The Big Picture |

- Kass’ 15 Surprises for 2015

- St Vincent: Dig A Pony

- What is an Online Financial Advisor?

- The Not So Friendly Skies

- 10 Friday AM Reads

- Cord 812 Phaeton

- Fed: The Replacement of Safe Assets: Evidence from the U.S. Bond Portfolio

| Posted: 03 Jan 2015 02:00 AM PST 15 Surprises for 2015

It's that time of year when people start thinking about New Year's resolutions and investment planning for the future. It's also the time of year when analysts feel more or less compelled to offer up forecasts. My friend Doug Kass turns the forecasting process on its head by offering 15 potential surprises for 2015 (plus 10 also-rans). But he does so with a healthy measure of humility, starting out with a quote from our mutual friend James Montier (now at GMO): (E)conomists can’t forecast for toffee … They have missed every recession in the last four decades. And it isn’t just growth that economists can’t forecast; it’s also inflation, bond yields, unemployment, stock market price targets and pretty much everything else … If we add greater uncertainty, as reflected by the distribution of the new normal, to the mix, then the difficulty of investing based upon economic forecasts is likely to be squared! Lessons Learned Over the Years “I’m astounded by people who want to ‘know’ the universe when it’s hard enough to find your way around Chinatown.” – Woody Allen There are five core lessons I have learned over the course of my investing career that form the foundation of my annual surprise lists:

Quoting from a very eclectic group of names, Doug does indeed give us a few surprises to think about, and I pass his thoughts on to you as this week's Outside the Box. (Doug publishes his regular writings in RealMoneyPro on theStreet.com.) As a bonus, and as a thoughtful way to begin the new year, we have a letter that my good friend and co-author of my last two books Jonathan Tepper wrote to his nephews. He began penning it on a very turbulent plane ride that he was uncertain of surviving. It made him think hard about what was really important that he would want to pass on to his nephews. As the song goes, I found a few aces that I can keep in this hand. I think you will too. His letter made me think about what I want to be passing on to my grandchildren, including the newest one, Henry Junior, who showed up less than 24 hours ago. They are going to grow up in a very different world than the one I grew up in, and I mostly think that's a good thing. But the values that I hope can be passed on don't change. Good character never goes out of fashion. My associate Worth Wray came down with a very nasty bug this past weekend, so he missed his deadline for delivering his 2015 forecast to you. We're giving him a few more days and will run it this weekend – which also of course gives me a little more time to mull over my own forecast. Taking to heart James Montier's quote above, I'm going to forgo the usual 12-month forecast and look farther out, thinking about what major events are likely to come our way over the next five years. I actually think that approach will be for more useful for our longer-term planning. Thanks for being with me and the rest of the team at Mauldin Economics this past year; and from all of us, but especially from me, we wish you the best and most prosperous of new years. You're staring hard at crystal balls analyst, John Mauldin, Editor subscribers@mauldineconomics.com Stay Ahead of the Latest Tech News and Investing Trends… Click here to sign up for Patrick Cox's free daily tech news digest. Each day, you get the three tech news stories with the biggest potential impact. 15 Surprises for 2015Doug Kass, Seabreeze Partners Stock quotes in this article: C, SBUX, TSLA, TWTR, GM, GLD, JNK, SPY, QQQ, AAPL, BAC, GOOGL, FB, CSCO It's that time of year again. “Never make predictions, especially about the future.” – Casey Stengel By means of background and for those new to Real Money Pro, 12 years ago I set out and prepared a list of possible surprises for the coming year, taking a page out of the estimable Byron Wien’s playbook. Wien originally delivered his list while chief investment strategist at Morgan Stanley, then Pequot Capital Management and now at Blackstone. (Byron Wien’s list will be out in early January and it will be fun to compare our surprises.) It takes me about two to three weeks of thinking and writing to compile and construct my annual surprise list column. I typically start with about 30-40 surprises, which are accumulated during the months leading up to my column. In the days leading up to this publication I cull the list to come up with my final 15 surprises. (Last year I included five also-ran surprises.) I often speak to and get input from some of the wise men and women that I know in the investment and media businesses. I have always associated the moment of writing the final draft (in the weekend before publication) of my annual surprise list with a moment of lift, of joy and hopefully with the thought of unexpected investment rewards in the New Year. This year is no different. I set out as a primary objective for my surprise list to deliver a critical and variant view relative to consensus that can provide alpha or excess returns. The publication of my annual surprise list is in recognition that economic and stock market histories have proven that (more often than generally thought) consensus expectations of critical economic and market variables may be off base. History demonstrates that inflection points are relatively rare and that the crowds often outsmart the remnants. In recognition, investors, strategists, economists and money managers tend to operate and think in crowds. They are far more comfortable being a part of the herd rather than expressing – in their views and portfolio structure – a variant or extreme vision. Confidence is the most abundant quality on Wall Street as, over time, stocks climb higher. Good markets mean happy investors and even happier investment professionals. The factors stated above help to explain the crowded and benign consensus that every year begins with, whether measured either by economic, market or interest-rate forecasts. But an outlier’s studied view can be profitable and add alpha. Consider the course of interest rates and commodities in 2014, which differed dramatically from the consensus expectations. To a large degree the business media perpetuates group-think. Consider the preponderance of bullish talk in the financial press. All too often the opinions of guests who failed to see the crippling 2007-09 drama are forgotten and some of the same (and previously wrong-footed) talking heads are paraded as seers in the media after continued market gains in recent years. Memories are short (especially of a media kind). Nevertheless, if the criteria for appearances was accuracy there would have been few available guests in 2009-2010 qualified to appear on CNBC, Bloomberg and Fox News Business. Indeed, the few bears remaining are now ridiculed openly by the business media in their limited appearances, reminding me of Mickey Mantle’s quote, “You don’t know how easy this game is until you enter the broadcasting booth.” Abba Eban, the Israeli foreign minister in the late 1960s and early 1970s once said that the consensus is what many people say in chorus, but do not believe as individuals. GMO’s James Moniter, in an excellent essay published several years ago, made note of the consistent weakness embodied in consensus forecasts. As he put it: “(E)conomists can’t forecast for toffee … They have missed every recession in the last four decades. And it isn’t just growth that economists can’t forecast; it’s also inflation, bond yields, unemployment, stock market price targets and pretty much everything else … If we add greater uncertainty, as reflected by the distribution of the new normal, to the mix, then the difficulty of investing based upon economic forecasts is likely to be squared!” Lessons Learned Over the Years“I’m astounded by people who want to ‘know’ the universe when it’s hard enough to find your way around Chinatown.” – Woody Allen There are five core lessons I have learned over the course of my investing career that form the foundation of my annual surprise lists:

