The Big Picture |

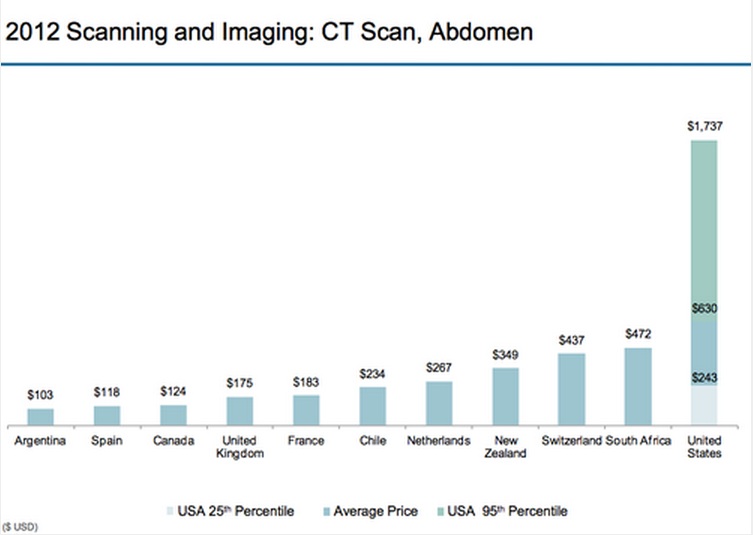

- Discuss: The Price of US Health Care is Too Damned High

- 10 Tuesday PM Reads

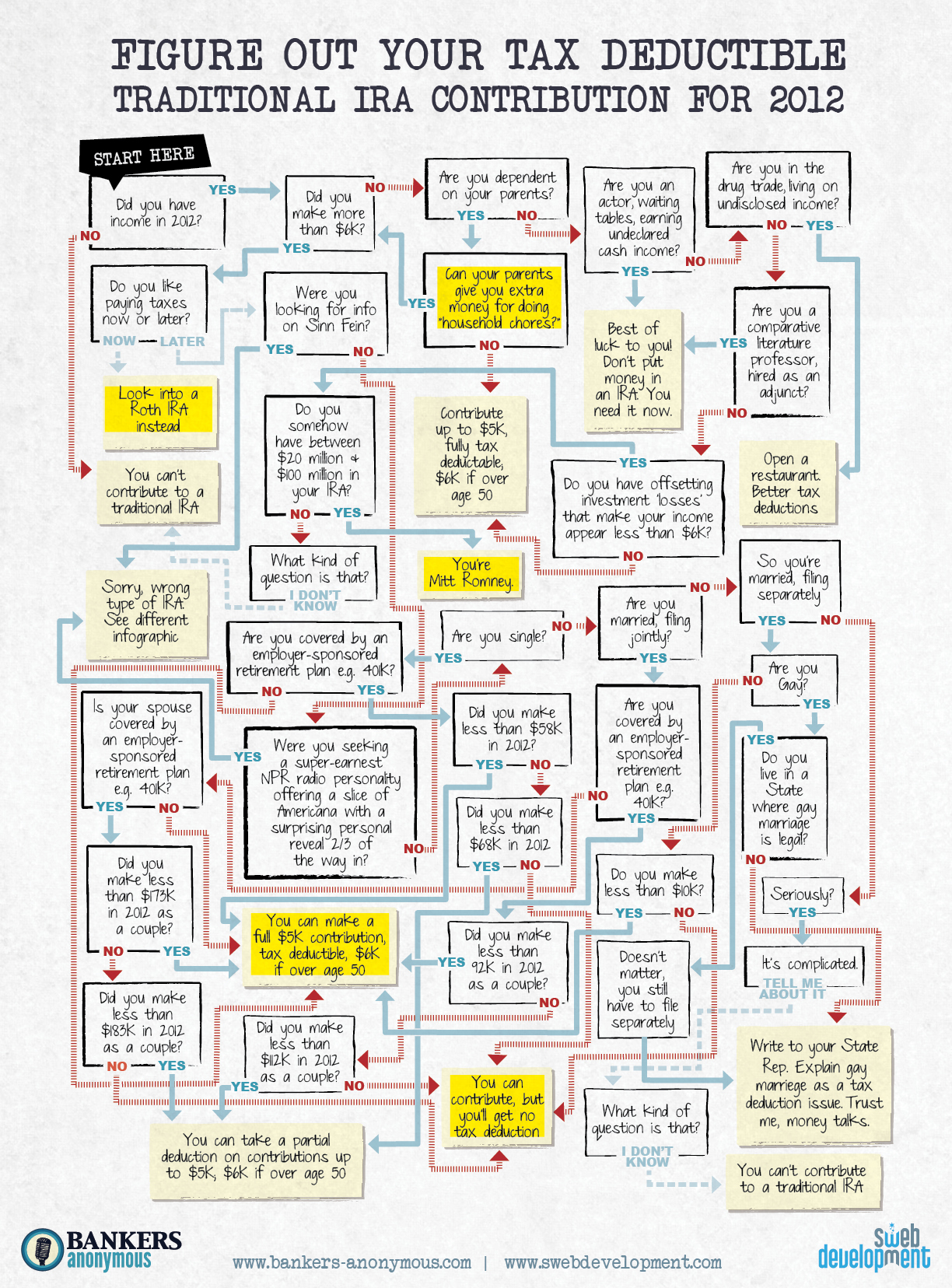

