The Big Picture |

- On the Causes of Declines in the Labor Force Participation Rate

- Holiday Gift Ideas for Traders, Investors and Analysts!

- 10 Thursday PM Reads

- Five Reasons Why Hedge Funds Underperform Stocks

- How many months it takes an average worker to earn what the CEO makes in an hour

- Are American Homeowners Back to Positive Equity? (No)

- We’re Hiring: CFP Wanted

- 10 Thursday AM Reads

- Holiday Gift Ideas: Traders, Investors and Analysts!

- Flow-of-Funds Report – ‘Tis the Season to Be Jolly

- Shiller vs Fama: Nobel Winning Economists Disagreement Goes to 11

| On the Causes of Declines in the Labor Force Participation Rate Posted: 13 Dec 2013 02:00 AM PST |

| Holiday Gift Ideas for Traders, Investors and Analysts! Posted: 12 Dec 2013 03:00 PM PST It's that time of the year when you probably want to pick up a bauble or two for your favorite trader, fund manager or analyst. Sure, I may make fun of Shopmas and our mad consumerist society, but every now and again I like to remind those folks who have been nice that their efforts are appreciated. A quick disclosure: All of the items on this list were hand selected by humble author (without interference or suggestion by the legions of PR weenies who darken my email box). I receive no compensation for these recommendations. The links to Amazon generate data (which we will discuss at a future date) as well as a modest referral fee – which I will donate to charity. On to the gifts!

Under $50 Dollars:

- Ella Wishes You a Swinging Christmas ($8) Ella at the top of her game made what is simply the best holiday disc ever recorded. If this disc doesn't make you smile, you are a hopeless grinch. Spike a cup of coffee with some Kahlua or Baileys and put this on. Enjoy. - Charlie Brown Christmas, Vince Guaraldi: Original SoundTrack CBS Television Special ($7) Guaraldi has a delightful way around a keyboard — quirky, humorous piano playing that warms the soul. You cannot listen to this without breaking into a smile. This jazz collection exudes pure holiday magic. Along with Ella, this may be one of all time favorite holiday albums. - A Jolly Christmas From Frank Sinatra ($7) This 1957 is a great addition to any holiday music collection. I love the first cut, Frank's version of Jingle Bells. The rest is very traditional, very 50′s. A perfect gift for the hipster with the soul patch in your trading room. No holiday collection is complete without this Sinatra holiday album. - A Winter’s Solstice: Windham Hill Artists ($11) Is your trader dude stressed out? Then he needs to pour himself a stiff drink, and chill out to this collection of acoustically rooted mellowness. The upside is this music will help him slow down relax from the day's tensions. The downside is his heart may not realize this is supposed to occur in Humans and assume he is dead.

• Shave your strategist’s face! - L'Occitane Baume Après Rasage, Cade (After Shave Balm for Men), 2.5-Ounce Tube ($29)

• Papa Bear's Chocolate Haus: ($40-90) Every year, a friend in California sends us the chocolate toffee with nuts from this Mendicino shop — and it is heavenly. This is quite simply the most delicious stuff I've ever had. Astonishingly, they don't have a webpage, but as Google reveals, they are well loved for a reason. (707) 937-4406

This big bold red is a complex wine that has berry and floral aromatics and a dark, ruby color. Its what I get for Economist David Rosenberg, who adores the stuff.

Gifts from $100-$500:

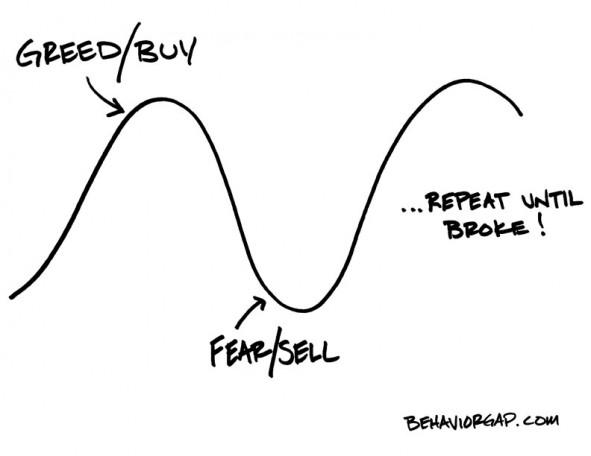

- Fear/Greed, Hand Signed ($249) C'mon, we're all sick of that cliched Bull and Bear print fighting it out in the street in front of the of NYSE. Instead, try one of these prints, each with a contrarian behavioral message.