“Let’s face it: Bottom-up consensus earnings forecasts have a miserable track record. The traditional bias is well-known. And even when analysts, as a group, rein in their enthusiasm, they are typically the last ones to anticipate swings in margins.” – UBS (top 10 surprises for 2012) Let’s get back to what I mean to accomplish in creating my annual surprise list. It is important to note that my surprises are not intended to be predictions, but rather events that have a reasonable chance of occurring despite being at odds with the consensus. I call these possible-improbable events. In sports, betting my surprises would be called an overlay, a term commonly used when the odds on a proposition are in favor of the bettor rather than the house. The real purpose of this endeavor is a practical one – that is, to consider positioning a portion of my portfolio in accordance with outlier events, with the potential for large payoffs on small wagers/investments. Since the mid-1990s, Wall Street research has deteriorated in quantity and quality (due to competition for human capital at hedge funds, brokerage industry consolidation and former New York Attorney General Eliot Spitzer-initiated reforms) and remains, more than ever, maintenance-oriented, conventional and group-think (or group-stink, as I prefer to call it). Mainstream and consensus expectations are just that and, in most cases, they are deeply embedded into today’s stock prices. It has been said that if life were predictable, it would cease to be life, so if I succeed in making you think (and possibly position) for outlier events, then my endeavor has been worthwhile. Nothing is more obstinate than a fashionable consensus and my annual exercise recognizes that, over the course of time, conventional wisdom is often wrong. As a society (and as investors), we are consistently bamboozled by appearance and consensus. Too often, we are played as suckers, as we just accept the trend, momentum and/or the superficial as certain truth without a shred of criticism. Just look at those who bought into the success of Enron, Saddam Hussein’s weapons of mass destruction, the heroic home-run production of steroid-laced Major League Baseball players Barry Bonds and Mark McGwire, the financial supermarket concept at what was once the largest money center bank, Citigroup (C), the uninterrupted profit growth at Fannie Mae and Freddie Mac, housing’s new paradigm (in the mid-2000s) of non-cyclical growth and ever-rising home prices, the uncompromising principles of former New York Governor Eliot Spitzer, the morality of other politicians (e.g., John Edwards, John Ensign and Larry Craig), the consistency of Bernie Madoff’s investment returns (and those of other hucksters) and the clean-cut image of Tiger Woods. My Surprises for 2014These generally proved in line with my historic percentages. “How’m I doin’?” – Ed Koch, former New York City mayor While over recent years many of my surprise lists have been eerily prescient (e.g. my 2011 surprise that the S&P 500 would end exactly flat was exactly correct), my 15 Surprises for 2014 had a success rate of about 40%, about in line with what I have achieved over the last 11 years. As we entered 2014, most strategists expressed a constructive economic view of a self-sustaining domestic recovery, held to an upbeat (though not wide-eyed) corporate profits picture and generally shared the view that the S&P 500 would rise by between 8-10%. Those strategists proved to be correct on profit growth (but only because of several non-operating factors and financial engineering), were too optimistic regarding domestic and global economic growth and recognized (unlike myself) that excessive liquidity provided by the world’s central bankers would continue to lift valuations and promote attractive market gains in 2015. Not one major strategist foresaw the emerging deflationary conditions, the precipitous drop in the price of oil and the broad decline in domestic and non-U.S. interest rates. Many readers of this annual column assume that my surprise list will have a bearish bent (to be sure that is the case for 2015). But I have not always expressed a negative outlook in my surprise list. Two years ago my 2012 surprise list had an out-of-consensus positive tone to it, but 2013′s list was noticeably downbeat relative to the general expectations. I specifically called for a stock market top in early 2013, which couldn’t have been further from last year’s reality, as January proved to be the market’s nadir. The S&P closed at its high on the last day of the year and exhibited its largest yearly advance since 1997. (I steadily increased my fair market value calculation throughout the year and, at last count, I concluded that the S&P 500′s fair market value was about 1645.) As I said, in 2014 my success rate was at about 40% (which included five also-ran predictions). This contrasted with my 15 surprises for 2013, which had the poorest success rate since 2005′s list (20%). By comparison, my 2012 surprise list achieved about a 50% hit ratio, similar to my experience in 2011. About 40% of my 2010 surprises were achieved, while I had a 50% success rate in 2009, 60% in 2008, 50% in 2007, 33% in 2006, 20% in 2005, 45% in 2004 and 33% came to pass in the first year of my surprises in 2003. Below is a report card of my 15 surprises for 2014 (and the five also-ran surprises). Surprise No. 1: Slowing global economic growth. RIGHT Surprise No. 2: Corporate profits disappoint. HALF RIGHT (as financial engineering buoyed EPS). Surprise No. 3: Stock prices and P/E multiples decline. WRONG Surprise No. 4: Bonds outperform stocks. Closed-end municipal bond funds are among the best asset classes, achieving a total return of +15%. VERY RIGHT Surprise No. 5: A number of major surprises affect individual stocks and sectors. (Starbucks (SBUX) falls, 3D printing stocks halve in price, General Motors (GM) drops by 20% in 2014). MORE WRONG THAN RIGHT Surprise No. 6: Volkswagen AG acquires Tesla Motors (TSLA). WRONG Surprise No. 7: Twitter’s (TWTR) shares fall by 70% as a disruptive competitor appears. MORE RIGHT THAN WRONG Surprise No. 8: Buffett names successor. WRONG Surprise No. 9: Bitcoin becomes a roller coaster. RIGHT Surprise No. 10: The Republican Party gains control of the Senate and maintains control of the House. Obama becomes a lame duck President incapable of launching policy initiatives. RIGHT Surprise No. 11: Secretary Hillary Clinton bows out as a presidential candidate. WRONG Surprise No. 12: Social unrest and riots appear in the U.S. RIGHT Surprise No. 13: Africa becomes a new hotbed of turmoil and South Africa precipitates an emerging debt crisis. HALF RIGHT Surprise No. 14: The next big thing? A marijuana IPO rises by more than 400% on its first day of trading. WRONG Surprise No. 15: An escalation of friction between China and Japan hints at war-like behavior between the two countries. WRONG Also-Ran Surprises: Crude oil trades under $75 a barrel (short crude and energy stocks) RIGHT, VIX trades under 10 (short VIX) RIGHT, gold trades under $1,000 (Short GLD) DIRECTIONALLY RIGHT. What Was the Consensus for 2014 and What Is the Consensus for 2015?“The only thing people are worried about is that no one is worried about anything … That isn’t a real worry.” – Adam Parker, chief U.S. strategist at Morgan Stanley “In ambiguous situations, it’s a good bet that the crowd will generally stick together – and be wrong.” – Doug Sherman and William Hendricks As mentioned earlier, we entered 2014 there was a generally upbeat outlook for global economic and profit growth, as well as upbeat prospects for the U.S. stock market. Projections for bond yields were universally for higher yields throughout the year and the same could be said for the general expectation of rising oil prices. As is typical, most sell-side projections for earnings, the economy, bond yields and stock prices were grouped in an extraordinarily tight range.

