The Big Picture |

- Evaluating Unconventional Monetary Policies ─ Why Aren’t They More Effective?

- The Myth that U.S. Has Never Defaulted On Its Debt

- Highlights and Impressions from The Big Picture Conference 2013

- Monday PM Reads

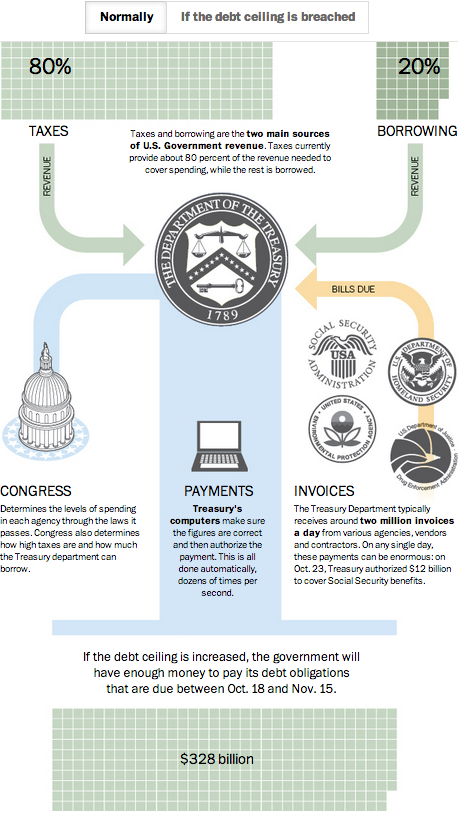

- How the Government Pays Its Debt

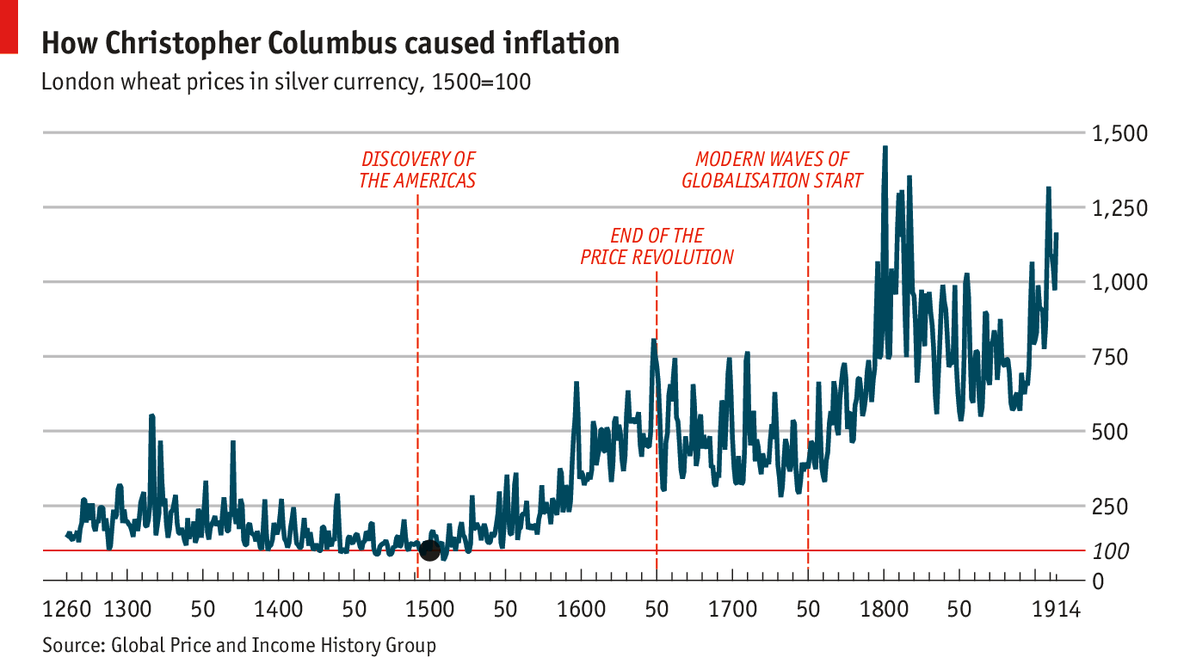

- How Columbus Caused Inflation

- 10 Monday AM Reads

- Shiller’s Financial Markets Course (Open Yale Courses)