- Your Traditional IRA Contribution

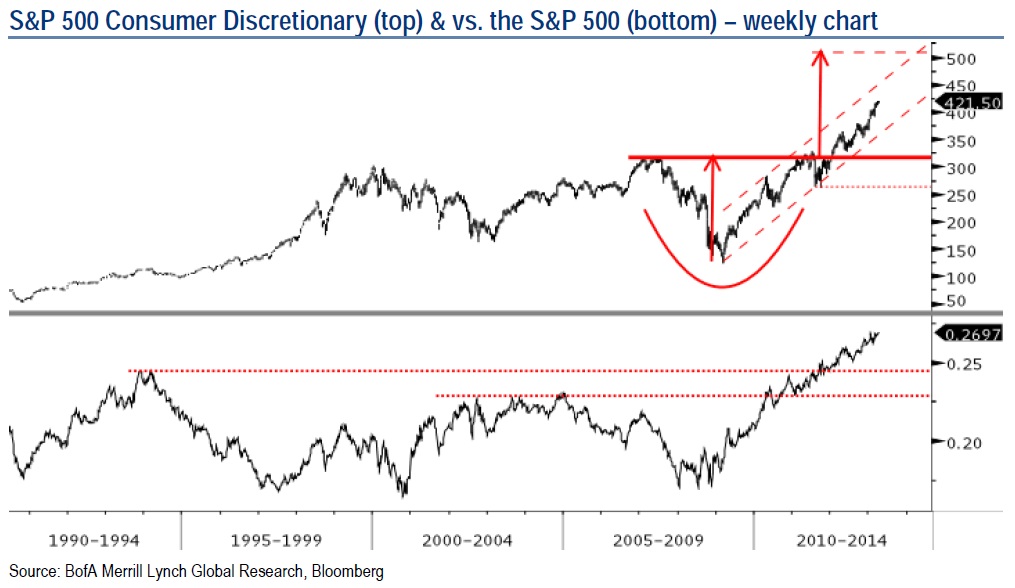

- Why is S&P500 Consumer Discretionary Hitting Highs?

- 10 Tuesday AM Reads

- Are Home Prices Are Rising Too Fast?