Virtually all strategists are now self-confident bulls, as gloom-and-doom forecasts have all but disappeared. After another year with no reactions of 10% or more, any future setbacks are being viewed by the consensus as bumps in the road and as opportunities to buy because (after the correction(s)) we will be up, up and away.” After missing the 25% rise in valuations in 2013 (and a further expansion in P/E ratios in 2014), the consensus now assumes that valuations will expand slightly again in 2015. (Note: The average P/E ratio has increased by about 2% per year over the last 25 years.) The domestic economy has forward momentum (as witnessed by +5% Real GDP growth in 3Q 2014), so the extrapolation of heady growth is now in full force by the consensus. In terms of the markets, the consensus remains of the view that liquidity (albeit, at a slowing rate) will overcome complacency and valuations again as it did last year, but my surprises incorporate the notion that the extremes that exist today (in price and bullish sentiment) put the markets in a different and less secure starting point in 2015. “We expect the growth recovery to broaden as global growth picks up to 3.4% in 2015 from 3% in 2014. Inflation is likely to remain low, in part due to declines in commodity prices, and as a result monetary policy should remain easy. We think this backdrop supports a pro-risk asset allocation.” – Goldman Sachs, Global Opportunity Asset Locator (December 2014) As we enter 2015, investors and strategists are again grouped in a narrow consensus and expect a sweet spot of global economic corporate profit growth that will translate to higher stock prices. The consensus is for U.S. economic growth of +2.5% to +3.25% real GDP, bond yields to be 50-75 basis points higher than year-end 2014 and closing 2015 stock market price targets to be up by about 8-10% (on average). Indeed, most strategists suggest (in sharp contrast to their views 12 months ago) that the big surprise for 2015 will be that there is upside to consensus economic growth and stock market price targets. Here were Goldman Sach’s views for 2014 made 12 months ago (with actual in parentheses). As can be seen, the brokerage’s growth forecasts for the real economy (as was the entire sell side) were too optimistic, while price targets for the S&P were not ambitious enough:

Again, let’s use Goldman Sachs’ principal 2015s views of expected economic growth, corporate profits, inflation, interest rates and stock market performance as a proxy for the consensus for the coming year. This year the brokerage, like most, is following the bullish trend and is more optimistic on the market relative to its uninspiring expectations last year.

The Rationale Behind My Downbeat Surprises for 2015There are numerous reasons for my downbeat theme this year. In no order of importance: corporate profit margins remain elevated, the rate of domestic economic growth is decelerating (despite five years of QE and ZIRP), a quarter of the world is experiencing minimum growth in GDP, optimism and complacency are elevated, signs of malinvestment are appearing, valuations (P/E ratios) rose again after a 25% expansion in 2013 (compared to only +2% annual growth since the late-1980s. As well, so many gauges of valuations are stretched (market cap/GDP, the Shiller P/E ratio and many others). Above all, I expect the theme of the U.S. as an oasis of prosperity will be tested in 2015-16 as contagion might be a bi**h. Moreover, given the large array of potentially adverse economic, geopolitical and other outcomes, the markets have grown complacent after a trebling in prices over the last five years. Finally, my downbeat surprises this year recognize, that as we enter 2015, we should not lose sight of the notion that if pessimism is the friend of the rational buyer, optimism is the enemy of the rational buyer. My 15 Surprises for 2015At last, here are my 15 surprises for 2015 (with a strategy that might be employed in order for an investor to profit from the occurrence of these possible improbables). Surprise No.1 – Faith in central bankers is tested (stocks sink and gold soars). “Investment bubbles and high animal spirits do not materialize out of thin air. They need extremely favorable economic fundamentals together with free and easy, cheap credit and they need it for at least two or three years. Importantly, they also need serial pleasant surprises in such critical variables as global GNP growth.” – Jeremy Grantham “The highly abnormal is becoming uncomfortably normal. Central banks and markets have been pushing benchmark sovereign yields to extraordinary lows – unimaginable just a few years back. Three-year government bond yields are well below zero in Germany, around zero in Japan and below 1 per cent in the United States. Moreover, estimates of term premia are pointing south again, with some evolving firmly in negative territory. And as all this is happening, global growth – in inflation-adjusted terms – is close to historical averages. There is something vaguely troubling when the unthinkable becomes routine.” – Claudio Borio European QE Backfires: The ECB initiates a sovereign QE in January 2015, but it is modest in scale (relative to expectations) as Germany won’t permit a more aggressive strategy. Markets are disappointed with the small size of the ECB’s initiative and European banks choose to hold their bonds instead of selling. ECB balance sheet still can’t get to 3 trillion euros and the euro actually rallies sharply. Bottom line, QE fails to work (economic growth doesn’t accelerate and inflationary expectations don’t lift). Draghi Is Exposed: Mario Draghi is exposed for what he really is: the big kid of which everyone is scared. For some time, no one wanted to fight him (or fade sovereign debt bonds, which would be contra to his policy). But, after the meek January QE, the response changes. He is now seen as the bully who never throws a punch and who always has gotten his way. But at the time of the January QE a medium-sized kid (and a market participant) teases him and Draghi warns him again to stop it. The kid keeps teasing. Draghi the bully takes a swing, it turns out he can’t fight and the medium-sized kid whips his butt. From then on, the big kid is feared no more. For some time Draghi has said he will do “whatever it takes,” but he never really had to do anything. When he finally gets going and has to act rather than talk, he will expose himself as only a bully and as a weak big kid. Mario Draghi gets fed up with the Germans and returns to Italy (where he was governor of the Bank of Italy between 2006-2011) and becomes the country’s president. Shinzo Abe and Haruhiko Kuroda Resign: Kuroda, an advocate of looser monetary policy, stays on at the Bank of Japan (for most of the year), but the yen enters freefall to 140 vs. the dollar and wage growth lags badly. Japanese people have had enough and, by year end, Prime Minister Shinzo Abe and Haruhiko Kuroda are forced to resign. The Fed Is Trapped: The Federal Reserve surprises the markets and hikes the federal funds rate in April 2015. A modest 25-basis-point rise in rates causes such global market turmoil that it is the only hike made all year. The Federal Reserve is now viewed by market participants as completely trapped, as an ah-ha-moment arrives in which there is limited policy flexibility to cope with a steepening downturn in the business cycle in late 2015/early 2016. Stated simply, the bull market in confidence in the Federal Reserve comes to an abrupt halt. Malinvestment Becomes the It-Word in 2015: Steeped in denial of past mistakes and bathing in the buoyancy of liquidity and the elevation of stock prices in 2014, market participants come to the realization that the world’s central bankers in general, and the Fed in particular, once again has taken us down an all-too-familiar and dangerous path that previously set the stage for The Great Decession of 2007-09. It becomes clear that the consequences of unprecedented monetary easing and the repression of interest rates has only invited unproductive investment and speculative carry trades. The impact of a lengthy period of depressed interest rates uncork malinvestment that has percolated and detonates among differing asset classes as the year progresses. Already seen in the deterioration and heightened volatility in commodities (the price of crude, copper, etc.), in widening spreads in the energy high yield (with yields up to 10% today, compared with only 5% a few months ago) and with the average yield on the SPDR Barclays High Yield Bond ETF (JNK) up to 