- NYT Discovers Confirmation Bias

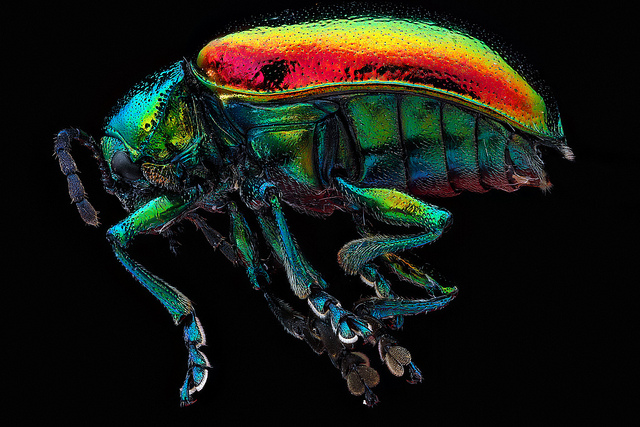

- Insect Macro

| Evaluating Unconventional Monetary Policies ─ Why Aren’t They More Effective? Posted: 15 Oct 2013 02:00 AM PDT |

| The Myth that U.S. Has Never Defaulted On Its Debt Posted: 14 Oct 2013 10:30 PM PDT The U.S. Has REPEATEDLY DefaultedSome people argue that countries can't default. But that's false. It is widely stated that the U.S. government has never defaulted. However, that is also a myth. Catherine Rampbell reports in the New York Times:

(Update.) Donald Marron points out at Forbes:

Many consider Nixon's decision to refusal to redeem dollars for gold to constitute a partial default. For example, University of Massachusetts at Amherst economics professor Gerald Epstein notes:

James Grant says in the Washington Post:

John Chamberlain argues at the Mises Institute that the U.S. defaulted on its:

States Have Defaulted AlsoStates have also defaulted. The Wall Street Journal notes:

And Catherine Rampbell explains:

China Alleges that the U.S. Has Already Defaulted By Weakening the DollarJames Grant argues:

(Indeed, the average life expectancy for a fiat currency is less than 40 years.) And our creditor – China – has said that America has already defaulted by printing too many dollars. For example:

That might be Chinese propaganda. But the point remains that the U.S. might not be able to print money forever without facing consequences from its creditors. |

| Highlights and Impressions from The Big Picture Conference 2013 Posted: 14 Oct 2013 03:00 PM PDT