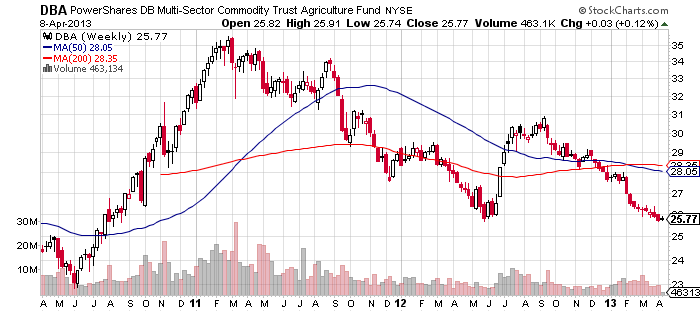

- The New Great Rotation: Commodities into Bonds

- Whistleblower Report on Bank of America Foreclosures

- Want to be happier? Stay in the moment

| Discuss: The Price of US Health Care is Too Damned High Posted: 09 Apr 2013 04:46 PM PDT In honor of my recently hospitalized (and released) colleague, discuss: American health care costs are wildly excessive relative to the rest of the world

Source: priceonomics |

| Posted: 09 Apr 2013 01:30 PM PDT My afternoon train reads:

What are you reading?

Thatcher’s Britain |

| Your Traditional IRA Contribution Posted: 09 Apr 2013 11:30 AM PDT Click to enlarge |

| Why is S&P500 Consumer Discretionary Hitting Highs? Posted: 09 Apr 2013 08:45 AM PDT Click to enlarge

Here is another one of those things I find perplexing: I keep hearing that healthcare, utilities and consumer staples are doing well — and that this rotation is usually caused by fear of an economic slowdown. But what if its something else? Might healthcare be part of a secular move caused by the aging of the baby boomers? Utilities and Staples both have high dividends — might these be an alternative to 10 year Treasuries yielding 1.73 today? To those people expecting a recession, how can we explain the Consumer Discretionary sector hitting highs? I don’t have the answers, but my curiosity leads me to these questions. And the chart above, via MER — showing that Consumer Discretionary sector is in a “secular bull market on both an absolute and relative price basis. The big breakouts from early 2012 remain intact and the sector achieved new all-time absolute and relative price highs yesterday.” Merrill notes that “this is a bullish back-drop for the sector and for the US equity market longer-term.”

Source: |

| Posted: 09 Apr 2013 06:45 AM PDT My morning reads:

What are you reading?

Japan’s Stimulus Generates Ripples |

| Are Home Prices Are Rising Too Fast? Posted: 09 Apr 2013 06:30 AM PDT Nick Timiraos explains how the Federal Reserve keeping interest rates low is causing home prices to grow faster than they normally would during a recovery, and that has some experts worried. |