- Buy! Sell! ($85) And yes, both of these hang in my office. • Bethpage Black Golf Course ($150): • Padron Anniversary Series 1926 Exclusivo ($250/case)

• Pax premium loose leaf vaporizer ($250) • Saddleback Leather Briefcase, Classic Dark Coffee Brown ($610) $1000 and up: • CineMassive Trio Gemini 17D 6 Screen holder ($1,599) Using a multi-screen display for the first time is often described as feeling like having received a new lobe of brain. • Skip Barber Performance Driving School ($1500 – $3200) The nice thing about giving this as a gift, is 1) It is very memorable; 2) You can save someone's life by teaching them to drive well; 3) It is ridiculously fun. I highly recommend it! • Caddy for a Cure ($5,000 and up) For the avid golfer who is having an especially good year. Caddy for the Cure gives an opportunity to spend the day caddying for one of the world's best golfers at an official PGA TOUR tournament. Select a player from the PGA TOUR events list; You either "Buy It Now" at the price listed, or make your best offer. The guys I know who did this lost their minds, saying it was the greatest experience on a golf course they ever had. And, 100% of the proceeds goes to charity. • Breguet Classique Hora Mundi 5717 ($74,200)

That's our tongue-in-cheek Gift Guide for Traders for 2013. If you have any other gift suggestions, by all means let us know in the comments! |

| Posted: 12 Dec 2013 01:30 PM PST My afternoon train reading:

What are you reading?

Snapshots of Retail Sales Are Coming In Blurry |

| Five Reasons Why Hedge Funds Underperform Stocks Posted: 12 Dec 2013 12:44 PM PST Barry Ritholtz, chief investment officer at Ritholtz Wealth Management, examines the performance of hedge funds compared to stocks. He speaks with Deirdre Bolton on Bloomberg Television’s “Money Moves.”

|

| How many months it takes an average worker to earn what the CEO makes in an hour Posted: 12 Dec 2013 11:30 AM PST From Quartz:

Source: Quartz |

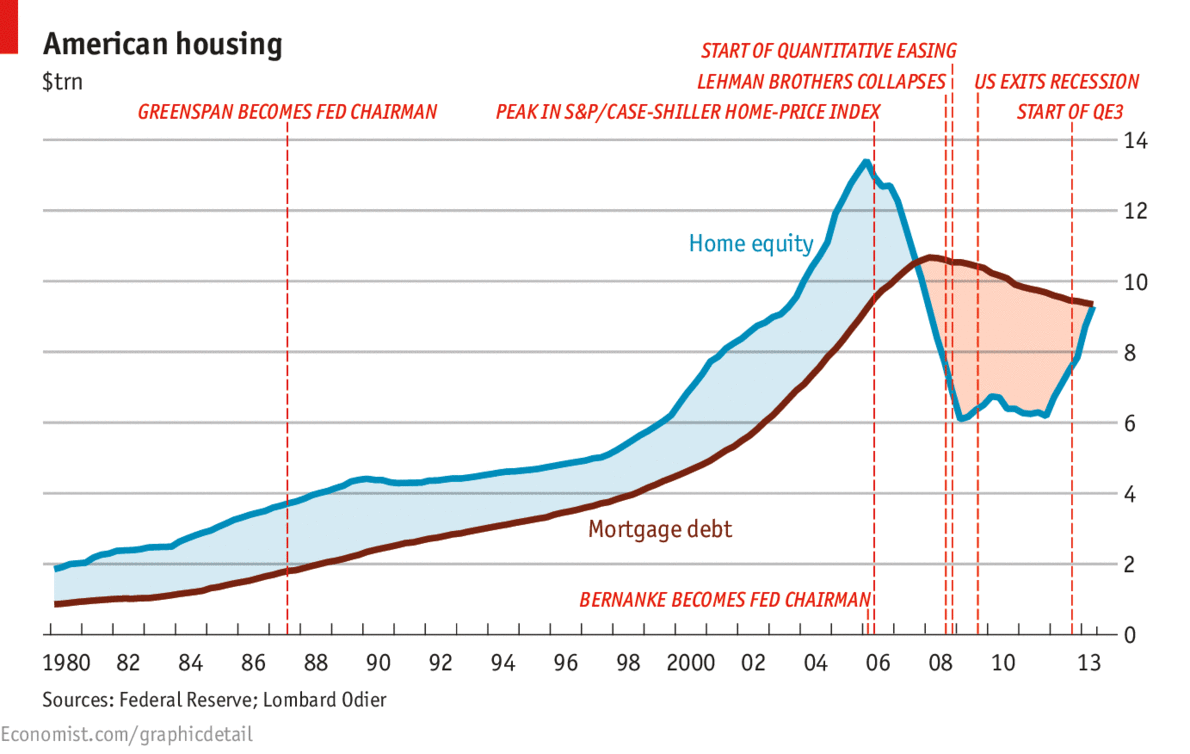

| Are American Homeowners Back to Positive Equity? (No) Posted: 12 Dec 2013 10:00 AM PST American Homeowners Are Finally Returning to Positive Equity

Here is a fascinating albeit somewhat confusing chart: Total US residential equity relative to total mortgage debt. The problem, even misleading part about the chart is some 30% of homes are bought with no mortgage — straight up cash deals.

Continues here |

| Posted: 12 Dec 2013 07:00 AM PST Ritholtz Wealth Management is looking to add a new member to our financial planning team. You must be a current CFP certificate holder to be considered for the position. You will work closely with our Director of Financial Planning here in our mid-town NYC office. This is a planning based role and involves direct interaction with current clients of the firm. Please send your resume to Kris Venne – kris -at- ritholtzwealth.com |

| Posted: 12 Dec 2013 06:30 AM PST Here are my morning reads:

Continues here |

| Holiday Gift Ideas: Traders, Investors and Analysts! Posted: 12 Dec 2013 05:30 AM PST It's that the time of the year when you probably want to pick up a bauble or two for your favorite trader, fund manager or analyst. Sure, I may make fun of Shopmas and our mad consumerist society, but every now and again, I like to remind those folks who have been nice that their efforts are appreciated. A quick disclosure: All of the items on this list were hand selected by humble author (without interference or suggestion by the legions of PR weenies who darken my email box). I receive no compensation for these recommendations. The links to Amazon generate data (which we will discuss at a future date) as well as a modest referral fee – which I will donate to charity. On with the gifts! Under $50 Dollars: • Wall Street Movies: After a long day at the desk, what's more relaxing than kicking back and watching a movie about investing or trading? Here are 4 flicks for your favorite keyboard jockey: - Eddie Murphy Trading Places ($9) Only tangentially related to trading, but filled with lots of oft quoted lines, this comedy is good for everyone. - Wall Street ($10) Blue Horseshoe loves Anacott Steel. Dated, but watchable. Skip the 2010 version — its awful. - Boiler Room ($6) Know a retail stock jockey? This gritty flick will show him what the bad old days were like in the land of penny stocks. A cautionary tale with a great cast. - Margin Call ($7)This 2011 film set during the financial crisis has already been called the greatest Wall Street movie ever made. - Ella Wishes You a Swinging Christmas ($8) - Charlie Brown Christmas, Vince Guaraldi: Original SoundTrack CBS Television Special ($7) - A Jolly Christmas From Frank Sinatra ($7)