7% (from a low of 5% earlier in 2014), the consequences of financial engineering (zero-interest-rate policy and quantitative easing) and lack of attention to burgeoning country debt loads and central bankers’ balance sheets, in addition to inertia on the fiscal front result in rising volatility in the currency markets. Malinvestment in countries like Brazil (where consumer debt has risen by 8x and export accounts have quintupled over the last eight years on the strength of a peaking export boom, in oil and iron ore, so dependent on the China infrastructure story that has now ended) translate into a deepening economic crisis in Latin America and in other emerging markets. Then, EU sovereign debt yields, suppressed so long by Draghi’s jawboning, begin to rise. Slowly at first and then more rapidly, EU bond prices fall, putting intense pressure on the entire European banking system. (In his greatest score, George Soros makes $2.5 billion shorting German Bunds). The contagion spreads to other region’s financial institutions. Shortly after, social media and high valuation stocks get routed and, ultimately, so does the world’s stock markets. As a result of the influences above, the VIX rises above 30. The price of gold soars to $1,800-$2000 and the precious metal is the best-performing asset class for all of 2015. Strategy: Buy GLD and VIX, Short SPY/QQQ and German Bunds Surprise No. 2 – The U.S. stock market falters in 2015. “In a theater, it happened that a fire started offstage. The clown came out to tell the audience. They thought it was a joke and applauded. He told them again and they became more hilarious. This is the way, I suppose, that the world will be destroyed – amid the universal hilarity of wits and wags who think it is all a joke.” – Soren Kierkegaard. Market High Seen in January, Low Seen in December (at Year End): The U.S. stock market experiences a 10%+ loss for the full year. (Note: Not one single strategist in Barron’s Survey is calling for a lower stock market in 2015. Projected gains by the sell side are between +6-16%, with a median market gain forecast at +11%). The S&P Index makes its yearly high in the first quarter and closes 2015 at its yearly low as signs of a deepening global economic slowdown intensify in the June-December period. While earnings expectations disappoint, the real source of the market decline in 2015 is a contraction in valuations (price-earnings multiples) after several years of robust gains. Investors begin to recognize that low interest rates, massive corporate buybacks, the suppression of wages, phony stock option accounting and other factors artificially goosed reported earnings and that earnings power and organic earnings are less than previously thought. So, 2015 is a year in which the relevant ways of measuring overvaluation (market cap/GDP currently at 1.25 vs. 0.70 mean) and the Shiller CAPE ratio (currently at 27x vs. 17x mean) become, well, relevant. With few having the intestinal fortitude to maintain skepticism and short positions into the unrelenting bull market of 2013-14, there is none of the customary support of short sellers to cover positions and soften the market decline, when it occurs. Stocks begin to drop in the first half, well before the real economy tapers, underscoring the notion (often forgotten) that the stock market is not the economy. But by mid-year it becomes clear that U.S. economic growth is unable to thrive without the Fed’s support. Year-over-year profits for the S&P decline modestly in the second half of 2015. Domestic Real GDP growth falls to under +1.5% in the third and fourth quarters. By year end the market begins to focus on The Recession of 2016-17, which looms ahead in the not so distant future. Strategy: Short SPY Surprise No. 3 – The drop in oil prices fails to help the economy. “In its November 14, 2014 Daily Observations (“The Implications of $75 Oil for the US Economy”), the highly respected hedge fund Bridgewater Associates, LP confirmed that lower oil prices will have a negative impact on the economy. After an initial transitory positive impact on GDP, Bridgewater explains that lower oil investment and production will lead to a drag on real growth of 0.5% of GDP. The firm noted that over the past few years, oil production and investment have been adding about 0.5% to nominal GDP growth but that if oil levels out at $75 per barrel, this would shift to something like -0.7% over the next year, creating a material hit to income growth of 1-1.5%.” – Mike Lewitt, The Credit Strategist Despite the near-universal view that lower oil prices will benefit the economy, the reverse turns out to be the case in 2015 as the economy as a whole may not have more money – it might have less money. Continued higher costs for food, rent, insurance, education, etc. eat up the benefit of lower oil prices. Some of the savings from lower oil is saved by the consumer who is frightened by slowing domestic growth, a slowdown in job creation and a deceleration in the rate of growth in wages and salaries. And the unfavorable drain on oil-related capital spending and lower-employment levels serve to further drain the benefits of lower gasoline and heating oil prices. In The Financial Times, recently, Martin Wolf wrote: “(A) $40 fall in the price of oil represents a shift of roughly $1.3 trillion (close to 2 per cent of world gross output) from producers to consumers annually. This is significant. Since, on balance, consumers are also more likely to spend quickly than producers, this should generate a modest boost to world demand.” But Wolf, and the many other observers, as Mike Lewitt again reminds us, “fail to explain how the $1.3 trillion that has been deducted from the global economy is able to shift from one group to another. ” Surprise No. 4: The mother of all flash crashes. “America is the ‘arch criminal’ and ‘unchangeable principal enemy’ of North Korea.” (Dec. 22, 2014) “America is a ‘toothless wolf’ and ‘the empire of devils.”” (March 27, 2010) “North Korean missiles will reduce Washington, D.C. to ‘ashes.’” (August 19, 2014) “America is a ‘group of Satan’ bent on destroying Korean religion.” (April 22, 2013) “American ‘ideological and cultural poisoning’ is undermining socialism around the world.” (July 