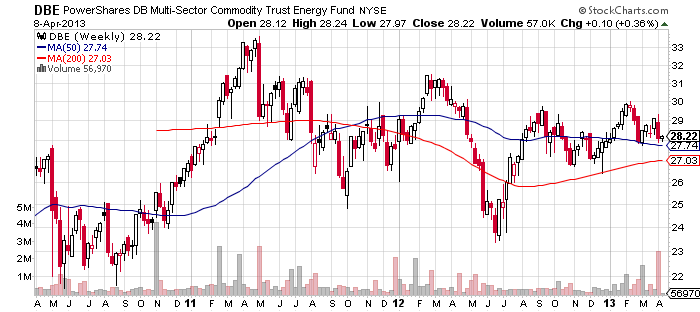

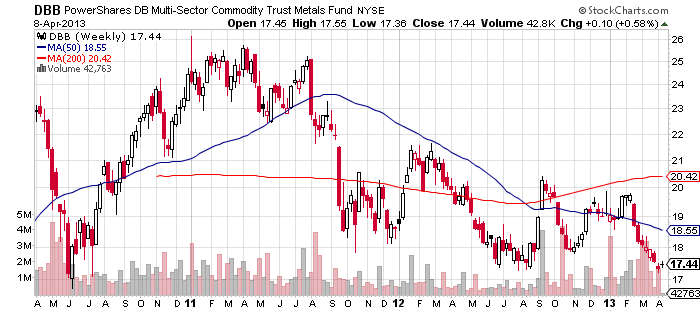

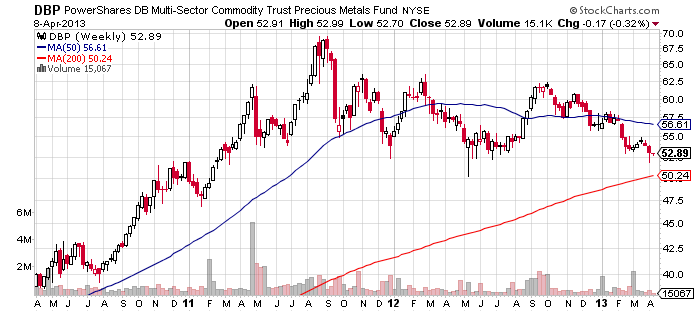

| The New Great Rotation: Commodities into Bonds Posted: 09 Apr 2013 04:15 AM PDT You probably heard the chatter over the past few quarters: “The Great Rotation” was about to unleash a new leg up in Equities. Bonds were going to be sold, equities purchased, and a new leg up was starting. The story goes something like this: U.S. Treasury Bonds had enjoyed a 30 year bull market, and it was now coming to an end. Paul Volcker rebooted fixed income, taking rates to 20% to break inflation, and in the three decades since bonds have seen their prices inflate as rates normalized, then fell precariously low, then were driven to zero by QE. That cycle is over, we are told, as rates now have nowhere to go but up, and investors will soon become sensible and rotate into equities. Except, of course, that it hasn’t. Why? Perhaps we should consider an alternative explanation to the sector rotation story, which is rapidly being revealed as little more than wishful thinking. The story that is not getting told nearly as much: The investment community noticed the success of Endowment funds (e.g., Yale’s David Swensen). The monkey-see-monkey-do community, ignoring valuations and prior gains, hired new consultants to shake it up. “Make us look like Yale” they pleaded to the mostly worthless community of consultants. No fools they, the overpaid consultants happily complied, and the next thing we know, these Whiffenpoof Wannabes are up to their eyeballs in private equity, hedge funds, structured products, real estate, and commodities/managed futures. Gee, late-to-the-party investors in illiquid, pricey investments — who ever could have imagined that this was not going work out particularly well. Time for a change: Fast forward a disastrous decade. As managers and consultants were replaced/fired, the new guys wanted to start unwinding the work of their priors. Since most of these alternative asset classes are illiquid, there is not a lot of wiggle room without severe haircuts (penalties for early withdrawal). What to do. One of the few that is not are the Commodities/Managed futures bucket. My guess, based on prices and logic, is that these new managers are selling what they can — and that is commodities. What do the charts (after jump) say? Gold and Silver flat for 2 years. Energy for even longer. Agricultural products back to 2010 prices. Industrial metals near 2010 lows. Commodities started the 2000s so promising — what with rampant inflation and the dollar losing 41% of its value, have since gone nowhere. So the new guys are sellers, and the money is going into less esoteric, liquid assets. That means traditional assets: Munis, Treasuries and Corporates for the safe money, stocks for their risk assets. The great rotation is already underway. Just not the way the stock bulls have been hoping for.

Agricultural Prices

Energy Products

Industrial metals

Precious metals

|

| Whistleblower Report on Bank of America Foreclosures Posted: 09 Apr 2013 03:00 AM PDT |

| Want to be happier? Stay in the moment Posted: 09 Apr 2013 02:00 AM PDT When are humans most happy? To gather data on this question, Matt Killingsworth built an app, Track Your Happiness, that let people report their feelings in real time. Among the surprising results: We’re often happiest when we’re lost in the moment. And the flip side: The more our mind wanders, the less happy we can be. (Filmed at TEDxCambridge.)

Want to be happier? Stay in the moment – Matt Killingsworth Hat tip Brain Pickings |

| You are subscribed to email updates from The Big Picture To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 comments:

Post a Comment