I’m finally getting caught up this week after a whirlwind conference-related stuff and I wanted to jot down a few thoughts about the event itself. For starters, all of you who came and shared the day with us – you guys are amazing. I really enjoyed talking with you and learning about your businesses and lives, we’re truly fortunate to have such fascinating and engaged readers. We also had a lot of celebrity finance and media folks in attendance (Peter Boockvar, Jim Bianco, Jeff Hirsch, Louise Yamada, etc), and it was cool watching them ask questions of the speakers on stage and interact with the crowd during breaks. The other thing I want to say is that of all the conferences I’ve attended this year – and I’ve been to, like, all of them – I genuinely believe ours was the best. I know I’m totally biased, but still, I honestly think it’s true. No other event could match the eclecticism or the insights per minute our speakers had to offer. It was simply amazing, there wasn’t a single panel of filler or moment in which anyone’s time was being wasted. Assembling a day like that was no mean feat, Barry and Marion outdid themselves this year. As far as the day’s events, my quick impressions below: Barry Ritholtz gave a talk about the high cost of hedge funds and why the industry is having so much trouble delivering results these days, even with a few outliers still continuing to crush it. The statistics were shocking, the conclusions were merciless and iron-clad. When he delivers this presentation to pension fund people and other institutional investors, as he often does, it’s got to be devastating. Michael Mauboussin discussed the results of his research for The Success Equation, maybe one of the most important books of the year. Mauboussin gave us some practical tips about determining how much luck is playing a role in our activities and how we can avoid confusing it for skill. The crowd was floored by his easygoing mastery of the subject matter, if you can read the book or catch him speaking, I highly recommend it. My panel was supposedly “the most fun” according to the feedback we’re getting. I had three of the sharpest chief strategists in the game on stage with me (Art Hogan, Jeff Kleintop and Dan Greenhaus) and, instead of asking them for their S&P targets, we talked about the silliness of targets themselves, the positivity bias that all strategists inherently have, the career risk of being bearish and wrong and the best and worst indicators for people to follow (or ignore). This was truly a one-of-a-kind look behind the scenes of the strategist profession itself, we got lucky to have had these guys and for them to have been so forthcoming. Jack Brennan, the chairman and former CEO of Vanguard, gave a talk about the revolutionary role ETFs are having on the industry and why financial advice has never been more important. Brennan believes that the $2 trillion in ETF assets today is just the starting point, and that someday it will be more like $10 trillion. I’m not sure if the industry is truly prepared for that. Most interestingly, Jack said that he did not believe that active management was dead – in fact, “just the opposite.” He believes, however, that “high-cost active management” is dead – or dying – and that a great way for investors to allocate is partly passive, low-cost index and partly low-cost active. There is a misunderstanding that Vanguard despises active investing, they do not. What they do despise, however, is high cost investing, and a lot of active strategies and vehicles are in that category. Lunch was sponsored by our friends and partners at TD Ameritrade Institutional, the custodian for all of our managed assets at Ritholtz Wealth Management. TD has been great to us over the years and we were thrilled to have them representing at the conference. After lunch, Randall Forsyth (Barron’s) interviewed maverick economist Stephanie Pomboy. She was the most bearish of all the speakers this year, her central point was that the consumer has been killing itself to keep spending while deleveraging at the same time. The couch cushions have been raided and every trick in the household spending book has been tried and exhausted. And now, running on fumes, the consumer needs wage growth and job growth to kick back in to save the day. And she just doesn’t see it happening in time, stimulus or not. For the next panel, Michael Santoli took the stage and brought on three gentlemen (Rich Repetto, Mark Boyar and Robert Matthews) who’ve been working on or analyzing Wall Street for decades to discuss “the big shrink.” In the aftermath of the crisis, the brokerage firms themselves have been getting smaller and fighting to figure out which businesses were healthy enough to invest in. Units and employees are being discarded, unprofitable business lines are being shuttered and the customers themselves are finding better alternatives to the traditional wirehouse service model sprouting up everywhere. The panelists discussed what’s going away forever, what’s going to come back and where the opportunities of tomorrow might be. James O’Shaughnessy was one of the lone bulls at 2012′s TBP conference and he absolutely nailed it. This year, O’Shaughnessy returned to hammer home is thesis that this is a “generational selling opportunity” for the long bond. He also shows why global dividend stocks are a screaming buy versus their US counterparts, which are already over-owned and over-loved. Jim says you’re going to have to deal with the volatility of stocks for your returns in the coming years as the bond bear market has just begun – the last one was almost four decades long. Finally, the guest of honor had arrived and taken the stage – the legendary Art Cashin, whose fifty years on the floor of the NYSE have afforded him the opportunity to watch the great drama of fear and greed from the front row, in every conceivable permutation. Art told some amazing stories that really get to the heart of what it means to be a trader. including some fascinating anecdotes concerning JPMorgan, Charles Tiffany, the day JFK was assassinated and trying to get a sale done while the markets were panicking about a Cuban missile launch. Barry sat in with Art for this epic fireside chat and, I gotta tell you, I’ve never seen him keep his mouth shut for so long! A few questions were fielded from the crowd after which Art announced that, “Fellas, there are some ice cubes that need to be marinated.” We laughed and laughed, all the way to the hotel rooftop bar across the street. From there, the rest was a blur If you missed the conference and would like to watch any of the individual sessions or the whole thing, go to Fora.TV here. And if you didn’t make it this year, we’ll see you in 2014!

Below, some of the press coverage from the event: Recap of the Big Picture Conference (MarketWatch) Hedge Funds Are Victims of their Own Size, Success: Ritholtz (Barron’s) Ritholtz's Big Picture: 24-7 Media Cycle Is Going to the Blogs (Think Advisor) A "Big Picture" View of a Smaller Wall Street (Breaking Call) Three Wall Street Strategists Explain What Investors Are Missing Right Now (Business Insider) ECONOMIST: The US Consumer Will Drop ‘Like Road Runner’ Falling Off A Cliff (Business Insider) Top Tweets: Ritholtz, Brown Conference Takeaways (Financial Planning) |

| Posted: 14 Oct 2013 01:30 PM PDT My afternoon train reading:

What are you reading?

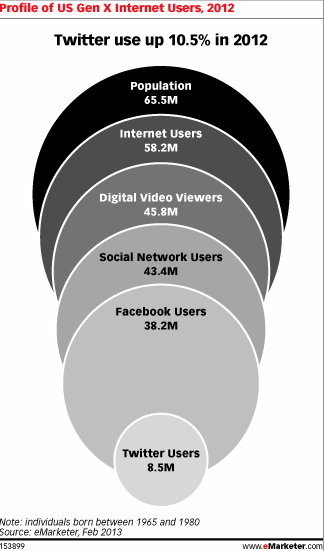

How Digital Behavior Differs Among Millennials, Gen Xers and Boomers |

| How the Government Pays Its Debt Posted: 14 Oct 2013 11:30 AM PDT Click for interactive graphic |

| Posted: 14 Oct 2013 08:30 AM PDT Click to enlarge

There you have it. Columbus ended price deflation by discovering lands rich in Silver. |

| Posted: 14 Oct 2013 07:00 AM PDT My good Columbus Day, congrats to Bob Shiller, Monday morning reading:

What are you reading?