Continues here |

| Flow-of-Funds Report – ‘Tis the Season to Be Jolly Posted: 12 Dec 2013 03:30 AM PST December 10, 2013 Q3: 2013 Flow-of-Funds Report – 'Tis the Season to Be Jolly I know that being a Debbie Downer gets more face time on cable news, but after looking at the Fed's latest Financial Accounts of the U.S. report, formerly known as the Flow-of-Funds report, I cannot contain my optimism about the economy's prospects in the New Year. First and foremost, the report shows that combined Fed and depository institution credit creation is not only accelerating, but is growing at a relatively high rate. Secondly, household balance sheets continue to improve, which implies that depository institutions will be more favorably disposed to lend in 2014. Thirdly, part of improvement to household balance sheets is related to the upward trend in the value of residential real estate. Fourthly, the reduction in federal government spending/borrowing is resulting in "crowding in" of spending/borrowing by other sectors. Thus, the wringing of hands and the gnashing of teeth by unreconstructed Keynesians (i.e., The Consensus) over the deleterious effect of budget sequestration on the pace of economic activity is not occurring. And lastly, federal government borrowing relative to the size of the economy is less than its post-WWII median value. Okay, let's go to the charts. Plotted in Chart 1 are the year-over-year percent changes of quarterly observations of the sum of Fed and depository institution credit and nominal Gross Domestic Purchases. Fed credit is defined here as the Fed's holdings of securities obtained by outright purchases as well as repurchase agreements. The sum of Fed and depository institution credit is advanced by one quarter because the historical relationship between the two series suggests that changes in this particular credit aggregate lead changes in nominal Gross Domestic Purchases. Notice that year-over-year growth in the sum of Fed and depository institution credit has been accelerating since Q4:2012, which is when the Fed's third round of quantitative easing (QE) commenced. Year-over-year growth in this credit sum reached 8.7% in Q3:2013, the highest since Q2:2006. The median year-over-year growth in this credit sum from Q1:1953 through Q3:2013 is 7.2%. The recent relatively rapid growth in this credit sum suggests that growth in nominal domestic spending will be gaining strength over the next couple of quarters. Chart 2 shows that the growth acceleration in the sum of Fed and depository institution credit starting in Q4:2012 was due to Fed QE actions. Growth in depository institution credit alone has been decelerating. But with the Fed expected to start "tapering" the quantity of securities it purchases by the end of Q1:2014, won't the sum of Fed and depository institution start to decelerate then with negative implications for the growth in nominal domestic spending? Not if growth in depository institution credit picks up. Chart 3 shows that starting in this past October and continuing through November, growth in commercial bank credit, the principal component of depository institution credit, has been accelerating. In the eight weeks ended November 27, bank credit increased by almost $58 billion. If this pace of bank credit increase were maintained, it would more than compensate for the anticipated decline in Fed securities purchases early in 2014. Which brings us to the balance sheet for households. Plotted in Chart 4 are quarterly observations of total liabilities of households and nonprofit organizations as a percent of their total assets. This ratio reached a post-WWII record high of 20.2% in Q1:2009. As of Q3:2013, this ratio had declined 520 basis points to 15.0%, the lowest since Q2:2001. This sharp decline in household leverage in combination with the sharp decline in the debt burden of households (see Chart 5) should make households appear more creditworthy in the eyes of depository-institution lenders. An improving residential real estate market has played an important role in the improvement of household balance sheets. Chart 6 shows the leverage of owner-occupied residential real estate. After reaching a post-WWII record high of 63.5% in Q1:2009, leverage has fallen to 49.2% in Q3:2013, the lowest since Q2:2007. The rise in the value of residential real estate in the past two years and the absolute decline in mortgage debt following the bursting of the housing bubble are responsible for the leverage decline in owner-occupied residential real estate. Again, this improves the creditworthiness of households. The rise in residential real estate values also reduces mortgage loan write-offs by depository institutions, which should increase their willingness to put new loans on their books. Speaking of residential real estate, it still looks attractive as an investment, but not as attractive because of the increase in its value and the rise in mortgage rates. Plotted in Chart 7 are quarterly observations of the imputed yield on owner-occupied housing, the effective mortgage interest rate and the differential between the two. The imputed yield