16, 2014) – Selected quotes from North Korea’s state-controlled media Hackers attack the NYSE and Nasdaq computer apparatus and systems by introducing a flood of fictitious sell orders that result in a flash crash that dwarfs anything ever seen in history. In the space of one hour the S&P Index falls by more than 5%. The identity of the attacker goes unknown for several days and it turns out to be North Korea. Strategy: Buy VIX, Short SPY/QQQ Surprise No. 5: The great three-decade bull market in bonds is over in 2015. “Take then thy bond thou thy pound of flesh…” – Portia, The Merchant of Venice Last year not one strategist saw lower interest rates (though that was my No. 1 Surprise last year). This year, not one strategist expects a spike in interest rates. In the first half of 2015, European yields and U.S. yields start to converge, in that European yields begin to jump to where the U.S. 10-year yield resides. The failure of Draghi’s policy (see Surprise No. 1) will result in an acceleration in the European debt yields rising and in a decay in debt prices. That will mark the end of the great three-decade bond bull market in the U.S. and it will occur as global growth eases. Strategy: None Surprise No.6 – China devalues its currency by more than 3% vs. the U.S. dollar. “It’s not like I’m anti-China. I just think it’s ridiculous that we allow them to do what they’re doing to this country, with the manipulation of the currency, that you write about and understand, and all of the other things that they do.” – Donald Trump For years, China has essentially pegged it’s currency to the U.S. dollar. (liberalization meant that a narrow trading range is permitted). With the huge run in the U.S. Dollar, China’s currency has appreciated compared with other Asian currencies. As a result, China has lost its manufacturing edge and its trade surplus has all but disappeared. Whether it’s a permitted day-to-day weakening, changing the peg from the dollar to a basket of currencies or whether there is an overnight surprise devaluation, China’s currency will weaken materially in 2015. Strategy: None Surprise No. 7 – Apple (AAPL) becomes the first $1 trillion company. “There’s an old Wayne Gretzky quote that I love. ‘I skate to where the puck is going to be, not where it has been.’ And we’ve always tried to do that at Apple. Since the very, very beginning. And we always will.” – Steve Jobs Apple’s next generation iPhone is seen to likely outsell its latest phone iteration as Re/Code uncovers (and reveals) some amazing and unique new features/applications that are planned for the next generation phone. I don’t know what features it will have or how it will improve design or performance. But I think there is now a near-consensus that it won’t and that the next product upgrade cycle is a while away. So, I predict Apple 2016 estimates rise significantly (to $10/share) and, despite a weak market backdrop, Apple becomes the first $1 trillion dollar market-cap company and the best-performing large-cap in 2015. Apple becomes the only one-decision stock during the stock market swoon during the last half of 2015. It is a must own. Strategy: Buy APPL Surprise No. 8 – Legislation is introduced that allows for repatriation for foreign cash. “The only difference between death and taxes is that death doesn’t get worse every time Congress meets.” – Will Rogers As signs of domestic economic growth fade in the second half of 2015, Congress and the Administration agree on a broad program to repatriate foreign cash at a low tax rate. The deal briefly rallies the U.S. stock market, but equities soon succumb to a slowing domestic economy and diminishing corporate profit growth. Strategy: None Surprise No. 9 – Energy goes from the worst-performing group in 2014 to the best-performing group in the first half of 2015 and then falls back later in the year. “Oil vey!” – Kass Daily Diary term Energy stocks are on a roller coaster in 2015. As the price of crude oil rises steadily (towards $65 a barrel) in early 2015, the energy sector (which was among the worst in 2014) becomes the best market group in the first half of the year. Slowing global economic growth during the last half of the year leads to profit-taking in the energy sector as the price of crude oil closes the year at under $50 and at its lowest price in 2015. In a surprise move, the president signs approval for the Keystone Pipeline in the second half of the year. Strategy: Buy oil stocks in first six months of the year, sell/short mid-year. Surprise No. 10 – More chaos in the Democratic Party. “Mothers all want their sons to grow up to be president, but they don’t want them to become politicians in the process.” – John F. Kennedy Sen. Elizabeth Warren pushes Secretary Hillary Clinton so far to the left that she loses independent voters, though she easily gains the Democratic nomination for president. Former President George H.W. Bush passes away during the first half of the year and Governor Jeb Bush immediately declares his candidacy. By the end of 2015, Jeb Bush is well ahead in the polls and is a big favorite to win the presidency in 2016. Strategy: None Surprise No. 11 – Food inflation accelerates after Russia halts wheat exports. “As life’s pleasures go, food is second only to sex. Except for salami and eggs. Now that’s better than sex, but only if the salami is thickly sliced.” – Alan King Russian turmoil continues and Putin decides to halt exports of wheat again to keep as much homeland as possible, resulting in a price spike in wheat, but also corn and soybeans. This price rise, on top of U.S. food inflation that is already running higher, offsets the consumer benefit of still-relatively-low gasoline and heating oil prices. Strategy: None Surprise No. 12 – Home prices fall in the second half of 2015. “I told my mother-in-law that my house was her house and she said, ‘Get the hell off my property.’” – Joan Rivers Under the weight of reduced home affordability, still-low household formation gains and continued pressure on real incomes, home prices fall in 2015. Builders lose pricing power. Strategy: Short homebuilders. Surprise No. 13 – Individual and sector market surprises. “Those who are easily shocked should be shocked more often.” – Mae West