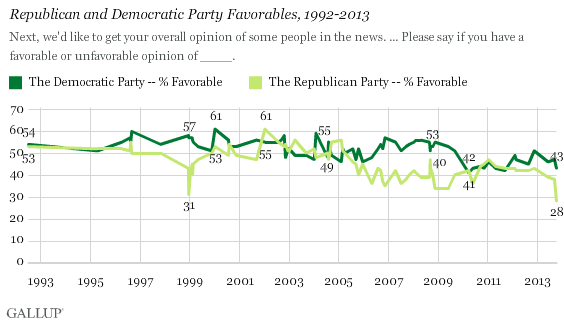

Republican Party Favorability Sinks to Record Low |

| Shiller’s Financial Markets Course (Open Yale Courses) Posted: 14 Oct 2013 05:35 AM PDT Financial Markets (2011) (ECON 252) Professor Shiller provides a description of the course, including its general theme, the relevant textbooks, as well as the interplay of his course with Professor Geanakoplos’s course “Economics 251–Financial Theory.” Finance, in his view, is a pillar of civilized society, dealing with the allocation of resources through space and time in order to manage big and important risks. After talking about finance as an occupation, he emphasizes the moral imperative to use wealth for the purposes of philanthropy, in the spirit of Andrew Carnegie, but also of Bill Gates and Warren Buffett. Subsequently, he introduces the guest speakers David Swensen, Yale University’s chief investment officer, Maurice “Hank” Greenberg, former Chief Executive Officer (CEO) at American International Group (AIG) and current CEO of C.V. Starr & Co. and of Starr International, and Laura Cha, former vice chair of the China Securities Regulatory Commission, member of the Executive Council of Hong Kong and of the government of the People’s Republic of China, and director of the Hong Kong Shanghai Banking Corporation (HSBC). Finally, he concludes with a description of the topics to be discussed in each lecture. 00:00 – Chapter 1. Introduction to the Course Complete course materials are available at the Open Yale Courses website: http://oyc.yale.edu This course was recorded in Spring 2011. |

| NYT Discovers Confirmation Bias Posted: 14 Oct 2013 04:20 AM PDT

From the better-late-than-never files: I want to direct your attention to an article from David Carr, titled It's Not Just Political Districts. Our News Is Gerrymandered, Too. That’s where the above quote came from. The bad news is that we learn that the media reporter for one of the more important American newspapers is only now discovering both confirmation bias and the Balkanization of the press. The good news? Well, let’s consider this a form of progress. As we have written oh so many times, confirmation bias is an expensive habit of investors. We tend to read that which agrees with our investments and posture. We disagree and downplay that which advises the other side of the trade. We even selectively forget things that challenge our views and holdings. In politics, it can divide the electorate into two warring camps, with Party first and Country second. But it also works to drive people away from the political parties — which may turn out to be a good thing in the modern era. Party affiliation has fallen over the years, and is now near its lowest levels, pretty much, ever. Independents are the largest voting group (even if they don’t vote as a bloc). Investors that read only that which agrees with their views do poorly in markets. Political strategists who read only that which agrees with their views do poorly in elections. Its not only important to be “reality based,” you must also seek out dissenting views and opinions. Find intelligent people of differing perspectives and worthwhile process, and see what they have to say. Not despite their disagreeing with you, but because of it. I don’t always agree with what colleagues like David Rosenberg or Doug Kass or Bill Fleckenstien argue — but I respect their process, and know their is an intelligence and method to their writings. Reading what they say, especially when I disagree with it, makes me a better investor. ~~~ One last issue with Carr’s column: He makes the horrific comparison of confirmation bias in news consumption with gerrymandering. For the record, the former is a hard wired cognitive error inherent to all humans; the latter is a corrupt process that serves to defeat the ideals of Democracy and “One Man, One Vote.” They are not remotely similar, and the NYT should be embarrassed by the comparison. Source: |

| Posted: 14 Oct 2013 03:00 AM PDT |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 comments:

Post a Comment