on housing is calculated by dividing the Commerce Department's estimate of the nominal dollar value of imputed shelter services produced by owner-occupied houses by the Fed's estimate of the market value of residential real estate (then multiplied by 100 to put the ratio into percentage terms). If the imputed yield on housing is higher than the mortgage rate, then one can purchase an asset that currently is yielding more than the cost of financing it. From Q1:1973 through Q3:2008, there has been only one instance in which the imputed yield on housing was above the mortgage rate – in Q2:2003, when the differential was a mere 0.04 percentage points. But after the bursting of the housing bubble, the market value of residential real estate plummeted, boosting the imputed yield on housing. The rise in the imputed yield on housing in combination with the plunge in mortgage rates brought the differential into positive territory starting in Q4:2008, where it has remained through Q3:2013. This positive differential, after having reached its zenith of 3.7 percentage points in Q4:2012, has drifted down to 2.3 percentage points in Q3:2013. At first blush, the narrowing in the positive differential between the imputed yield on housing and the mortgage rate might suggest that the pace of the current expansion in residential real estate would moderate in 2014. But if depository institutions "loosen" their mortgage qualification terms due to the improved balance sheets of households, then "effective" demand for owner-occupied housing could increase. Remember how the sequestration-induced federal government expenditure cuts and the increase in the marginal tax rate for upper-income households were going restrain nominal total spending in the economy? Well, they didn't because of "crowding in". The reduction in federal government spending in recent years along with increased tax revenues has reduced federal government deficits. Those entities that had planned to lend to the Treasury had its deficits been larger, now have some excess funds on their hands. They can either lend to some other entity that will spend – a household, a business, a state or local government, a furiner – and/or they can spend these funds themselves. Either way, the decrease in spending caused by the decline in federal government expenditures and the increase in taxes is offset by increases in other nonfederal government spending. So, as the federal government borrows less, other nonfinancial entities save less, i.e., spend more. This is what is meant by the term "crowding in". "Crowding out" is the opposite – the government borrows more, other nonfinancial entities save more, i.e., spend less. This is shown in Chart 8. Notice that as federal government net borrowing decreased precipitously in the second and third quarters of 2013, net lending by the remaining entities in the nonfinancial sectors also fell precipitously. Conversely, as federal borrowing surged in 2009, in part due to the fiscal stimulus, nonfinancial sector net lending also surged. This is an example of "crowding out". In analyzing the macroeconomic effects of changes in fiscal policy, it is a good idea to "follow the money". The funds have to come from somewhere to finance an increase in government expenditures and/or a decrease in taxes. Unless there is a net increase credit created by the Fed and the depository institution system, i.e., unless there is a net increase in thin-air credit, it is likely that the funds will come from the nonfinancial sector, which means that the stimulus to demand emanating from the government sector will crowd out spending that otherwise would have emanated from other nonfinancial sectors. And when government spending is cut and/or taxes increased, the fiscal drag on spending emanating from the government sector will crowd in spending from other nonfinancial sectors. Think of the extra money that otherwise would have gone to purchase government bonds "burning a hole" in the pockets of the otherwise lenders. Lastly, for all you fiscal hawks out there, Chart 9 should make you jolly. Plotted in Chart 9 are quarterly observations of seasonally adjusted at annual rates (SAAR) net lending / net borrowing by the federal government (obtained from the Fed's Financial Accounts report) as a percent of SAAR nominal GDP. The median percentage from Q1:1953 through Q3:2013 is minus 3.2%. In the second and third quarters of 2013, this ratio was minus 1.3% and minus 1.9%, respectively. With some help from the Fed in getting thin-air credit back up to a more normal post-WII growth rate in order to stimulate nominal GDP, some restraint in federal government spending along with some tax increases and voilá! the federal government deficit relative to the size of the US economy looks quite reasonable in an historic context. I hope to send out my airing-of-grievances Festivus letter next week. I have a lot of problems with you people! Paul L. Kasriel |

| Shiller vs Fama: Nobel Winning Economists Disagreement Goes to 11 Posted: 12 Dec 2013 03:00 AM PST

|

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 comments:

Post a Comment