Strategy: Long AAPL TWTR, CSCO, VIX, GOOGL and short banks Surprise No. 14 – Berkshire Hathaway (BRK.A) makes its largest acquisition in history. “When I was 15 years old, I read an articls about Ivan Boesky, the well-known takeover trader – turned out years later it was all on inside information! But before that came to light, he was very successful, very flamboyant. And I thought, ‘This is what I want to do.’ So I’m 15 years old, I decide I’m going to Wall Street.” – Karen Finerman During the depths of the market’s swoon in the later part of the year, Warren Buffett scoops up his largest acquisition ever. The $55+ billion acquisition is not in his customary comfort zone (a consumer goods company), but rather the deal is for a company in the energy, retail or construction/equipment areas. Strategy: None Surprise No. 15 – A derivative blowup precipitates an abrupt market drop. “I view derivatives as time bombs, both for the parties that deal in them and the economic system.” – Warren Buffett The $300 trillion holdings of derivatives by the U.S. banking industry has been all but forgotten. The four-largest U.S. banks account for $240 trillion of that total, dwarfing their combined $750 billion in statutory capital! This sort of exposure in which notional derivatives are more than 300x the banks’ net worth, is, as my friend The Credit Strategist’s Mike Lewitt has written, “would be laughable if the consequences of a financial accident were not so potentially catastrophic.” To make matters worse, the passage of the $1.1 trillion spending bill passed this month (written by lobbyists and voted on by bought-and-paid-for legislators who probably neither read nor understood the complex spending bill) has kept taxpayers on the hook –through the FDIC – for those derivatives (what Warren Buffett previously called “financial weapons of mass destruction.”) On any measure, the sheer size of these derivative portfolios pose potential risk to the world’s financial stability. What we have learned from the past cycle is how opaque the exposure really is and how stupid and avaricious our bankers really are when allowed to venture into territories of leverage. Whether it is energy derivatives or some other asset class, a derivative blowup in 2015 will serve to preserve the wise words of Benjamin Disraeli (who served twice as Great Britain’s Prime Minister) that “what we have learned from history is that we haven’t learned from history.” It will also harm our markets, once again. |

