolved promptly after they are brought to the attention of a bank’s management and directors. In some instances, problems are of more serious concern and use of the Federal Reserve’s enforcement authority is deemed appropriate. In these cases, an informal supervisory action may be taken, such as requiring an institution’s board of directors to adopt an appropriate resolution or executing a memorandum of understanding between an institution and a Reserve Bank. In the most serious cases, the Federal Reserve may take a formal enforcement action against an institution. These actions may include a written agreement, a cease and desist order, or a civil money penalty. Congress has also given the Federal Reserve the authority to terminate the operations of certain entities operating in the U.S. upon the conviction of a money laundering offense by the Department of Justice, and to prohibit insiders who intentionally commit such offenses from participating in the banking industry. The type of enforcement action pursued by the Federal Reserve against an institution is directly related to the severity of the offense, the type of failure that led to the offense, and management’s willingness and ability to implement corrective action. In the last five years, the Federal Reserve has issued 113 enforcement actions relating to BSA and OFAC compliance, including 25 public cease and desist orders and written agreements. Together with these recent actions, the Federal Reserve has assessed hundreds of millions of dollars in penalties. The institutions that have been subject to these actions are large and small, domestic and foreign. In each case, the Federal Reserve has required the institution to take corrective measures to ensure their programs are brought into compliance. Enforcement of U.S. Economic Sanctions The misconduct in these cases relates primarily to the manner in which these firms handle cross-border payments. Cross-border payments can be broadly defined as transactions between banking entities that are located in different countries, but there are many different permutations of cross-border payments. For example, cross-border payments can be carried out as a wire transfer where the originator and beneficiary are located in different countries; a wire transfer where the originator and beneficiary are in the same country, but where one or more correspondents in a second country are used; or as a chain of wire transfers that has at least one international element. Cross-border payments typically occur when the originator and beneficiary, or their banks, are located in different countries or where the currency used for the payments is not the currency of the country where the transaction originates. For example, U.S. dollars may be used to make a payment between parties each located in a different foreign country. Structurally, there are usually two components to these cross-border payments: (1) the instructions, which contain information about the originator and beneficiary of the funds, and (2) the actual funds transfer. The payment instructions for cross-border payments typically are sent to an intermediary bank using industry financial telecommunications systems, such as the Society for Worldwide Interbank Financial Telecommunication (SWIFT). The actual funds transfer occurs separately, typically through the domestic funds transfer system of the originator, via a book transfer of an intermediary with a presence on both sides of the border, and through the domestic funds transfer system of the beneficiary. Foreign banks often operate in jurisdictions that do not impose the same economic sanctions on foreign customers as the United States. Transactions involving these sanctioned customers are nonetheless subject to U.S. law if the transaction is routed through the U.S., as is typical for transactions conducted in U.S. dollars. Foreign banks that operate in countries without sanctions similar to those imposed by the United States have not always had in place the mechanisms to ensure transactions routed through the U.S. comply with U.S. law. Many of the Federal Reserve’s enforcement activities are directed at remedying these situations. One of the Federal Reserve’s most important sanctions enforcement cases involved ABN AMRO. In response to corrective measures the Federal Reserve imposed on the firm’s New York branch in 2004,2 which required the bank to review certain historical transactions, ABN AMRO discovered numerous payment messages that were sent through its U.S. branch or a U.S. correspondent in a manner designed to circumvent the filters used by the U.S. institution to detect transactions involving sanctioned parties. In particular, the information that identified a U.S. sanctioned party was omitted from the SWIFT payment sent through the U.S., while a complementary payment instruction with sanctioned party information was deliberately routed outside the United States. The Federal Reserve responded by escalating our enforcement action to a cease and desist order and imposing a substantial penalty on ABN AMRO.3 The Federal Reserve’s order required ABN AMRO to implement a global compliance program and take specific steps to prevent circumvention of the required U.S. sanctions filters. We coordinated this action with other U.S. and foreign regulators, including the home country supervisor for ABN AMRO. The Federal Reserve’s enforcement action against ABN AMRO triggered important changes in cross-border payment practices. The Federal Reserve played a key role in this debate and in developing the standards that have since been adopted to improve transparency in cross-border payment messages–including the standards adopted by the Basel Committee on Banking Supervision and SWIFT. These standards require the expanded disclosure of the originator and beneficiary on payment instructions sent as part of cover payments. In the years since the ABN AMRO case, the Federal Reserve and other U.S. authorities have taken action against international banks that had been engaged in similar evasive misconduct. Most recently, the Federal Reserve has imposed cease and desist orders on Credit Suisse, Barclays, Standard Chartered, and HSBC.4 In each case, the bank’s home country supervisor has agreed to help monitor compliance with the Federal Reserve’s order. These enforcement cases reflect our continued view that international banks have an obligation to ensure that they do not interfere with the ability of U.S. financial institutions to comply with the sanctions laws. Enforcement of the Bank Secrecy Act The Federal Reserve takes seriously its responsibility to pursue formal, public action in cases of BSA non-compliance. For example, in January, the Federal Reserve issued a cease and desist order requiring JPMorgan Chase to take corrective action to enhance its program for compliance with the BSA and other anti-money laundering requirements at the firm’s various subsidiaries.7 In June 2012, we issued a public enforcement action against Commerzbank AG and its U.S. branch for its failure to comply with certain BSA reporting obligations.8 Conclusion Thank you very much for your attention. I would be pleased to answer any questions you may have.

1. The FFIEC member agencies include the Federal Deposit Insurance Corporation (FDIC), National Credit Union Administration (NCUA), Office of the Comptroller of the Currency (OCC), and the Consumer Financial Protection Bureau (CFPB), as well as the Board of Governors of the Federal Reserve System. Return to text 2. Board of Governors of the Federal Reserve System (2004), “Written agreement with ABN AMRO Bank,” press release, July 26. Return to text 3. Board of Governors of the Federal Reserve System (2005), “Agencies release bank supervisory and penalty actions against ABN AMRO Bank, N.V.,” press release, December 19. Return to text 4. Board of Governors of the Federal Reserve System (2009), “Consent order to cease and desist against Credit Suisse,” press release, December 16; Board of Governors of the Federal Reserve System (2010), “Cease and desist order against Barclays Bank and Barclays Bank New York Branch,” press release, August 18; Board of Governors of the Federal Reserve System (2012), “Federal Reserve Board issues consent cease and desist order, and assesses civil money penalty against Standard Chartered,” press release, December 10; and Board of Governors of the Federal Reserve System (2012), “Federal Reserve Board issues consent cease and desist order, and assesses civil money penalty against HSBC Holdings PLC and HSBC North America Holdings, Inc.,” press release, December 11. Return to text 5. Board of Governors of the Federal Reserve System (2010), “Cease and desist order against HSBC North America Holdings,” press release, October 7. Return to text 6. Board of Governors of the Federal Reserve System (2012), “Federal Reserve Board issues consent cease and desist order, and assesses civil money penalty against HSBC Holdings PLC and HSBC North America Holdings, Inc.,” press release, December 11. Return to text 7. Board of Governors of the Federal Reserve System (2013), “Federal Reserve Board issues two consent cease and desist orders against JPMorgan Chase & Co.,” press release, January 14. Return to text 8. Board of Governors of the Federal Reserve System (2012), “Federal Reserve Board issues enforcement actions with Calvert Financial Corporation and Mainstreet Bank, Commerzbank AG, First Security Bank of Malta, Grant Park Bancshares, Inc., and Robertson Holding Company, L.P.,” press release, June 14. Return to text

|

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 comments:

Post a Comment