| Posted: 02 Jan 2015 04:00 PM PST Fantastic cover, which led me to her new album earlier this year.

|

| What is an Online Financial Advisor? Posted: 02 Jan 2015 11:30 AM PST I thought this infographic was inforamtive. We launched our own online advisor last year called Liftoff:

|

| Posted: 02 Jan 2015 08:30 AM PST @TBPInvictus I’m excited about skiplagged.com, the website that is currently being sued by United Airlines and Orbitz for enabling “hidden city ticketing” (which you should read up on before continuing). I needed to travel to Cincinnati last spring. During a period in which my plans were tentative, round-trip fares were in the mid-$300 range or so, maybe close to $400. By the time I’d firmed them up, round-trip fares were around $900, and I was seething (along with trying to figure out why, if there was little demand and ample supply, the price would go up instead of down, but that’s another story). Although it was quite time consuming, I did manually what skiplagged has apparently now automated, i.e. found a “hidden city ticketing” opportunity that brought my round-trip price back down to under $400. The solution for me: I found a one-way, multi-city ticket that went NYC > Cincinnati > Chicago and sent an empty (but paid for) seat from Cincy to O’Hare. On the return, I found another one-way, multi-city ticket (different carrier) that went Cincy > NYC > Boston and sent an empty (but paid for) seat from NYC to Logan. The airlines are, of course, apoplectic that someone has found a way to exploit and expose the inefficiencies and opacity of their ticketing schemes. So they’ve sued: "Purchasing a ticket to a point beyond the actual destination and getting off the aircraft at the connecting point is unethical," according to the letter by American, which isn't party to the case. Overbooking and bumping people, of course, is perfectly ethical. Also, I’m not sure if any airline official has yet commented on the ethicality of not lowering fares in the face of the price of oil – the airline industry’s single largest expense – being halved. Funny how prices aren’t sticky on the way up, but only on the way down. And before you shed a tear for the industry, read on: The International Air Transport Association, an industry group based in Geneva, estimated that the industry's profits would grow 26 percent next year, to reach a record $25 billion, not adjusted for inflation. The group expects $19.9 billion in collective profits in 2014. In 2013, the industry had nearly $11 billion in profits. Airlines have been screwing passengers for decades – nickel and diming travelers with charges for bags, for peanuts, for earbuds, for blankets, for pillows and, of course, for a few extra inches of legroom. They are among the most reviled industries extant. Now Delta’s going to introduce a five-tiered seating plan. I’m sure that will work out well. Below is a leaked photo of what economy class will look like: Technology has – and continues to – let multiple genies out of multiple bottles. And they aren’t going back in. Technology will continue to disrupt all manner of businesses and squeeze out inefficiencies, just as Uber, Netflix, Amazon, eBay, and countless other companies have done. There is no going back. If it’s not skiplagged who gives the airlines their comeuppance, it will be someone else. Either way, the jig is up. If you want to contribute to skiplagged’s legal defense fund, you can do so here. Finally, I went to Cincy to meet with Bonddad, who runs one of the most underrated blogs (on economics and markets) in the blogosphere. He should be in your bookmarks. |

| Posted: 02 Jan 2015 05:00 AM PST My first market day of the new year morning reads:

What’s up for the weekend ?

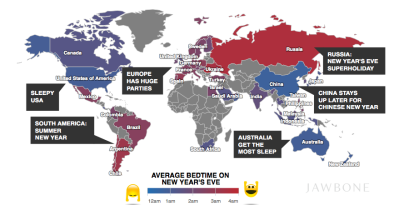

How Late Does the World Stay Up on New Year’s Eve? Source: Jawbone

|

| Posted: 02 Jan 2015 03:00 AM PST

From WSJ:

More after the jump.

|

| Fed: The Replacement of Safe Assets: Evidence from the U.S. Bond Portfolio Posted: 02 Jan 2015 02:00 AM PST Although U.S. investors continue to tap foreign financial markets for “safe” assets, we show that the type of foreign financial debt that fills this portfolio niche post-crisis is quite different than pre-crisis. Post-crisis, we find that U.S. investors have replaced offshore-issued structured securities with high-grade U.S. dollar-denominated financial debt issued from a small group of OECD countries (most notably Australia and Canada). Lastly, these developments have led to a decline in home bias in the U.S. financial bond portfolio that we are able to document for the first time.

|

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

0 comments:

Post a Comment